Underrated Ideas Of Tips About Sole Trader Income Statement

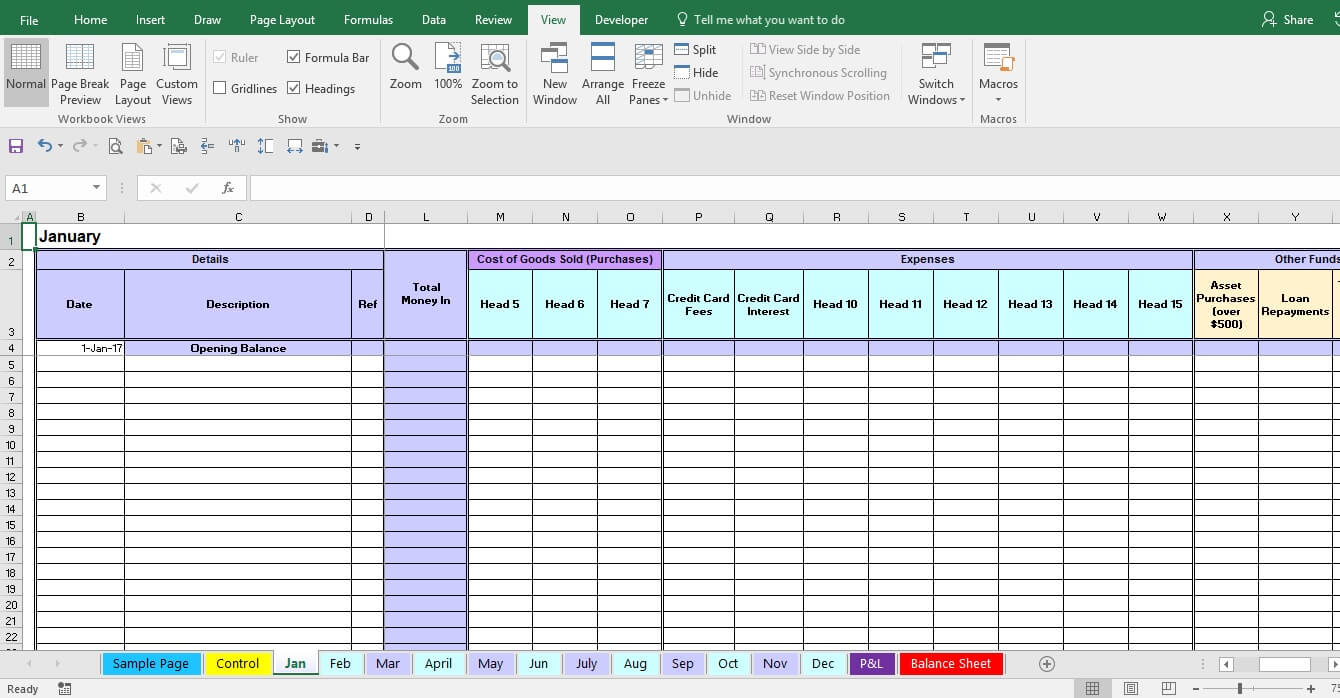

It is categorised into different line items such as revenue by type, or costs.

