Out Of This World Info About Form T2125 Statement Of Business Activities

Create a new t2125 form.

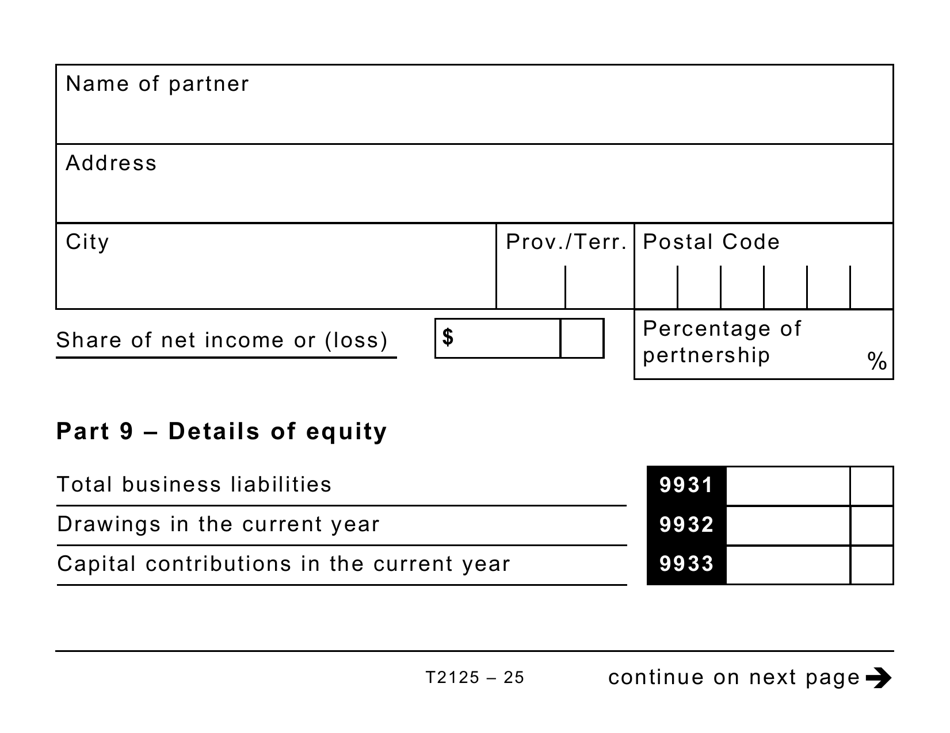

