Casual Tips About Meaning Of Pro Forma Financial Statements

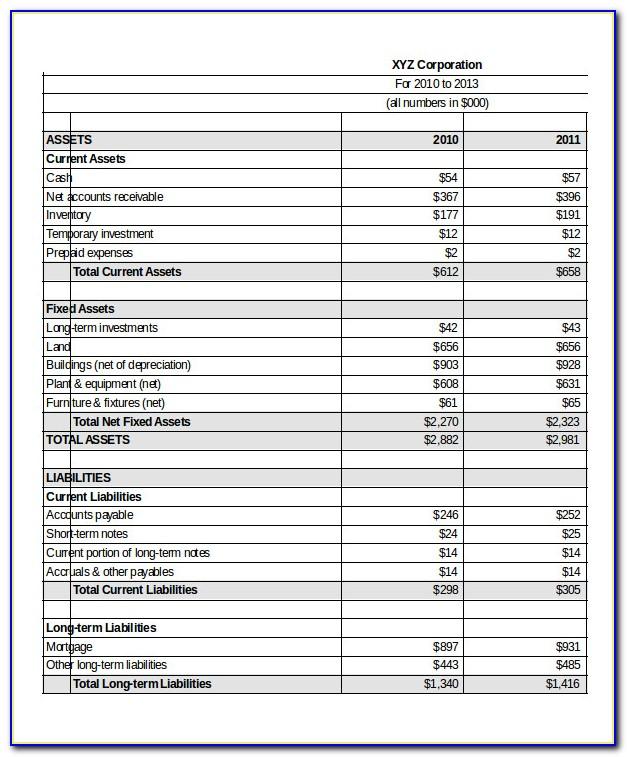

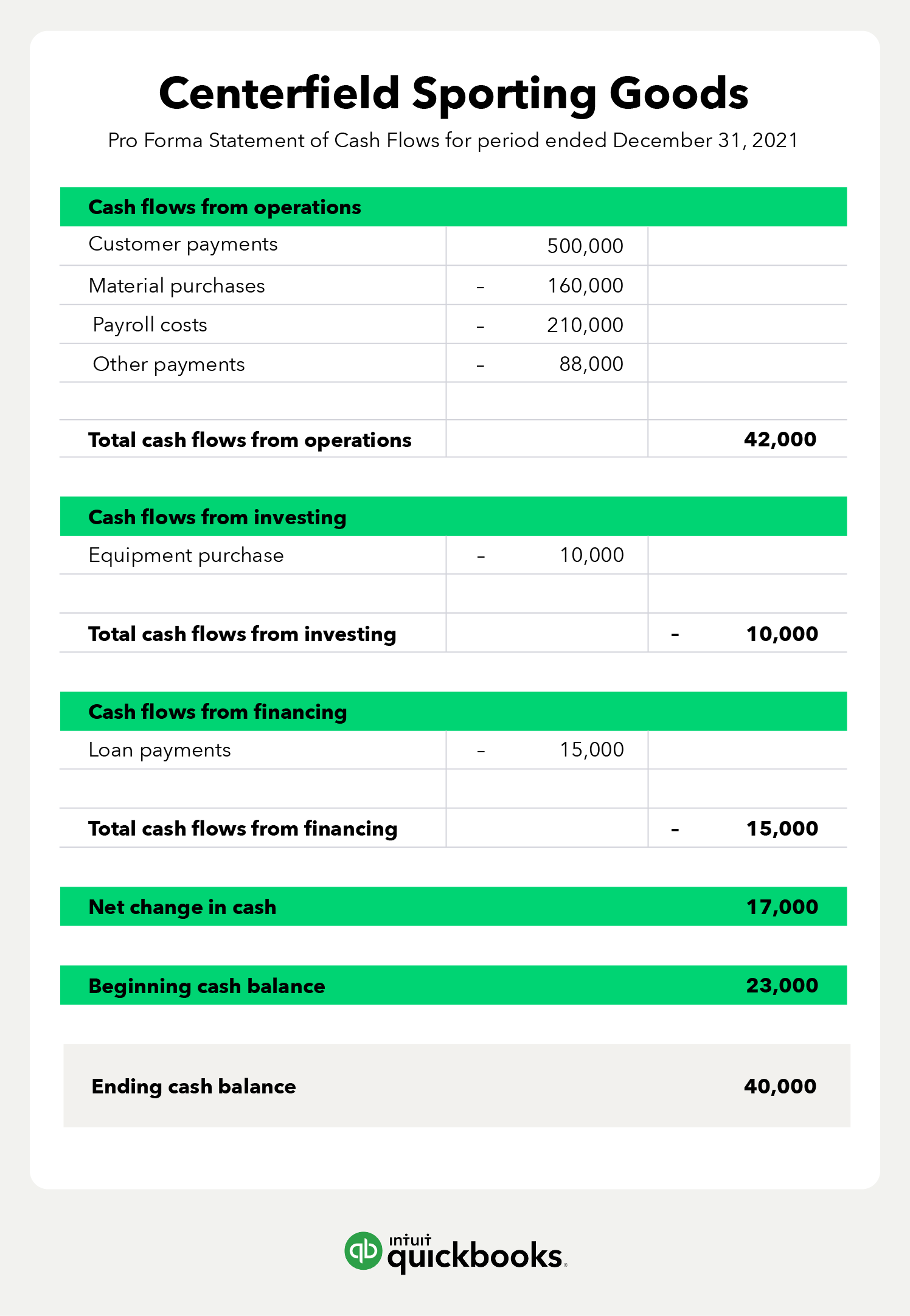

Therefore, it prepares a projected balance sheet, income statement, and statement of cash flows for each of the three financing options.

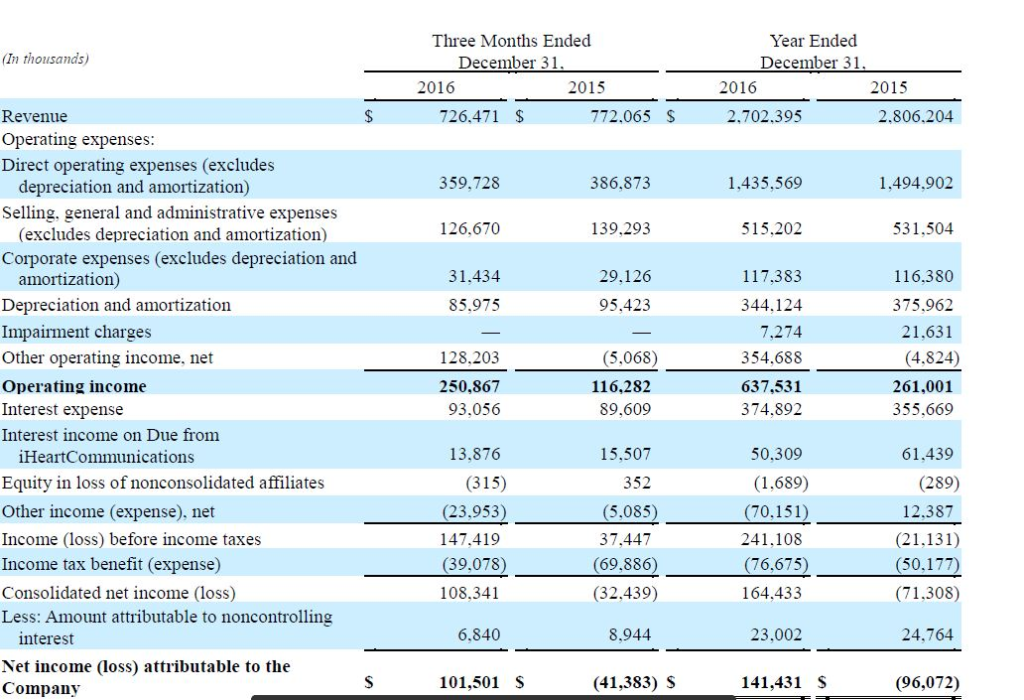

Meaning of pro forma financial statements. These projected financial statements are referred to as pro forma financial statements. Consolidated revenue of $1.48 billion, a 13% increase compared to the prior year quarter. Pro forma financial statements often include several years of financial projections.

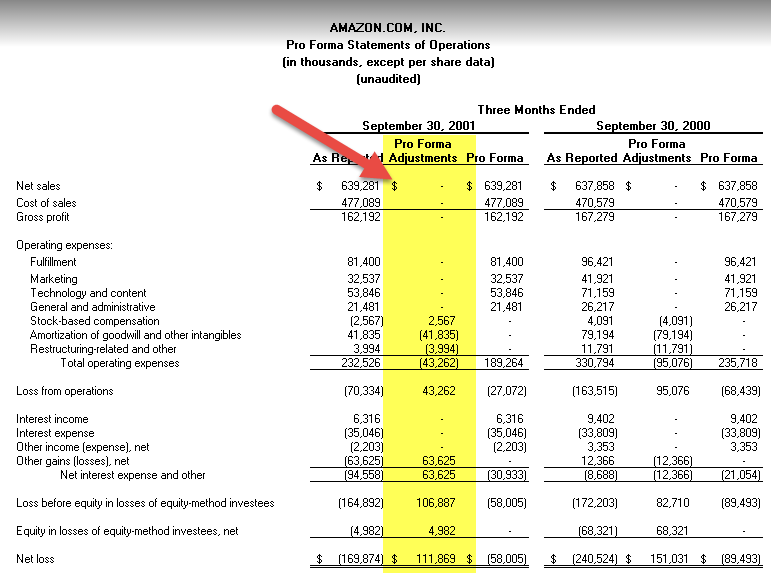

Gross margin expanded to 58.3% from 57.0% in the prior year quarter. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an.

Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Being able to project future financial performance can be valuable for an organization because it can help it adjust its processes or budgets to maximize revenue. What are pro forma financial statements?

But budgets and pro forma statements are two distinct financial tools. Key takeaways pro forma financial statements illustrate how a company’s financial position might change in. Standard financial statements are based on a company’s historical performance.

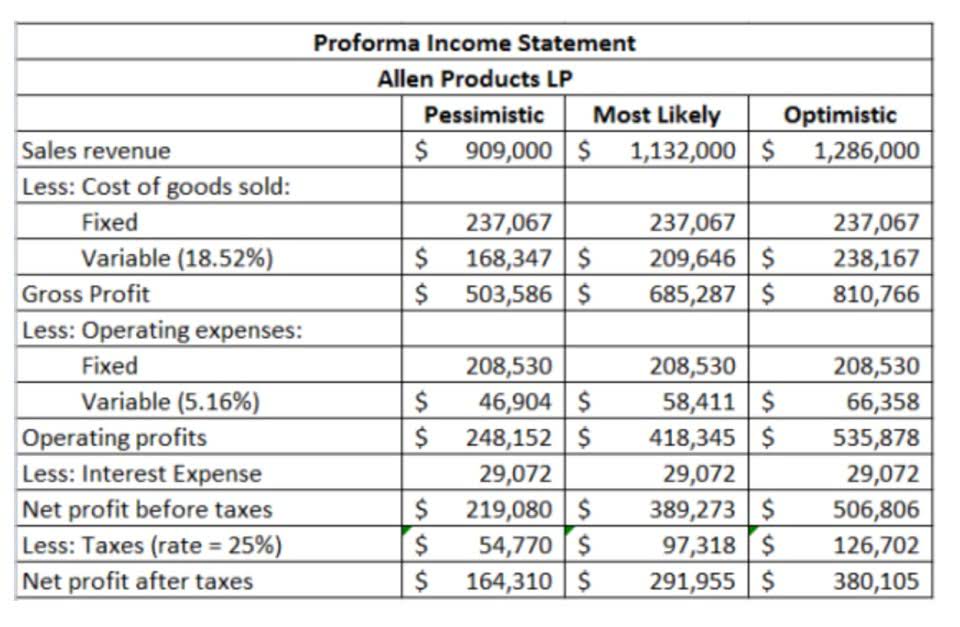

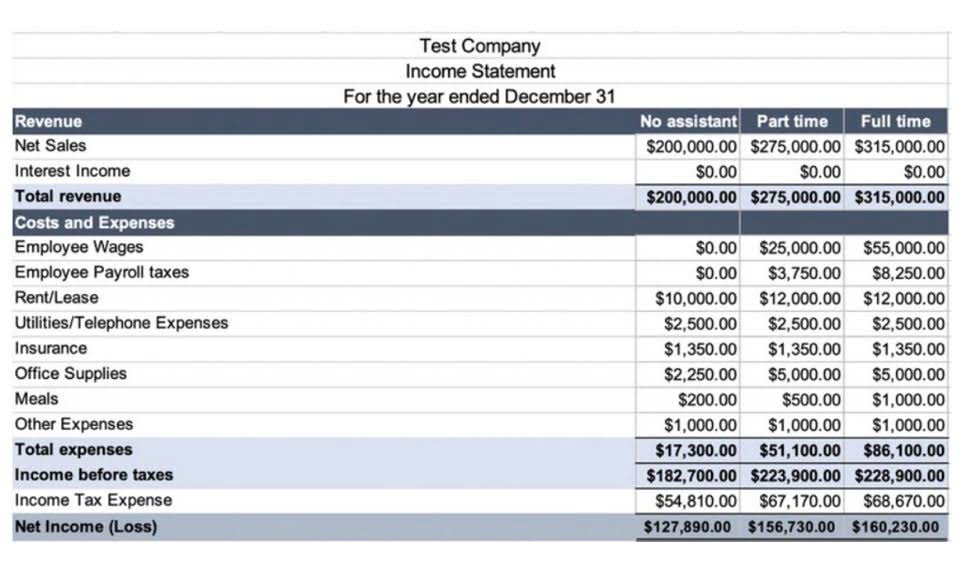

Highlights for fourth quarter 2023 include: A corporation may want to see the effects of three possible financing options. When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios.

These include any changes in the assets and liabilities of the business, including cash, receivables, inventories, account. To include or exclude items that gaap wouldn't allow. In the online course financial accounting, pro forma financial statements are defined as “financial statements forecasted for future periods.

In business, pro forma financial statements are prepared in advance of a planned transaction, such as a merger, an acquisition, a new capital investment, or a change in capital structure such as incurrence of new debt or issuance of stock. Think of it this way: A pro forma financial statement offers projections of what management expects to happen under a particular set of circumstances and assumptions.

These statements are used to present a view of corporate results to outsiders, perhaps. The unaudited consolidated financial statements and the notes to the audited consolidated financial statements as at and for the year ended december 31, 2023 provide a. The term pro forma in financial statements refers to the act of calculating future financial results based on projections and assumptions.

Pro forma financials may not be. Pro forma financial statements are preliminary financials that show the effects of proposed transactions as if they actually occurred. Definition a pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history.

Pro forma data estimates are built in to show the company’s profits if. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions.