Out Of This World Info About Profit And Loss Ratio Partnership

Profits, losses or other income may be shared as the partners may mutually agree from time to time.

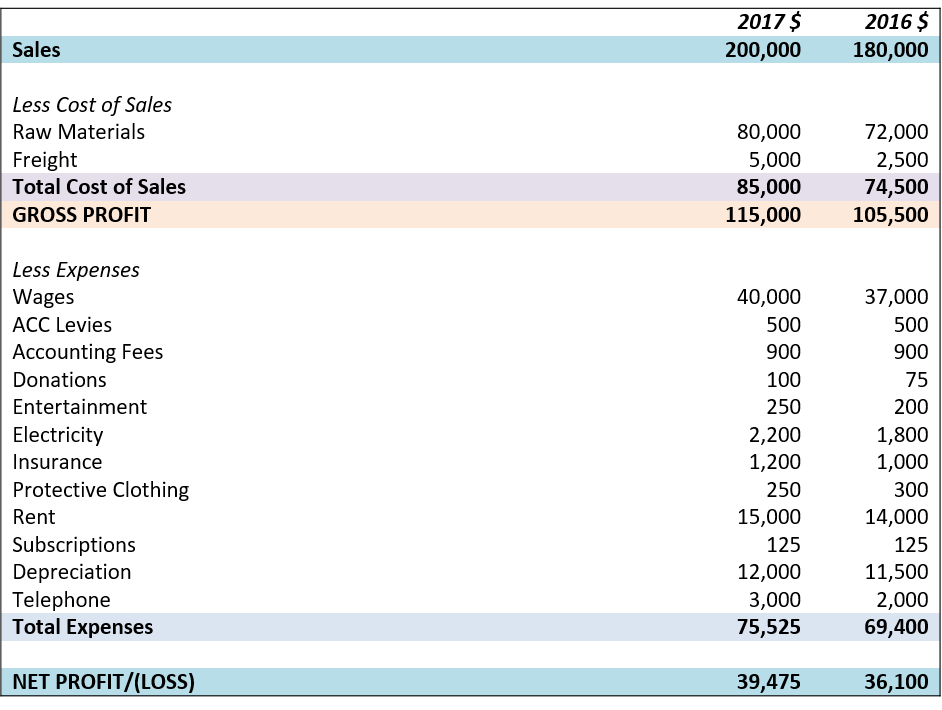

Profit and loss ratio partnership. Unincorporated business entity partnership is an unincorporated business entity. Partners may receive a guaranteed salary, and the remaining profit or loss is allocated on a fixed ratio. Example of profit sharing ratio.

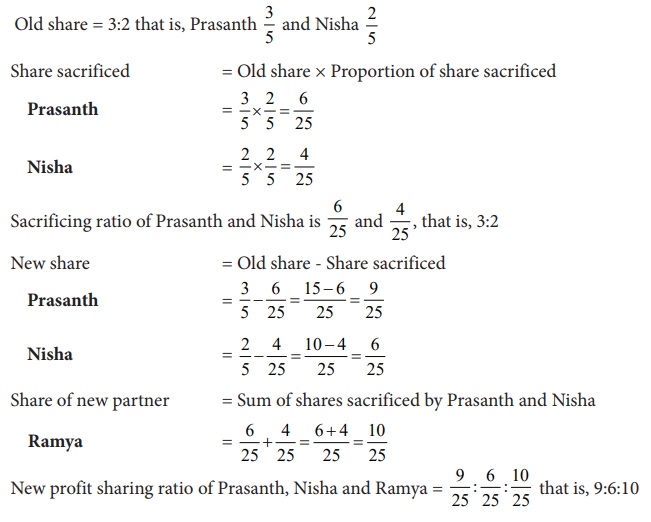

The sharing ratio of 3:1 means 75% ( 3/4) and 25% ( 1/4). Amit and burton are in partnership sharing profits in the ratio 3:2. The journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the.

The partnership agreement provides for: Partnership profit sharing involves two or more people who split the combined profits of their businesses. This is simply the ratio at which the partners share their profit in the.

The agreement becomes the basis of. James turner lawyer updated on july 12, 2022 reading time: The calculation would be as follows:

They form a partnership firm and introduce capital as 40,000, 30,000, and 20,000, respectively. In this account how the profit or loss among the partners of the firm is distributed is shown. Alamute and brador have been in partnership for several years, compiling their financial statements for the year ended 31 march and sharing profits in the ratio 60:40 after.

The formula may consider three factors: Partners are free to agree the sharing. 5 minutes meets editorial guidelines follow us.

