Underrated Ideas Of Info About Dividend Payable In Balance Sheet

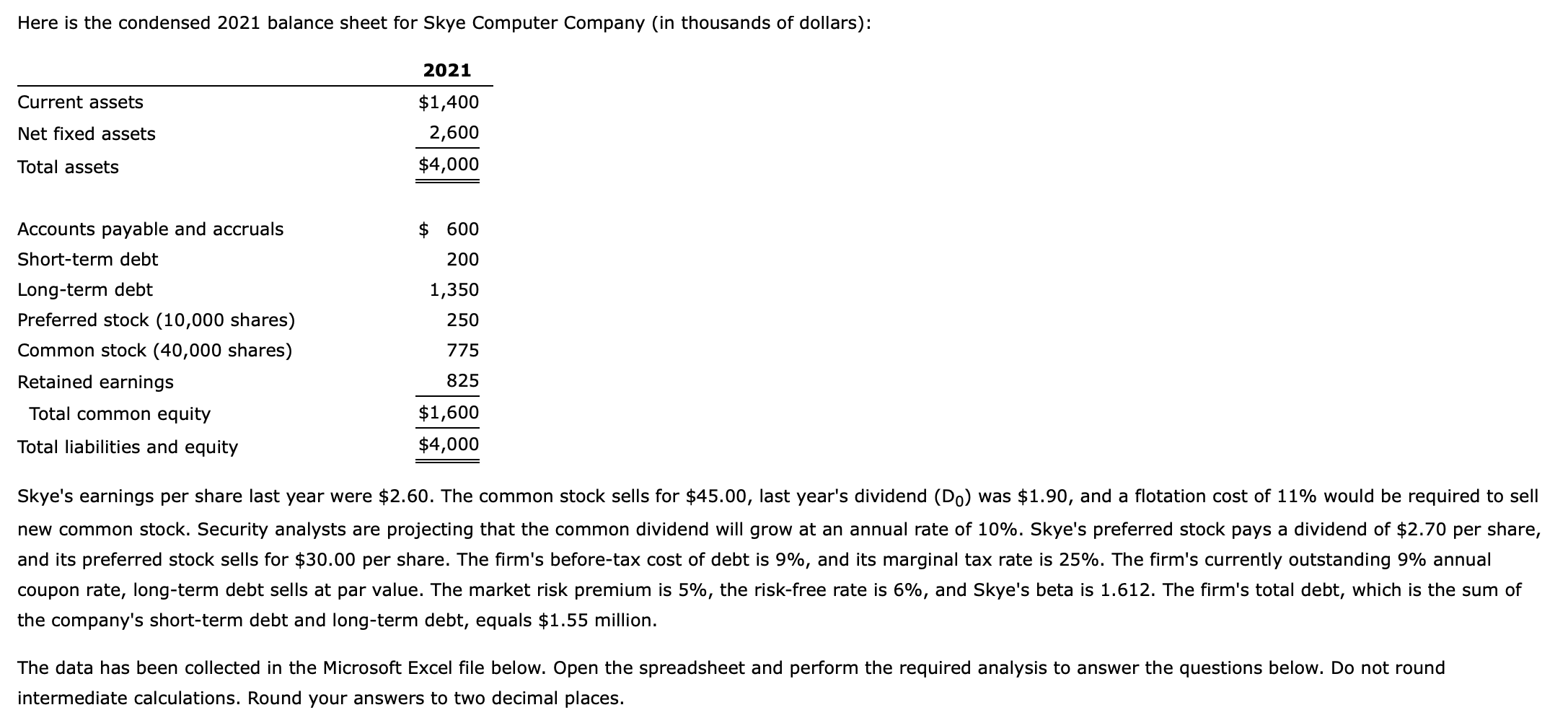

The balance sheet the interpretation of financial statements example of dividends payable for example, on march 1, the board of directors of abc.

