Heartwarming Tips About Does Closing Stock Comes In Trial Balance

As per this treatment, the closing stock is not shown in the trial balance because it is already a part of the purchases of the.

Does closing stock comes in trial balance. Hence, it will not reflect in the trial balance. Gross profit method is also used to estimate the amount of closing stock. Closing stock is the leftover balance out of goods which were purchased during an accounting period.

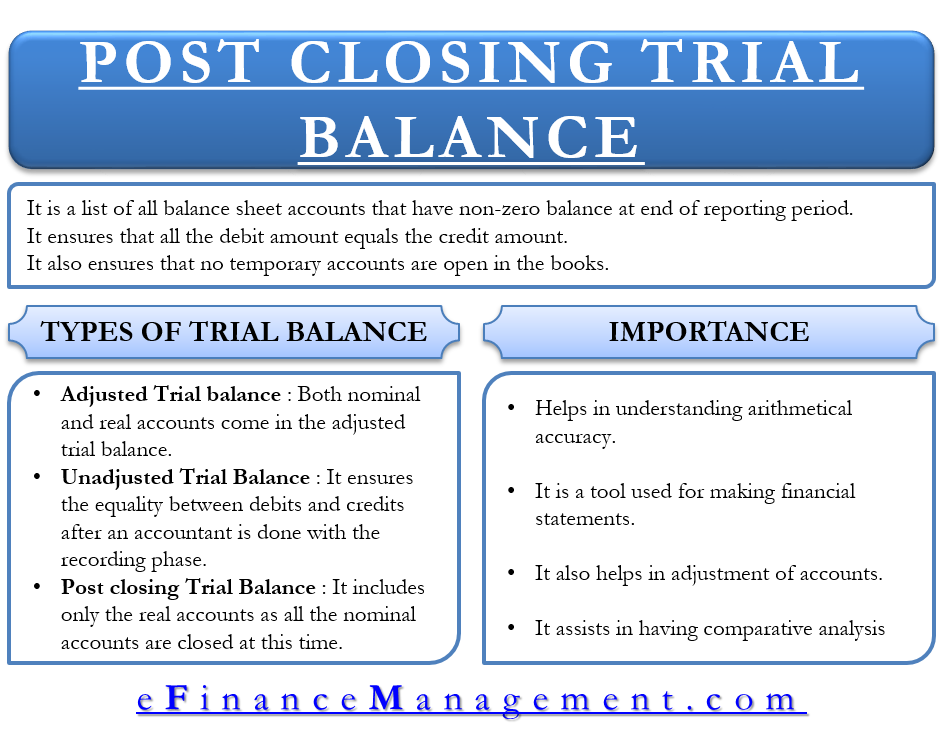

If it is included, the. A trial balance is a list of all accounts in the general ledger that have nonzero balances. It helps to record the income and expenditures of the.

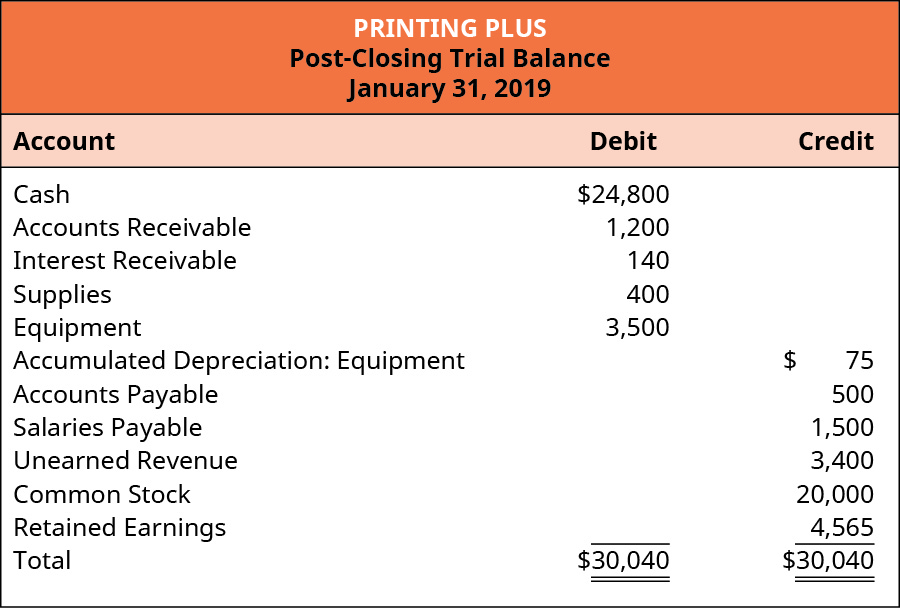

Let’s explore each entry in more detail using printing plus’s information from analyzing. The trial balance shows the. Closing stock is the balance of unsold goods that are.