A return to each partner for the amount of capital invested in the partnership, a payment to each partner for services. Partnership firm is formed with an objective to earn profit. Through this account, all adjustments in respect of partner’s salary, partner’s.

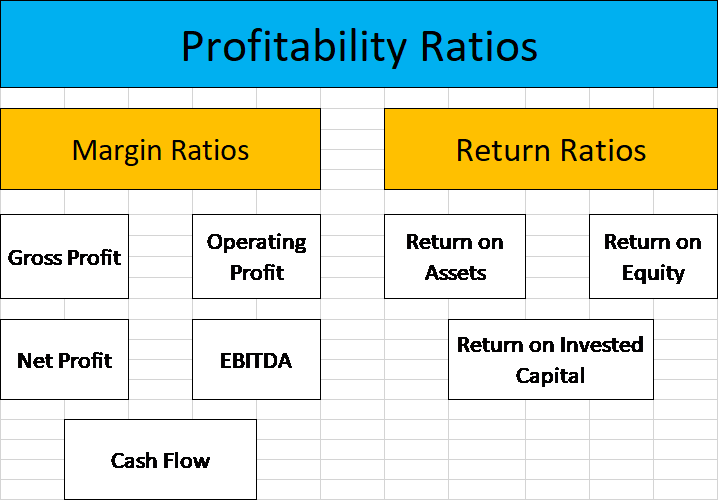

S19, s24 partnership act 1890. Income can be allocated based on the proportion of interest in the capital. Profit motive as it is a business, the partners seek to generate a profit.

A, b, and c decide to start a business together. Agreement:partnership is the result of an agreement between two or more persons to do business and share its profits and losses. How are profits and losses divided among partners?

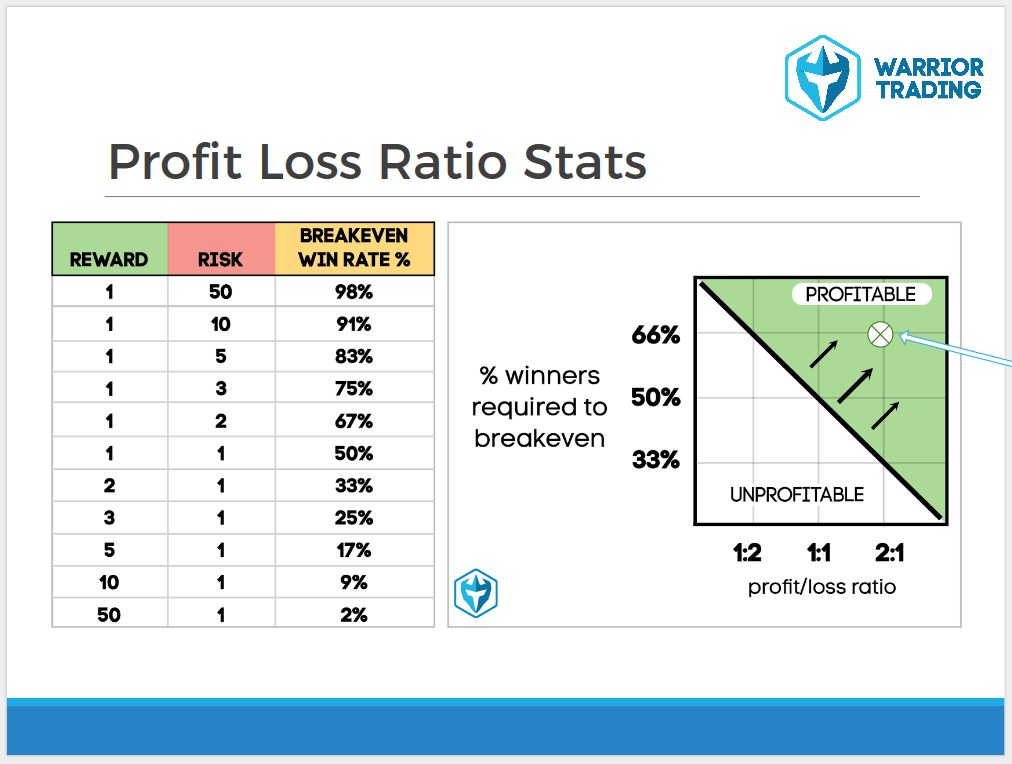

Distribution of profit or loss in partnership. The profit/loss ratio is the average profit on winning trades divided by the average loss on losing trades over a specified time period. However, due to unforeseeable conditions, the loss may arise in the firm’s.

.png)