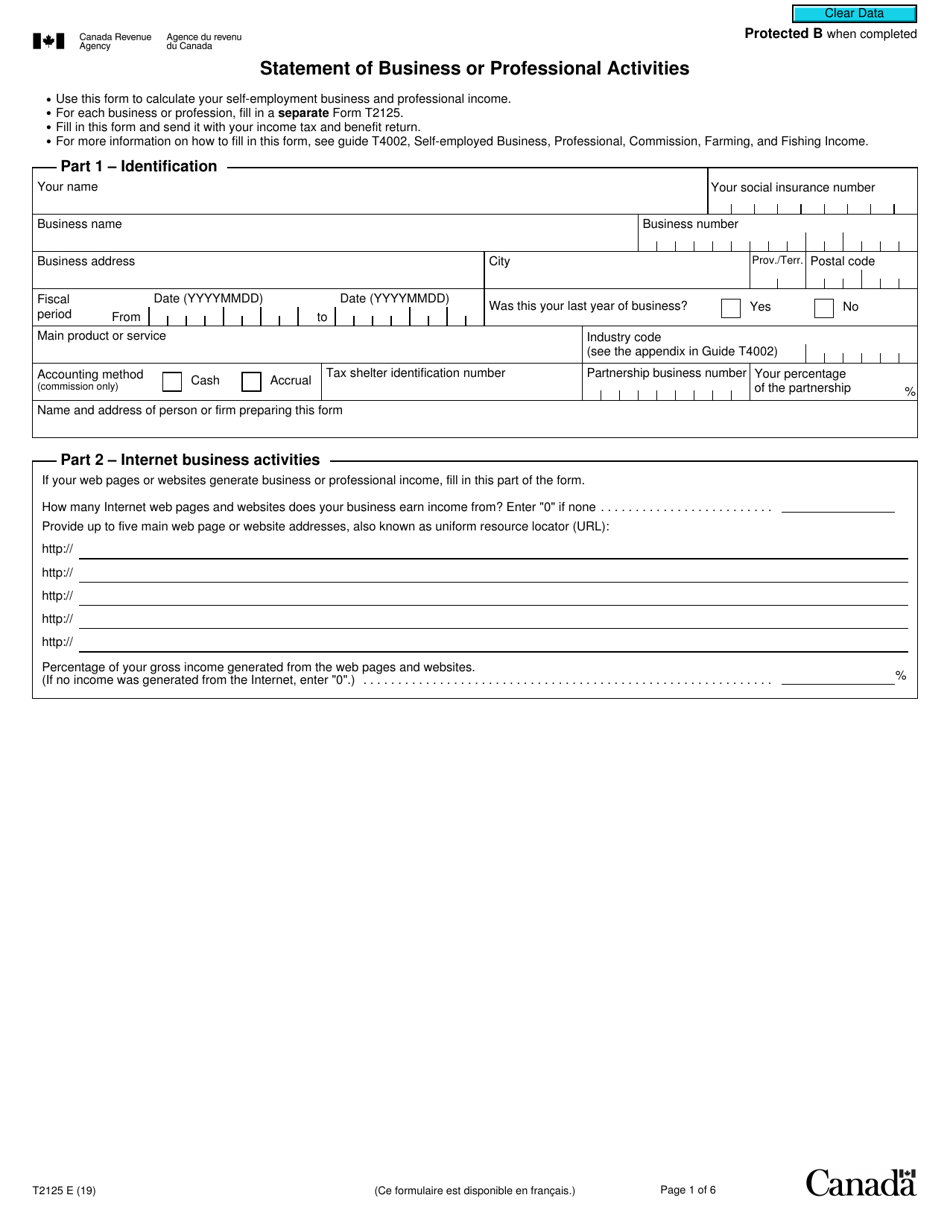

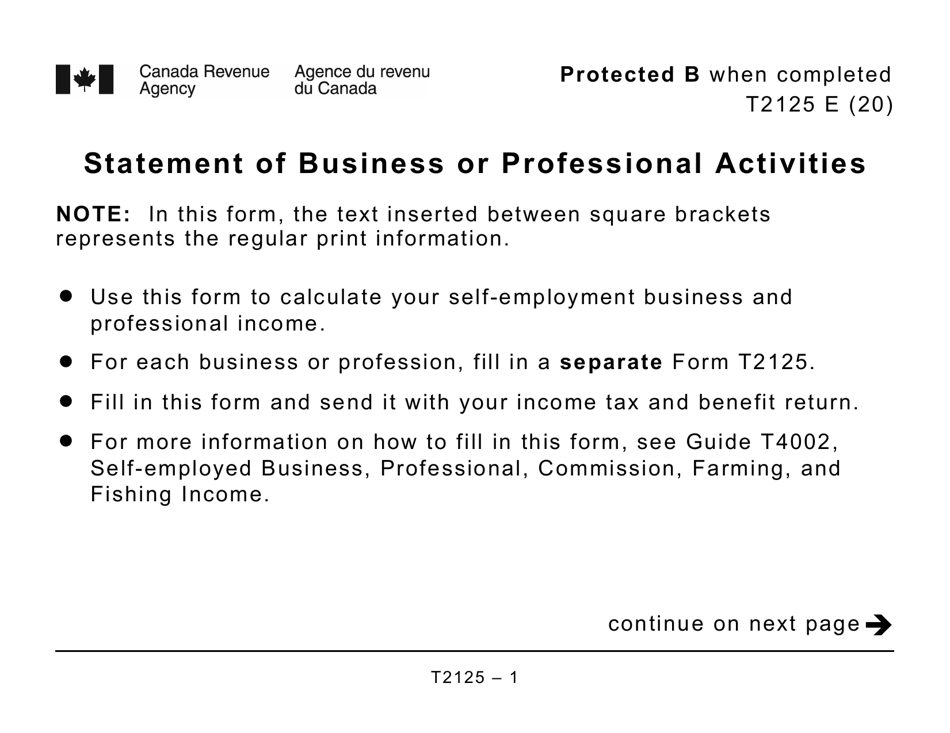

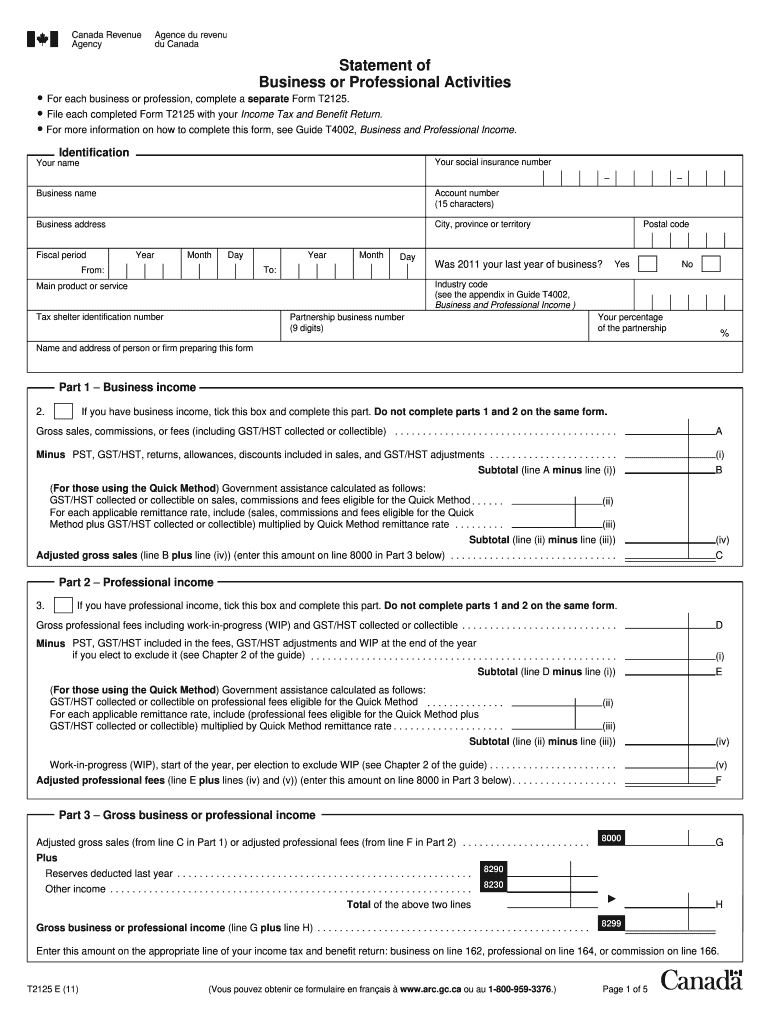

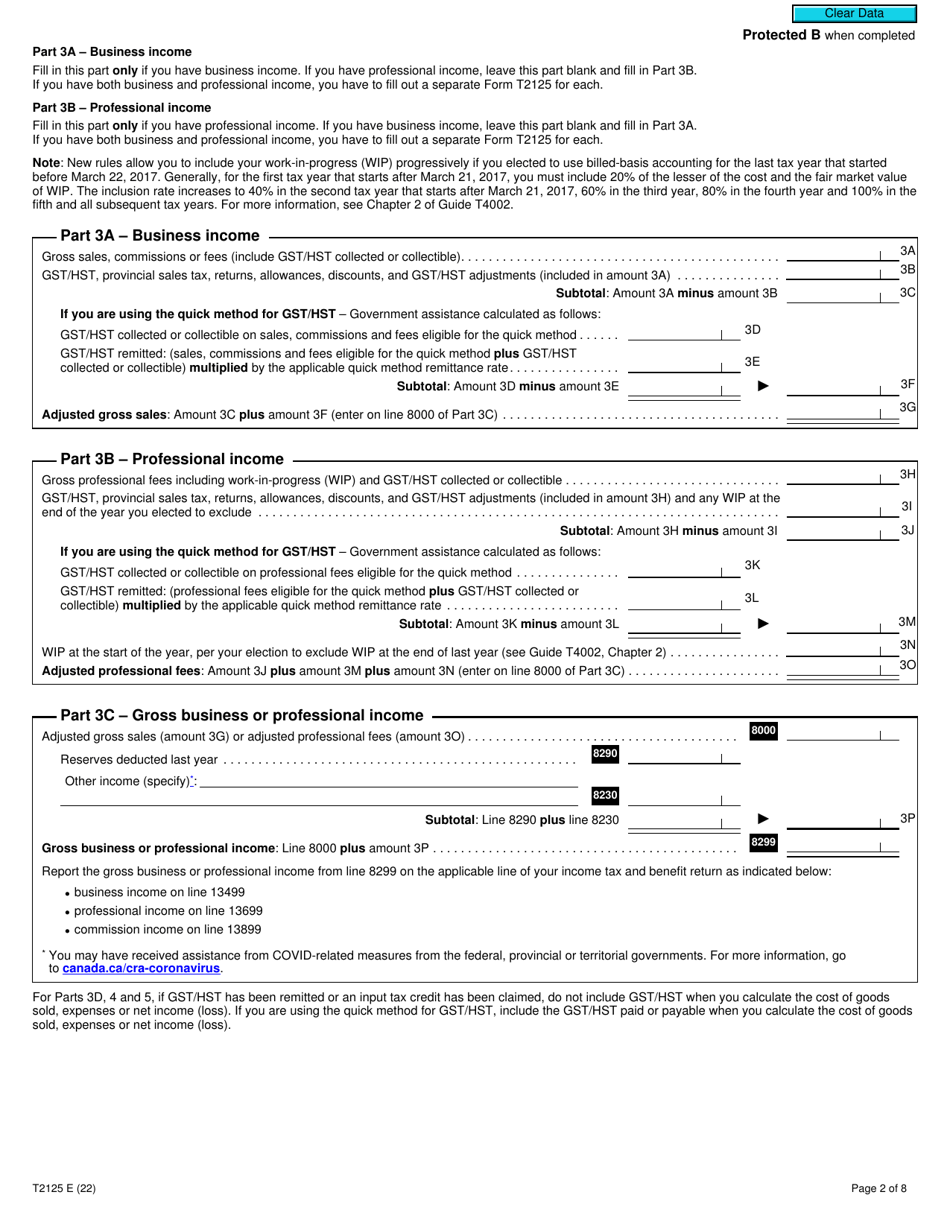

