Fantastic Info About Comparative Statement Balance Sheet

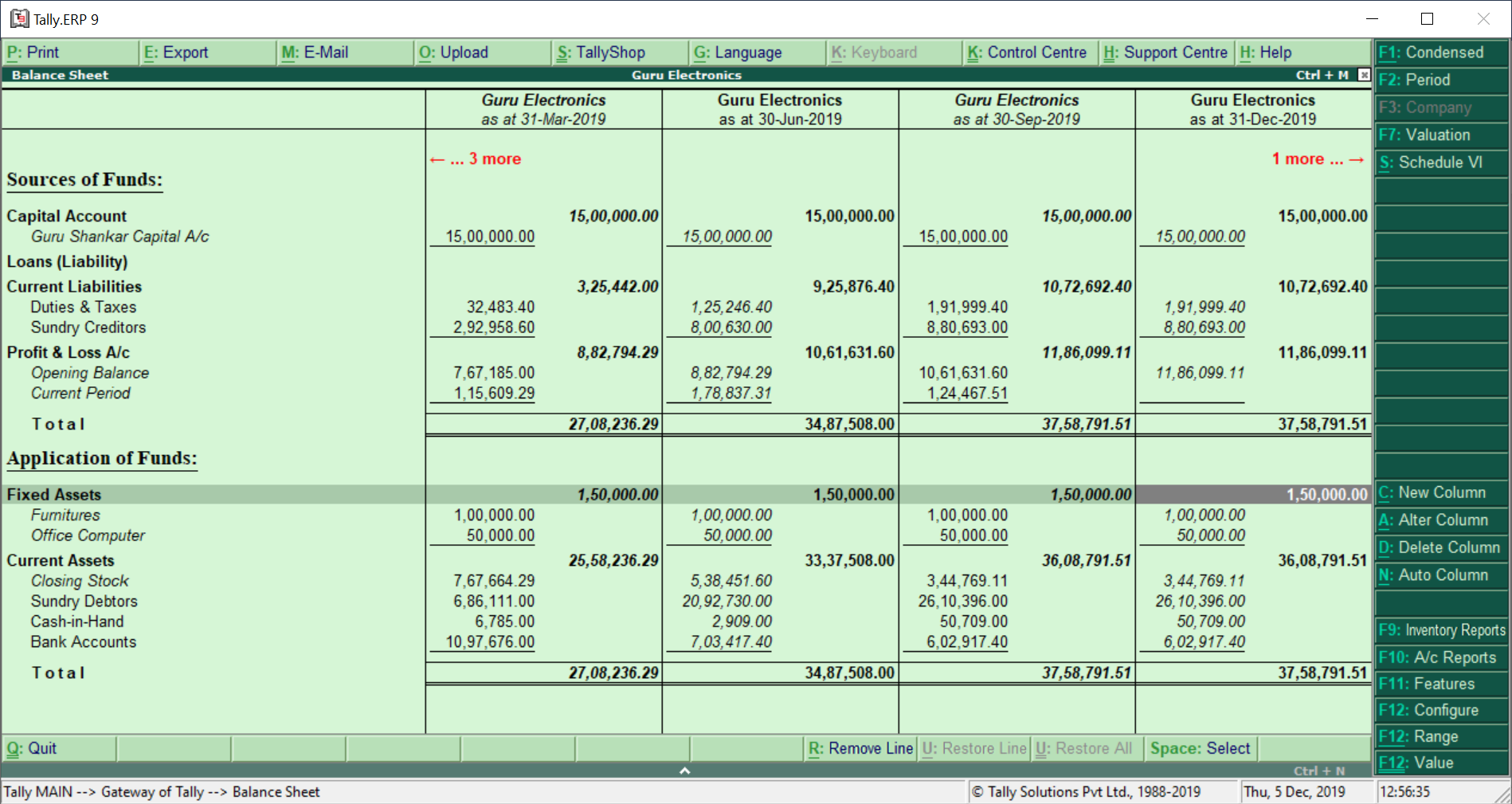

The financial position is compared with 2 or more periods to depict the trend, direction of change, analyze and take suitable actions.

