Inspirating Info About Ifrs For Banks

The support of the multilateral development bank community was instrumental in the prior introduction of ifrs accounting standards in regions such as africa, latin america & the caribbean, eastern europe and south east asia.

Ifrs for banks. Functional and presentation currency 18 4. Use of judgements and estimates 18 5. Also, the international sustainability standards board (issb) has published.

Ifrs s1 and ifrs s2 must always be applied together. Our quarterly newsletter, the bank statement, brings you an overview of the accounting issues affecting banks. Statements in accordance with ifrs by illustrating one possible format for financial statements for a fictitious banking group involved in a range of general banking activities;

Therefore, this checklist includes disclosure requirements from both ifrs s1 and ifrs s2. For the purposes of this checklist, the. [ias 30.24] disclosures are also required about:

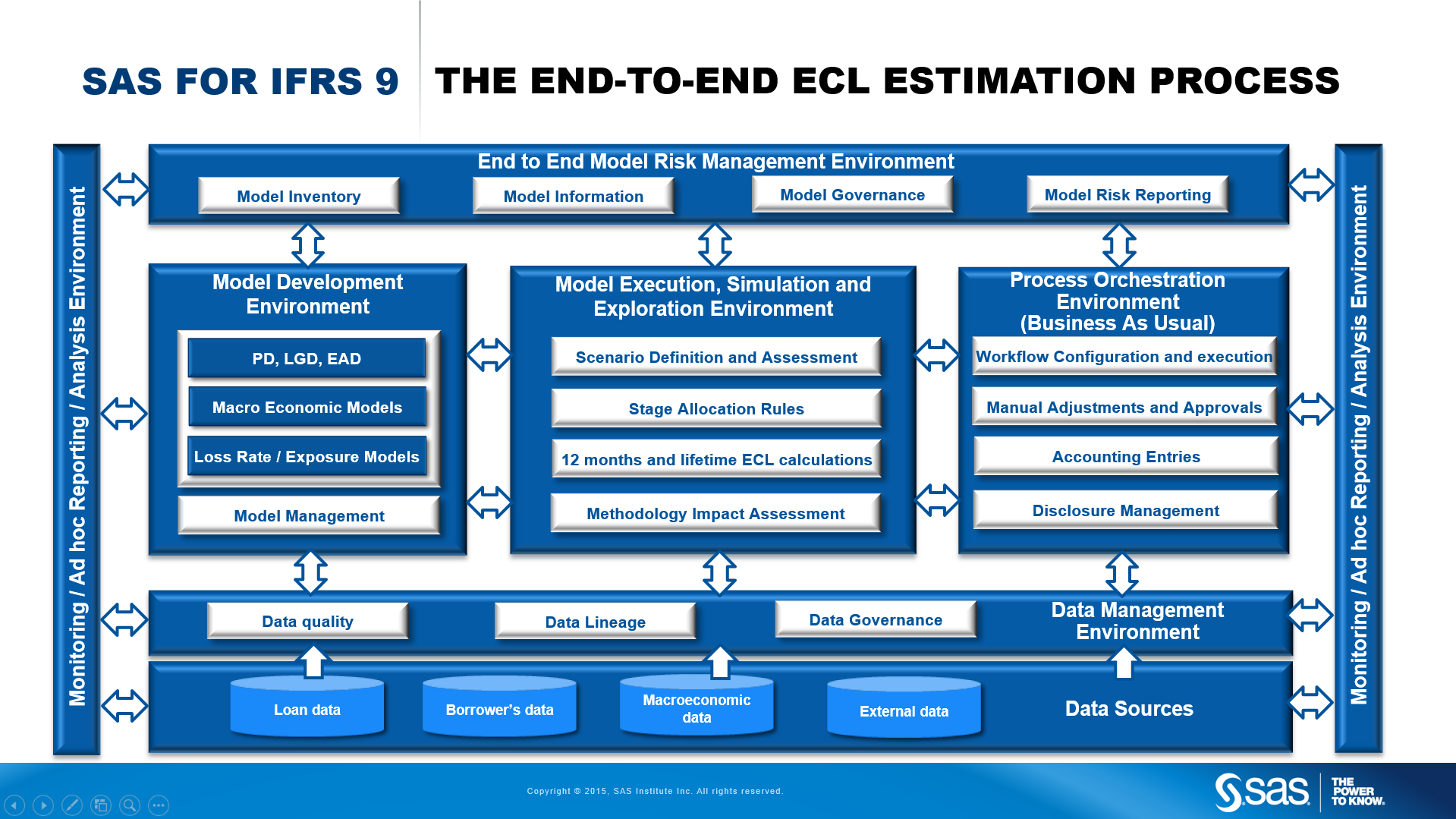

Ifrs for banks kpmg is committed to provide long term support to our clients as they tackle challenges raised by the upcoming new standard on financial instruments. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the implementation of indian accounting standards (ind as) and. However, not all of a bank’s transactions are accounted for under ifrs 9;

Ifrs 15 explicitly excludes from its scope transactions governed by ifrs 9. Examples of financial instruments are cash and balances with central banks, investments which can include equity investments or bonds, loans and advances to customers, derivatives and repurchase aggrements. Fair values of financial instruments 70 performance for the year 83 8.

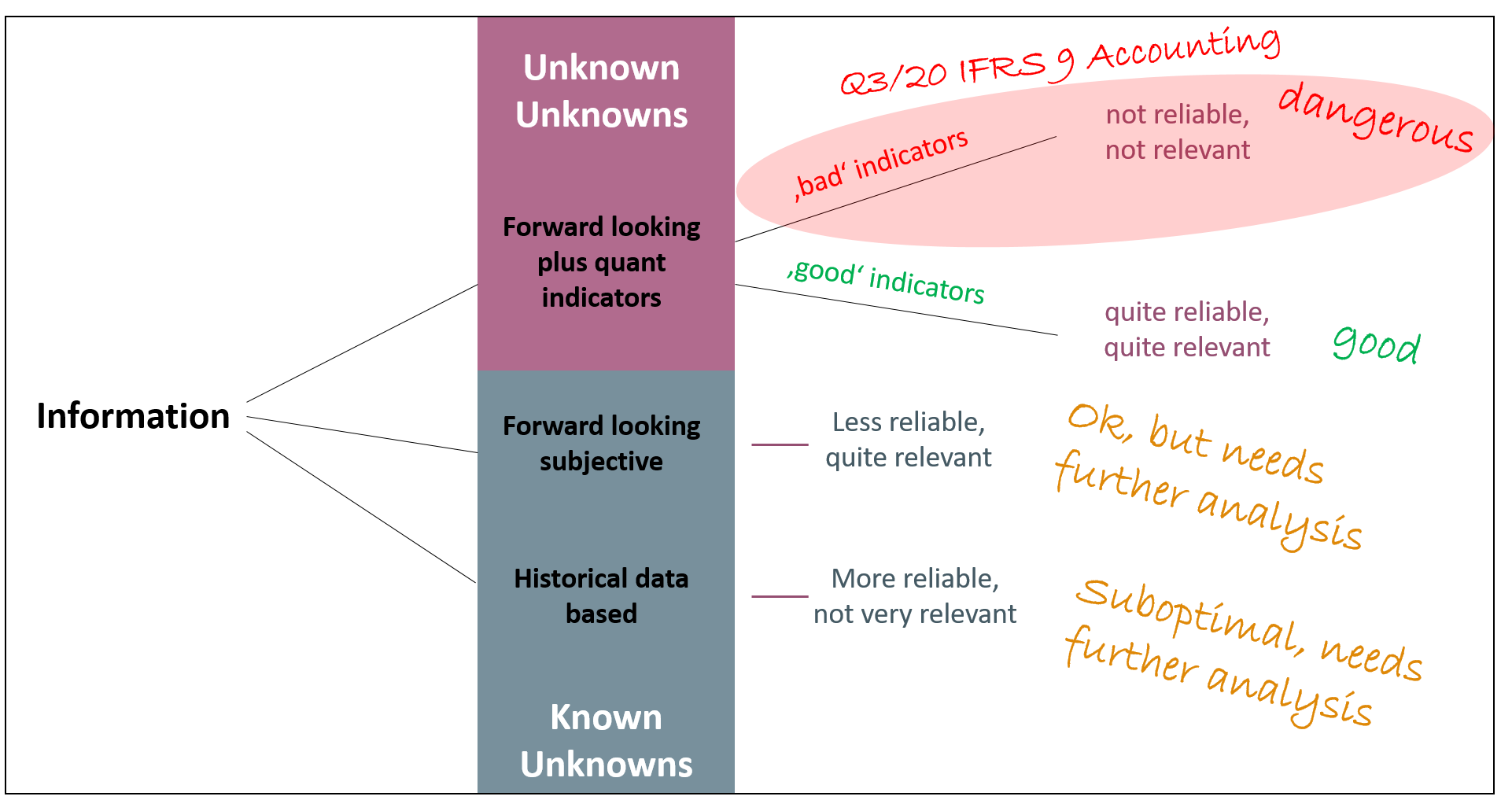

Financial risk review 23 7. The biggest accounting development for banks today is likely to be ifrs 9 financial instruments, which will have a significant impact on the balance sheet, along with accounting systems and processes.ongoing deliberations on how to. Some of the translations are only available through the ifrs foundation shop, however, most of the content is available free of charge.

With one year down, and many more to go, the application of ifrs 9 has just started. Ifrs 9 allows a bank to switch to a new hedge accounting model that is aligned more closely with risk management. A bank must disclose the fair values of each class of its financial assets and financial liabilities as required by ias 32 and ias 39.

It is a subjective, relative and complex standard. 2 international gaap bank limited illustrative disclosures under ifrs 7 as amended by ifrs 9 The world bank ramp accounting team has.

Undoubtedly demands for what banks should So, when assessing the impact of ifrs 15, banks must determine. The ifrs foundation announces the release of azeri, bosnian, brazilian portuguese, french, hebrew, macedonian, russian, spanish and ukrainian translations.

Changes in accounting policies 20 financial risk review and fair value 23 6. Annual accounts, prudential reporting and more and more financial information reporting are based on ifrs. Is the minimum, many banks are choosing to say more.