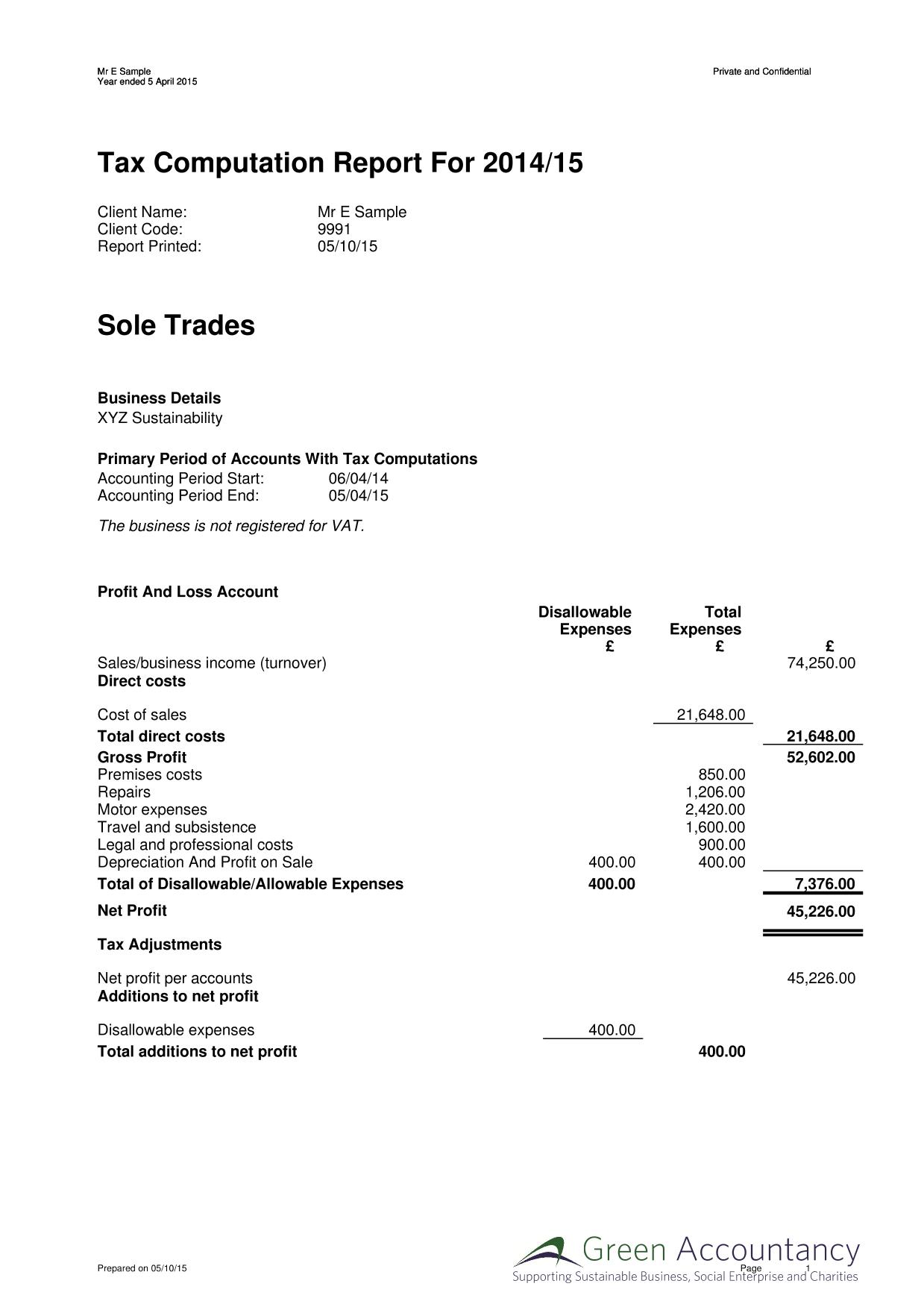

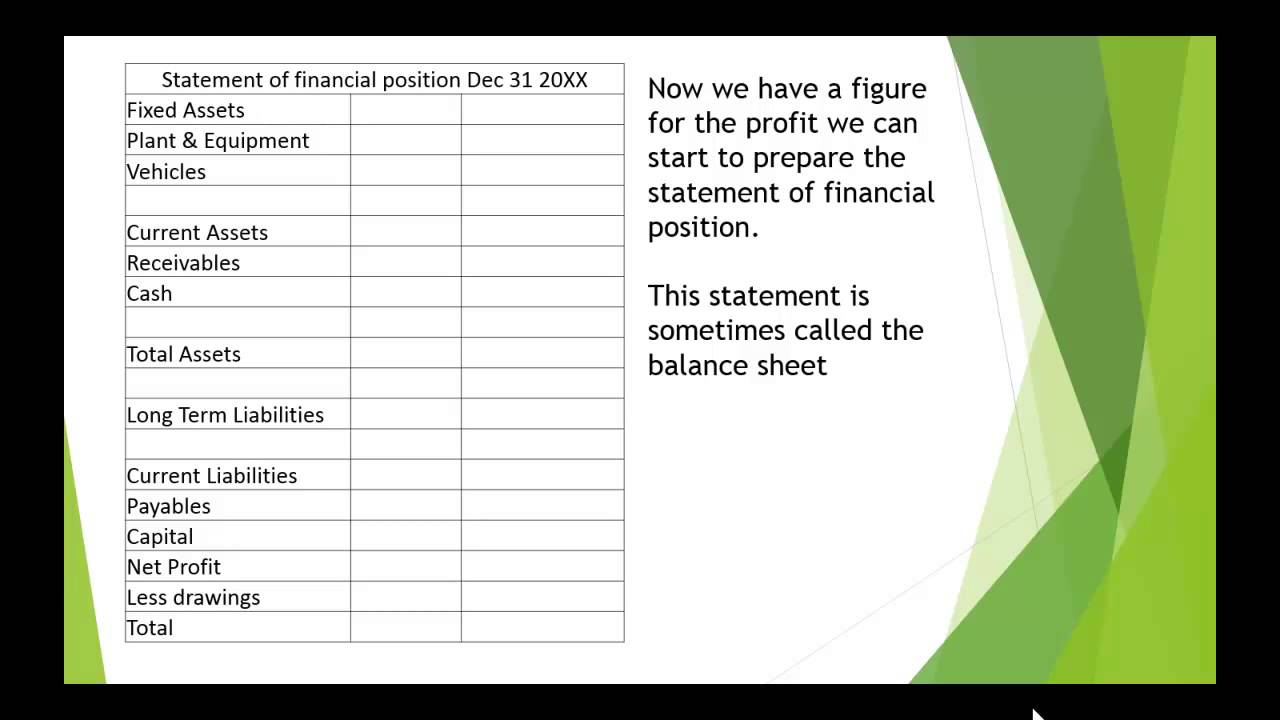

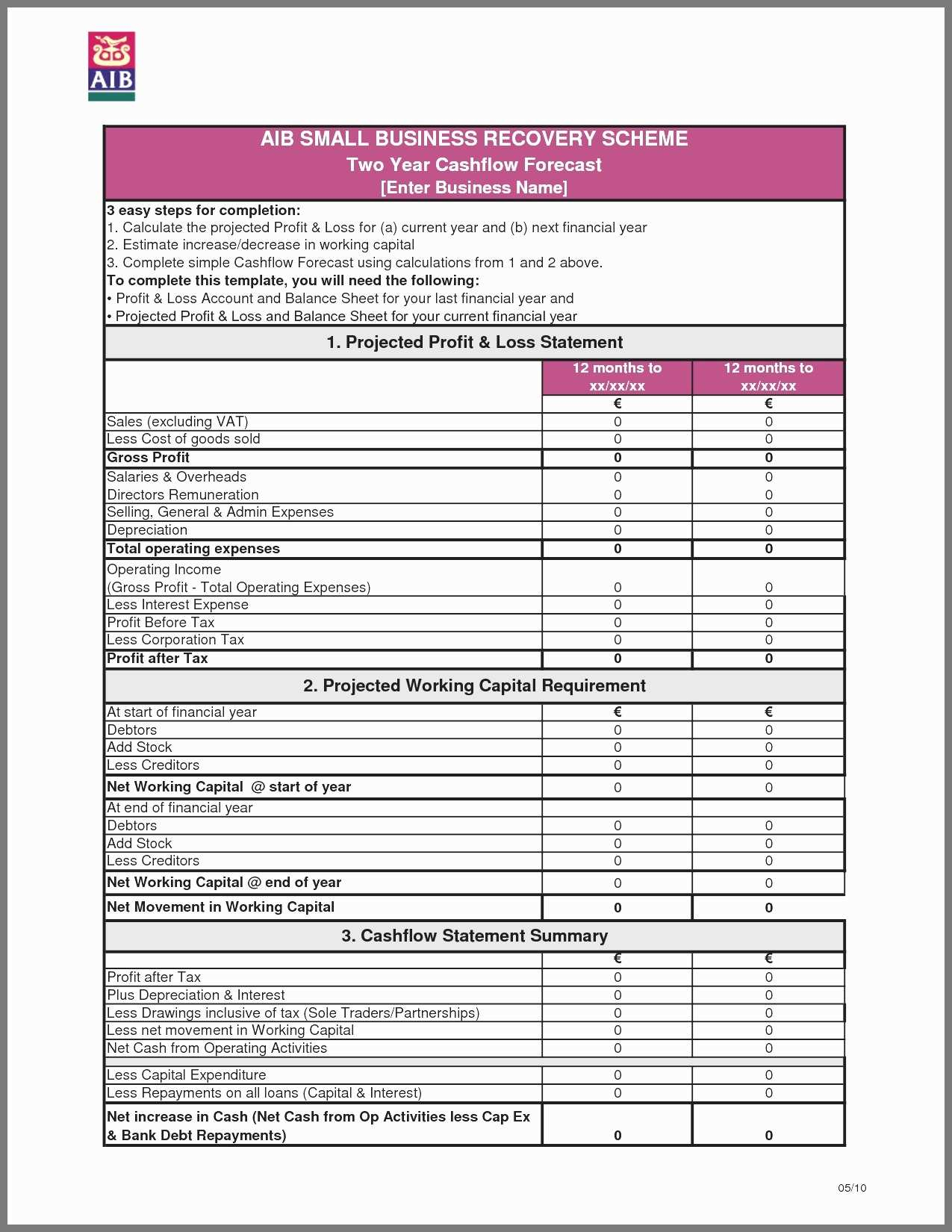

Sole trader income statement. A profit and loss (or income) statement lists your sales and expenses. Statement of financial position , showing the financial position of a business at a point in time, and income statement , showing the financial performance of a. After allowable expenses for the cost of running the business, and before income tax and other personal deductions.

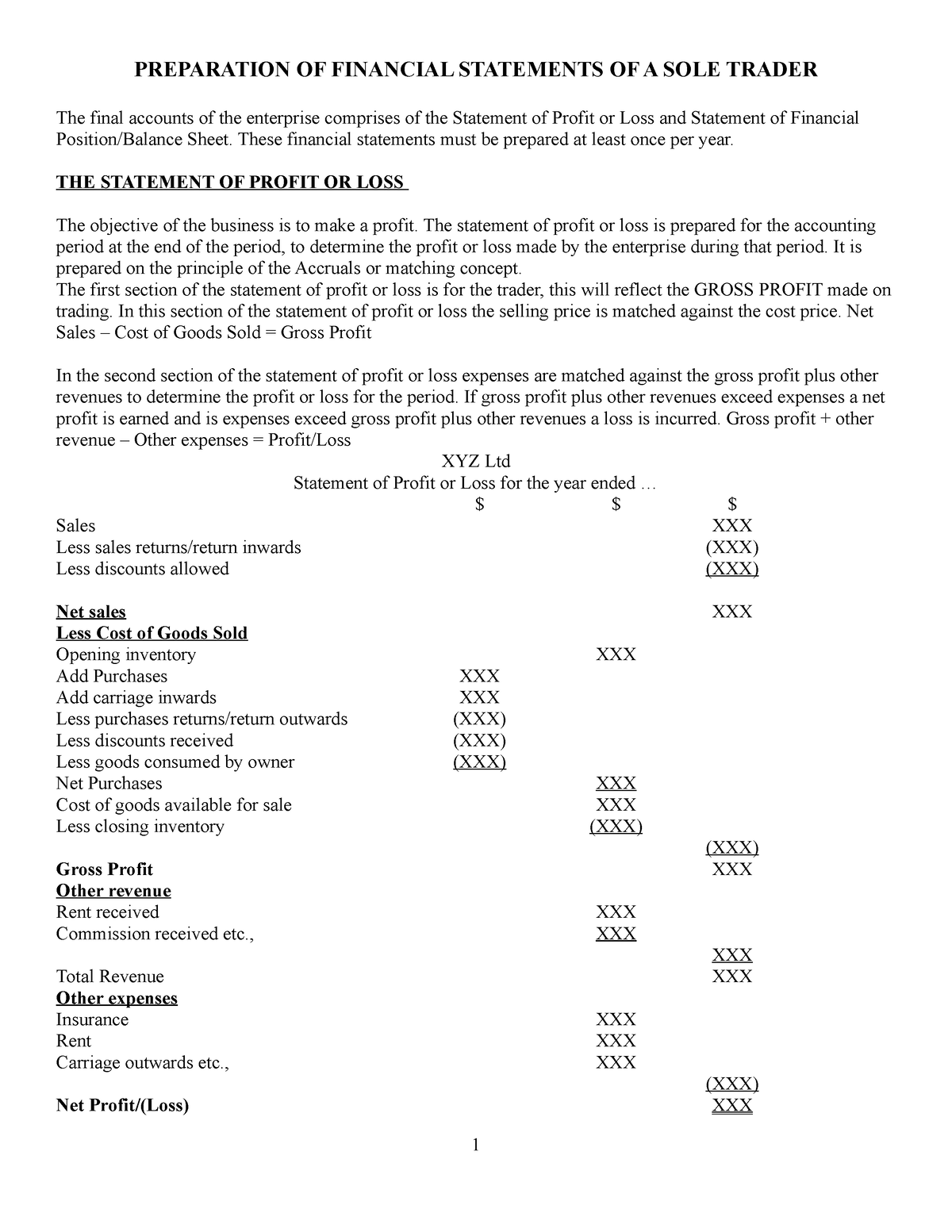

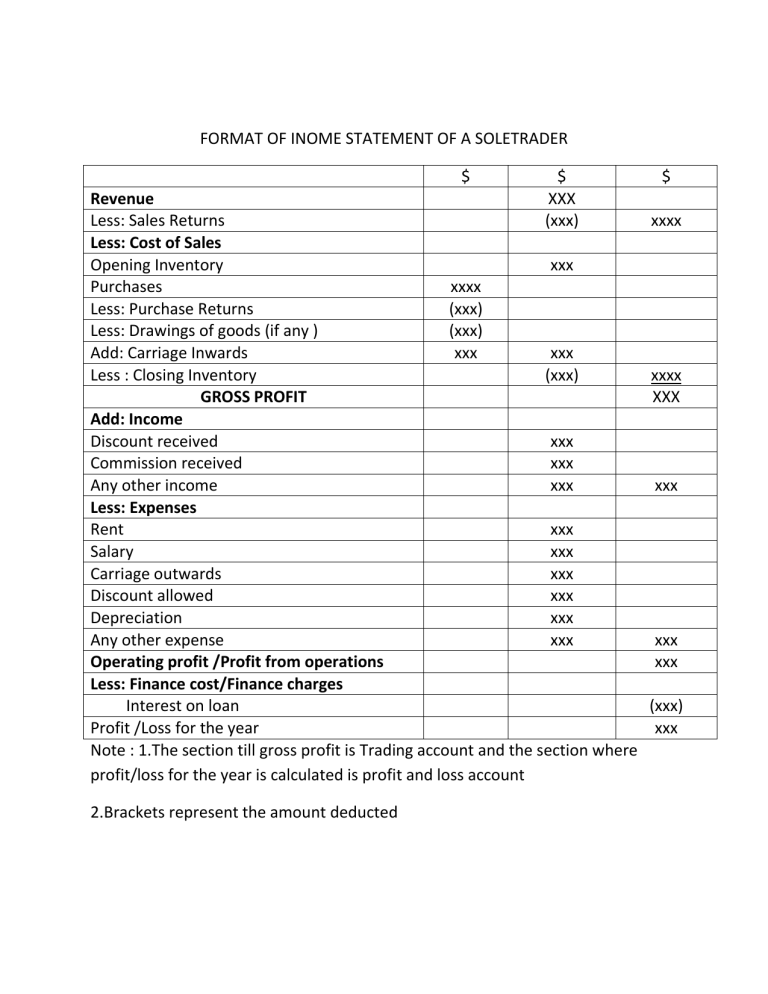

They belong only in the division of profit statement section. Livestock trading account if the business is a primary production business. Income statement the main part of the income statement is prepared exactly as for a sole trader.

Essentially, it summarises all your business income and expenses. Income from a sole trader or partnership business is the net amount: Financial statement of a sole trader.

Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or services. You usually complete a profit and loss statement every month, quarter or year. A sole proprietorship or sole trader is an unincorporated business with a single owner who pays personal income tax on business profits.

You were a sole trader or had business income or losses, partnership or trust distributions (not from a managed fund) business/sole trader income or loss, and either of personal services income. This video explains the concepts of the income statement and the statement of financial position for the sole trader with illustrated formats. Example of an income and.

