Best Tips About Provision Of Doubtful Debts In Balance Sheet

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but.

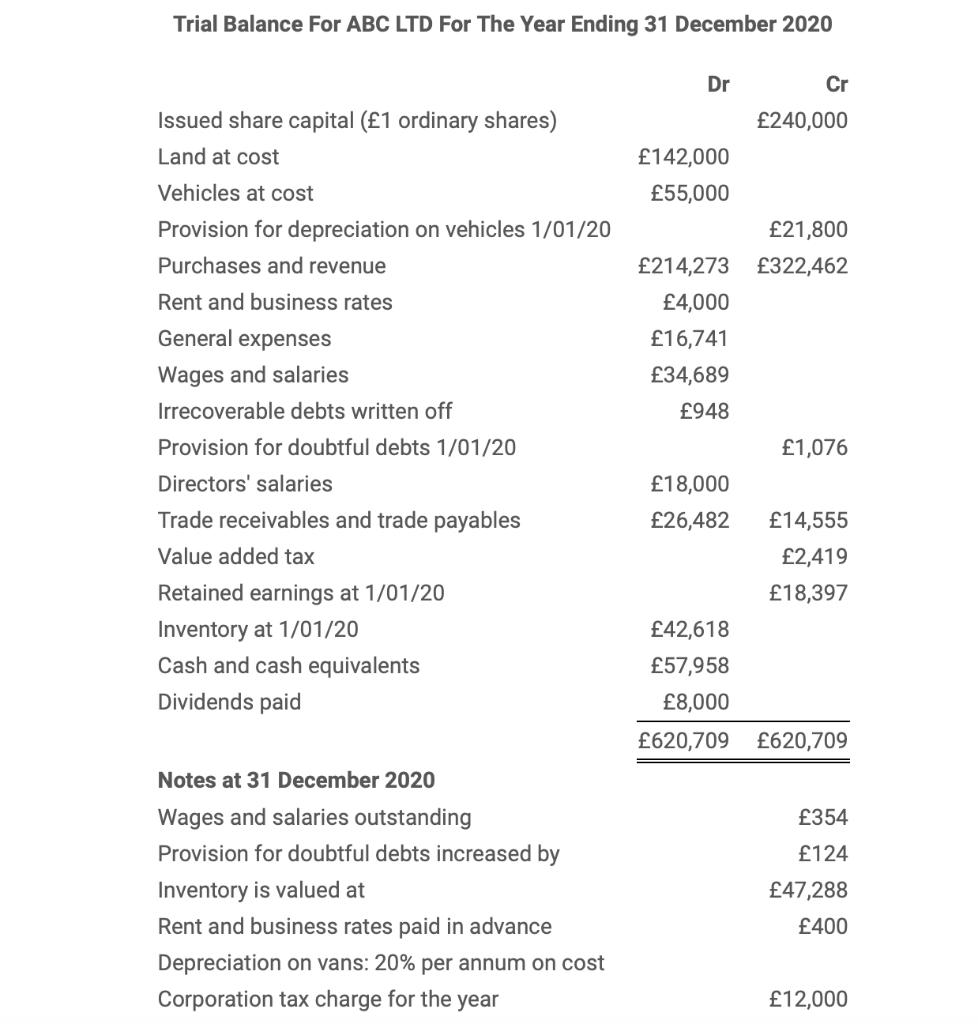

Provision of doubtful debts in balance sheet. Every year the amount gets changed due to the provision. Side of the profit & loss a/c. One of the most common forms of provisions is for doubtful debts.

2 minutes of reading. In such a case, it will be shown only on the dr. The two line items can be combined for reporting.

The provision for bad debts should include an. Provision for doubtful debts. In simple words, provision for doubtful debts refers to the amount set aside as a provision from the profits of the business for the amount that is doubtful to be received.

