Impressive Tips About Stock Based Compensation Income Statement

Stock compensation is an expense.

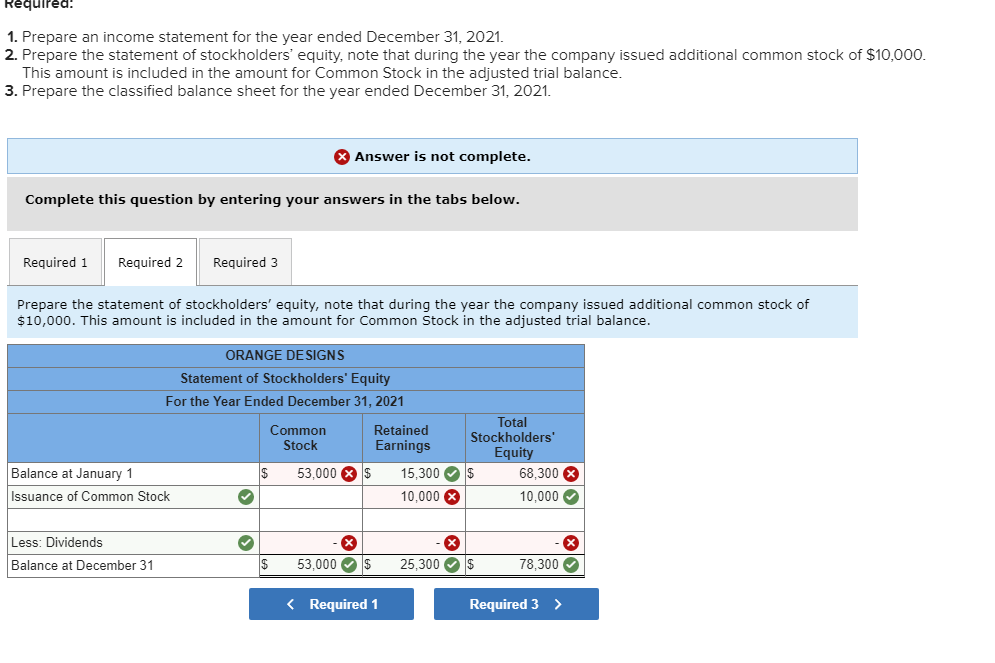

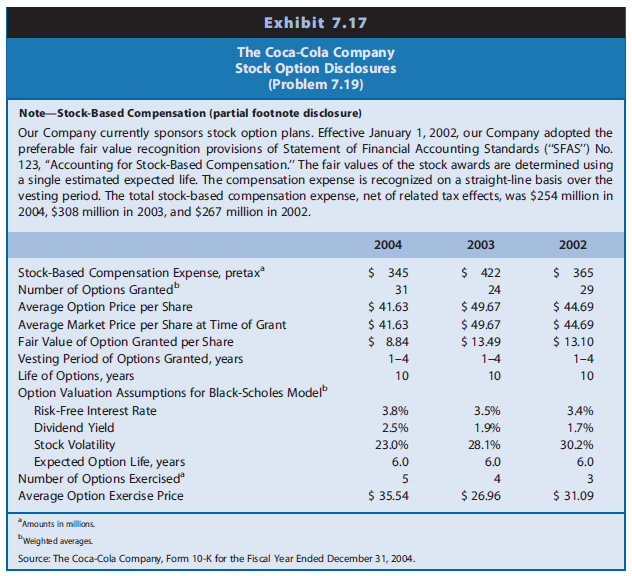

Stock based compensation income statement. Here are six fundamental principles that govern how stock compensation is accounted for. Stock based compensation is the expense in the income statement which the company uses its own stock to reward the employees. May 1, 2019 related topics.

