Glory Tips About Most Important Financial Ratios For A Company

If you see too much, it's easy to.

Most important financial ratios for a company. Helps measure company’s ability to generate profits/income 4. Measure period of cash inflow and outflow. These ratios help assess the valuation of a company and are a primary tool for fundamental analysis.

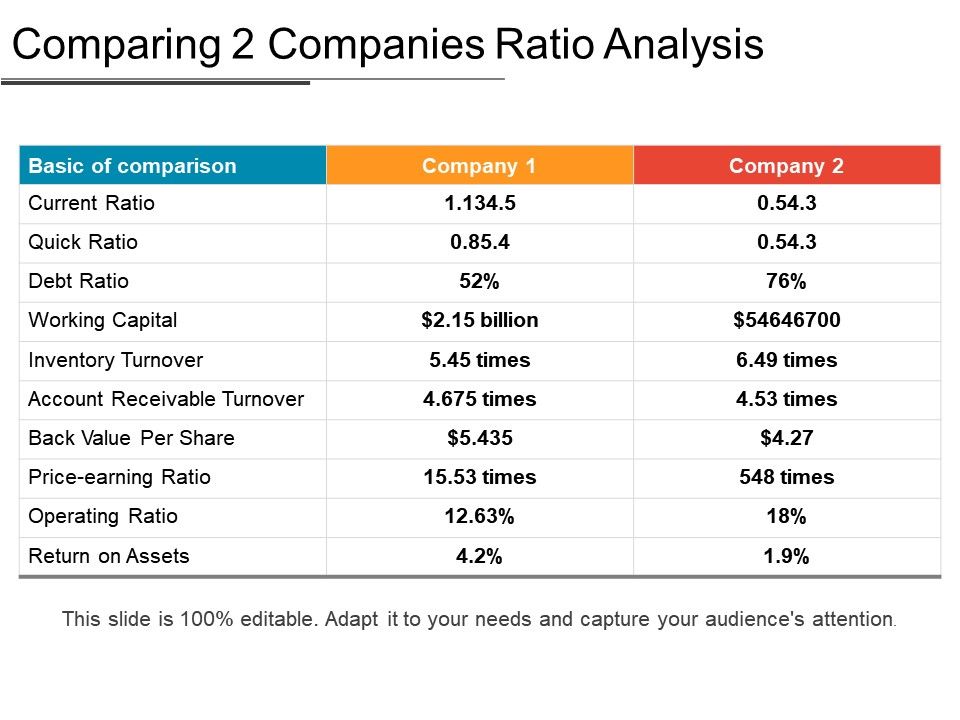

This is one of the most frequently used types of financial ratios, giving a quick indicator of business liquidity. Things such as l iquidity, profitability, solvency, efficiency, and valuation are assessed via financial ratios.those are metrics that can help internal and external. Here are some of the most important financial ratios to know.

Figuring out a stock's value can be as simple or complex as you make it. There are dozens of financial ratios you can track, but the most important financial ratios fall into one of four broad categories: Helps measure company’s efficiency in using its resources 3.

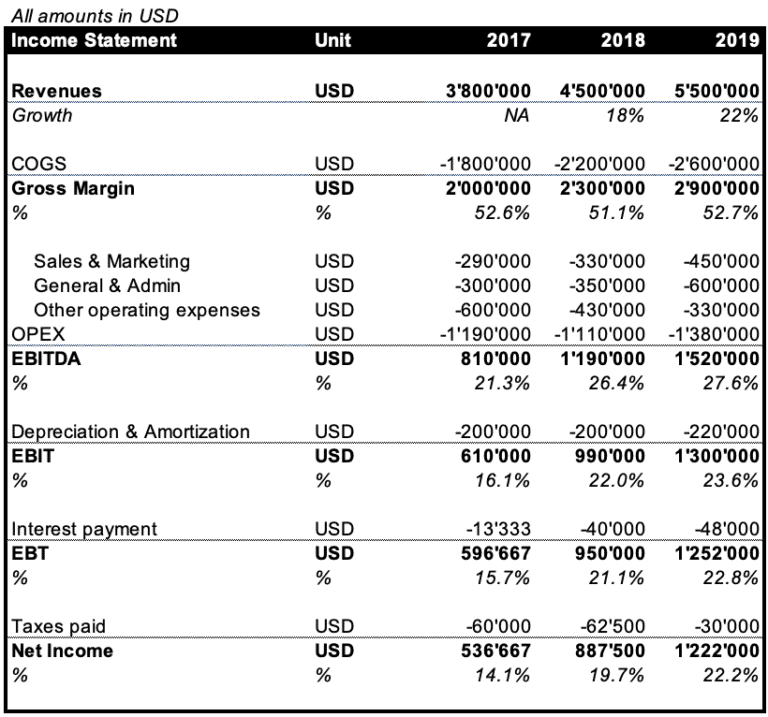

Return on assets (roa) return on assets (roa) is an indicator of how profitable a company is relative to its total assets. Helps understand company’s ability to repay short. We’ll look at 10 ratios across these four categories and provide a detailed walkthrough for each.

It can be calculated as: A financial ratio is a metric usually given by two values taken from a company’s financial statements that compared give five main types of insights for an organization. It depends on how much depth of perspective you need.

Earnings per share (eps) earnings per share, or eps, is one of the most common ratios used in the financial world. Benchmark your most important financial ratios keep in mind that financial ratios in and of themselves may not always be useful. What are financial ratios?

Investors tend to use some financial ratios more often or place more significance on certain ratios when evaluating business or companies. Most important financial ratios. Helps measure company’s debt 2.

Keep in mind that a higher net profit margin indicates that your business is more efficient in converting its revenue to real profits. 2) return on equity (roe) return on equity measures a company’s ability to generate earnings in relation to its. Much of their cash is going towards debt repayment.

Investors use financial ratios to investigate a stock’s health before investing. The term liquidity refers to how easily a company can turn assets into. 20 key financial ratios 1) return on assets (roa) return on assets measures a company’s ability to generate income from its assets.

The most important financial ratios to consider quick ratio. In this post, i will describe the 5 main pillars of ratios and then the 10 most popular financial ratios. Fact checked by michael logan what is ratio analysis?