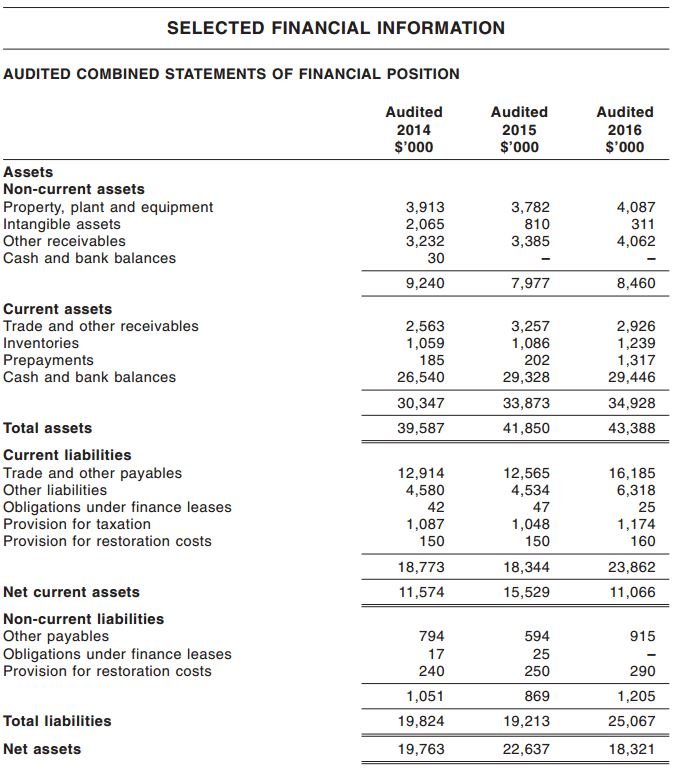

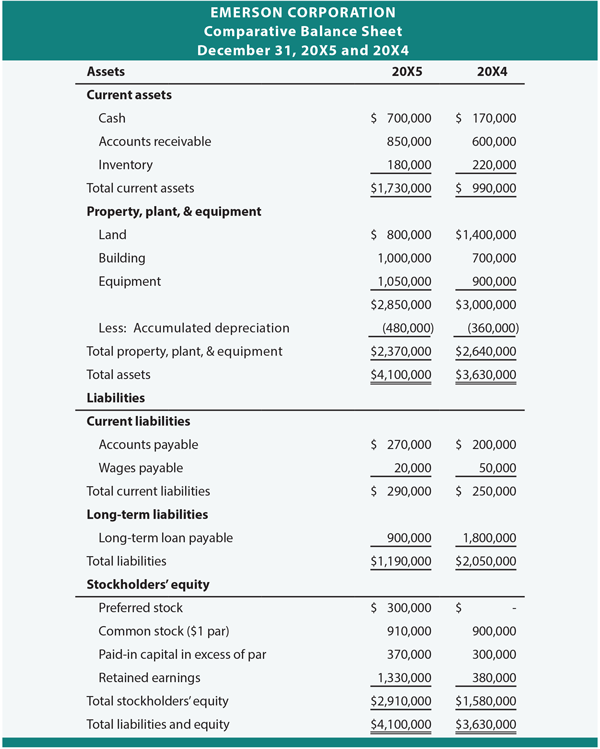

Dividend payable in balance sheet. The common practice concerning the dividends payable account treats it as a current liability if the. Cash dividends affect two areas on the balance sheet: It is shown under the head.

Investors will not find a separate balance sheet account. Once a proposed cash dividend is approved and declared by the board of directors, a corporation can distribute dividendsto its shareholders. Here is the formula for dividends per share:

Dividends in the balance sheet. Dividends payable is a liability on the balance sheet that represents the amount owed to shareholders in the form of dividends. The announced dividend, despite the cash still being in the possession of the company at the time of the announcement, creates a current liability line item on the balance.

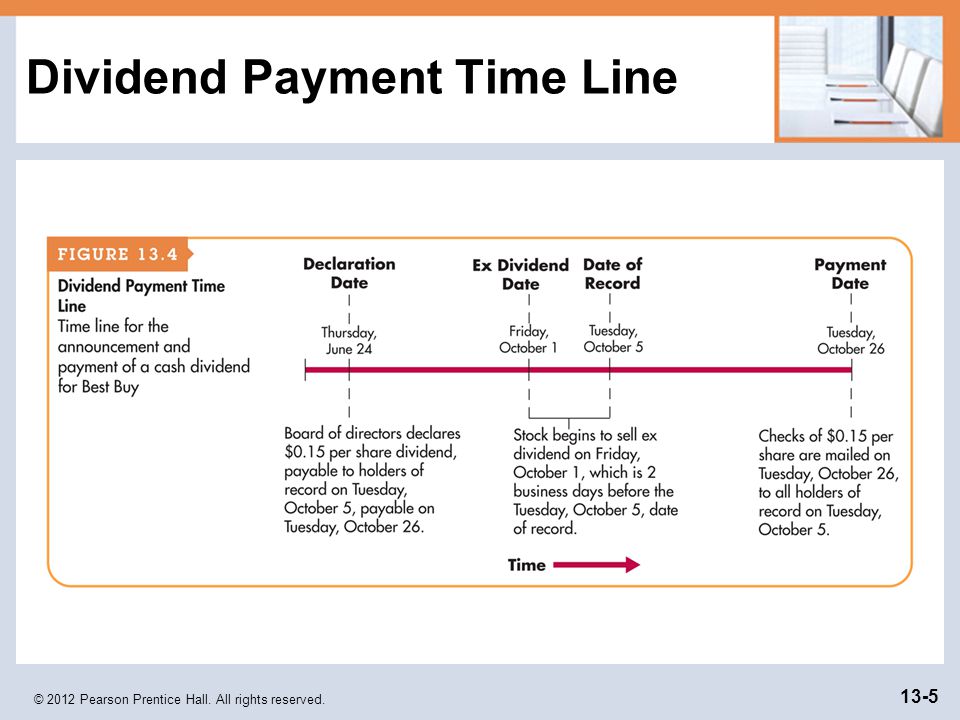

It can also be referred to as a statement of net worth. A corporation may issue dividends to its shareholders, which represent a distribution of its retained earnings to them. When the balance sheet date is between the date of declaration and the date of distribution, and the amount to be paid in cash is determinable, it is typically classified as dividends.

The dividend is owed to shareholders on record on 21 july and paid on 30 july. Our dividend proposals are a reflection of the strong 2023 financials, our growth prospects in 2024 and balance sheet strength.”. Additionally, the company intends to initiate a share buyback of up to £1.0bn after the balance sheet date.

If a business has accounts payable (a/p), they have received goods or services from other companies that they need to pay off in the near. That is an impressive level of growth in the dividend. When the dividends are paid, the effect on the balance sheet is a decrease in the company's retained earnings and its cash balance.

For shareholders of record mar. Ug's 4.6 million share count has been historically reliable and gives us a base. Limits on dividends dividends payable account faqs.

Paying the dividends reduces the amount of retained. In other words, retained earnings. But investors may be dissuaded from investing in the healthcare company for the dividend as pfizer reported diluted earnings per share (eps) totaling just $0.37 in.

The total cash dividend to be paid is based on the number of shares outstanding is: Analyst earnings estimates are at $4.13 for 2024, $5.84 for 2025,. The board of directors will.

Adr is payable april 3; In terms of classification, dividends declared but not yet paid are reported as a current liability in the liabilities section of the balance sheet under “dividends. Dividend payable is a short term liability of the company (short term liabilities are those liabilities which have to be paid within one year).

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)