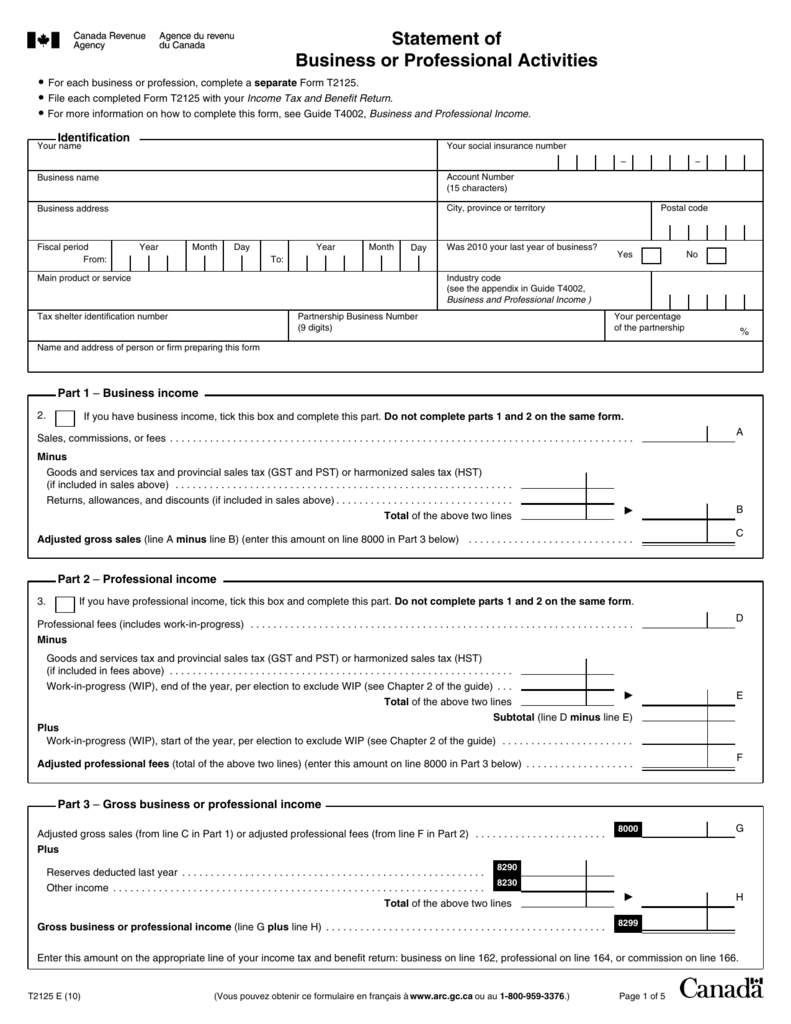

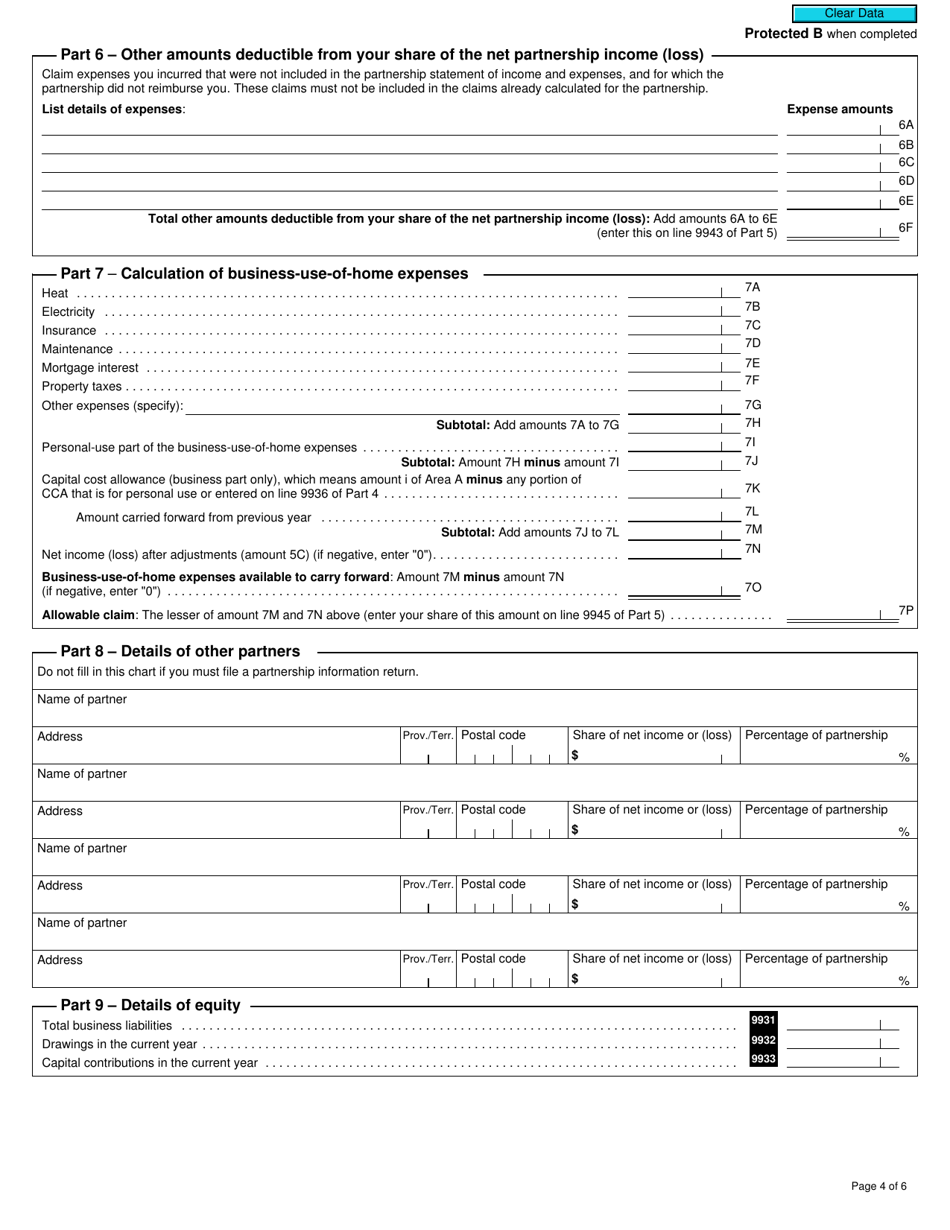

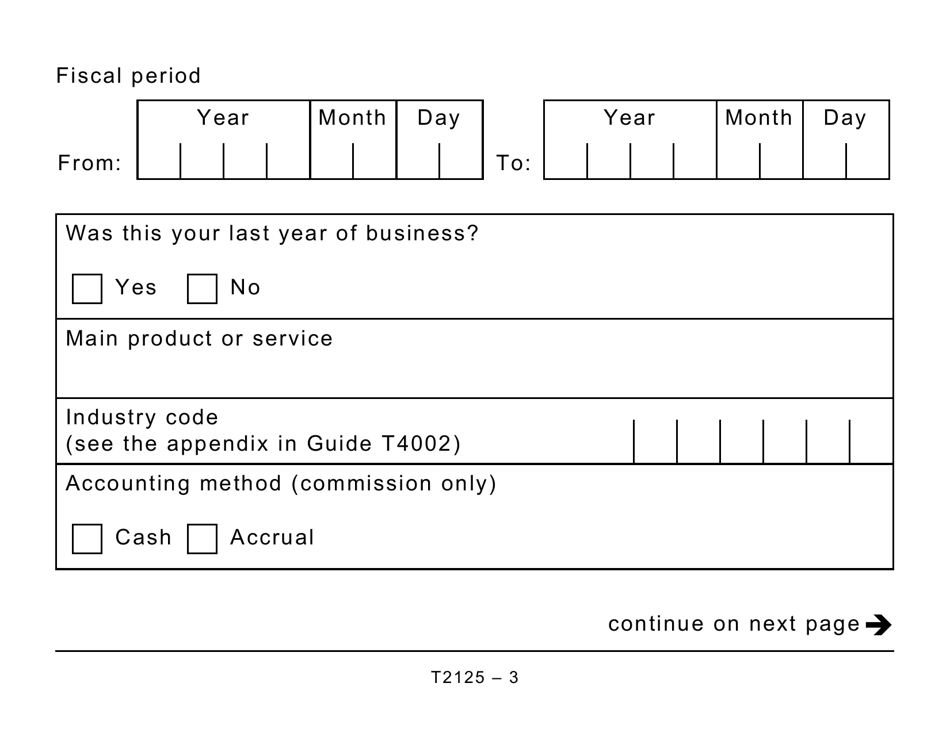