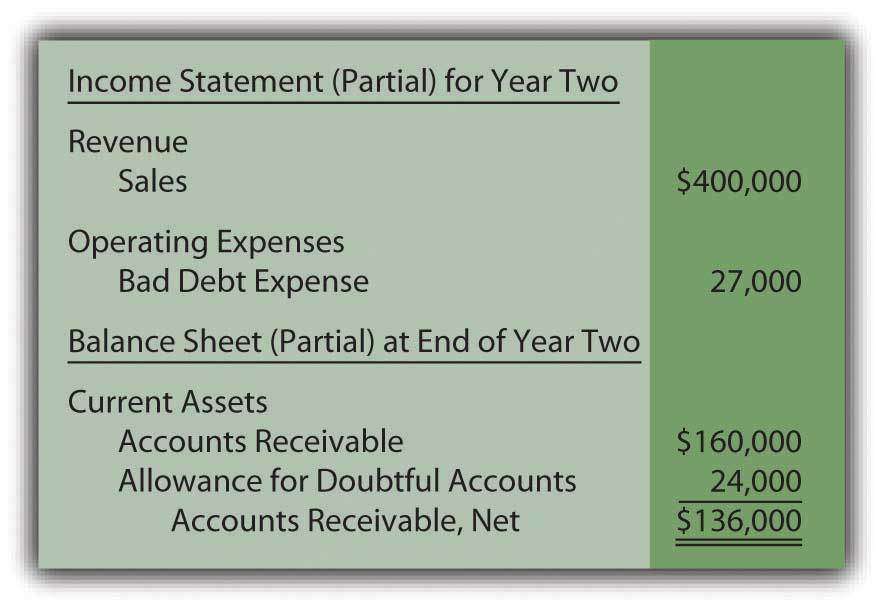

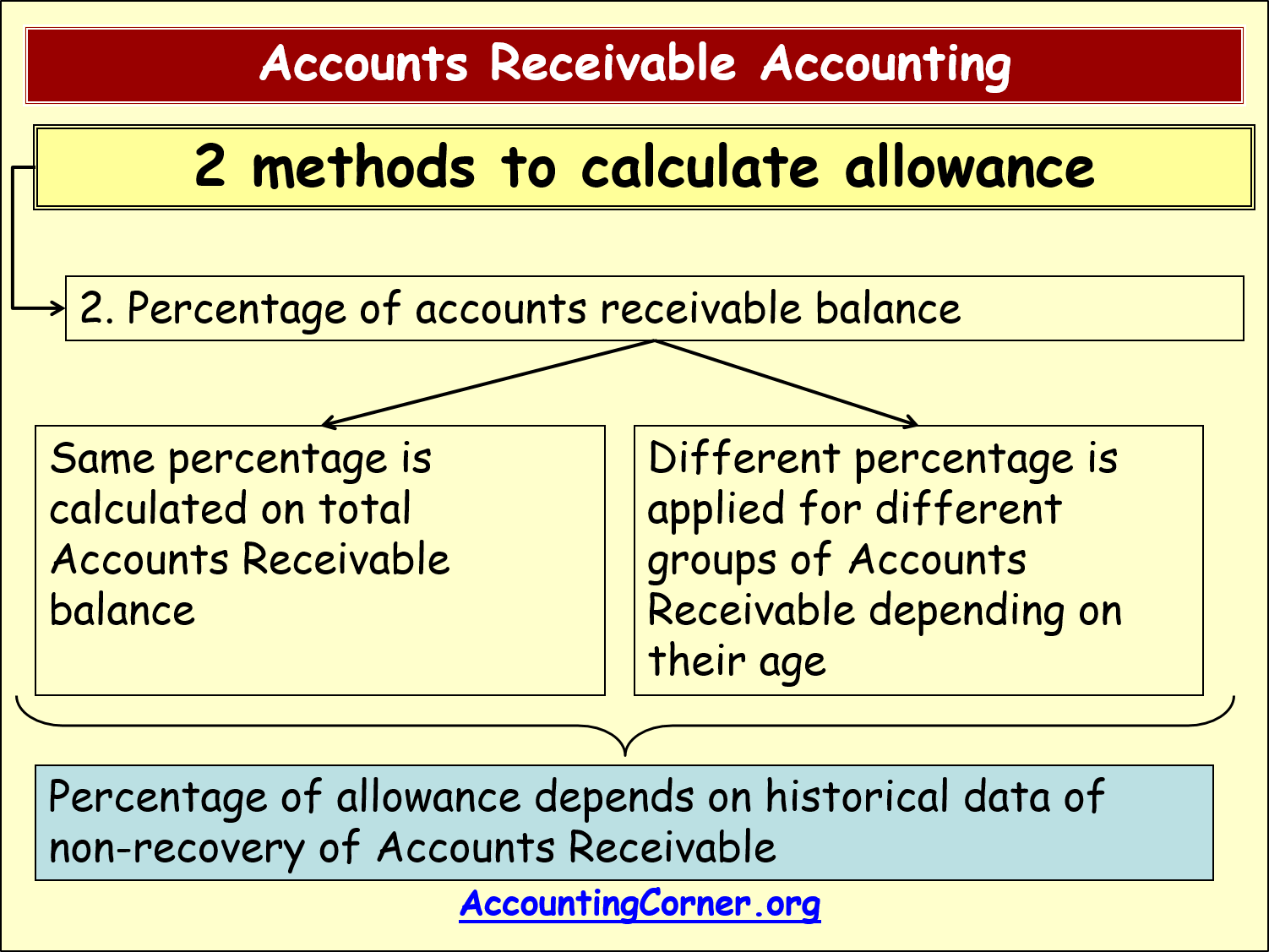

The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet. To this end, a new account is opened in the books called provisions for bad debts account, or provisions for doubtful debts account.

The provision for doubtful debts is an accounts receivable contra account, so it should always have a credit balance, and is listed in the balance sheet directly below the accounts receivable line item. When this account is first. A debt existed at the balance sheet date, and at that date the debtor had the capacity to pay, but before the accounts were finalised, circumstances arose which rendered the.

If provision for bad & doubtful debts is given inside the trial balance: Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit.

Provision for doubtful debts. Businesses providing any sale on credit, and therefore having trade debtors on. The provision for doubtful debts, often described as the provision for losses on accounts receivable or bad debt provision,.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)