Painstaking Lessons Of Tips About Financial Audit And Cost

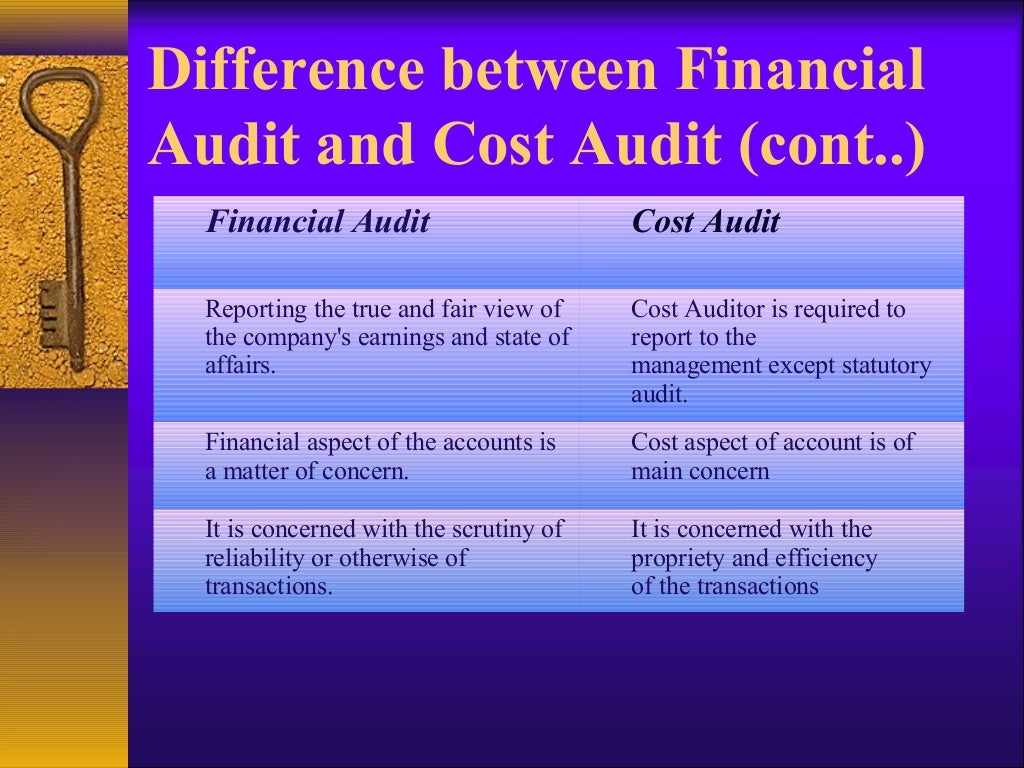

The main difference between a cost audit and a financial audit is that the former deals with operational data whereas the latter deals with accounting information.

Financial audit and cost audit. Arrivecan app so poorly managed auditor general can only guess the cost. This article throws light upon the three points of comparison between cost audit and financial audit. Typically, those that own a company, the shareholders, are not those that manage it.