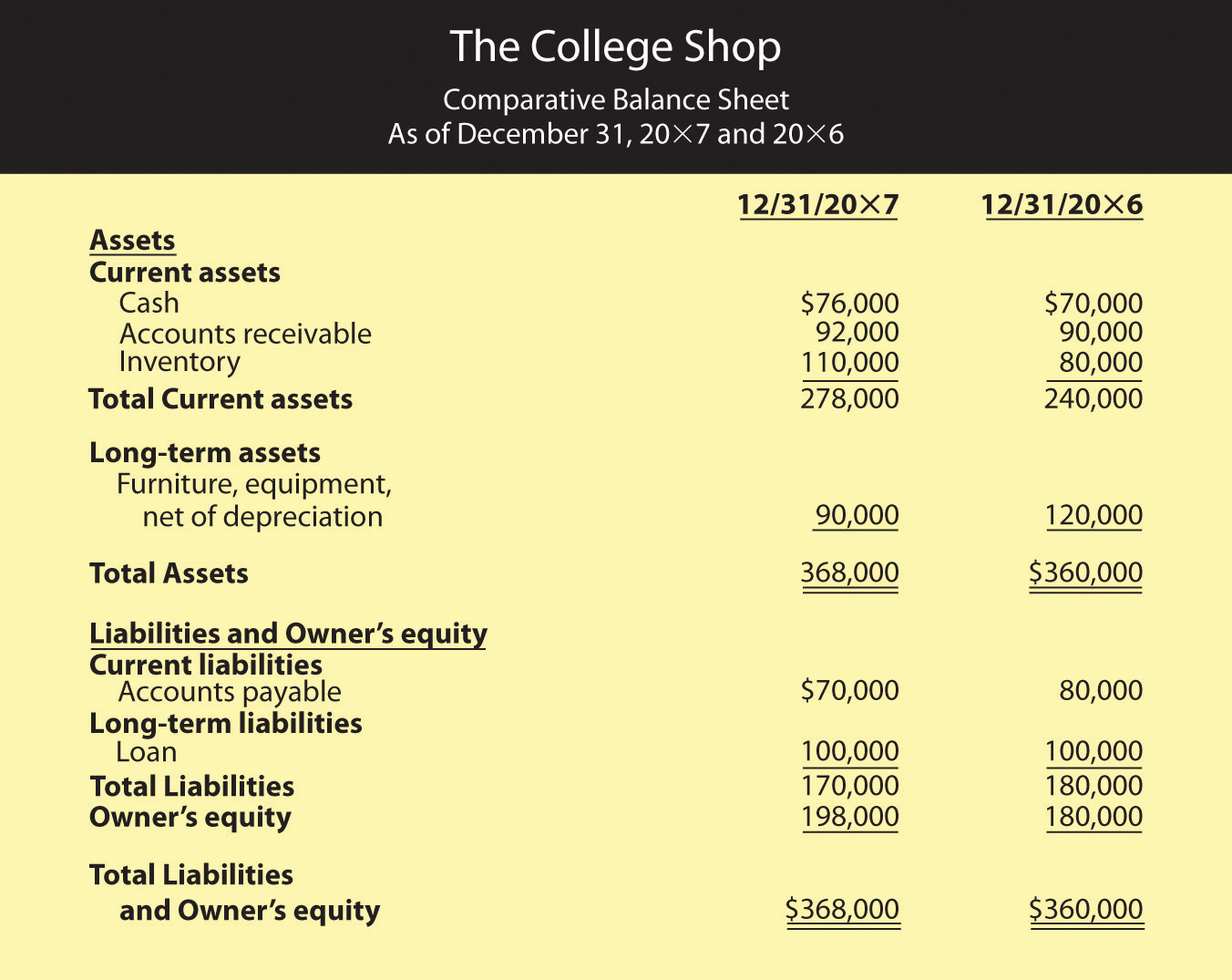

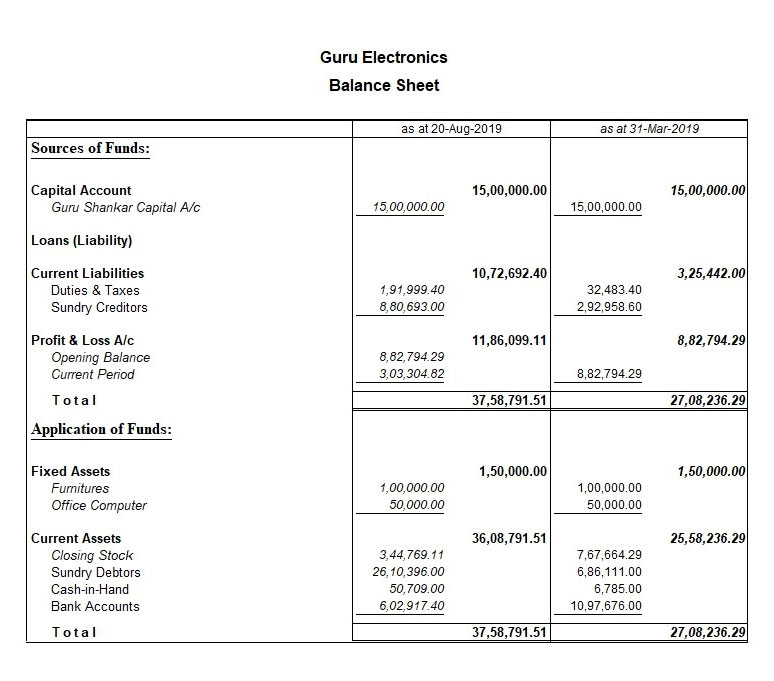

Comparative statement balance sheet. Using it, we can depict the direction of change, trend, analyse and take suitable actions. A comparative balance sheet typically has two columns of amounts that appear to the right of the account titles or other descriptions such as cash and cash equivalents, accounts receivable, accounts payable, etc. The first column of amounts contains the amounts as of a recent moment or point in time, say december 31, 2022.

Reporting balance sheets in financial statements. The balance sheet, or statement of financial position as it is sometimes called, is one of the four primary financial statements. A comparative statement is a financial statement that helps compare components of a business’s income statement and balance sheet over a duration of at least two periods, in percentage and absolute form.

