Spectacular Tips About Accounting Policy Note

Making critical accounting judgment and estimates.

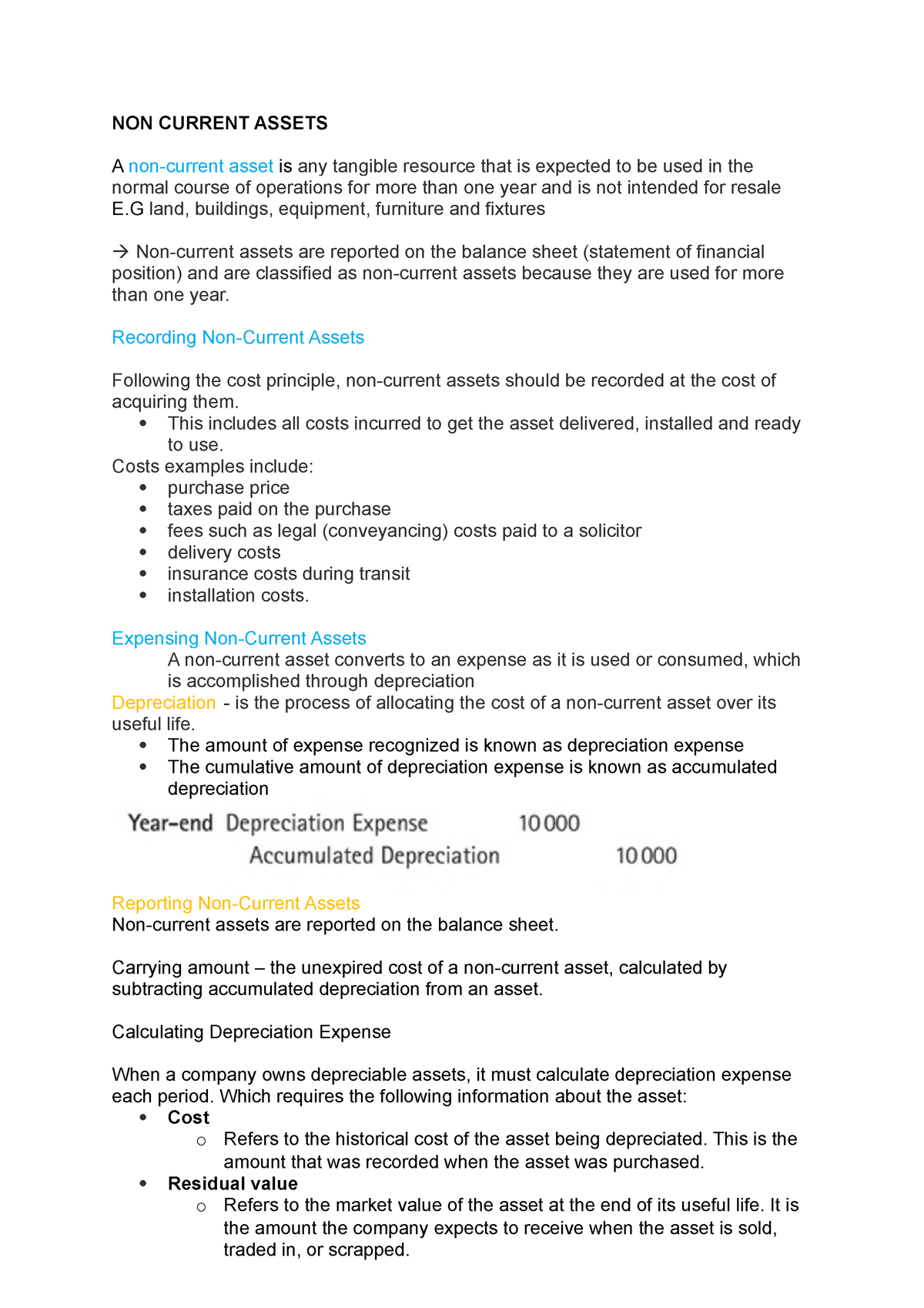