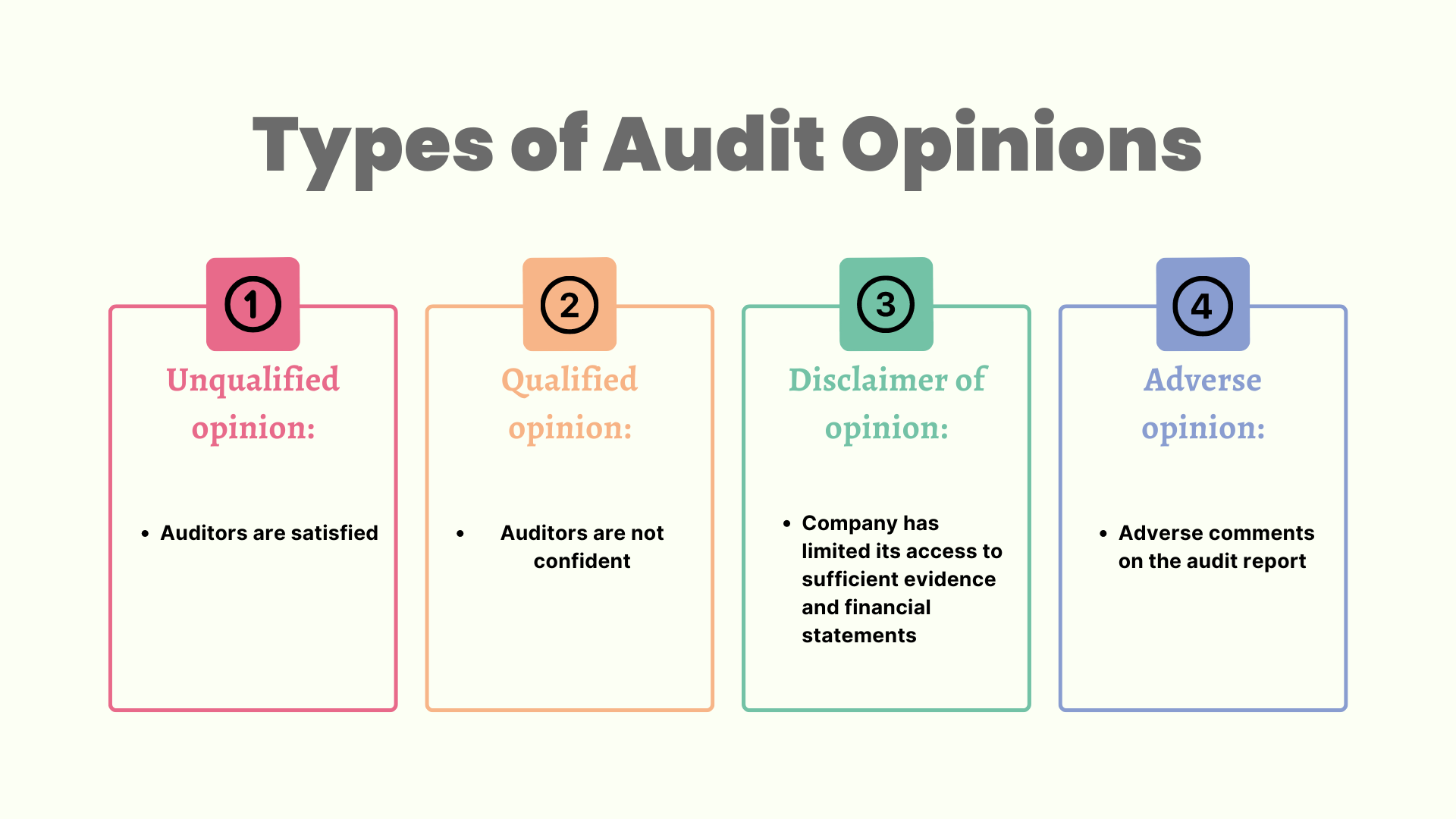

Difference between cost audit and management audit management audit refers to an independent examination of the managerial activities undertaken at different levels of the management so as to determine its functions, efficiency and achievement. A financial audit is an examination of a company's financial statements and records to ensure they are accurate, complete, and in compliance with generally accepted. A financial audit covers all the financial transactions recorded in financial books and.

Cost audit and financial audit are two types of audits that serve different purposes for a company. Let’s explore some of the key distinctions: Key differences between cost audit and financial audit.