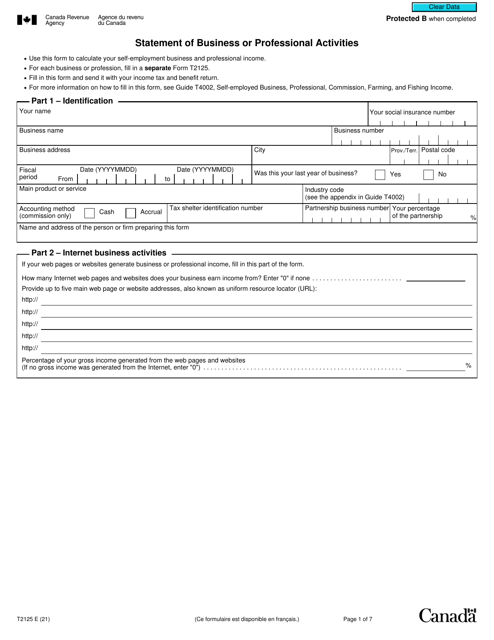

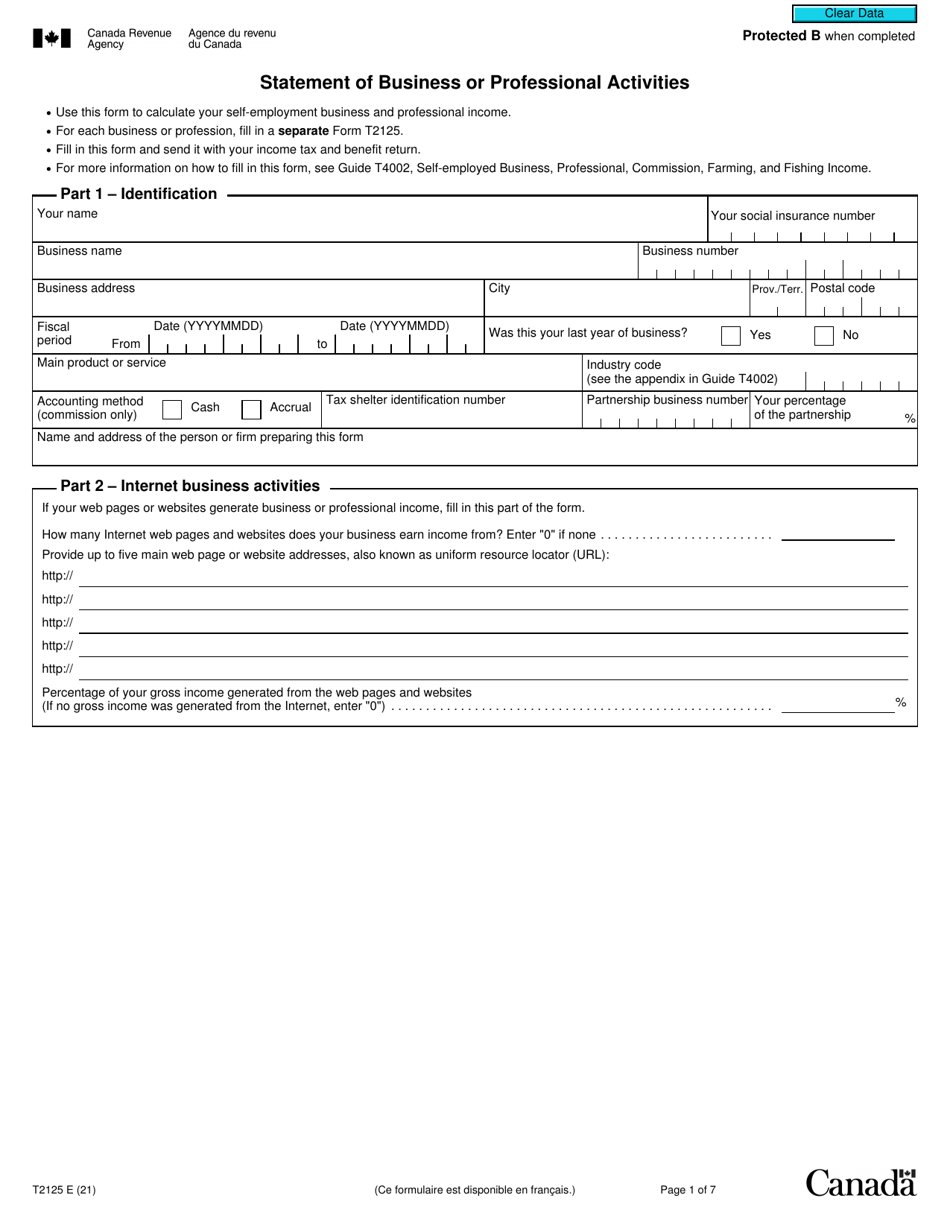

Form t2125 statement of business activities. You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses. Use the t2125 form to report either business or professional income and expenses. T2125 statement of business or professional activities.

Statement of business or professional activities • for each business or profession, complete a separate form t2125. We encourage you to use it. Any client that earns a professional income from a business, even if that business is unregistered, must account for that income using the statement of.

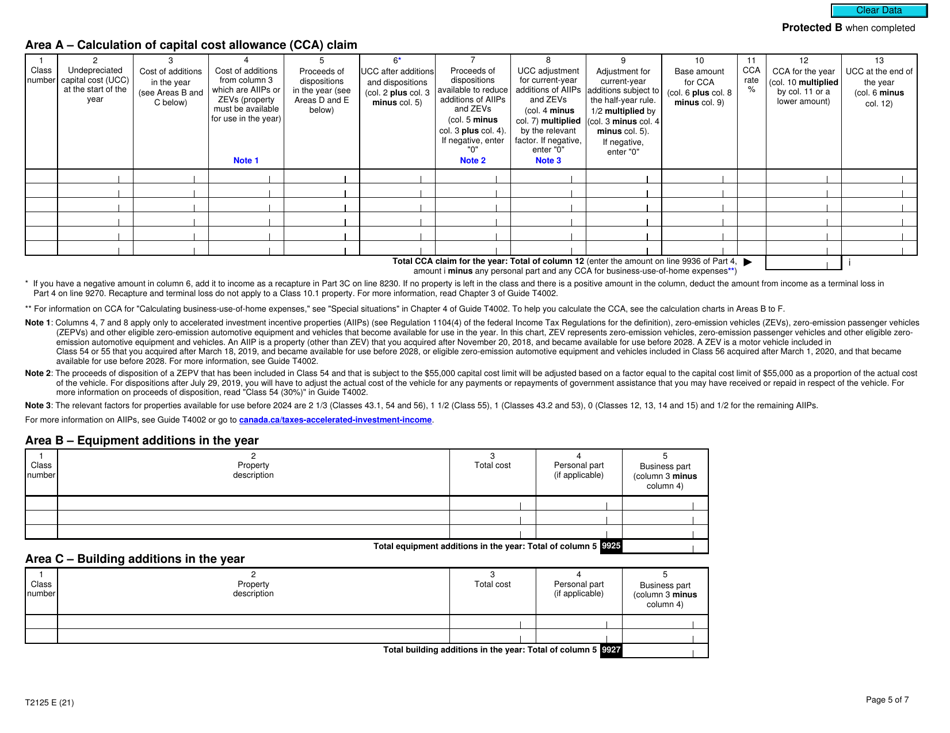

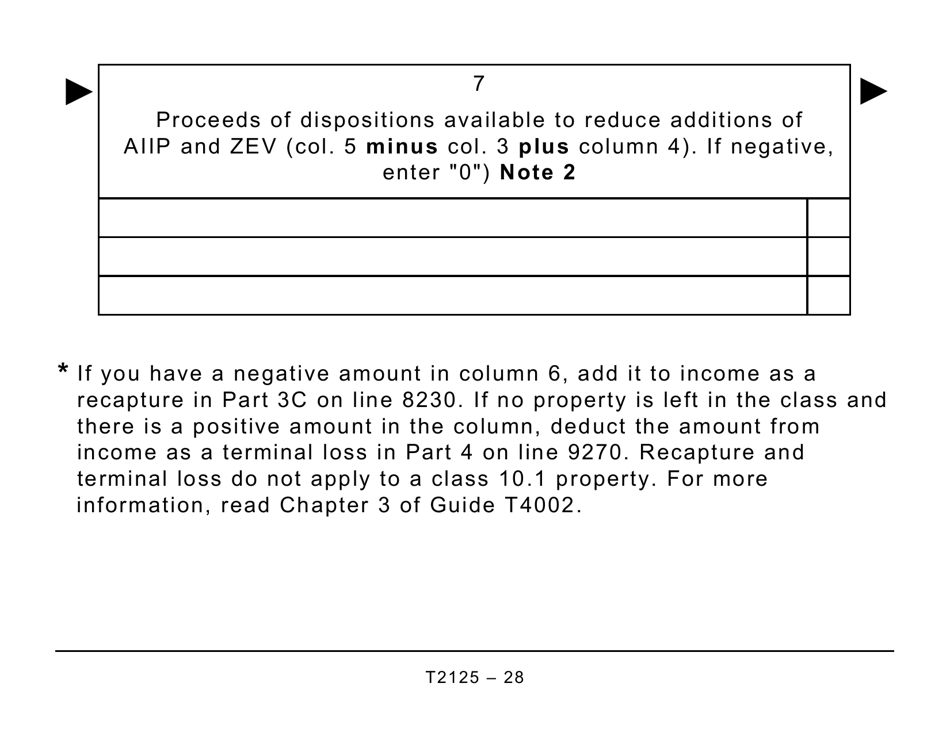

However, we will continue to accept other types of financial. Information for sole proprietorships and partnerships on getting and completing form t2125, statement of business or professional activities, information on capital. This form can help you calculate your.

For each business or profession, fill in. Statement of business or professional activities form to report your income and expenses for the year.

Prepare a federal t2125 statement of business or professional activities in taxcycle t1. When completing form t2125, statement of business or professional activities, form t2121, statement of fishing activities, or form t2042, statement of farming. The t2125 form is a versatile reporting tool that allows taxpayers to disclose many facets of their enterprise to the cra including, but not limited to their business.

This form can help you calculate your income and expenses for income tax purposes. For each business or profession, fill in a separate form t2125. Use this form to report either business or professional income and expenses.

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)