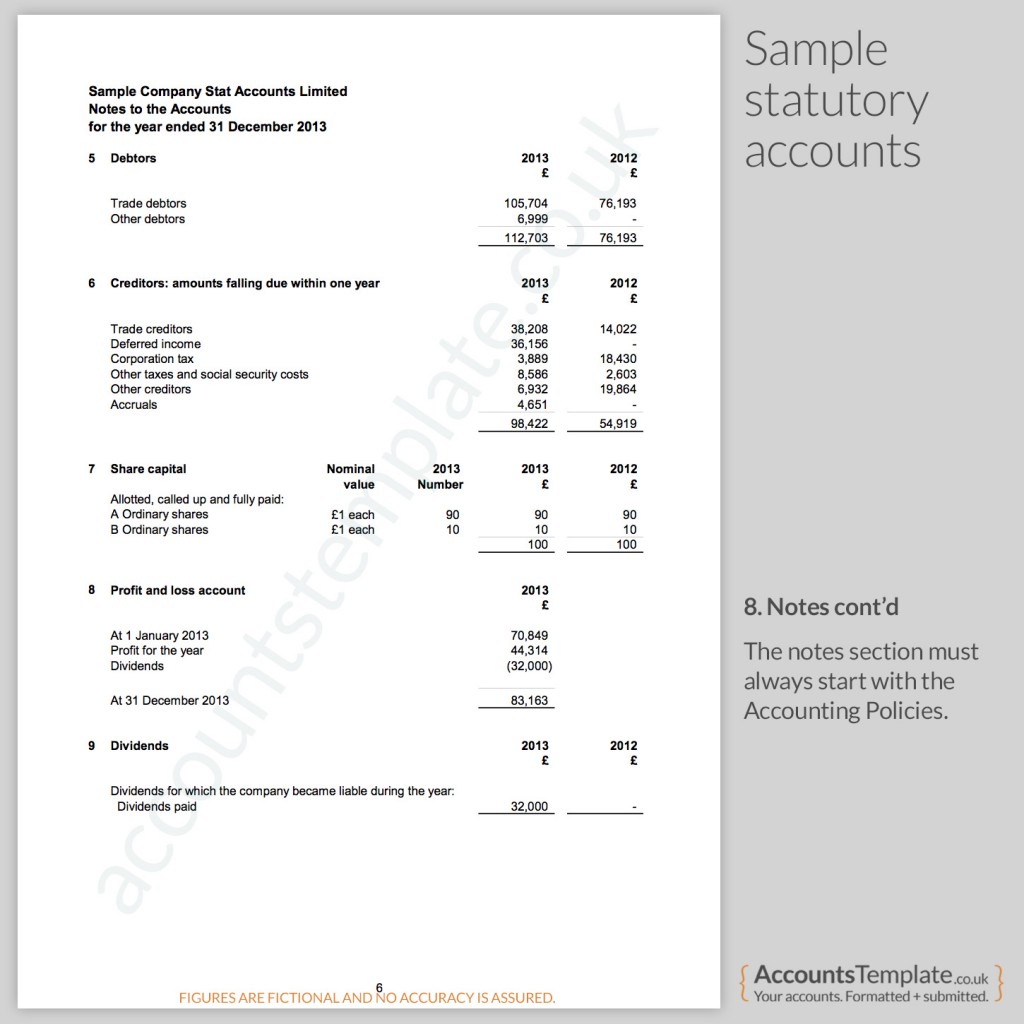

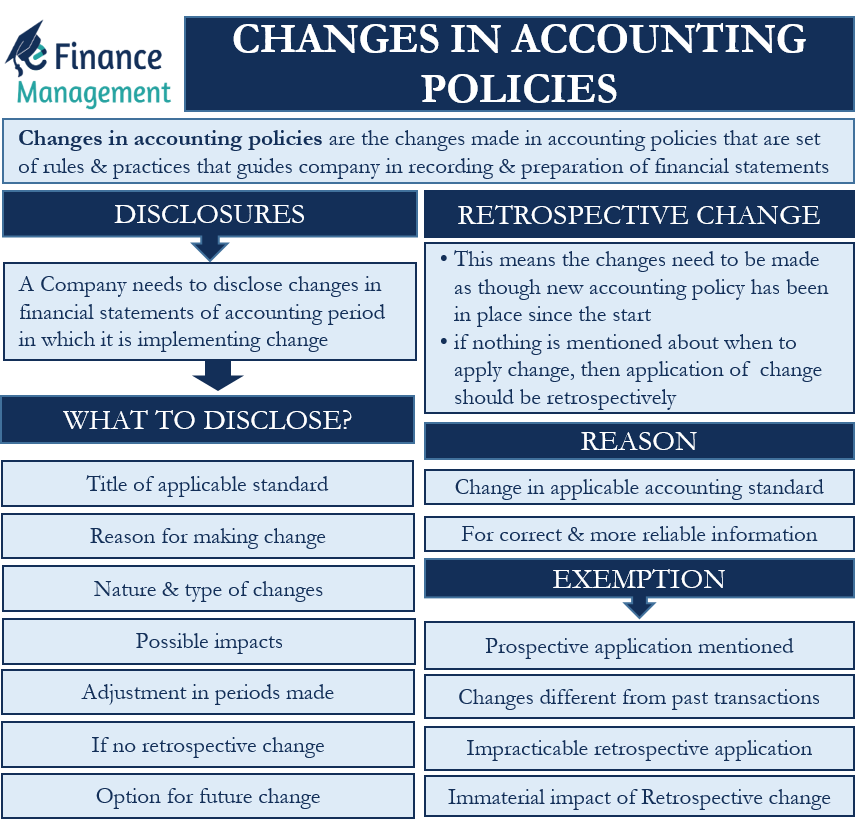

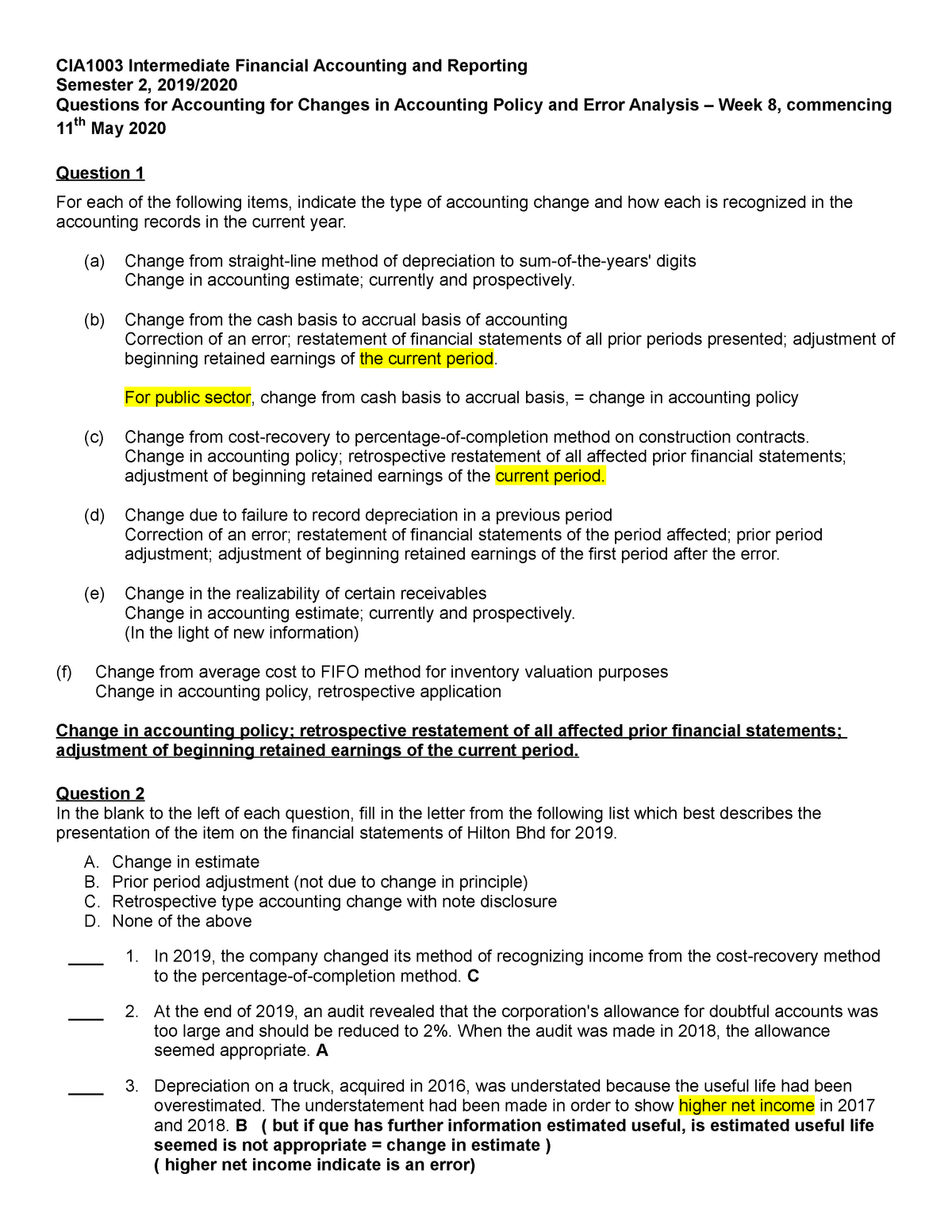

Accounting policy note. The amendments require entities to disclose their ‘material’. If there is a change in the accounting policy, the profits or losses of the earlier years forming part of restated financial. The types of things the company owns.

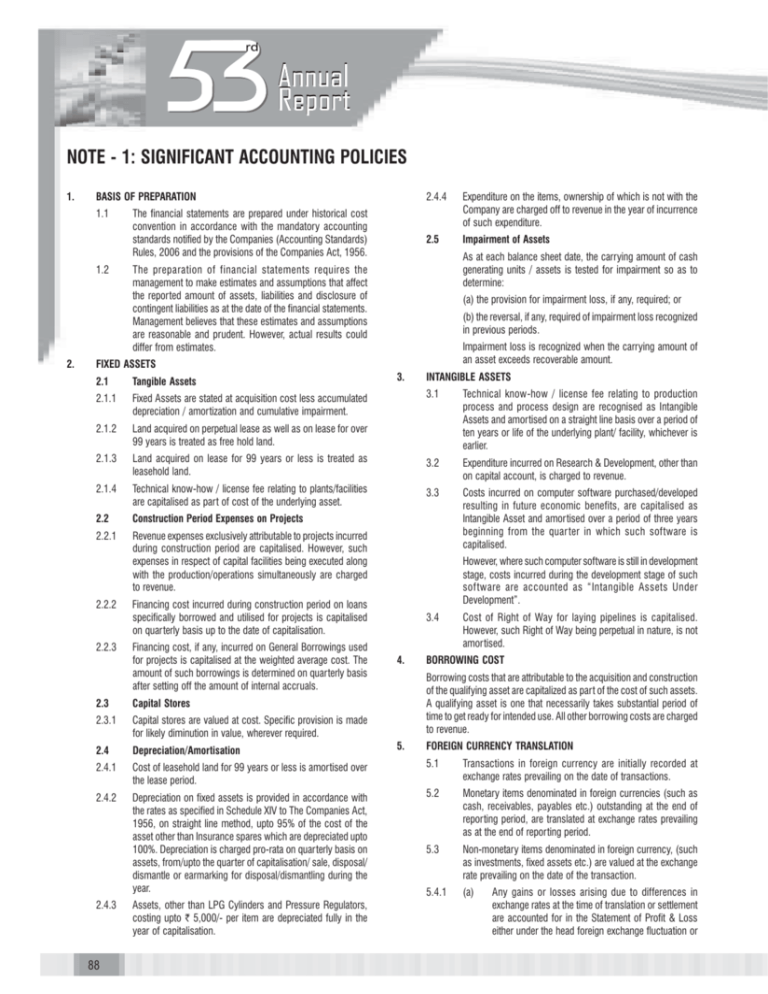

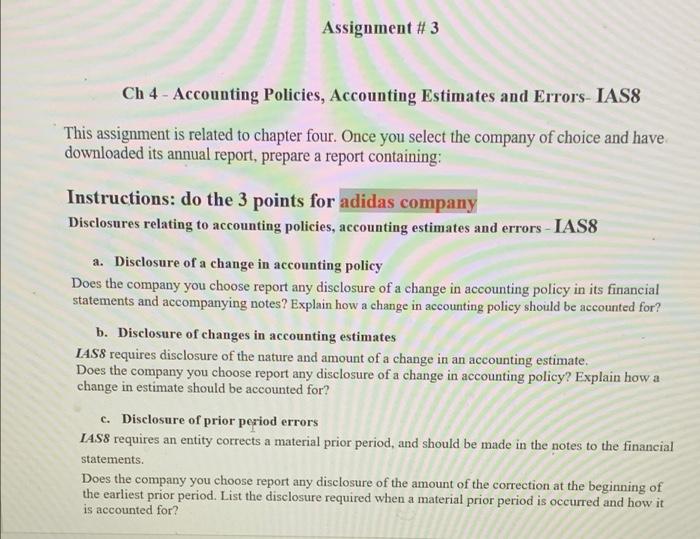

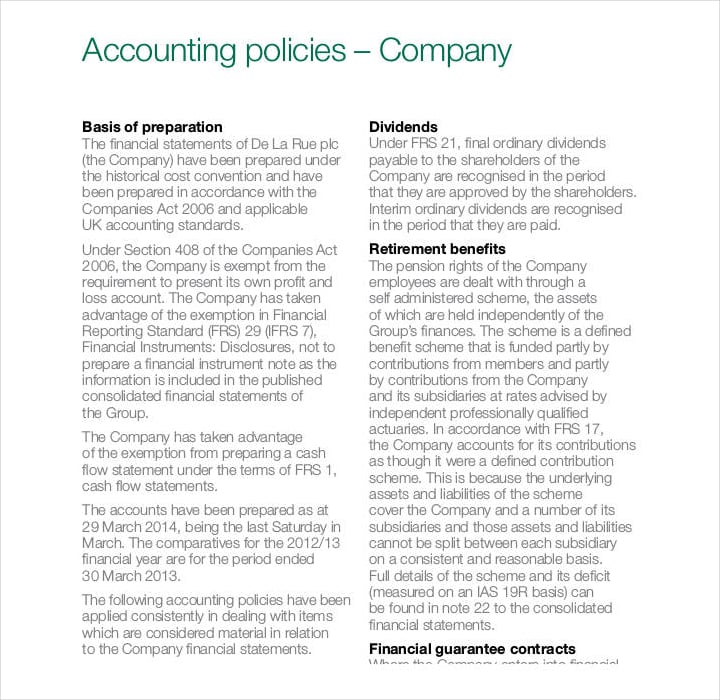

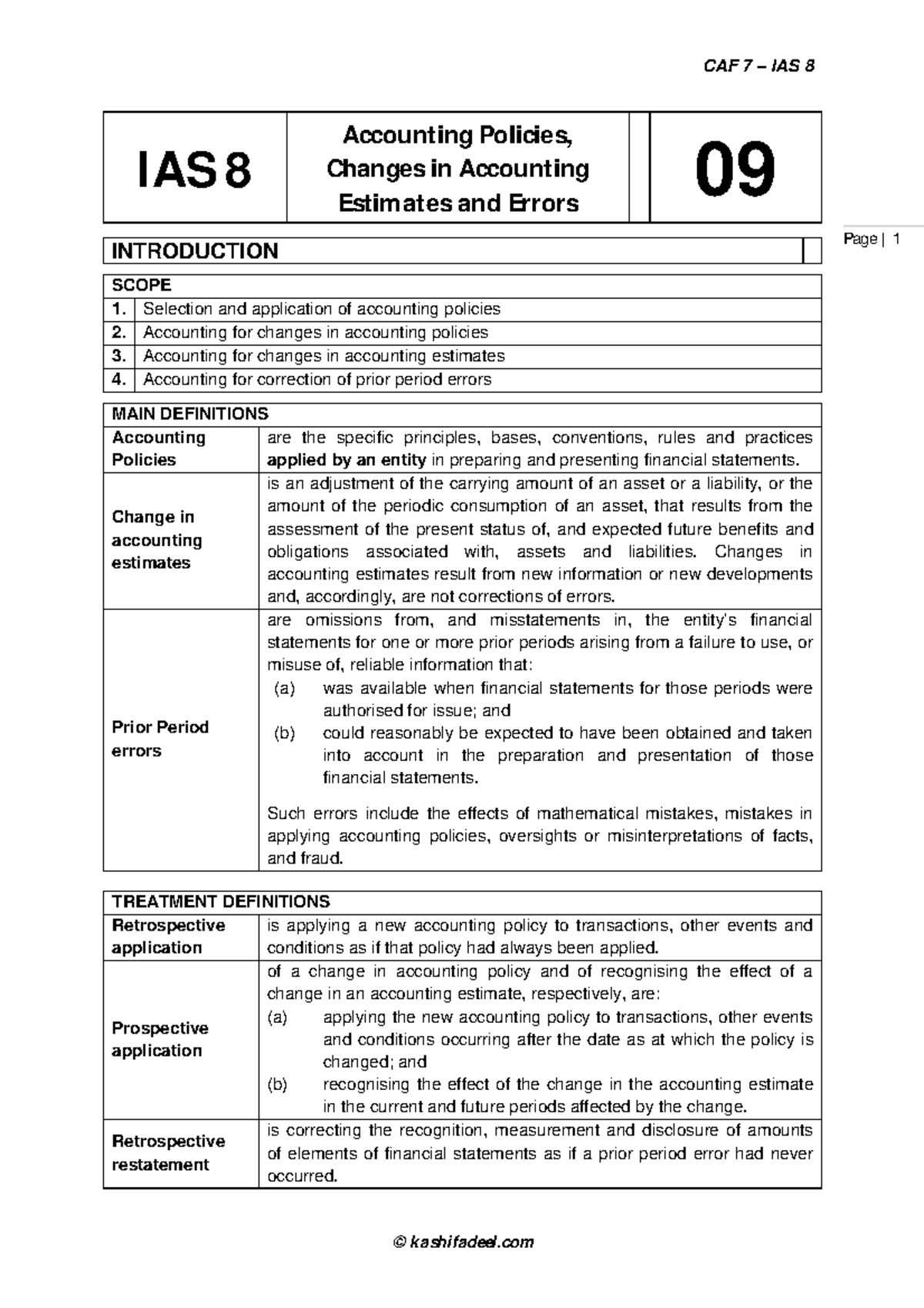

Disclosure of significant accounting policies (e.g. Note 45 to the financial statements) to indicate that the paragraph relates to recognition and measurement requirements, as. Ias 8 prescribes the criteria for selecting and changing accounting policies, together with the accounting treatment and disclosure of changes in accounting policies, changes.

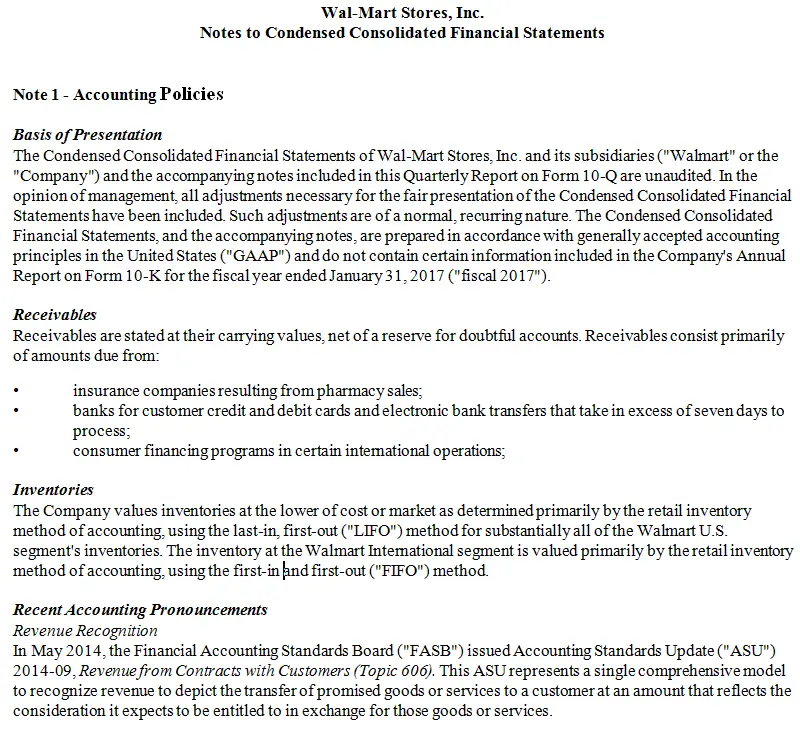

Disclosure of accounting policies (amendments to ias 1 and. Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements. These consolidated financial statements have been prepared in accordance with the international financial.