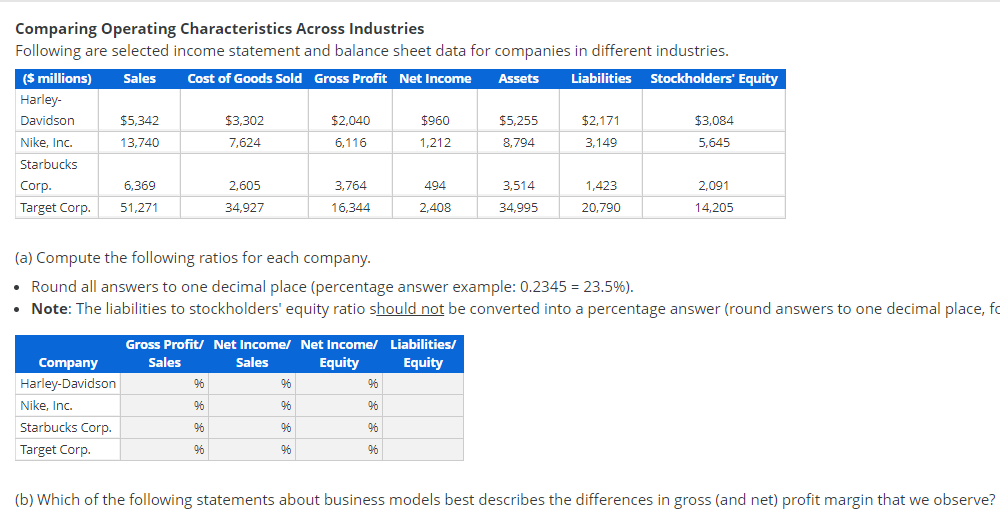

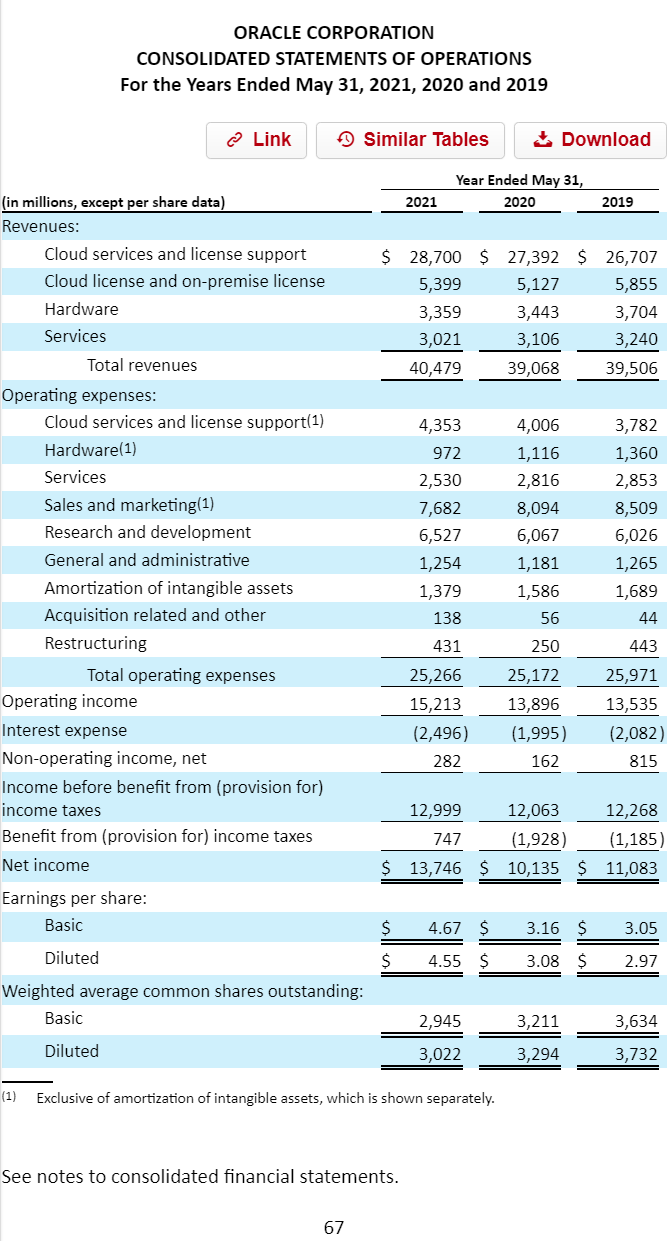

The bottom line is that you should see stock based. In fact, footnotes in nancial lings. Sbc issued to direct labor is allocated to cost of goods sold.

