Casual Tips About Cash Flow Statement In Excel Indirect Method

In this article, we will discuss how to prepare a cash flow statement using the indirect method in detail, including the following topics:

Cash flow statement in excel indirect method. Accountants favor this technique because it’s simpler and cheaper than tracking every single cash transaction as per the direct method. What is an indirect cash flow statement? What is the cash flow statement indirect method?

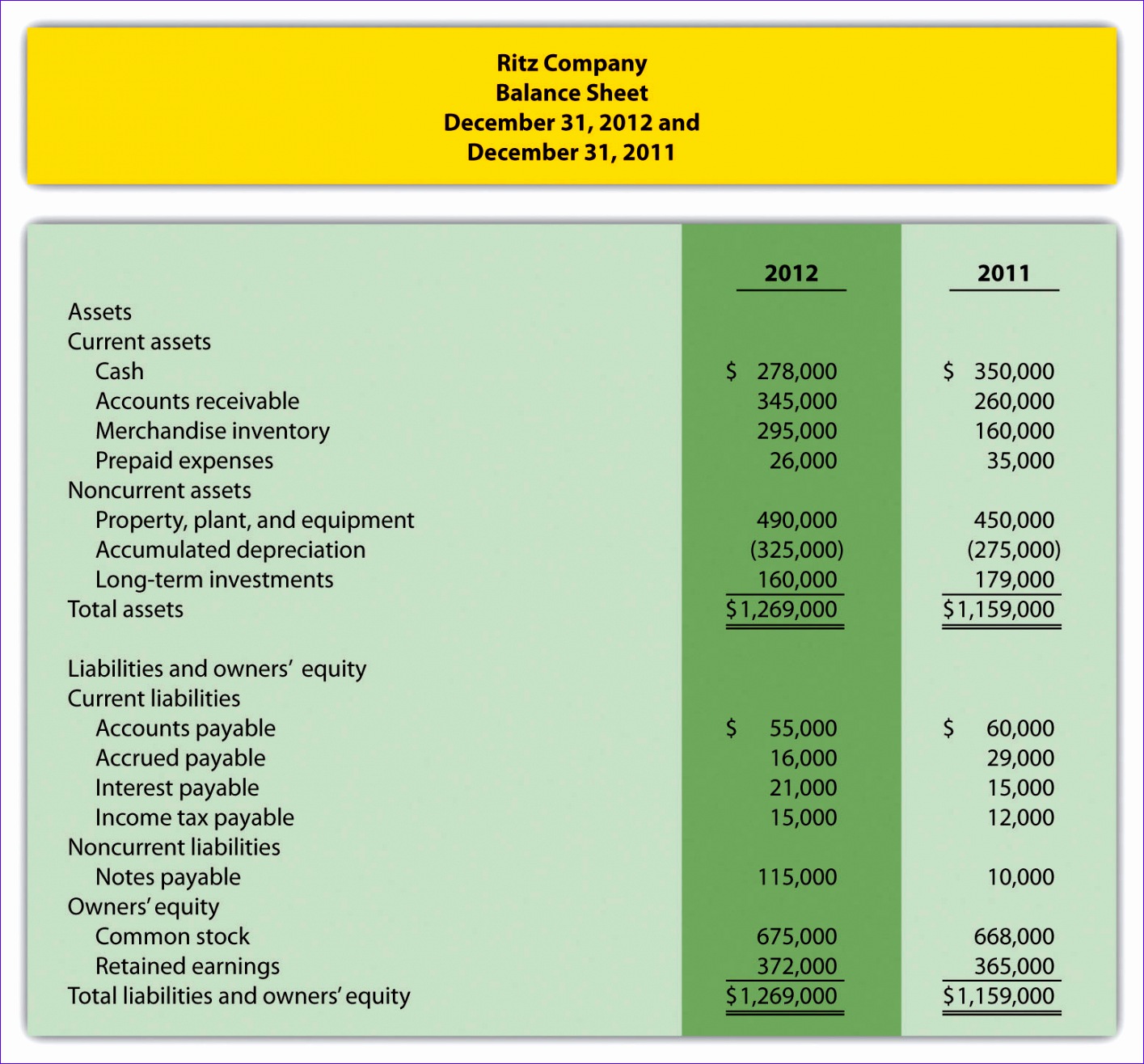

The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). So, follow the steps below. The cash flow statement shows how a company generated and spent cash throughout a given timeframe.