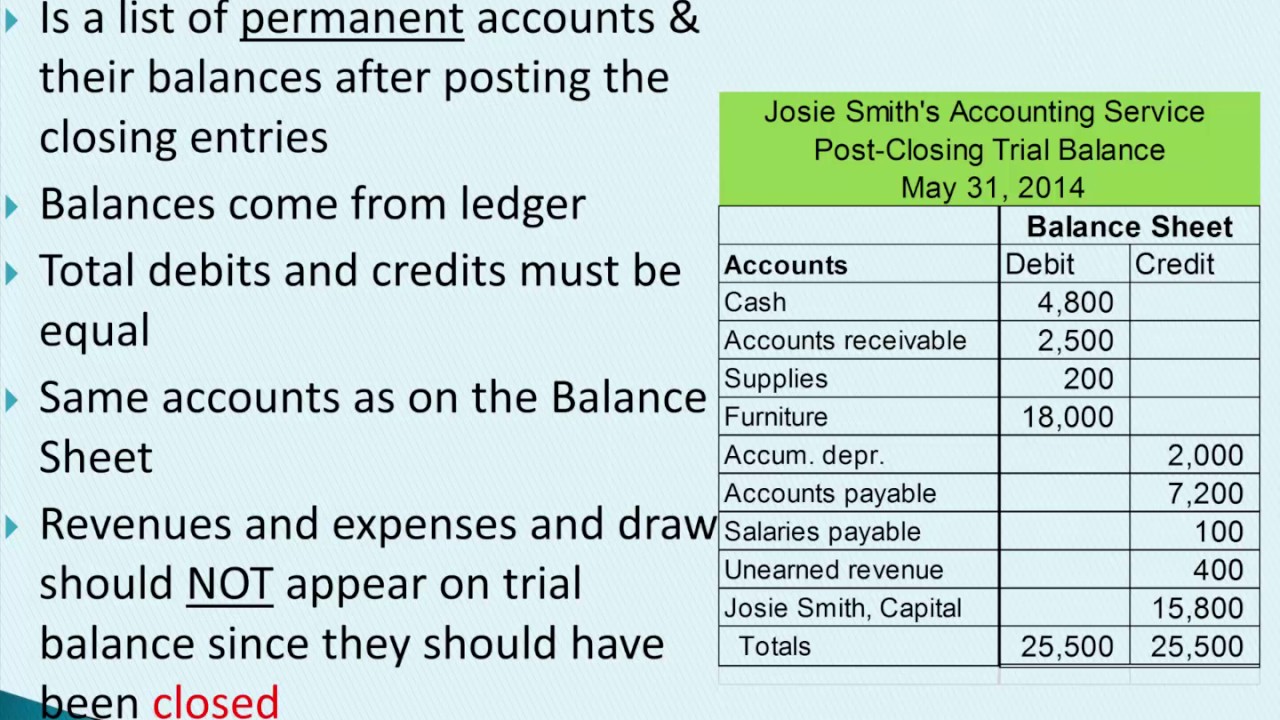

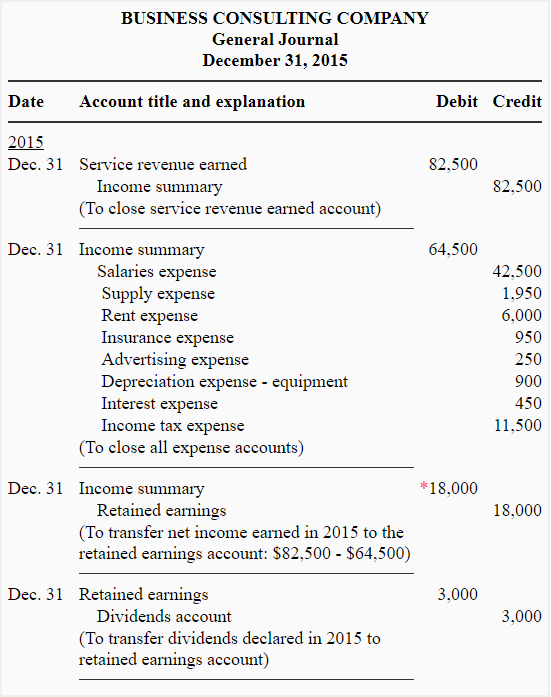

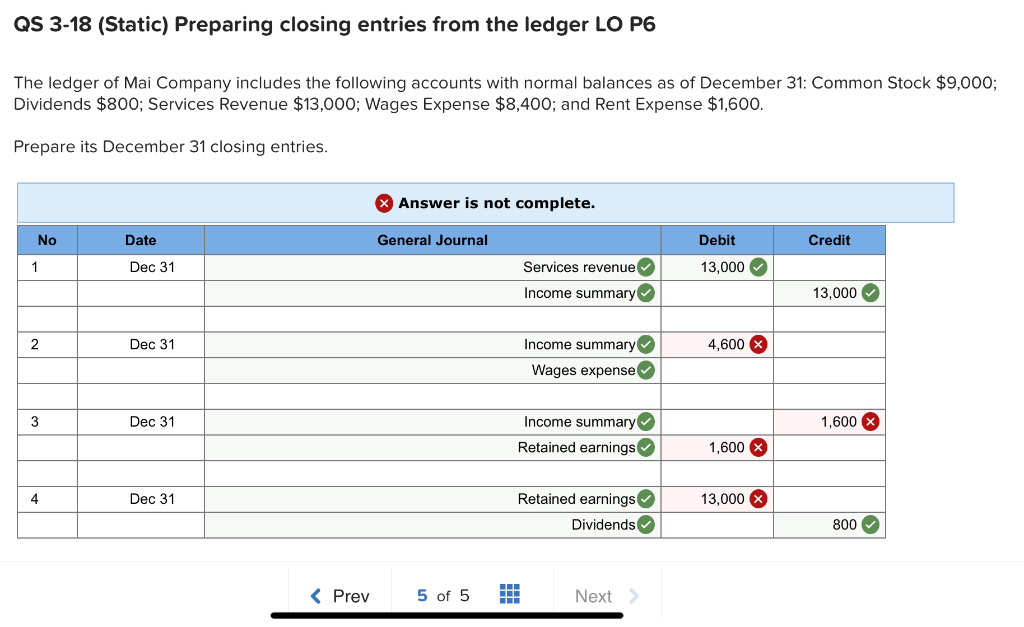

Closing stock is the balance out of goods that were purchased during an accounting period, and have remained unsold. The aim is to have the two figures equal each other for a net zero balance. Close income summary to the appropriate capital account.

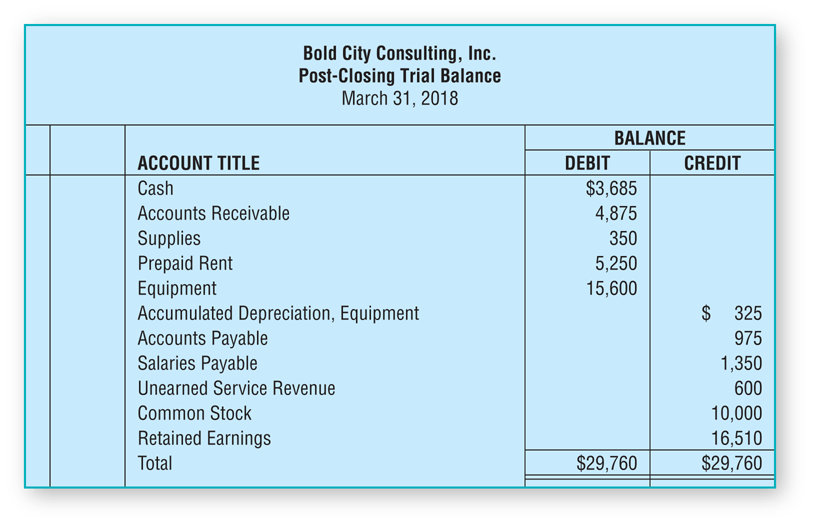

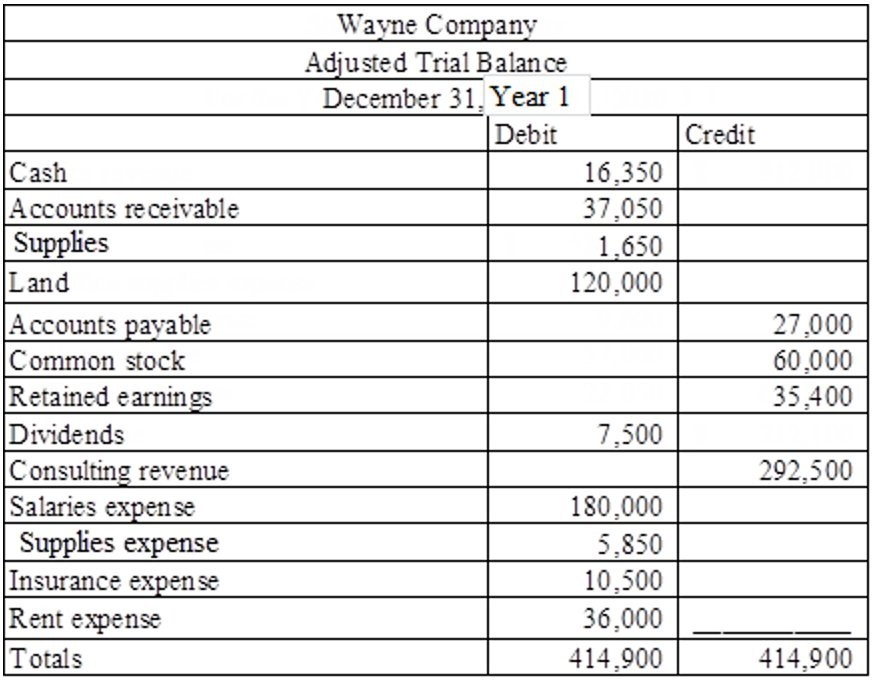

Sometimes in the trial balance, this adjusted purchase is given and this means that the opening stock and closing stock are adjusted through this purchase. The cost of purchases we will arrive at the cost of goods. Example to illustrate, here is a sample adjusted trial.

