Best Info About Freight In Income Statement

Pt from b.c.'s transportation minister rob fleming said, in the interest of safety, a formal cancellation notice was issued to chohan freight.

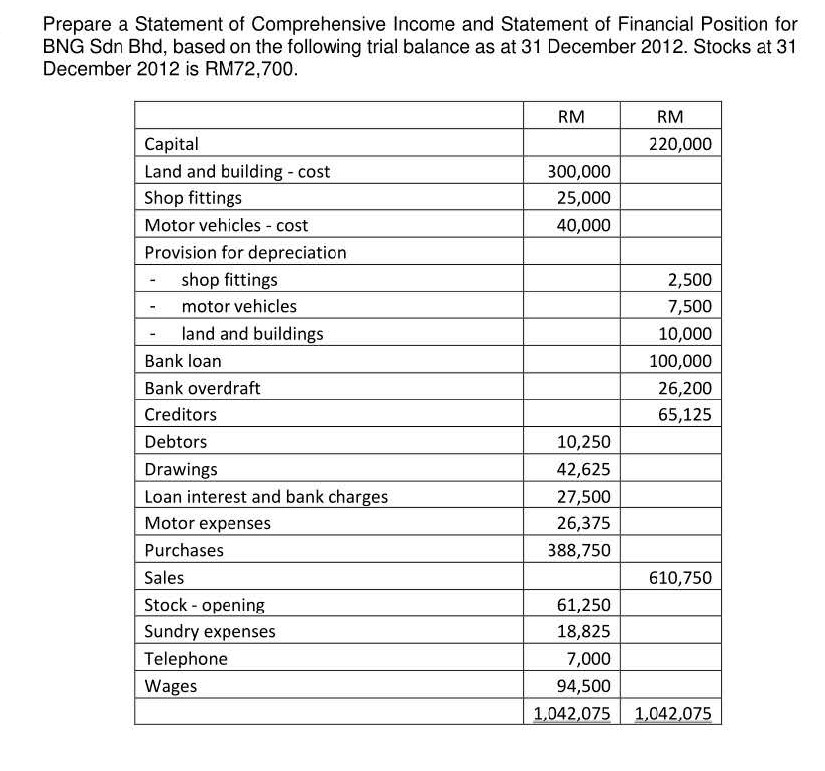

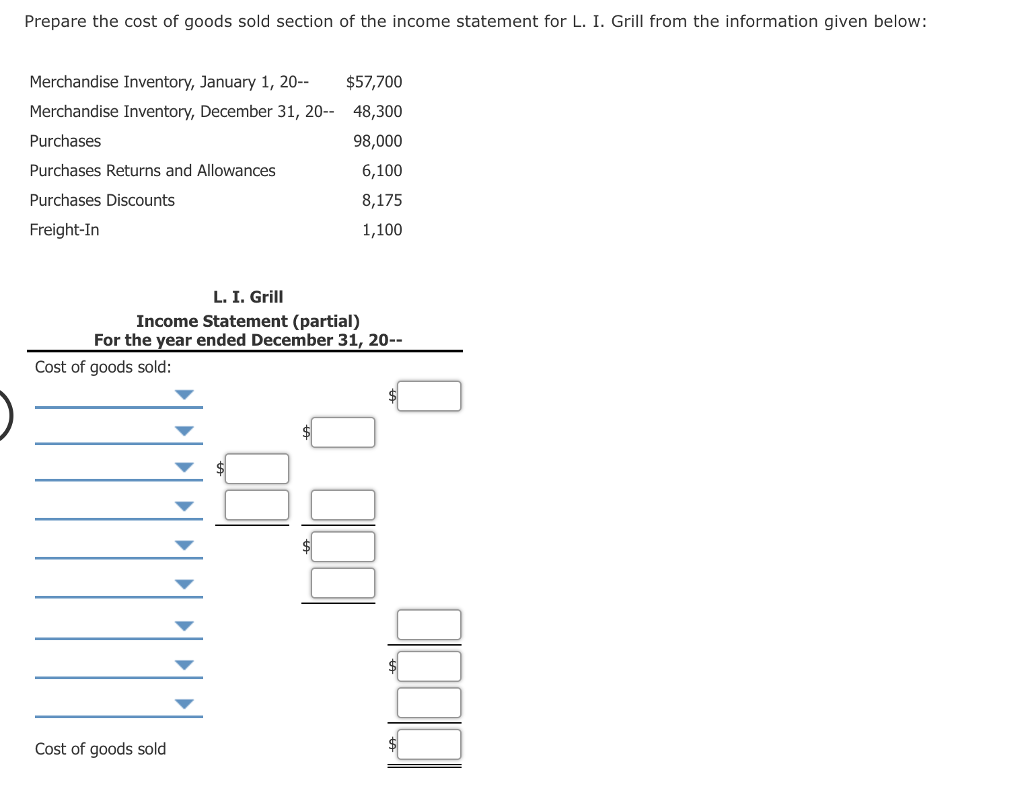

Freight in income statement. Is freight out an operating expense? Freight in is the transportation cost associated with the delivery of goods from a supplier to the receiving entity. The plan details how the cec’s clean transportation program will spend $1.9 billion in state funding over the next four years, with at least 50 percent targeted to.

Freight out is the transportation cost associated with the delivery of goods from a supplier to its customers. When a company hires a 3rd party transportation company to transport inventory to a customer,. The reason is that accountants define cost as all costs necessary to.