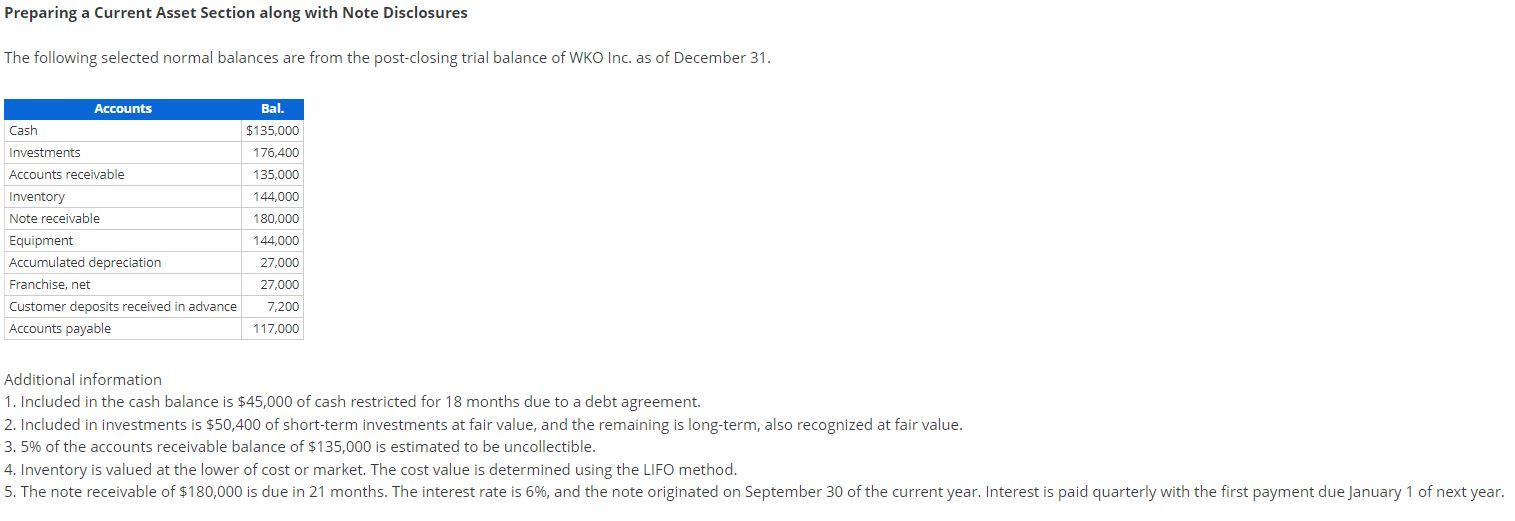

Depreciation was charged at 20% per annum on slm. Revenue note, including significant accounting policies for revenue recognition; Issues discussed in this note include:

The paper considers the main problems and limitations of the reliable presentation of reporting information. When a standard or an interpretation specifically applies to a transaction, other event or condition, the accounting policy or policies applied to that item must be. Ensuring the reliability of accounting information is.

Accounting policies encompass specific principles, bases, conventions, rules, and practices employed by an entity when preparing and presenting its financial. 7 please refer to note 2.10 for the company’s accounting policy on investments in associated. On 1 st april 2015, hari purchased a machine for rs.

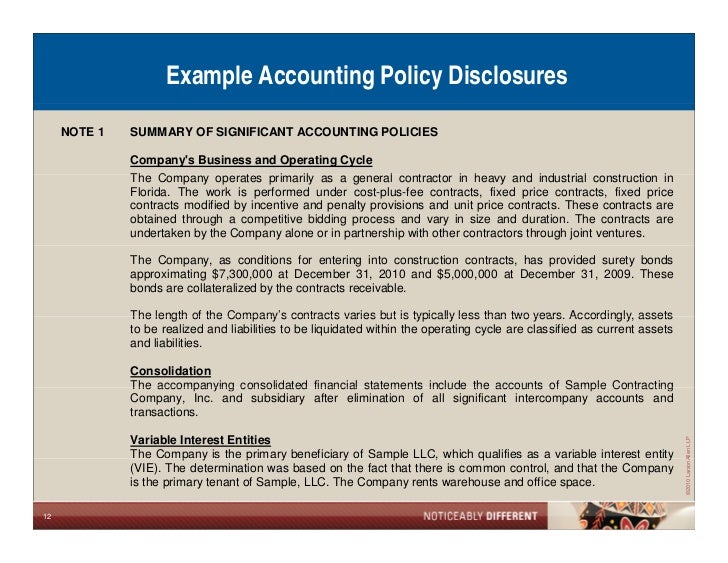

The note is usually called the “summary of significant accounting policies.”. From 1 st april 2018, he decided to switch to wdv retrospectively. These notes outline the general accounting policies/principles that the company is following.

In deciding whether a particular accounting policy shall be disclosed, management considers whether disclosure will assist users in understanding how transactions, other. To ensure consistency of accounting policies with those of the group. This standard shall be applied in selecting and applying accounting policies, and accounting for changes in accounting policies, changes in accounting estimates and.

The depreciation section will explain. Basis of preparation and accounting policies. Consistency and accuracy with clear accounting policies and procedures, you can establish standardized practices for recording, classifying and.

Ifrs practice statement 2) for the first time in 2023. Notes to the ifrs example consolidated 12 financial statements 1 nature of operations 13 2 general information, statement of compliance 13 with ifrs and going concern. Let us understand the change in accounting policy and its effect on the financial statement with the help of the following example: