Recommendation Tips About Financing Cash Flow

Financing activities will differ depending on your type of business, but here are a few of the most common financing activities found on cash flow statements:

Financing cash flow. Cash outflows from buying back equity/shares. Financing activities detail cash flow from both debt and equity financing. Siemens energy has sold a stake in its indian unit.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

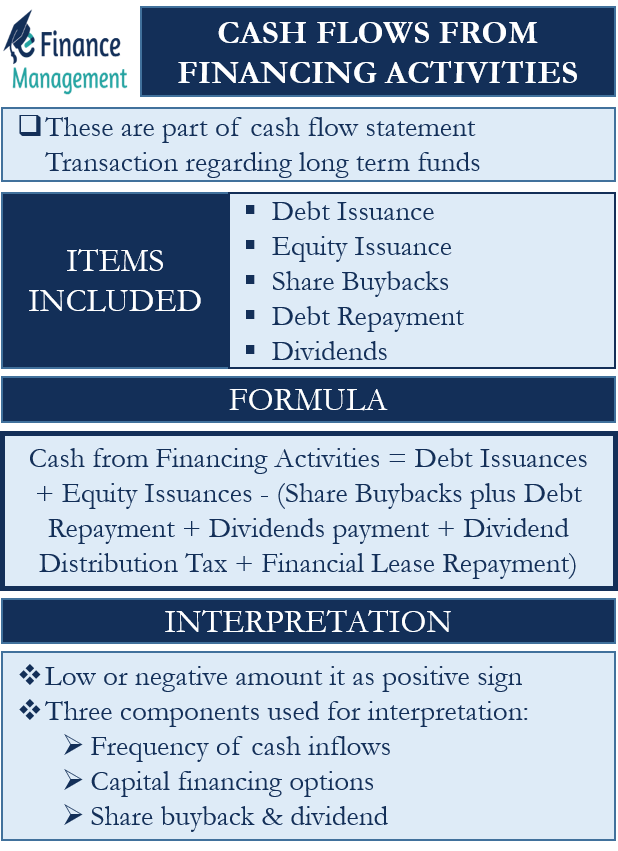

Department of the treasury published the 2024 national risk assessments on money laundering, terrorist financing, and proliferation financing. Cash flow from financing activities is the net amount of funding a company generates in a given time period. Importance of financing cash flow

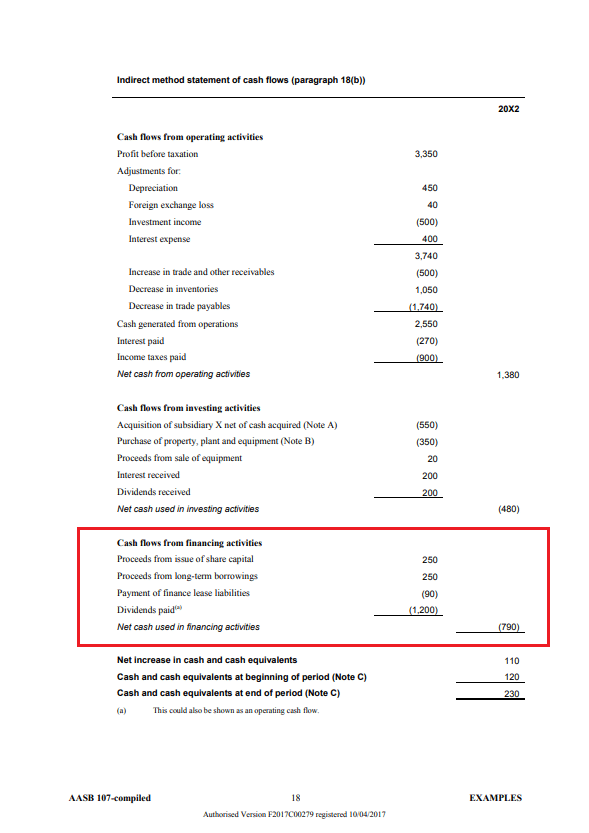

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a given period. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. Best fast small business loans.