By cash we mean both physical currency and money in a checking account. Hence, one needs to make adjustments to find the ebit (earnings before interest and taxes). This method is generally easier to.

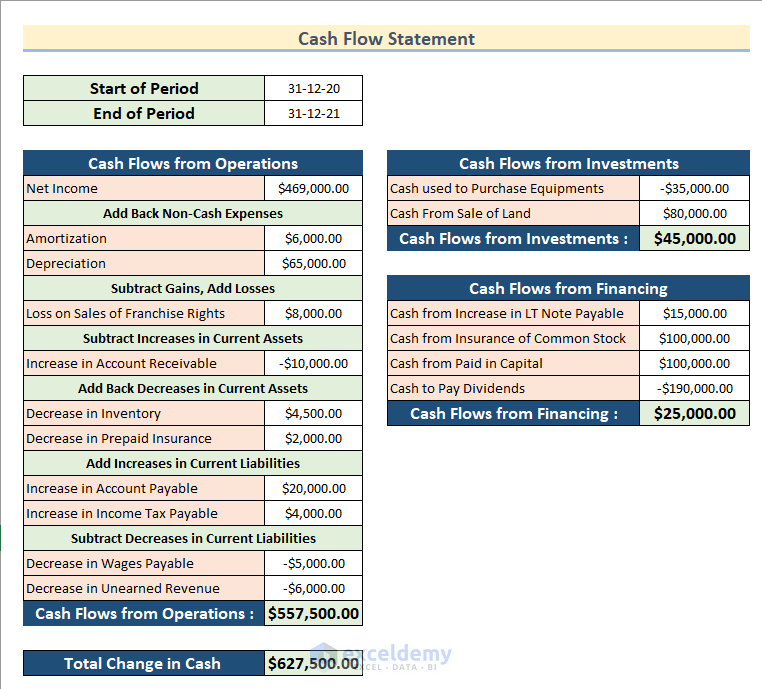

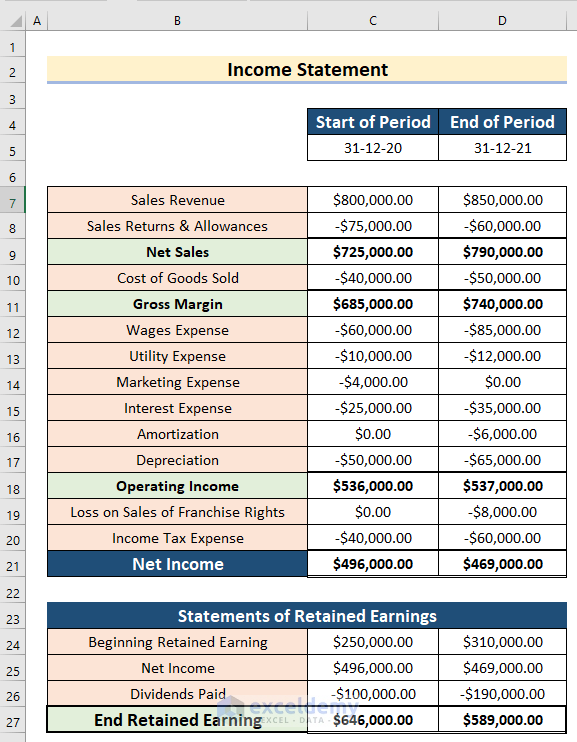

The first of these is the income statement, also known as the profit & loss statement (p&l). Using the indirect method for cash flow performance analysis helps businesses gain greater percision when forecasting cash flow performance. Now, we’ll calculate operating cash flow using the indirect method in excel.