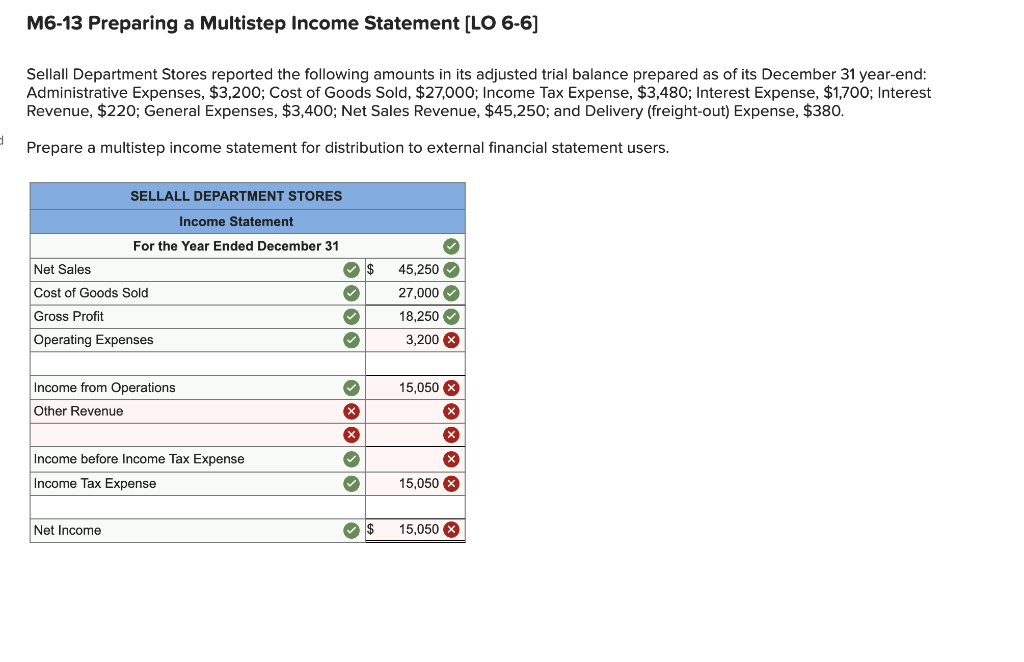

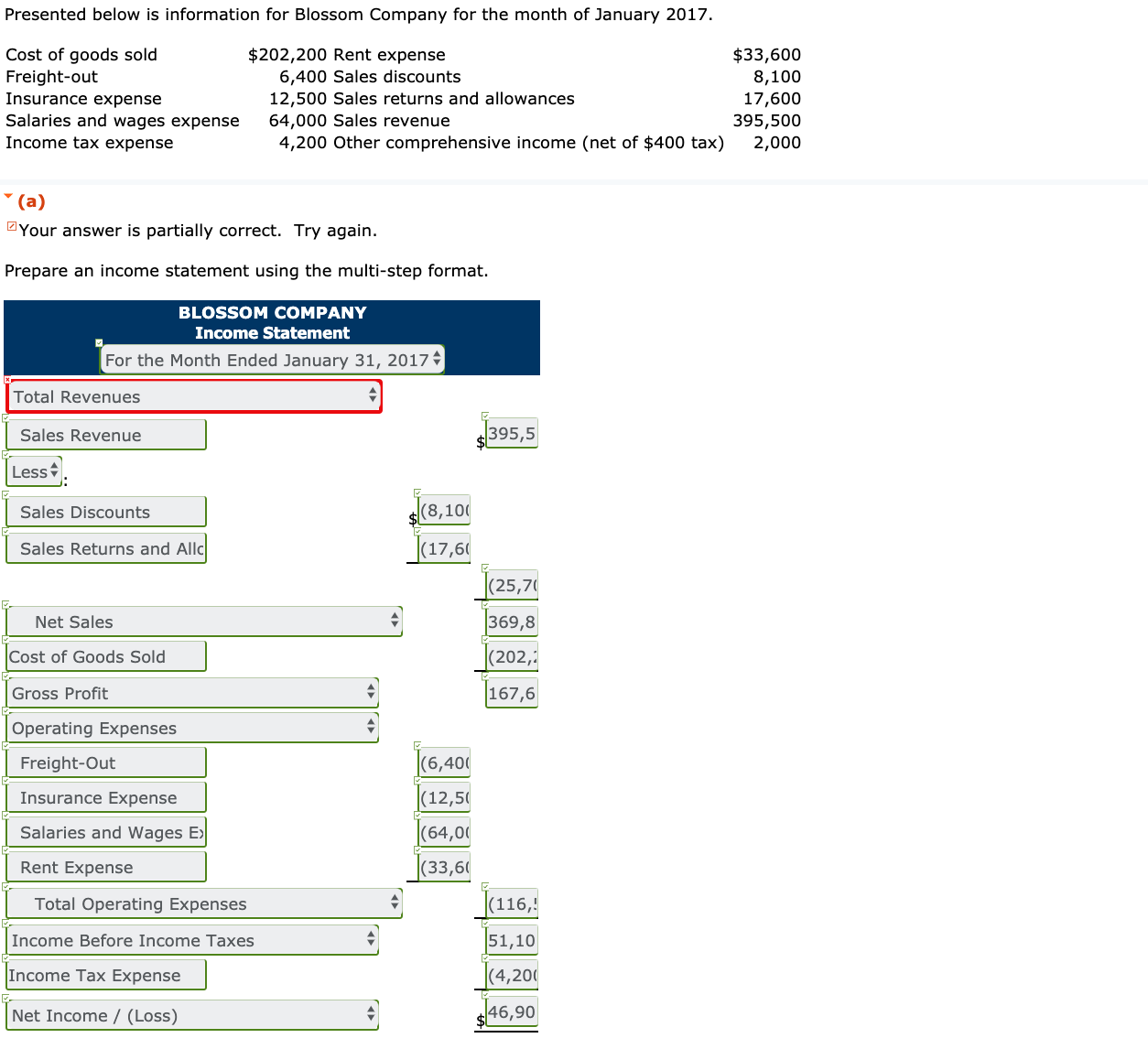

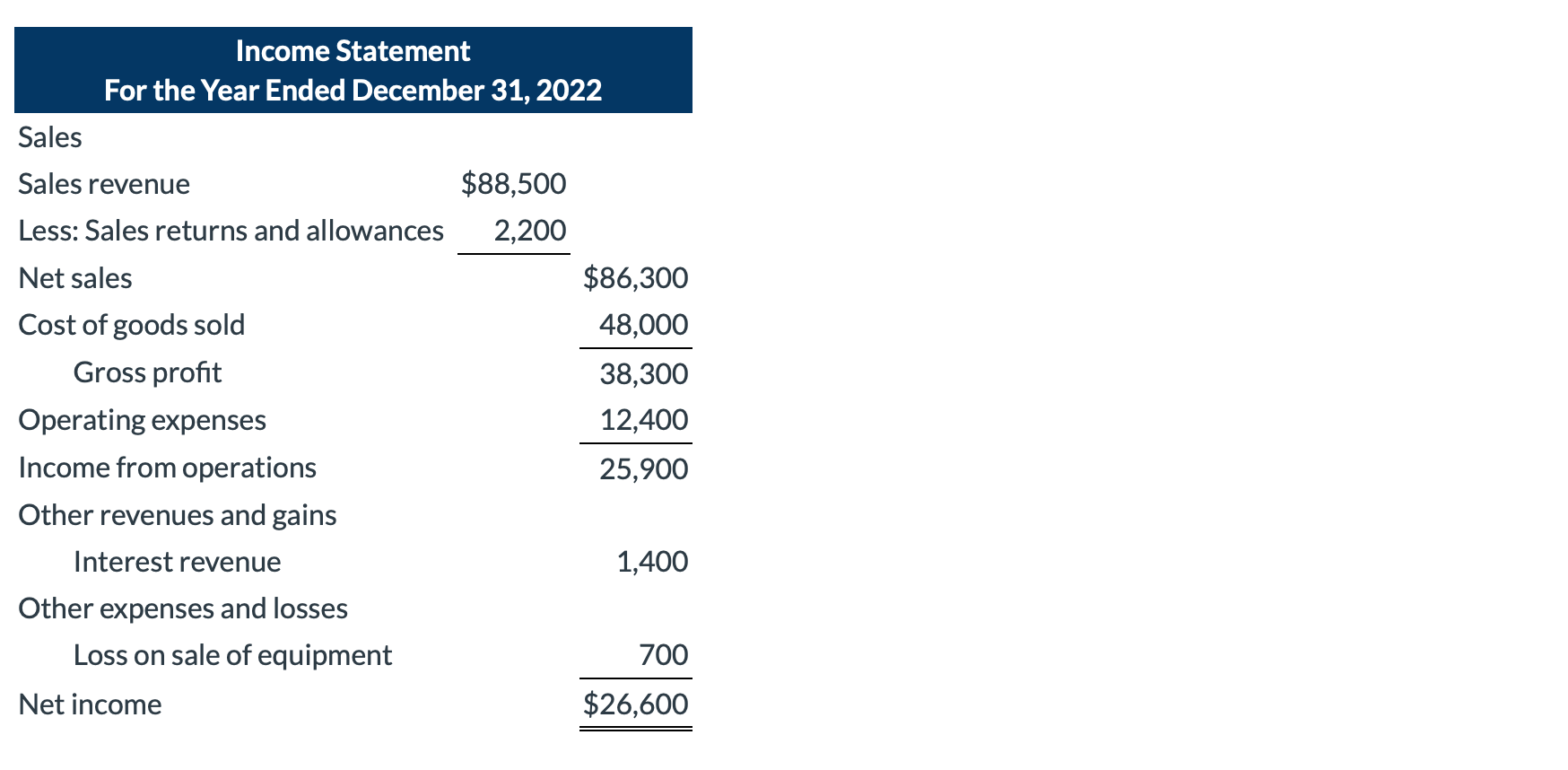

Below is an example of amazon’s consolidated statement of operations, or income statement, for the years ended december 31, 2015. There may even be cases where the freight out expense is negative, if the amount billed is routinely higher than the amount of the expense. An income statement is a financial statement that reports a company's financial performance over a specific accounting period.