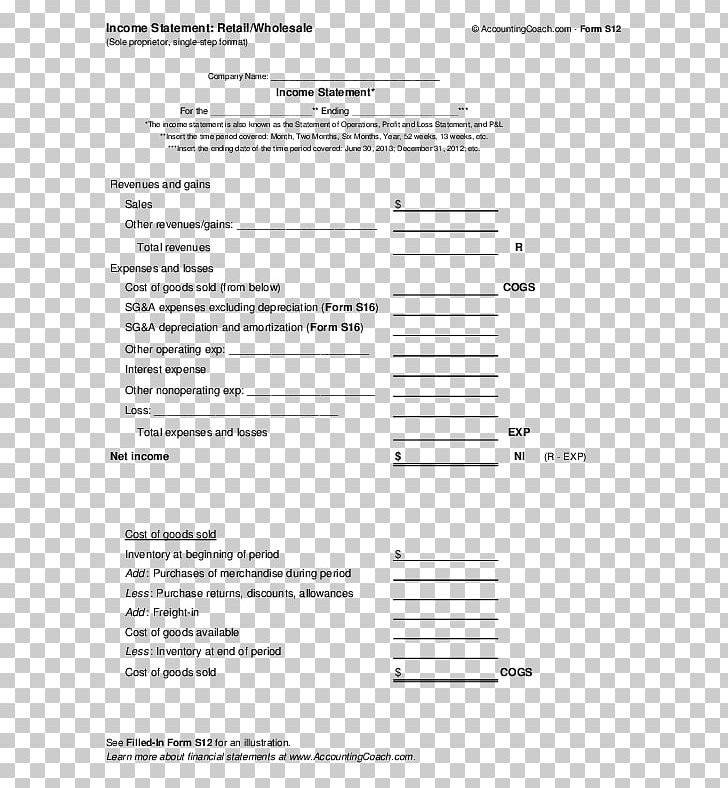

Income statement income statement ascertain the net profit or loss through two stages; For example, freelancers, travel, website costs and marketing. A small business income statement template is a financial statement used to report performance.