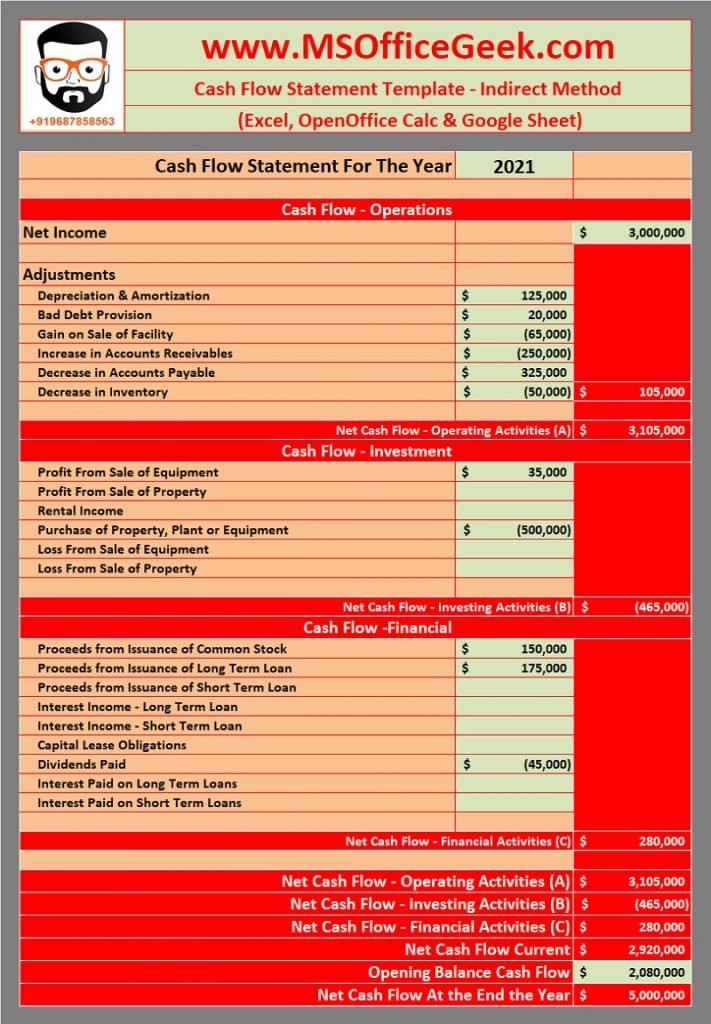

Get all the necessary fields, simply download, print and use. The indirect method is a common method of preparing cash flow statements, which involves calculating net income first, then adjusting for items that don't include actual cash flows like depreciation. It allows you to understand where the money is coming from and how it is spent.

Quickly generate statements of cash flows using the indirect method in minutes with this template. You can find this as net income on your income statement. Get free indirect method cash flow statement format in excel & statement of cash flows template!

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: This video is perfect for anyone who wants to understan. The period can vary for a cash flow statement.

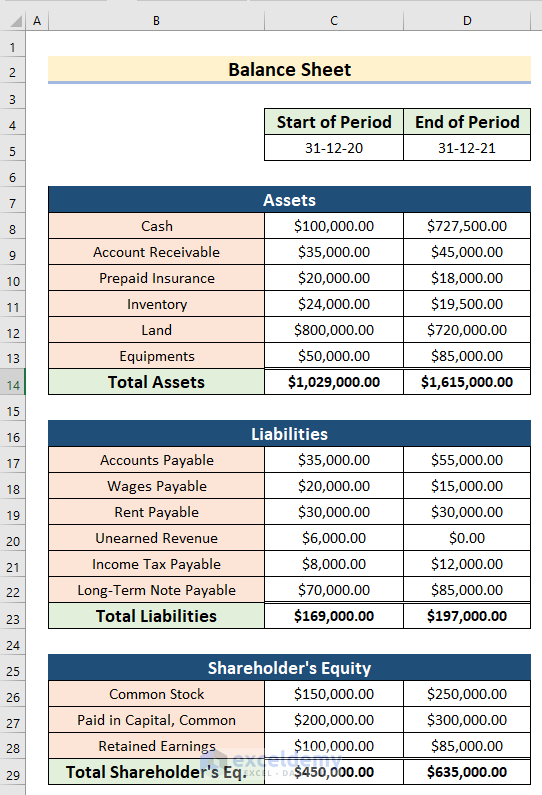

To construct the cash flow statement using the indirect method, we combine information from the two fundamental financial statements. The second major limitation of the indirect method is the format of the cash flow statement itself. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to.

There are a broad range of online tools that can help you produce a cash flow statement. Analyzing income and expenses when analyzing cash flow performance using the indirect method, it is important to identify both income and expenses. In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow.

In the indirect cash flow method, cash flow from operating activities is derived. Cash flow statement indirect method format in excel. Begin with net income from the income statement.