Is freight in on the income statement? A statement sent a 6 a.m. Updated june 24, 2022.

An income statement contains many aspects of financial information, including specific costs that are sometimes hard to categorize. The expense is paid by the. A real example of an income statement.

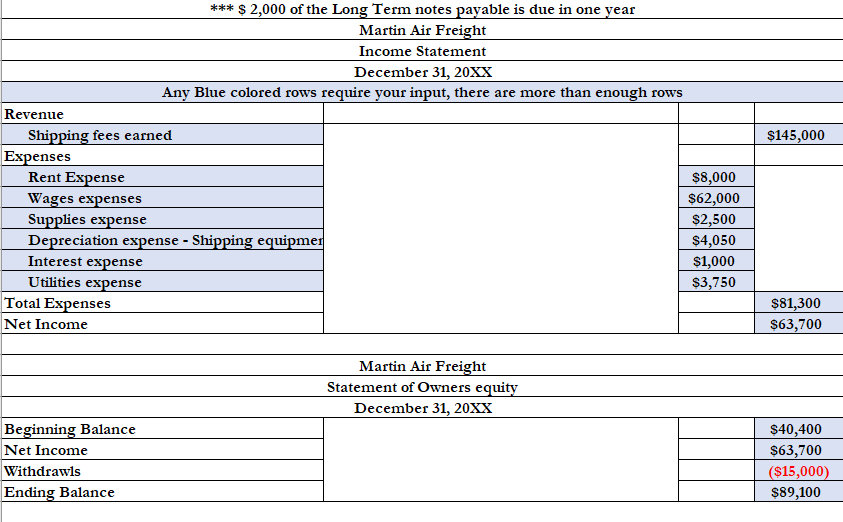

There are several key factors to consider when determining. It is considered an operating expense in a business’s accounting system. Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100.

November 03, 2023 what is freight out? To record this, calculate your freight costs under the costs of goods sold section in your income statement. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

Transportation costs recorded in the income statement are the costs related to the entity’s transportation of goods to customers or suppliers. Therefore, operating expenses, including freight out, are recorded. This cost should be charged.

Freight out charges are expenses that result from transporting goods or raw materials from suppliers to customers, which can either be companies or private.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)