Great Info About Finance Lease Treatment In Cash Flow Statement

In the statement of cash flows, lease payments are classified consistently with payments on other financial liabilities:

Finance lease treatment in cash flow statement. Determine if your lease liability payment is for a capital. The type of lease a lessee or lessor has will affect how it appears within the financial statement. The adoption of the new standard may also affect covenants, credit ratings, borrowing costs and other key

In the case of a finance lease, however, only the portion of the lease payment relating to interest expense potentially reduces operating cash flows, while the portion of the lease payment which reduces the lease liability appears as a cash outflow in the cash flow from financing section. The present value of the lease liability is cu 17 000; Operating lease an operating lease is defined as being any lease other than a finance lease.

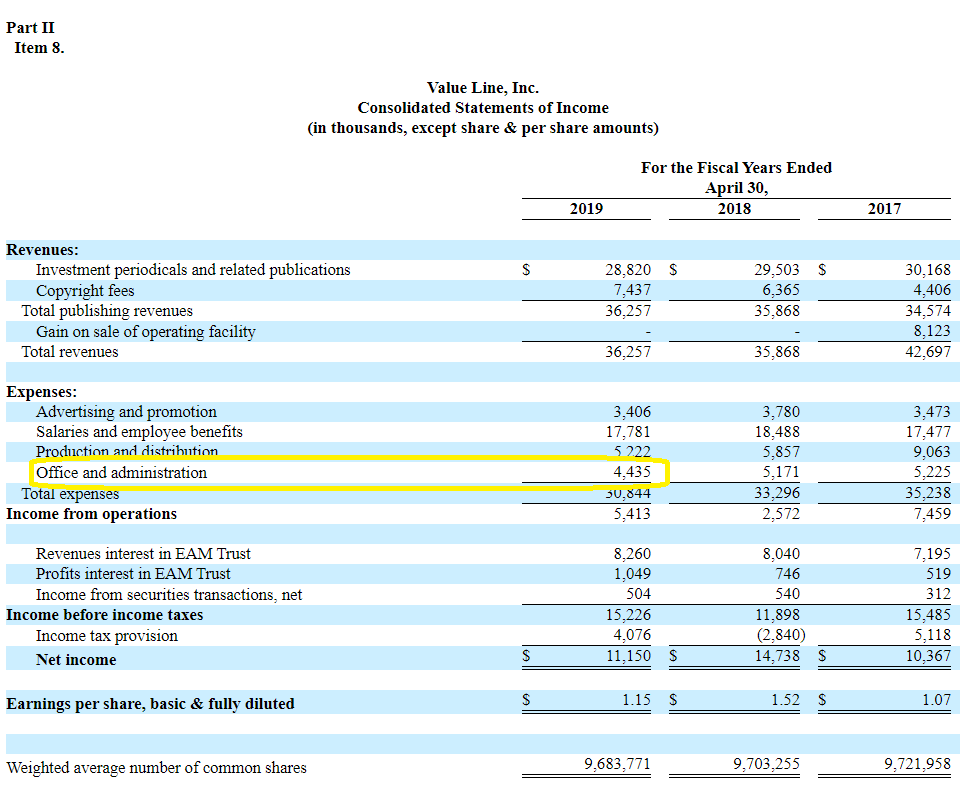

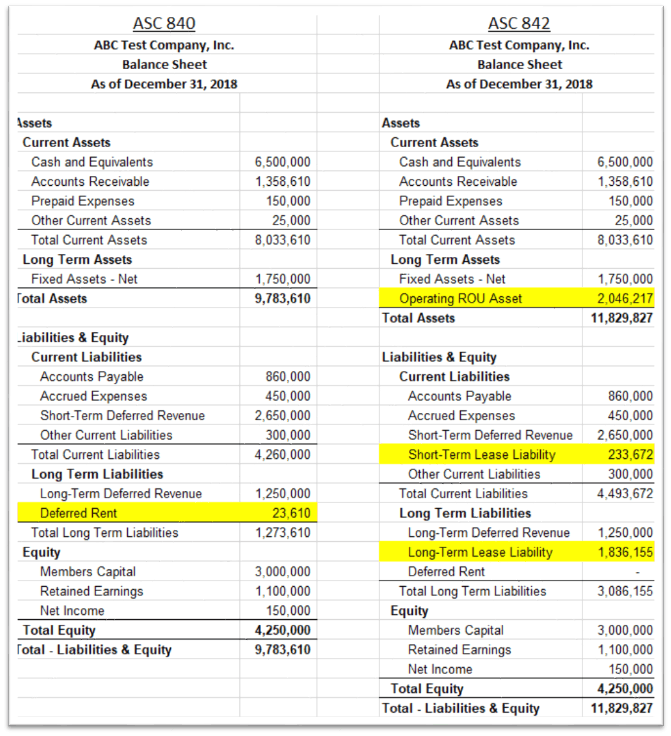

In this report, we will cover the guidance in fasb asc 842 related to presentation in the balance sheet, income statement, and statement of cash flows. And the presentation of cash flows arising from leases in the statement of cash flows will be driven by the presentation of lease expense in the income stat. Initial direct costs paid in cash are cu 3 000.

(a) cash payments for the principal portion of the lease liability within financing activities (b) cash payments for the interest portion of the lease liability applying the requirements in aasb 107 statement of cash flows for interest paid; The impact of leases on the statement of cash flows includes (ifrs 16.50): A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an asset to the lessee.

What you need to know ifrs 16 is effective for annual reporting periods beginning on or after january 2019. The issuance of the standards are the culmination of multiple years of deliberating a leasing model with the primary objective of bringing almost all leases onto the balance sheet for lessees. Flow from investing (cfi) section of the statement of cash flows.

In the statement of cash flows, a lessee shall classify: Entities may need to change aspects of their financial statement presentation and significantly expand the volume of their disclosures when they adopt the new leases standard issued by the iasb. Repayments of the principal portion of the lease liability, presented within financing activities.

For both operating and capital leases, each lease payment reduces cash but their effects on the cash flow statement vary. The repayment of the lease liability was cu 3 209; Presentation of lease expense for operating leases, and amortization and interest expense for finance leases in the statement of comprehensive income is generally consistent with prior gaap;

The payment of the related. Only the cash flows related to lease repayments are reported in the cash flow from financing (cff) section. From 2019, the accounting treatment of leases by lessees will change fundamentally.

Us ifrs & us gaap guide the fasb and iasb issued their respective standards in the first quarter of 2016. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private companies, requiring lessees to recognize most leases on their balance sheets. Payments related to accrued interest, classified according to the accounting policy for interest payments.

Lessees and lessors also have slightly different reporting requirements, explained further below. The part of the lease payment that represents cash payments for the principal portion of the lease liability is presented as a cash flow resulting from financing activities. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)