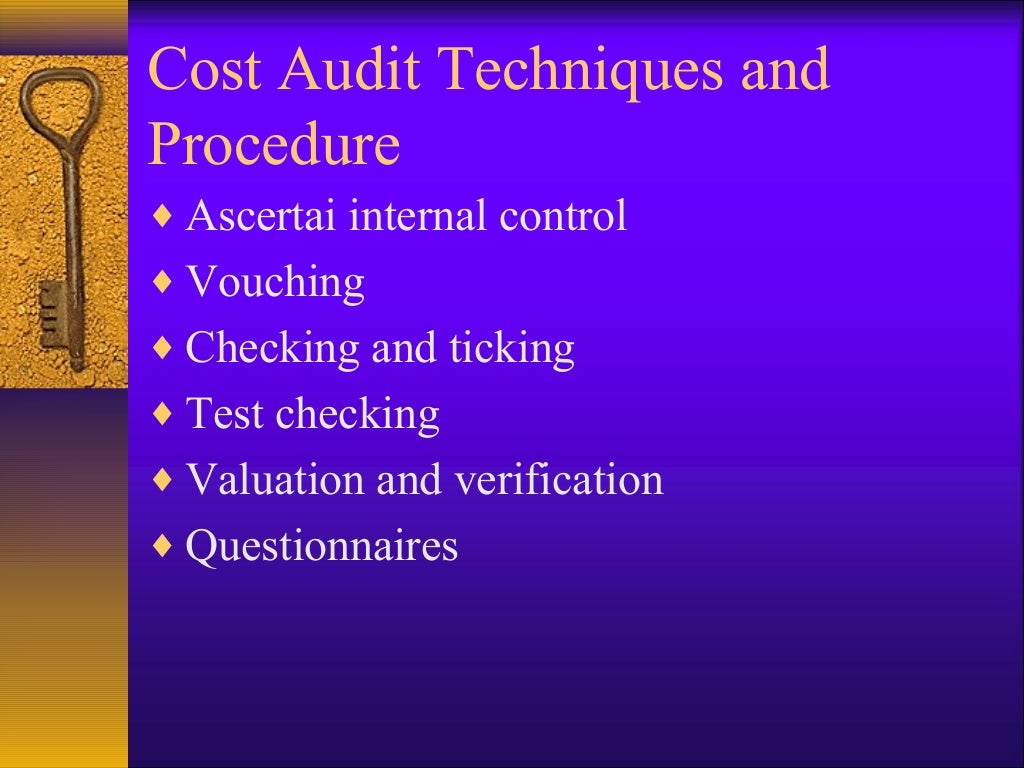

Some of the key differences between. A cost audit is an examination of a company's cost records and financial statements to ensure they are accurate and comply with relevant laws and regulations. Cost audit focuses on evaluating cost management practices and optimizing expenses, financial audit provides assurance on the overall financial statements and compliance with accounting standards.

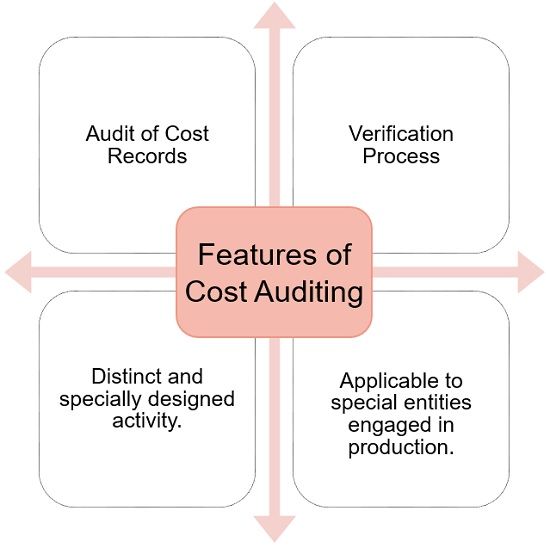

The purpose of a financial audit is to ensure an organization’s financial statements are a fair Cost audit is the verification of accounts and cost records and a careful compliance accounting process. While there is some overlap between the two, they have distinct objectives and procedures.

A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of. This figure is indicative of. Overview purpose of a financial statement audit companies produce financial statements that provide information about their financial position and performance.

A cost auditor will review financial data as well as operational. Cost audit means the checking and verification of the cost accountancy books, records, statements, reports and other data related to the cost of a product or service being provided by a business unit. A financial audit is a thorough, detailed examination of a company’s financial statements and accounts.

Auditor general karen hogan estimated that the canada border services agency spent $59.5 million on the app. The basic difference between cost audit and financial audit lies in their applicability, i.e. The internal revenue service said on wednesday it plans to crack down on wealthy executives who may be using company jets for personal trips but claiming the costs as business expenses for tax purposes, as part of a new audit push to boost revenue collections.

A financial audit is the investigation of your business’ financial statements and accompanying documentation and processes, and is performed by someone who is independent of your organization. According to smith and day, a cost audit involves detailed checking of the costing system,. The average annual net price of the universities in this ranking amounts to about $17,500.

Having a conversation with one of our subject matter experts. This information is used by a wide range of stakeholders (e.g., investors) in making economic decisions. It is an independent examination of the correctness of the cost statements and accounts and its conformity with the cost accounting plan.