First Class Tips About Three Main Accounting Statements

Here’s a look inside donald trump’s $355 million civil fraud verdict.

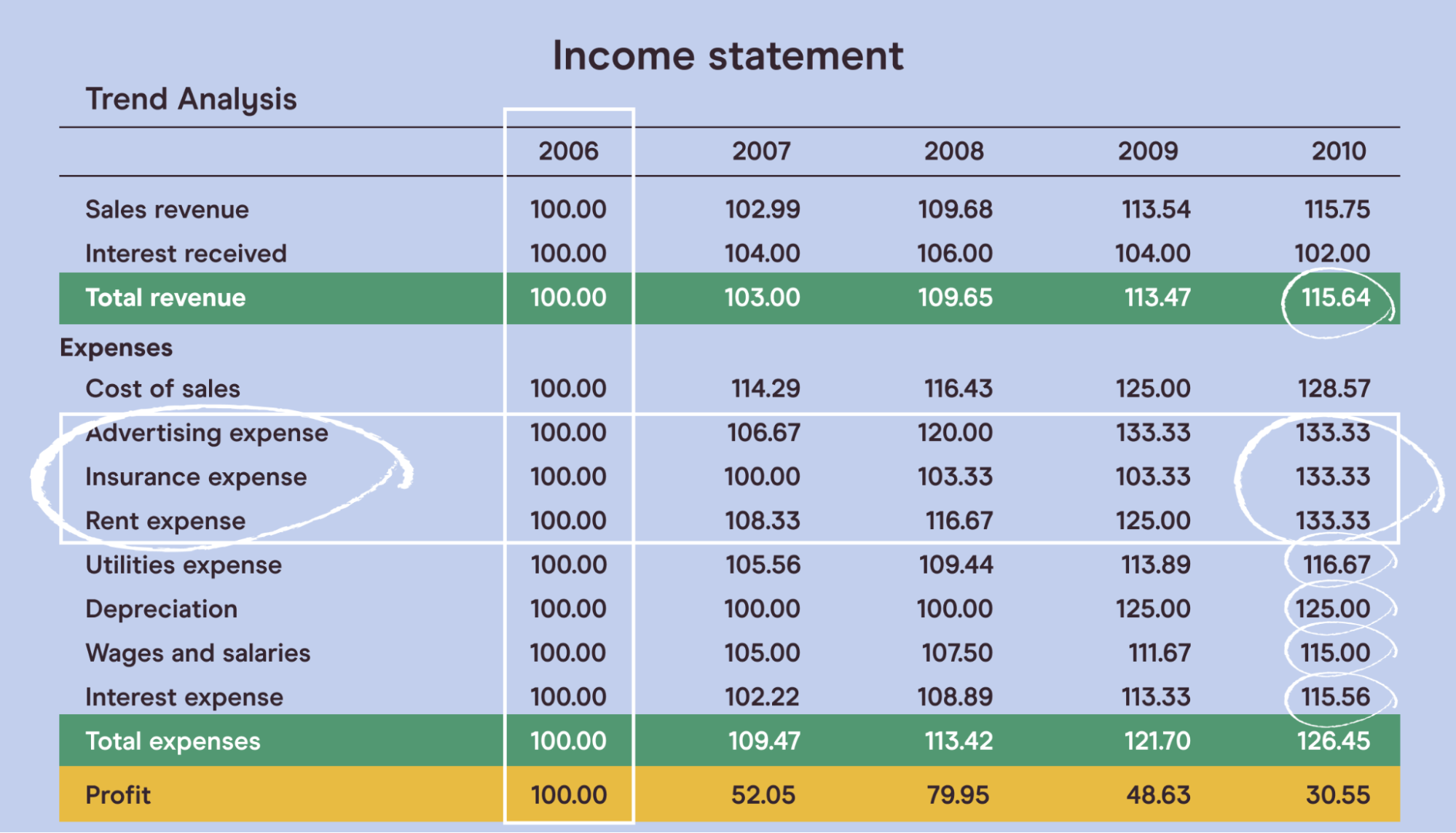

Three main accounting statements. The income statement equation that describes their relationship is (k) The accounting information contained in the income statement, the cash flow statement and the balance sheet can be analysed to show how. A financial statement segments into three divisions;

For example, the purpose of the income statement is to tell users whether the entity makes a profit or loss. A new york judge has ordered donald trump and his companies to pay $355 million. Unit 1 interest and debt.

Accounting reports guarantee accurate bookkeeping, prevent accounting errors, help businesses in making better financial decisions, and are preferred by shareholders. Income statements show how much money a company made and spent over a period of. Notice that maxidrive's income statement has three major captions, revenues, expenses, and net income.