A comparative statement is a document that compares a particular financial statement with prior period statements. A comparative balance sheet showcases: Taking this quiz will assess what you know about the following:

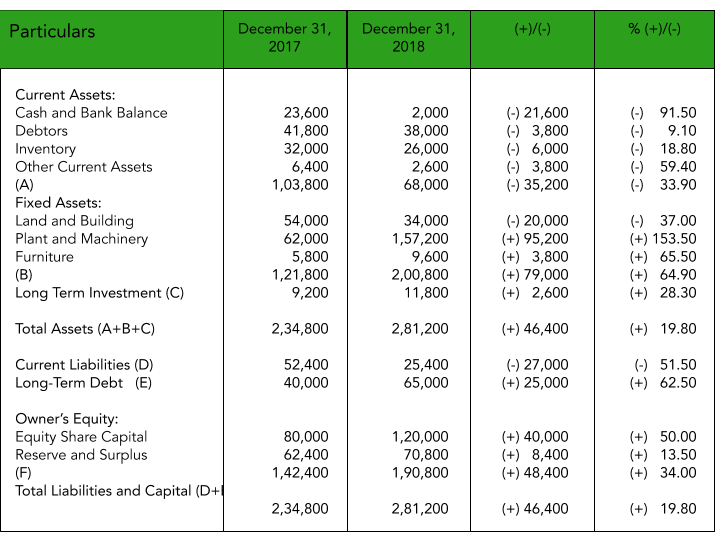

Comparative statement analysis allows businesses to identify trends and changes in their financial statements over time. Changes (increase or decrease) in such assets and liabilities. The following is an example of a balance sheet that is presented on a comparative basis.

Previous financials are presented alongside the latest figures in. Comparative balance sheet. A comparative balance sheet contains two columns that differentiate between the financial objective of the concerning terms.

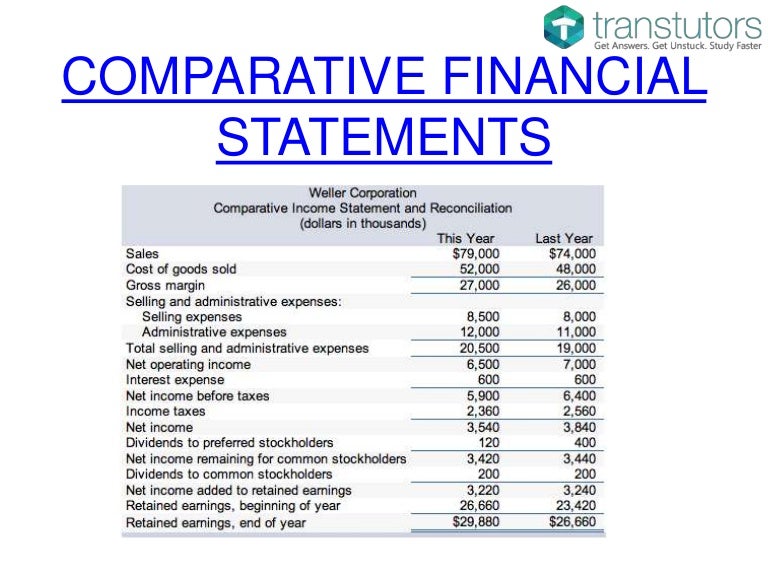

Example of comparative financial statements. Comparative balance sheet analyses the assets and liabilities of business for the current year and also compares the increase or decrease in them in relative as well as absolute parameters. A profit and loss (p&l) statement summarizes the revenues.

