Have A Info About Equipment In Cash Flow Statement

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992.

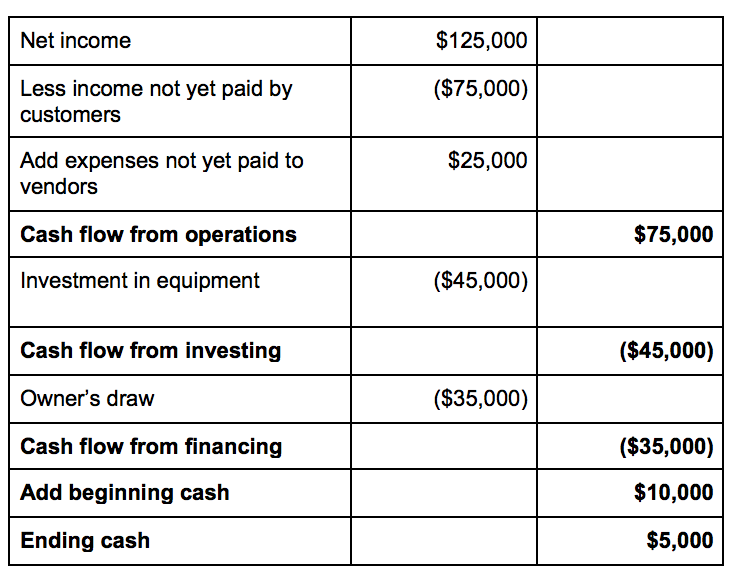

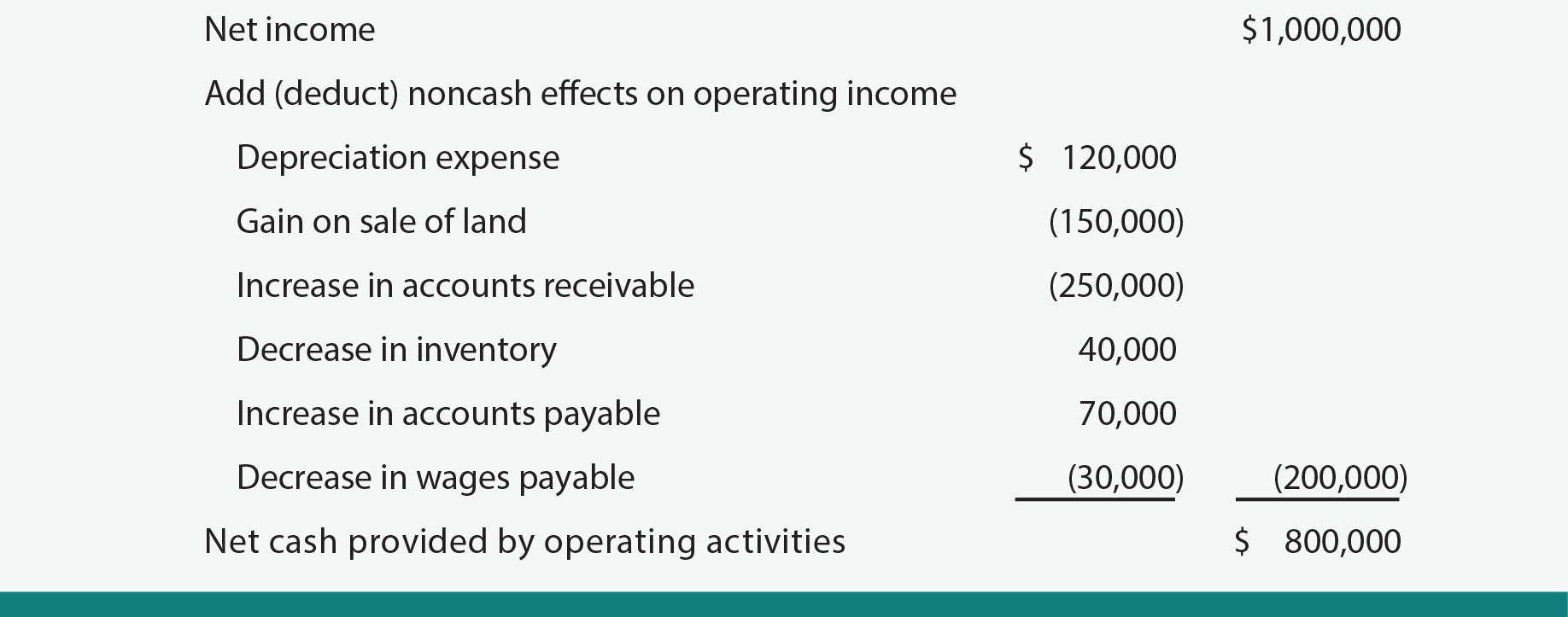

Equipment in cash flow statement. Gains and losses on cash flow statement. Net cash used in investing activities ( 480) cash flows from financing activities. To clarify the concept of a cash flow statement, here are two examples:

Sap s/4hana cloud for finance. A balance sheet comparing may 31 amounts to april 30 amounts and the resulting differences or changes is shown here: Xyz corp is a clothing manufacturer.

The cash flow statement looks at the inflow and outflow of cash within a company. Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. Gains or losses on the cash flow statement that we usually see are the gains or losses that resulted from investing and financing activities such as gains or losses on the disposal of fixed assets and gains or losses on the sale of investments.

After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. The cfs highlights a company's cash management, including how well it generates. The closing cash balance becomes the opening cash balance for the next financial period.

Did you get it ⬇️🤔 question: The cash flow statement is one of the most revealing documents of a firm’s financial statements,. The input that will cause this change to be reflected in a three statement model will most likely be located on the pp&e schedule under “capital expenditures.”

If a company's business operations can generate positive cash flow, negative overall cash flow. Cash flow from operating activities. A cash flow statement is a financial statement that presents total data.

Operating activities are the business activities other than the investing and financial activities. Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The cost of the office equipment is $1,100 and is paid in cash. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Brought to you by velotrade, Equipment & defense was up by 17.3% supported by both narrowbody and widebody programs, although constrained by supply chain difficulties.

Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a. Income statement and free cash flow. On may 31 good deal purchases office equipment (a new computer and printer) that will be used exclusively in the business.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)