Best Tips About Bank Overdraft Treatment In Balance Sheet

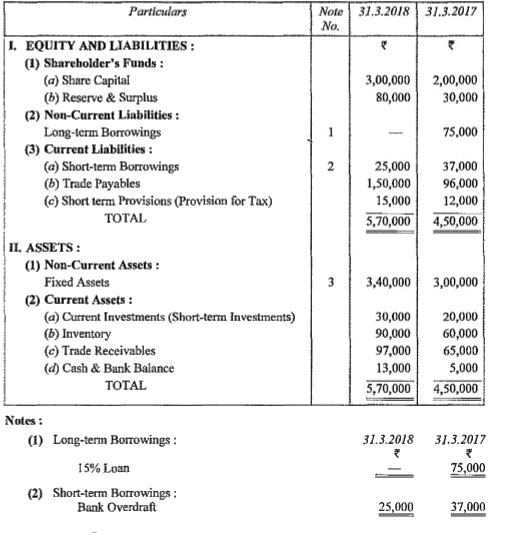

In such circumstances, the reporting entity should aggregate all bank accounts that are subject to the notional pooling arrangement into a single balance on its balance sheet and to combine these balances when assessing if there is a bank overdraft.

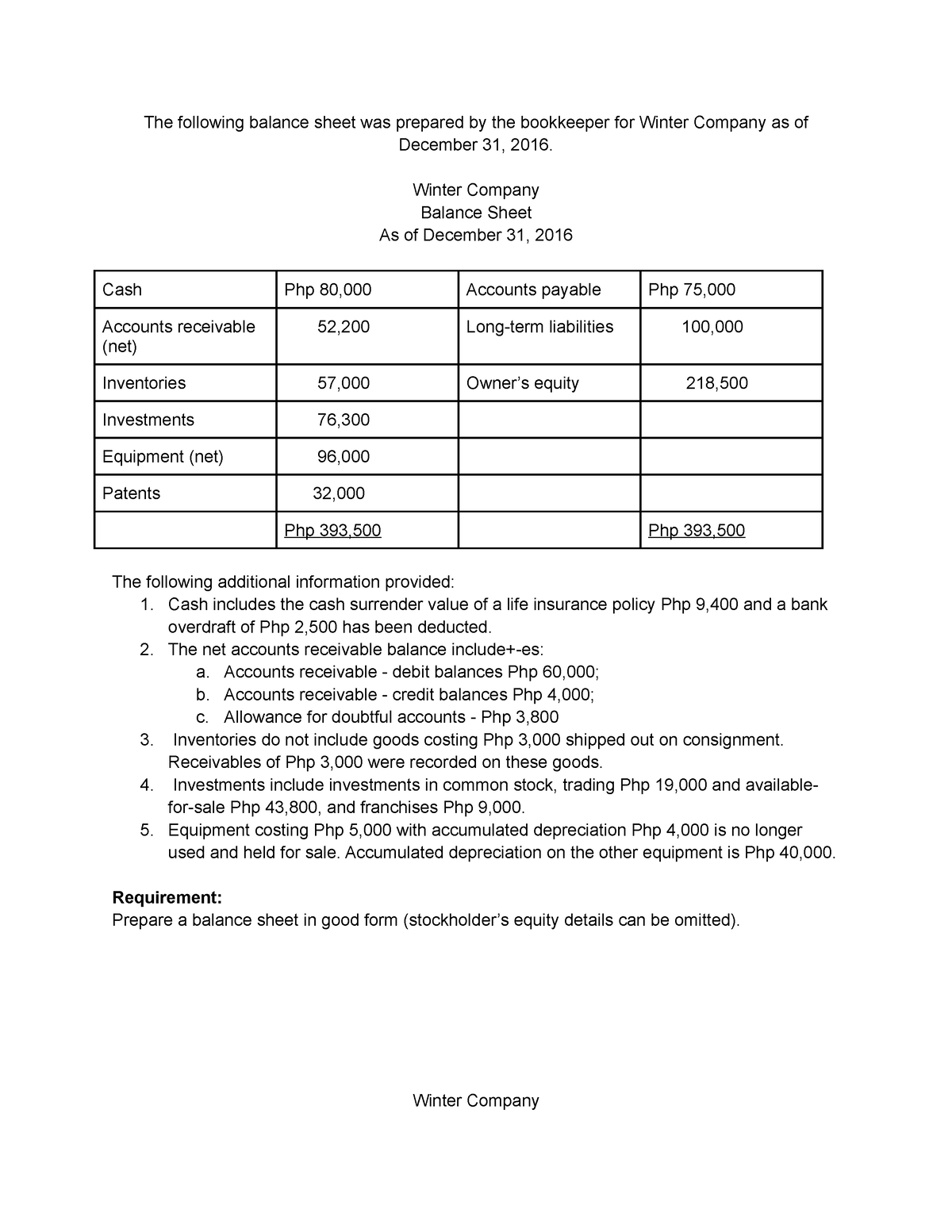

Bank overdraft treatment in balance sheet. [ias 30.18] ias 30.19 sets out the specific line items requiring disclosure. This change is then added to the opening amount of cash and the total equals the closing cash on hand balance. It goes to the balance sheet only when the company starts using it.

The overdraft allows the customer to. In an overdraft account the withdrawal or deposit of an amount can be done anytime upto the specified limit. In these circumstances, bank overdrafts are included as a component of cash and cash equivalents.

Banks offer overdraft facilities on a predetermined limit which differs from borrower to borrower. Because a bank overdraft is treated as excess money withdrawn from an account instead of the amount deposited. In some countries, bank overdrafts which are repayable on demand form an integral part of an entity's cash management.