In 2006, the year that companies had to reflect sbc as an expense on the income statement, total sbc expense for companies in the russell 3000 was about $25. The impact on financial statements is primarily reflected in the following: This guide explains the fundamental principles of.

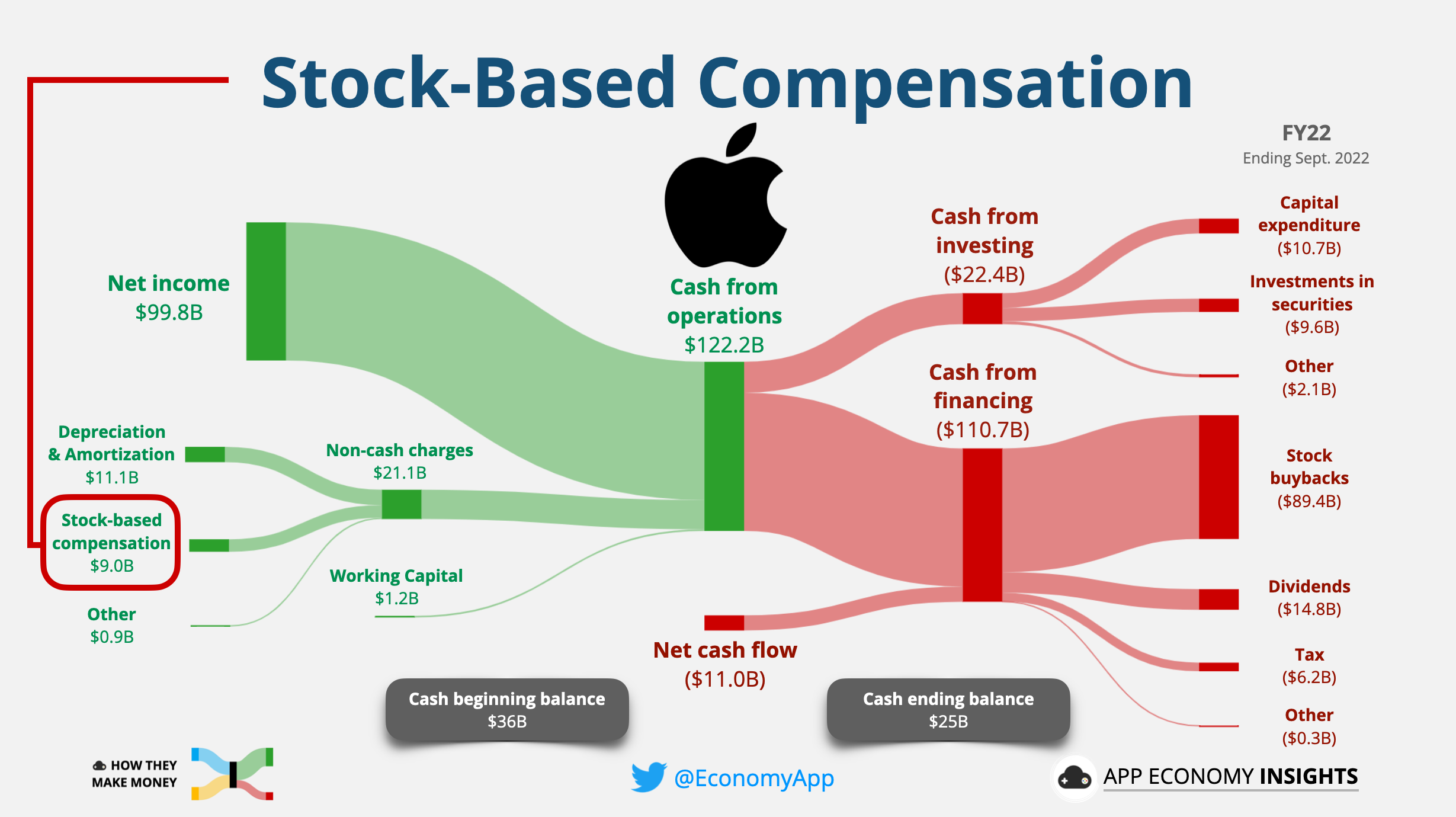

Here’s how sbc shows up in a company’s financials today. This guide explains the fundamental principles of. This paper reviews the statement of cash flow implications of stock compensation expense and the effect it can have on valuations.