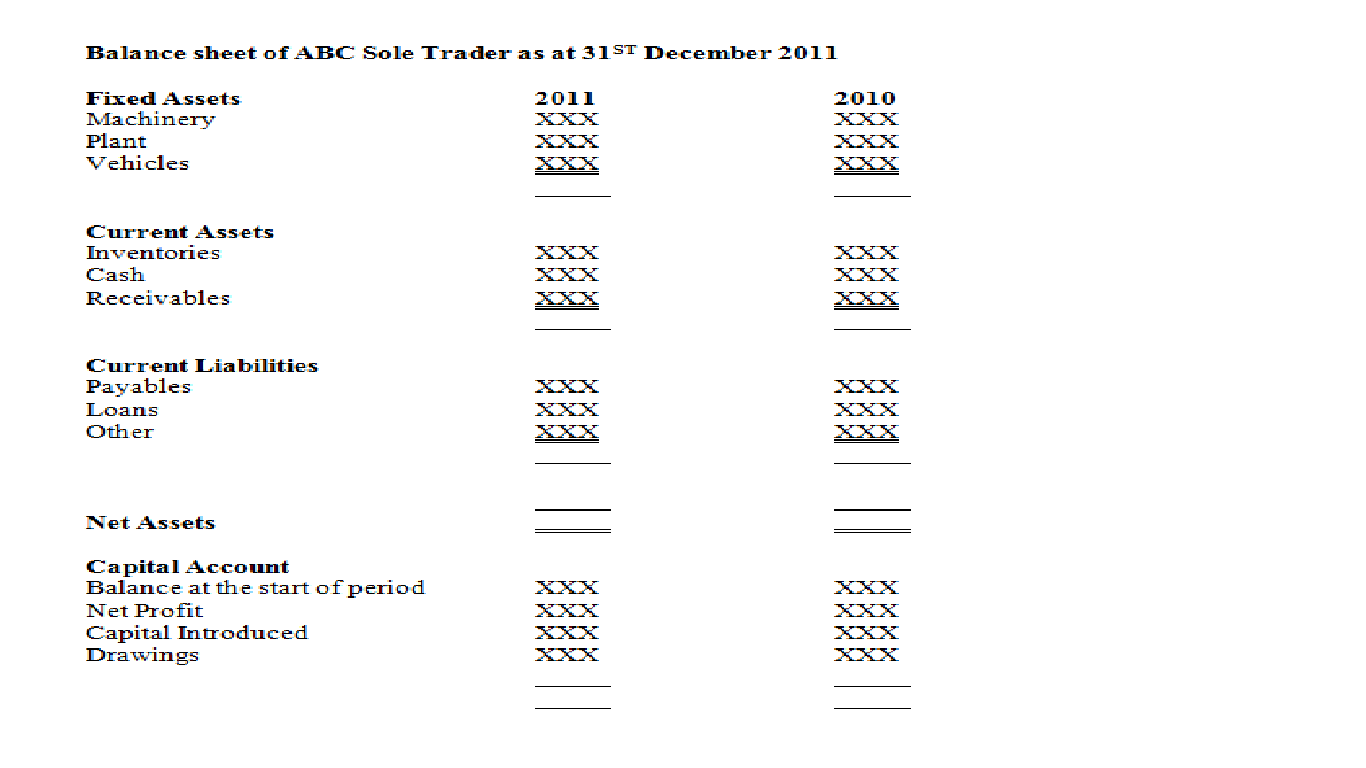

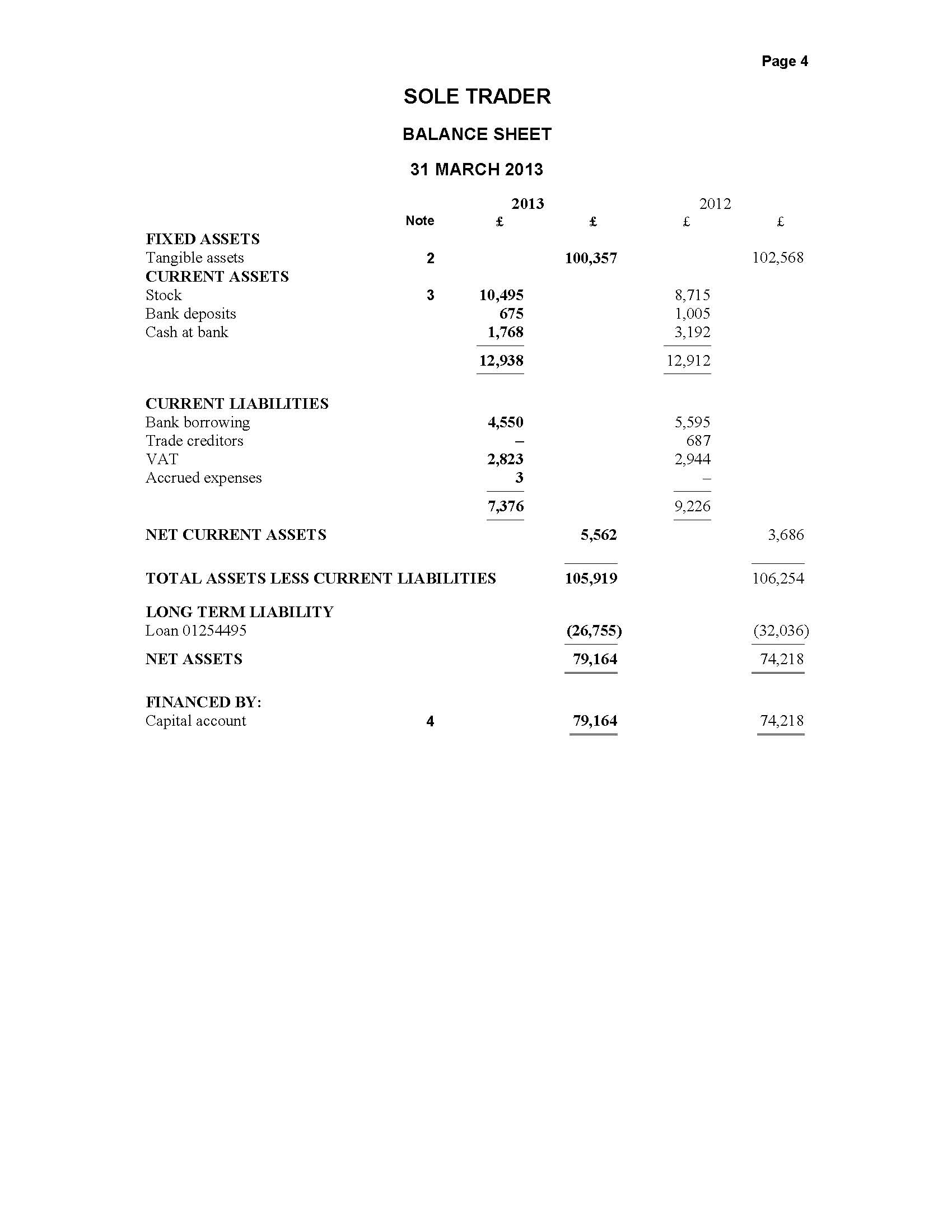

It shows how much money has been earned (revenue) and how much money has been spent (expenses) over a specific period. (a) do not put partners' salaries or interest on capital into the main income statement. There are two key elements to the financial statements of a sole trader business:

You should also give us a copy each year of your financial statements and personal and business income tax returns. The balance sheet the balance. The business income statements and payment summaries section will be automatically displayed if, at personalise return, you have selected:

By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. It tells you how much profit you're making, or how much you’re losing. As a sole trader, you declare all your income in your individual tax return, using the section for business items to show your business income and expenses.

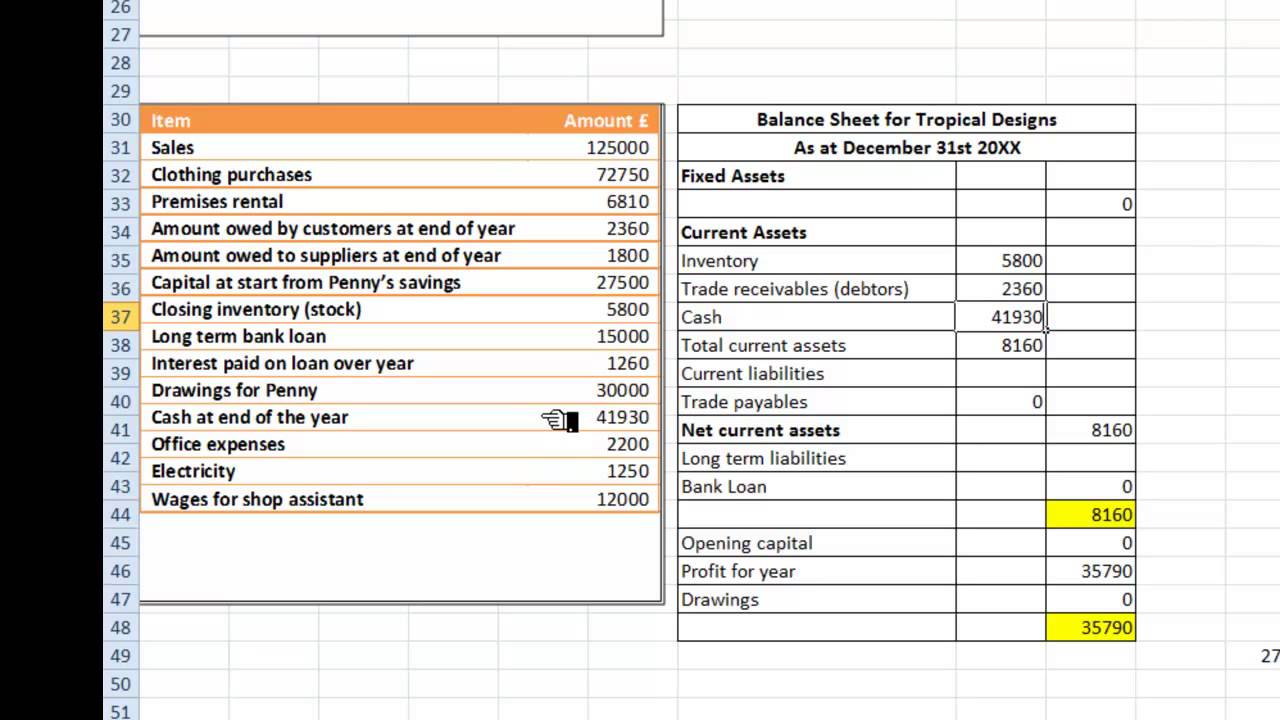

A walkthrough of two example questions requiring the preparation of an income statement (trading section only) for a sole trader. The trial balance provides the essential input for preparation of these accounts or statements. The sole trader financial statements are the balance sheet, the income statement, statement of change in owner's equity and the statement of cash flows.