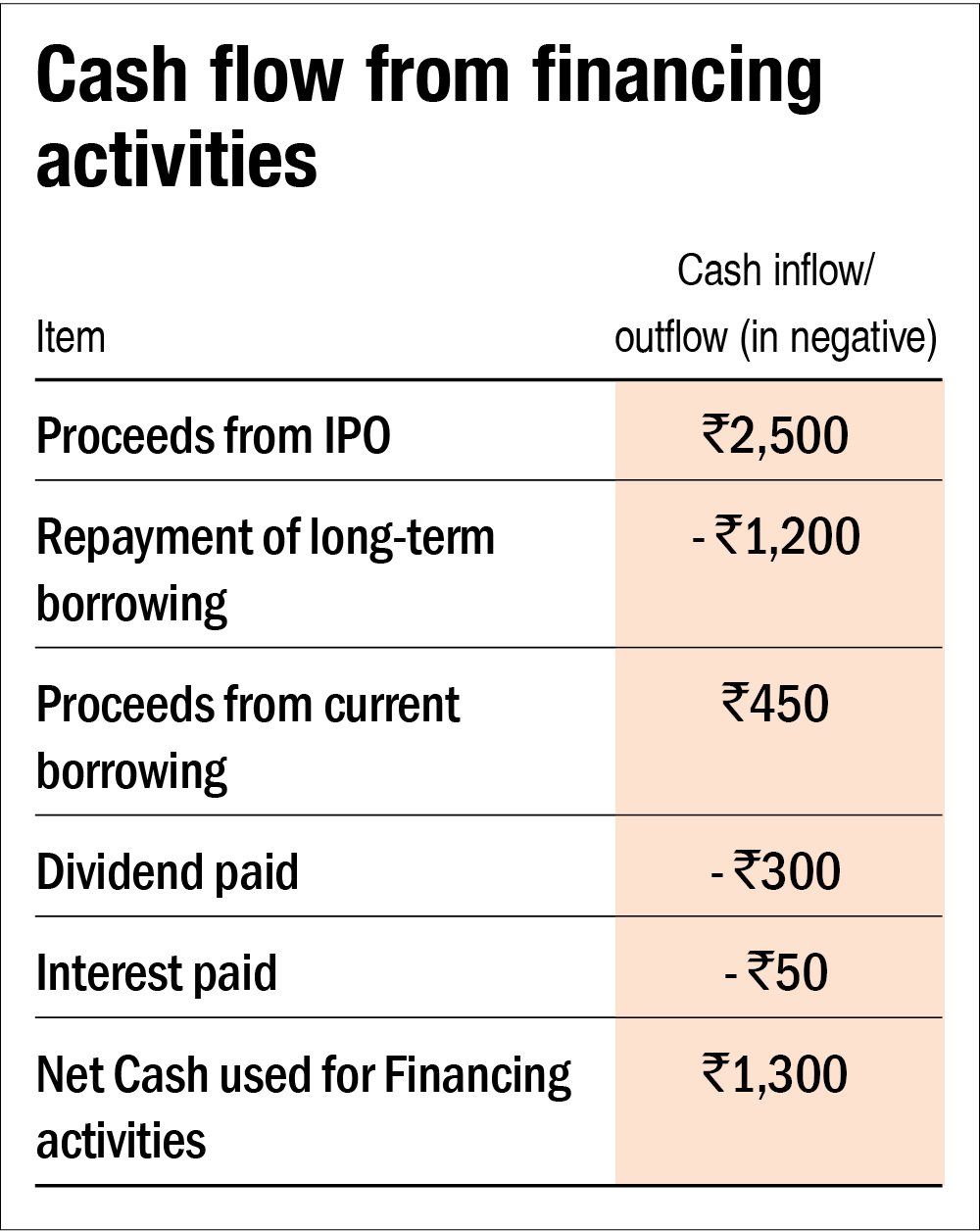

Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity shares, preference shares, issuing debt, debentures, and from the redemption of securities or repayment of a long term or short term debt, payment of divi. Then there’s cash on hand, which simply put, is the amount of capital a company has at its disposal to finance acquisitions, debt reduction, expansion and shareholder. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing how much a company.

You can use cash flow from financing to fund a company's operations, expand its business, or pay dividends to shareholders. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Like any other area of your financial life, cash flow management is a skill that you can improve over time.

Based on the cash flow statement, you can see how much cash different types of activities generate, then make business decisions based on your analysis of financial statements. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. This, in turn, allows you to estimate the future requirements to service this debt, or provide returns to shareholders.

This includes issuing new equity, taking out loans, and repaying existing debt. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth.

What are cash flows from financing activities? Becoming conscious of where your money is going and looking for opportunities to cut back on spending are big steps in the right direction. These activities also include paying cash.

The three variables used to calculate your financing cash flow are: Cash inflows from raising loans, mortgages and other borrowings. Best for lower credit scores:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)