Outstanding Info About Interest Payment In Cash Flow Statement

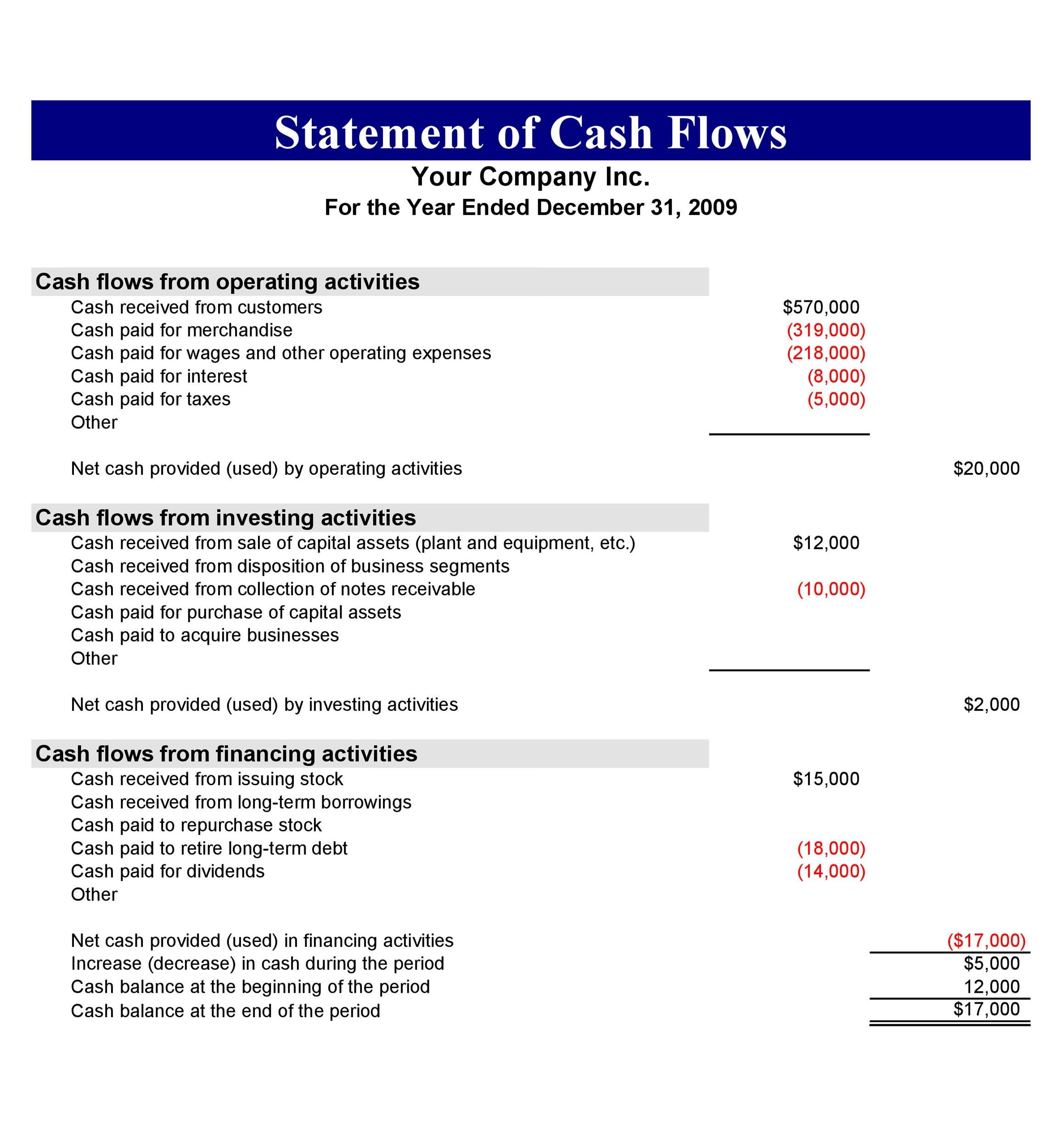

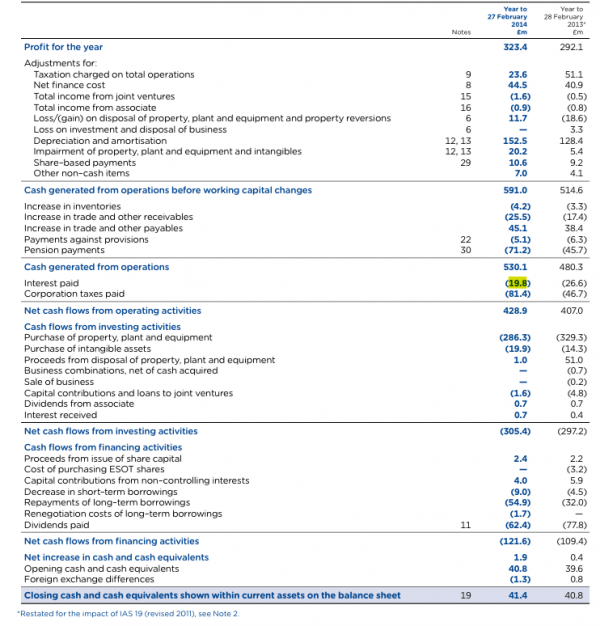

Many companies present both the interest received and interest paid as operating cash flows.

Interest payment in cash flow statement. The interest element is treated as a standard interest payment and is included as either a cash flow from operating activities or financing activities. The following examples illustrate all three of these examples. The repayment of the principal is included as a cash flow from financing activities, because it is the same as the repayment of a debt.

This is due to the fact that $12,500 of interest expense is included in net income, the first line on the cash flow statement. Some companies may also term it as finance expenses in the income statement. Under the accrual method of accounting, interest expense is reported on a company's income statement in the period in which it is incurred.

We begin with reasons why the statement of cash flows (scf, cash flow statement) is a required financial statement. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. Upon redemption in 20x3, entity a receives $10.

When the amount is due. Since most companies use the indirect method for the statement of cash flows, the interest expense will. Hence, interest expense is one of the subtractions from a company's revenues in calculating a company's net income.

It will deduct the profit during the period regardless of the cash flow or not. Have you already checked out the ifrs kit? The statement of cash flows is a primary financial statement, mandated for presentation by all entities, irrespective of their business profile.

In the statement of cash flows, interest paid will be reported in the section entitled cash flows from operating activities. The interest rate and terms. This transaction has been incorporated to financial statements as shown below.

This will reduce diversity in practice making users’ analysis of the statement of cash flows simpler and less costly—users would not need to identify where in the statement of cash flows interest and dividends cash flows have been classified. In this monthly financial model we will explore how to project interest. Since most corporations report the cash flows from operating activities by using the indirect method, the interest expense will be included in the company's net income or net earnings.

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. Interest expense is the expense line item that will appear on the income statement. Taxes @ 30% ($8 million) net income:.

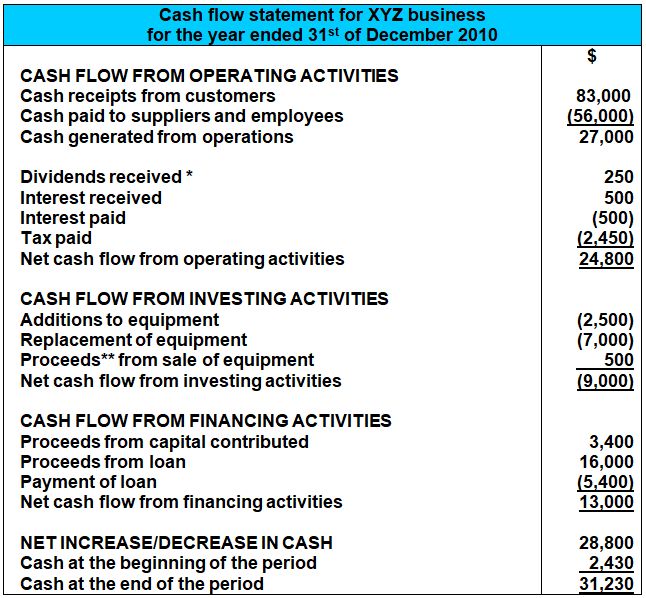

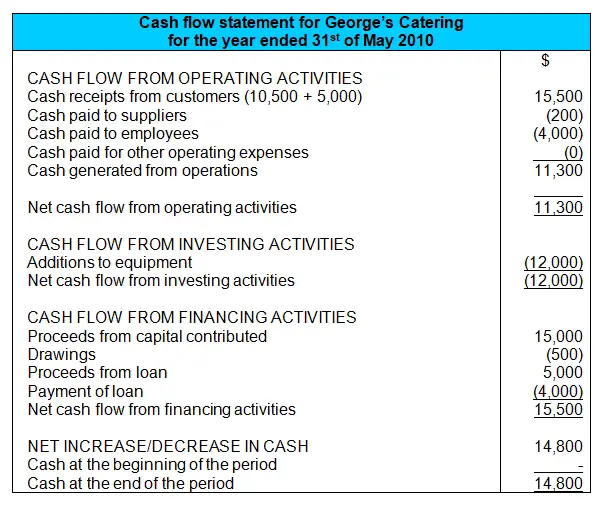

Others treat interest received as investing cash flow and interest paid as a financing. Cash payments to suppliers for goods and services and to, and on behalf of, employees. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

Interest paid will appear in the statement of cash flow when the cash is actually paid to the creditors. The cfs highlights a company's cash management, including how well it generates. These activities also include paying cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)