Smart Tips About Trial Balance Explained

Willis (d) defended her cash reimbursements to special prosecutor nathan wade.

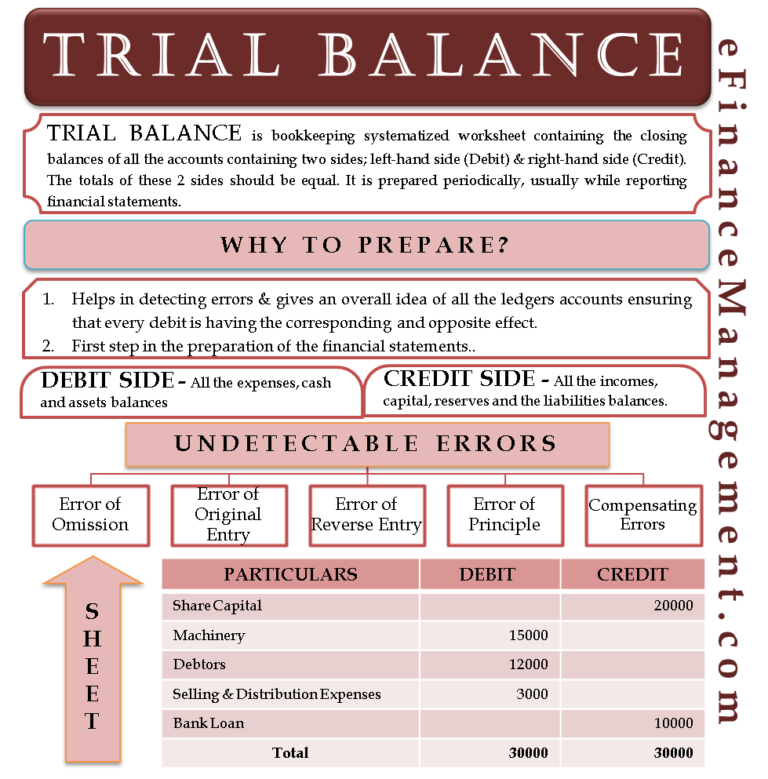

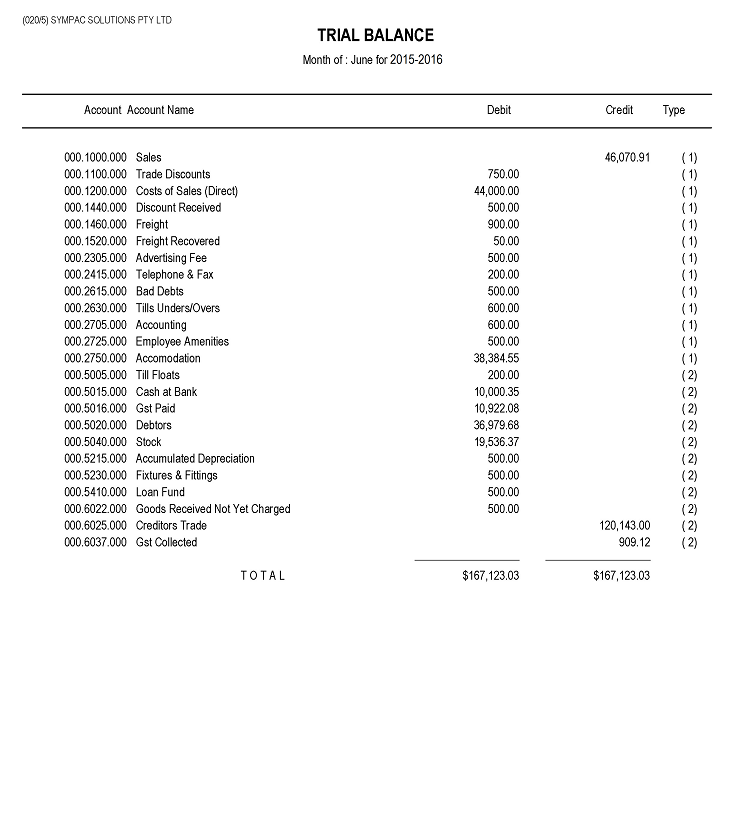

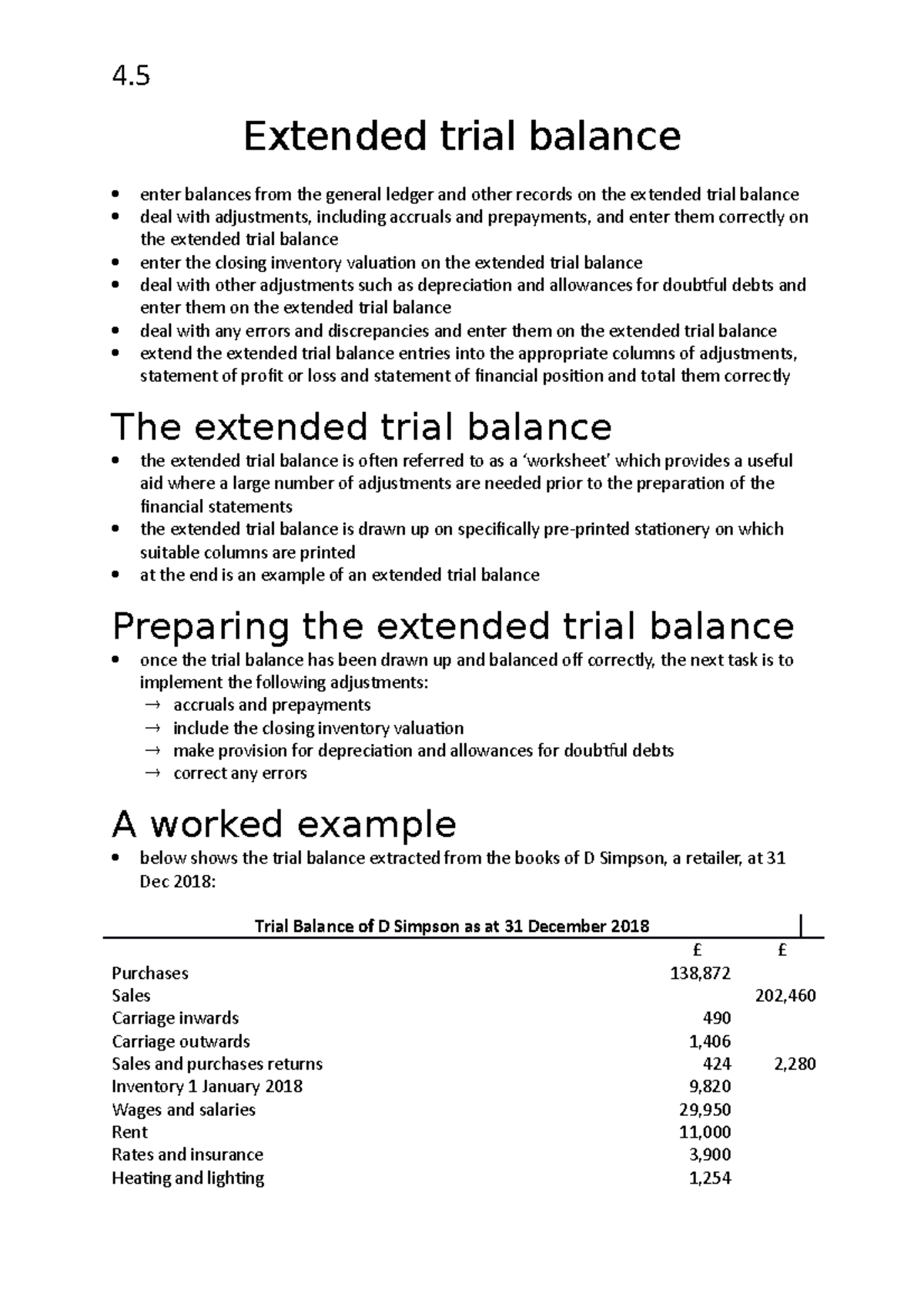

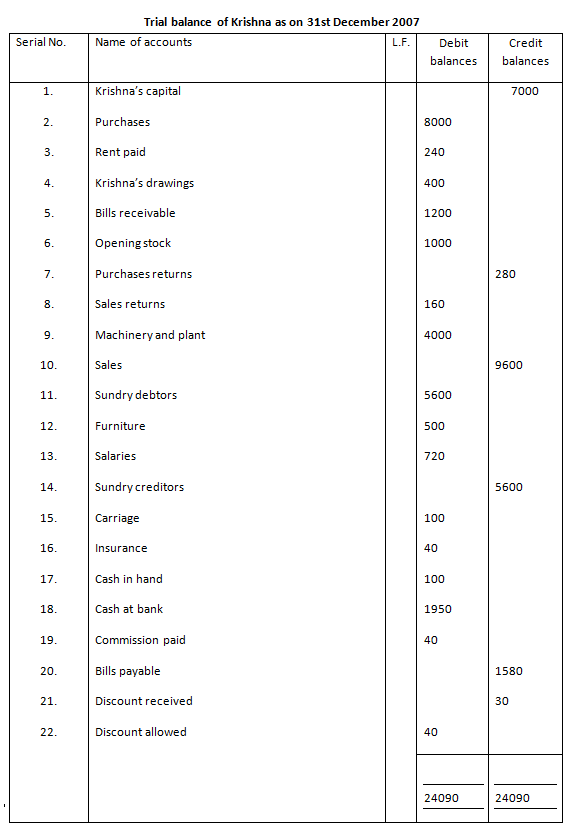

Trial balance explained. A trial balance is a summary of balances of all accounts recorded in the ledger. Trial balance forms: Namely, ledger form where the trial balance is cast in the form of an account with credit and debit sides.

A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year, before and after special adjustments a business needs it when they change to new bookkeeping software trial balance example what is a trial balance example trial balance for the year end The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. The trial balance lists every general ledger account (both revenue and capital) by their closing balances at a specific time.

The total of both should be equal. Each account's function and characteristics are briefly described in its account description. Trial balance is prepared to check the accuracy of the various transactions that.

What is a trial balance? A trial balance is an accounting tool. Note that for this step, we are considering our trial balance to be unadjusted.

A trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time. This statement is sometimes printed out with the financial statements and sometimes not. Trial balances gather information that aids in the preparation of financial statements.

Trial balances can summarize account performance, providing an overview of individual account balances. All the ledger accounts (from your chart of accounts) are listed on the left side of the report. Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements.

What is an adjusted trial balance? 15, fulton county district attorney fani t. Trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books.

The account numbers are unique identifiers assigned to each account in the general ledger. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available;

Although a trial balance may equal the debits and credits, it does not mean the figures are correct. A trial balance is a report that lists all the accounts in the general ledger of a company and their balances. It serves as a check to verify that the total of all debits equals the total of all credits for every account on the trial balance.

The adjusted trial balance is the statement that listed down all the general ledgers after making the adjustments. The columns total in such a way that both column totals balance our (i.e are equal). Creating a trial balance is the first step in closing the books at the end of an accounting period.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)