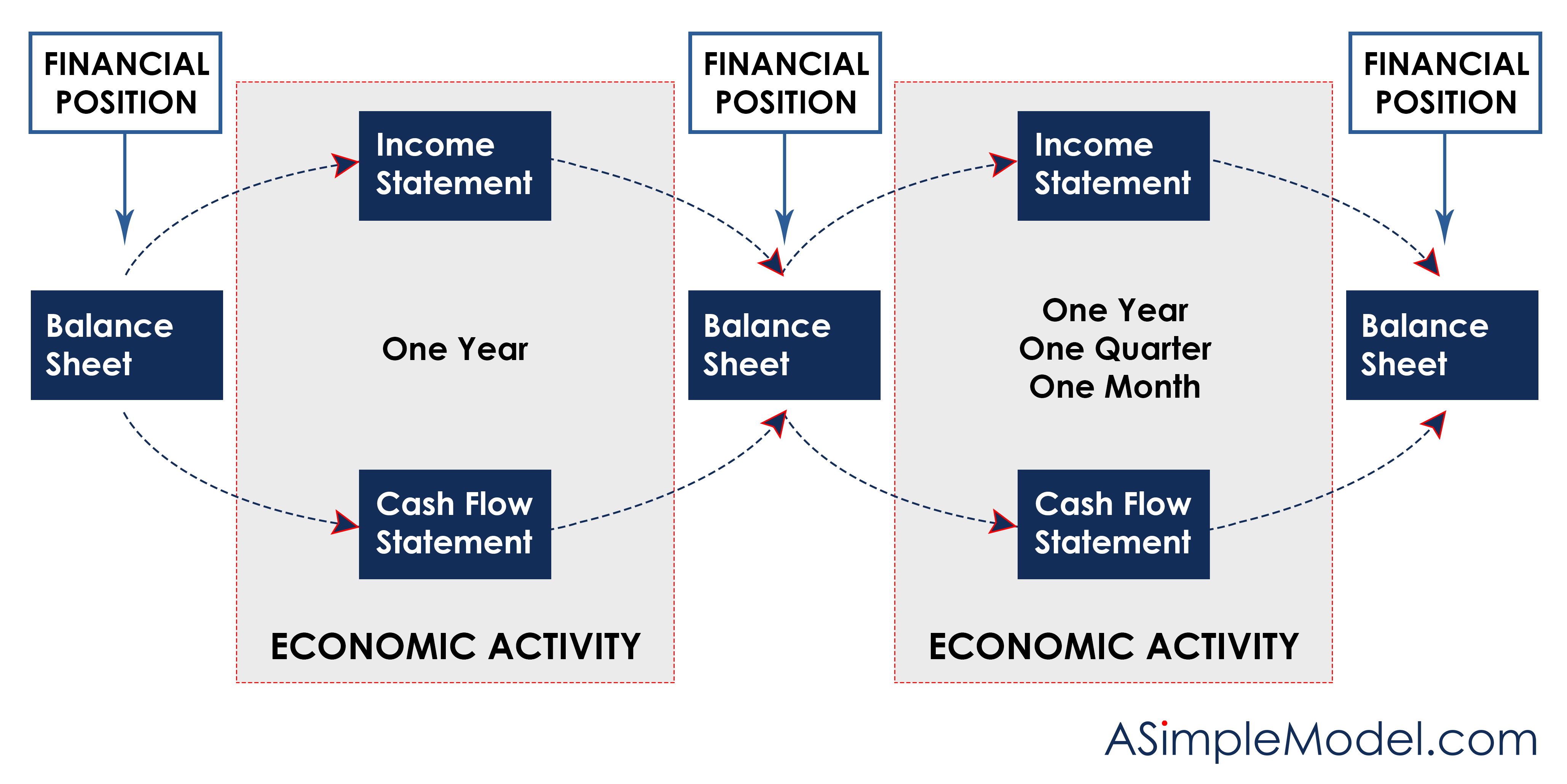

Each of these statements provides a different perspective on a company’s financial situation. A good cash flow has more money coming in than going out. The three main financial statements provide a wide spectrum of data that covers either an entire fiscal year from january to december or an accounting cycle, such as the first quarter, for example.

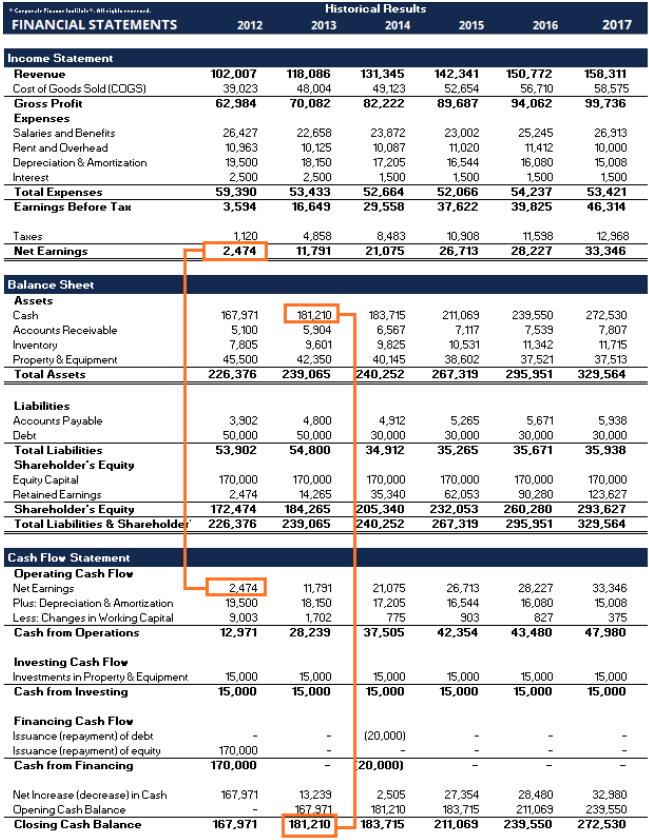

Balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Balance sheets show what a company owns and what it owes at a fixed point in time. Are spreadsheets that forecast a business’s financial performance into the future. The time period covered by the financial statements (one year in this case) is called an accounting period.

The income statement a company's income statement provides. They are not only used to show how a business uses its funds committed by the shareholders and the lenders, but also to see where the business stands in terms of its financial position. It begins with the revenue line and after subtracting various expenses arrives at net income.

There are four main financial statements. The three major financial statements are prepared as a summary of figures and facts showing the financial condition of a business. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

Financial statements dealing with cash flows are big indicators of how well a small business is doing. The three financial statements are income sheets (profit and loss), balance sheets, and cash flow statements. Unit 6 stocks and bonds.

These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. What are the main types of financial statements? Watch cfi’s free webinar on how to link the 3 financial statements in excel.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)