This secondary documentation can include anything from a bank statement to a spreadsheet and invoices. It presents previous figures with the latest financials, enabling one to compare a company’s performance against its competitors. It displays a company’s financial position at two or more distinct points, typically from one accounting period to another.

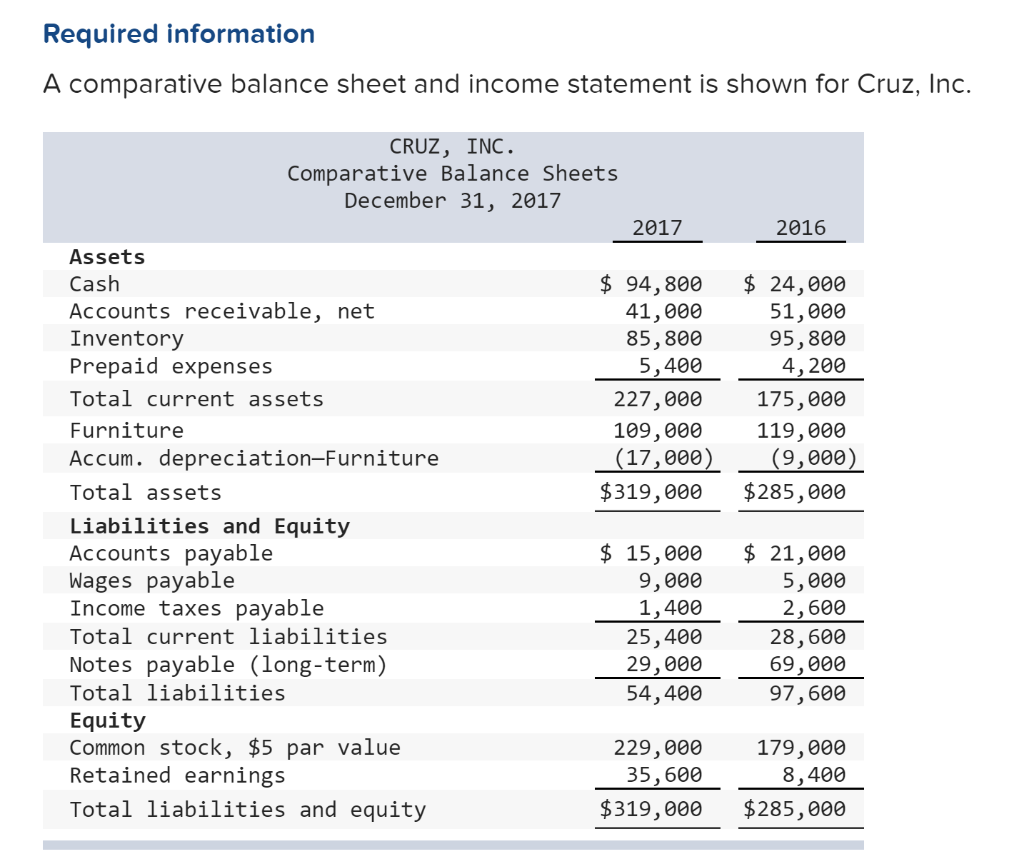

A company must include it whenever financial statements are. This can help businesses make informed decisions about their financial strategies and investments. A comparative balance sheet and income statement is shown for cruz, incorporated.

For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years. A comparative balance sheet is one of the many financial statements. The comparative balance sheet is a balance sheet that provides financial figures of assets, liabilities, and equities for “two or more periods of the same company,” or “two or more subsidiaries of the same company” or “two or more companies of the same industry” in the same format so that it can be easily understood and analyzed.

For comparing the financial condition of different periods of the same company, the periods would be added to the balance sheet and the changes and fluctuations between the periods will be described. A balance sheet provides both investors and creditors with a snapshot as to how effectively a company's management uses its resources. This can help spot discrepancies before they affect other processes, eliminate errors, and even prevent fraud.