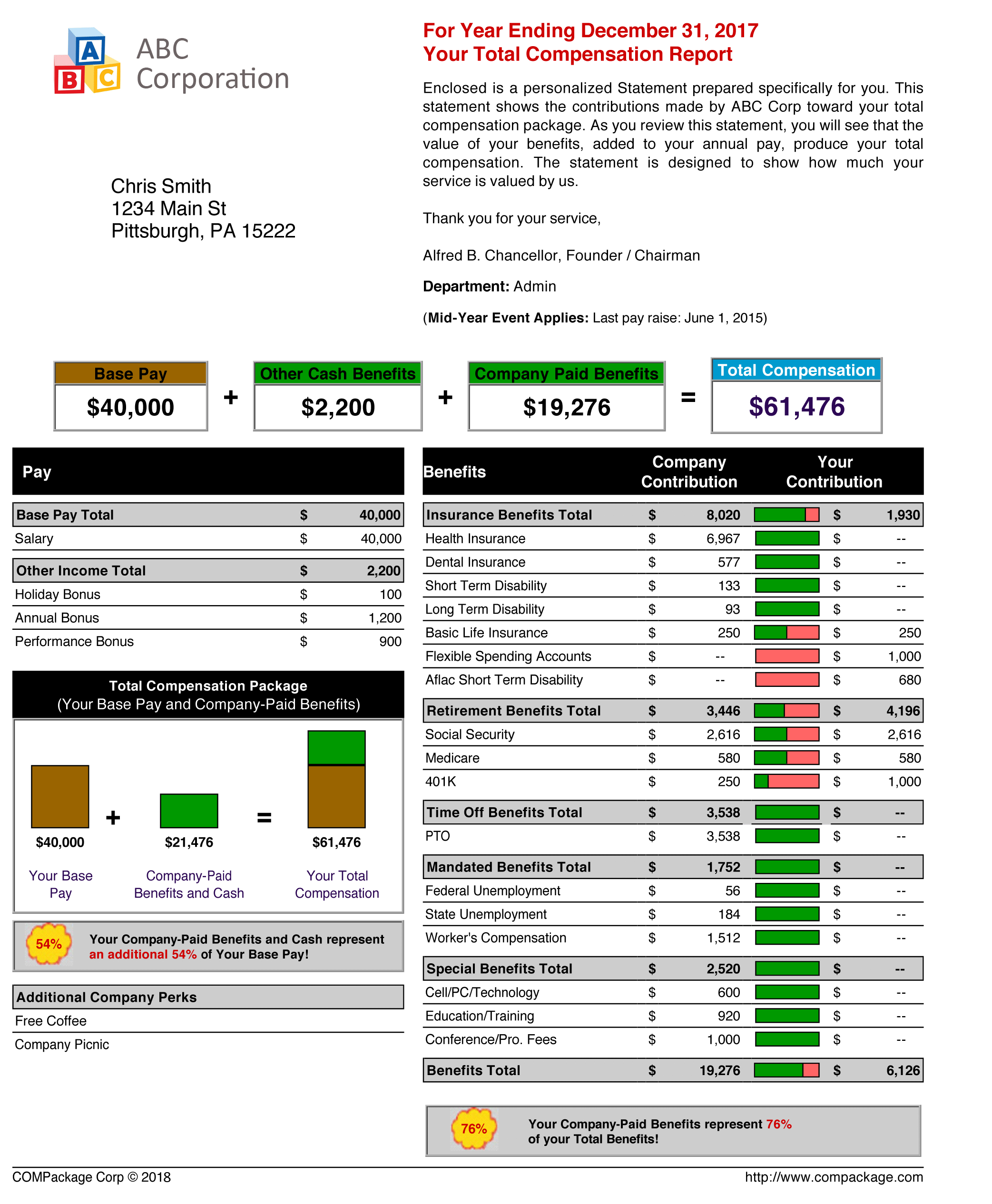

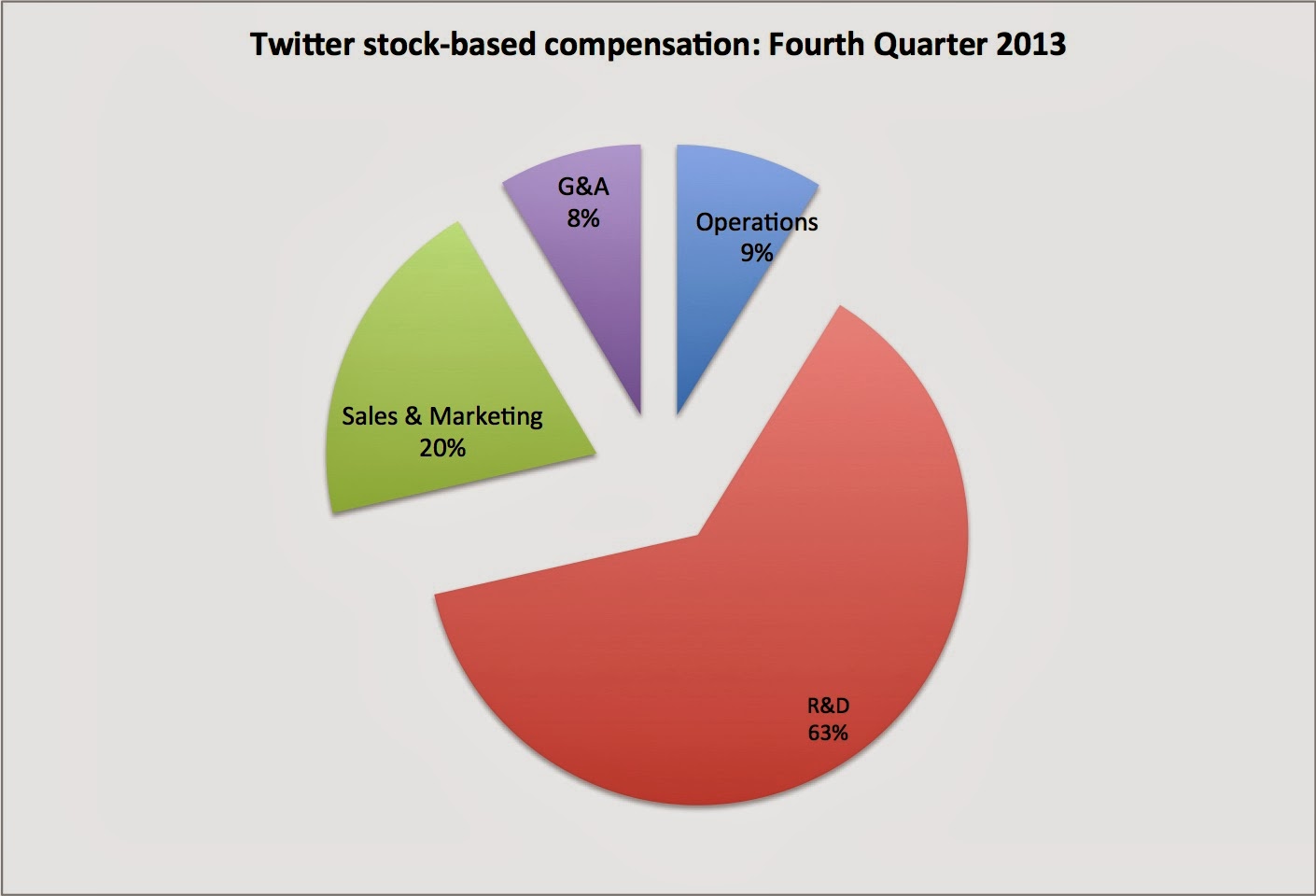

Followed by a strong year in 2021, where median actual total direct compensation (tdc) pay increased +14% driven by higher actual bonus incentive. Specifically, sbc expense is an operating expense(just like wages) and is allocated to the relevant operating line items: Back to basics by vlada edwards, cpa, seattle, and norma sharara, j.d., washington, d.c.

In fact, under us gaap , stock. The consolidated income statement will often not explicitly identify sbc on the income statement, but it's there, inside the expense categories. Asc 740 governs how companies recognize the effects of income taxes on their.