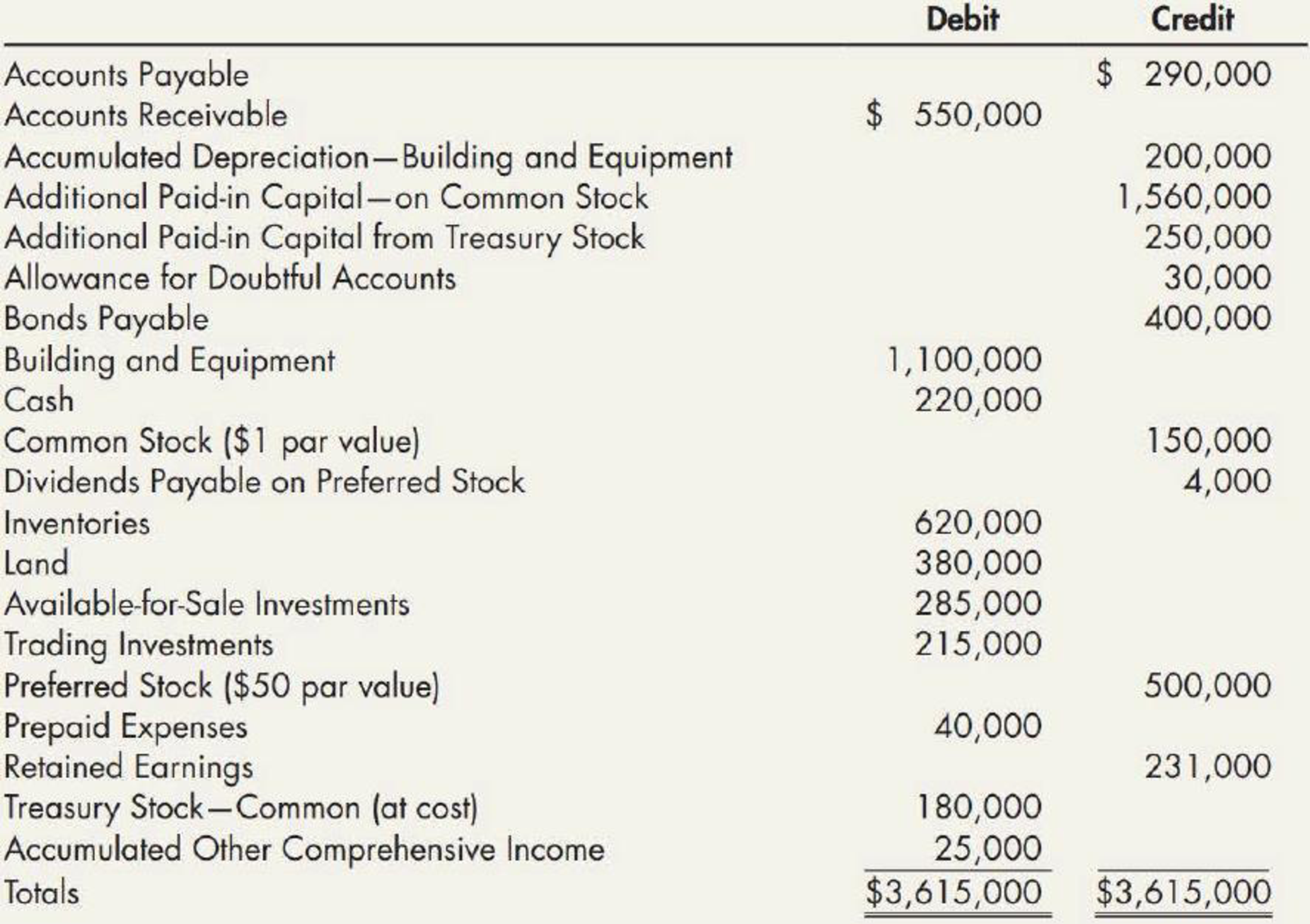

If closing stock is included in the trial balance , the effect will be doubled. Now for this step, we need to get the balance of the income summary account. This is your starting trial balance for the next year.

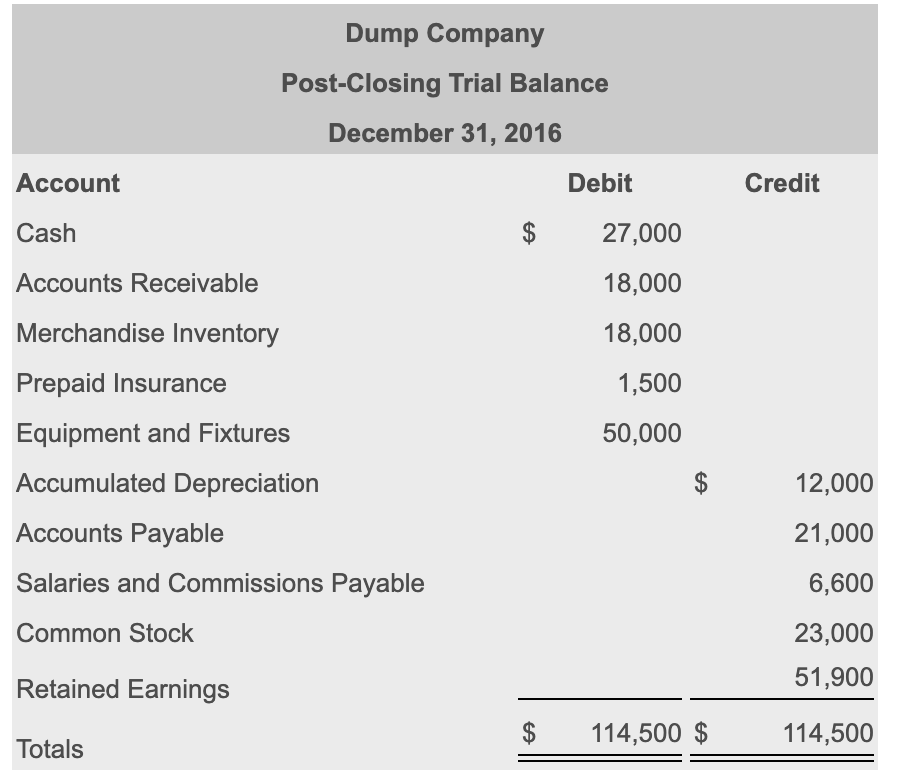

After closing all general ledger accounts, the trial balance is prepared at the end of the financial year. When closing stock is shown in the trial balance, then this is due to an adjustment made in the books and by reason of this adjustment closing stock does not. Total purchases are already included in the trial balance, hence closing stock should not be included in the trial balance again.