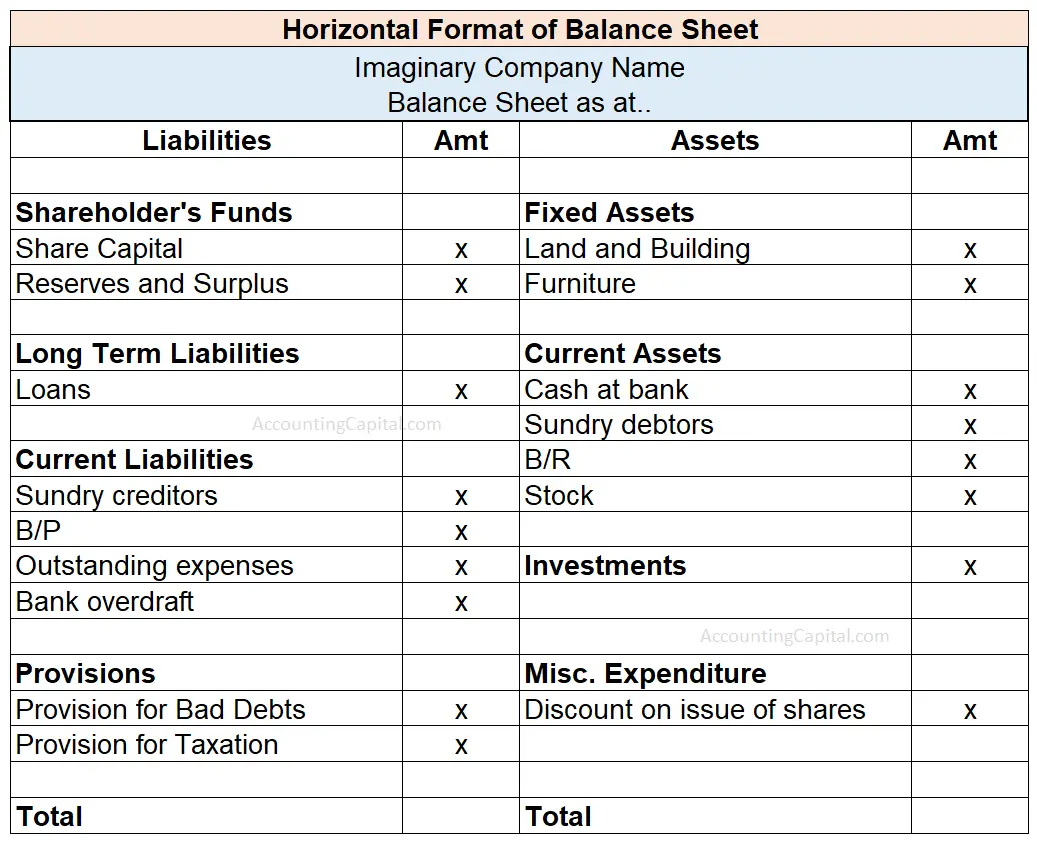

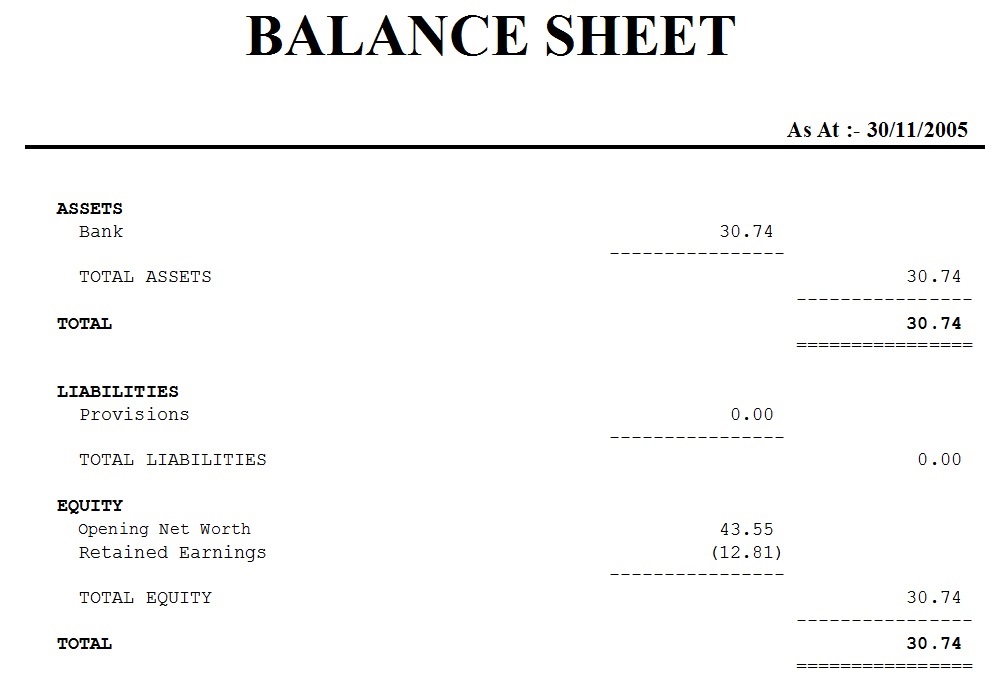

Ifrs allows two treatment options for overdrafts / revolvers as follows: Unlike other credit facilities, an overdraft works only when required by the borrower. When preparing a balance sheet, the bank overdraft accounting treatment would be to record a negative cash balance as a current bank overdraft liability, which may have a journal.

Company has a total overdraft facility of £10k and as at balance sheet date is £2k overdrawn. I am a bit confused. Overdrafts and cash and cash equivalents.

At the agreement date. A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account, resulting in a credit cash balance reported on an entity’s balance sheet as of a reporting date. A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account, resulting in a credit cash balance reported on an entity’s balance sheet as of a reporting date.

Under ifrs bank overdrafts or revolvers may be deducted as negative cash. How is this reflected in the balance sheet? Book overdrafts—representing outstanding checks in excess of funds on deposit—should be classified as liabilities at the balance sheet date.

The balance sheet items are average balances for each line item rather than the balance at the end of the period. For example, a business keeps only $5,000 in its bank account and three checks amounting to a total of $6,000 need to be paid. Under ifrs accounting standards, bank overdrafts are generally 6 presented as liabilities on the balance sheet.

¹spotme® on debit is an optional. It shall show a corresponding bank overdraft liability of $10 million, the sum of overdrafts in account b and account d. This would entail listing it as an increase in cash flow — an increase as a bank overdraft asset — while also being reported on the other side of the general ledger as an increase in.

A characteristic of such banking arrangements is that the bank balance often fluctuates from being positive to overdrawn. Deducted from cash and cash equivalents in both the balance sheet and cash flow statement; There is just one company bank account, no petty cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)