This video explains the logic behind why the closing stock does not appear in the trial balance along with an exception.you can refer the below video if you. In step 1, we credited it for. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

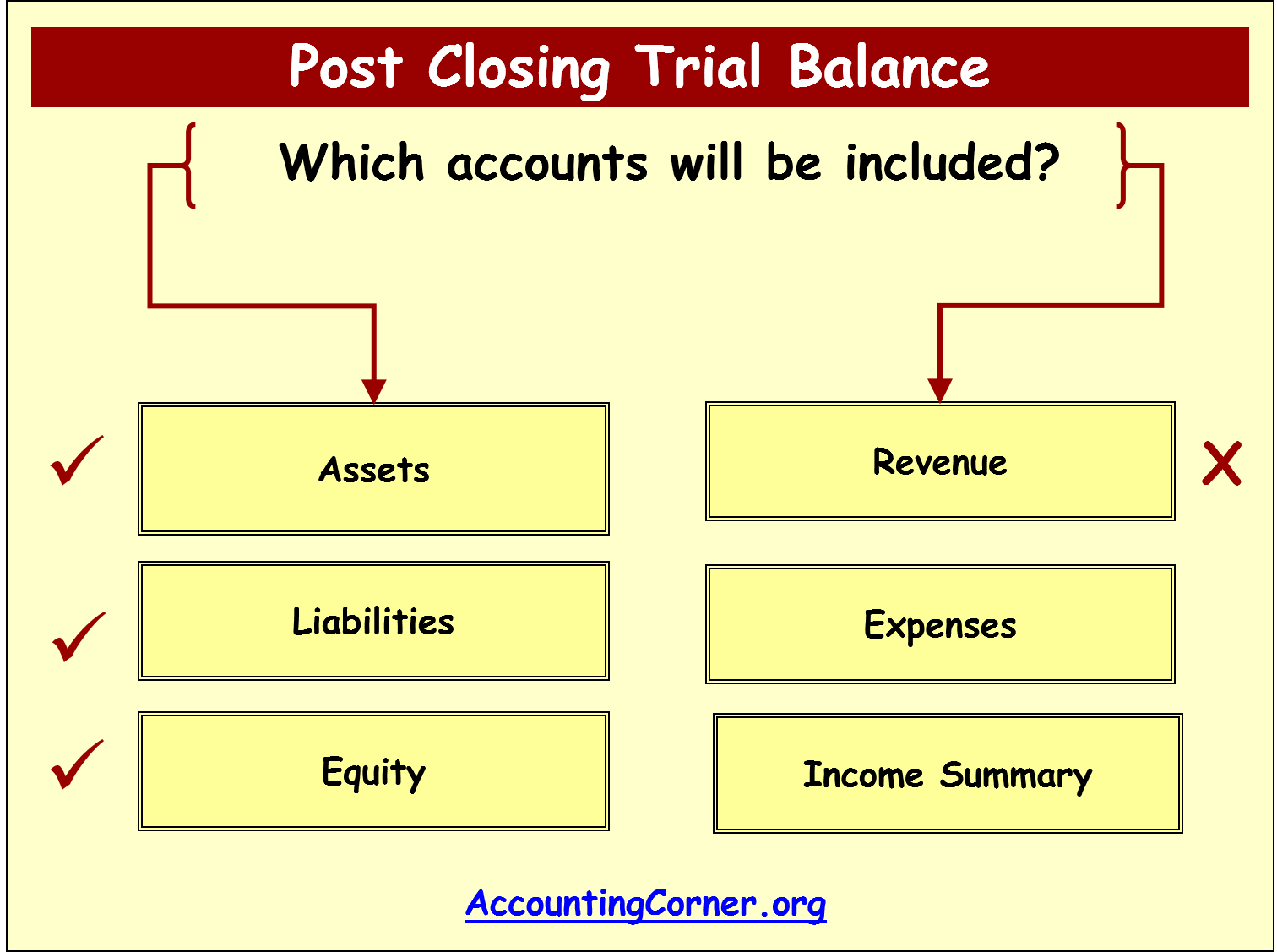

The accounts reflected on a trial balance are related. You are preparing a trial balance after the closing entries are complete. The information needed to prepare closing entries comes from the adjusted trial balance.

A trial balance is an important step in the accounting process, because it helps identify. Closing stock is not shown in the trial balance: Closing stock represents sales made in an earlier accounting period (such as in the current month,.