Spectacular Info About Aia Statement For Income Tax

Contains information for replace of aia priority protection and income protection accident only plans and priority protections plans with term level premiums.

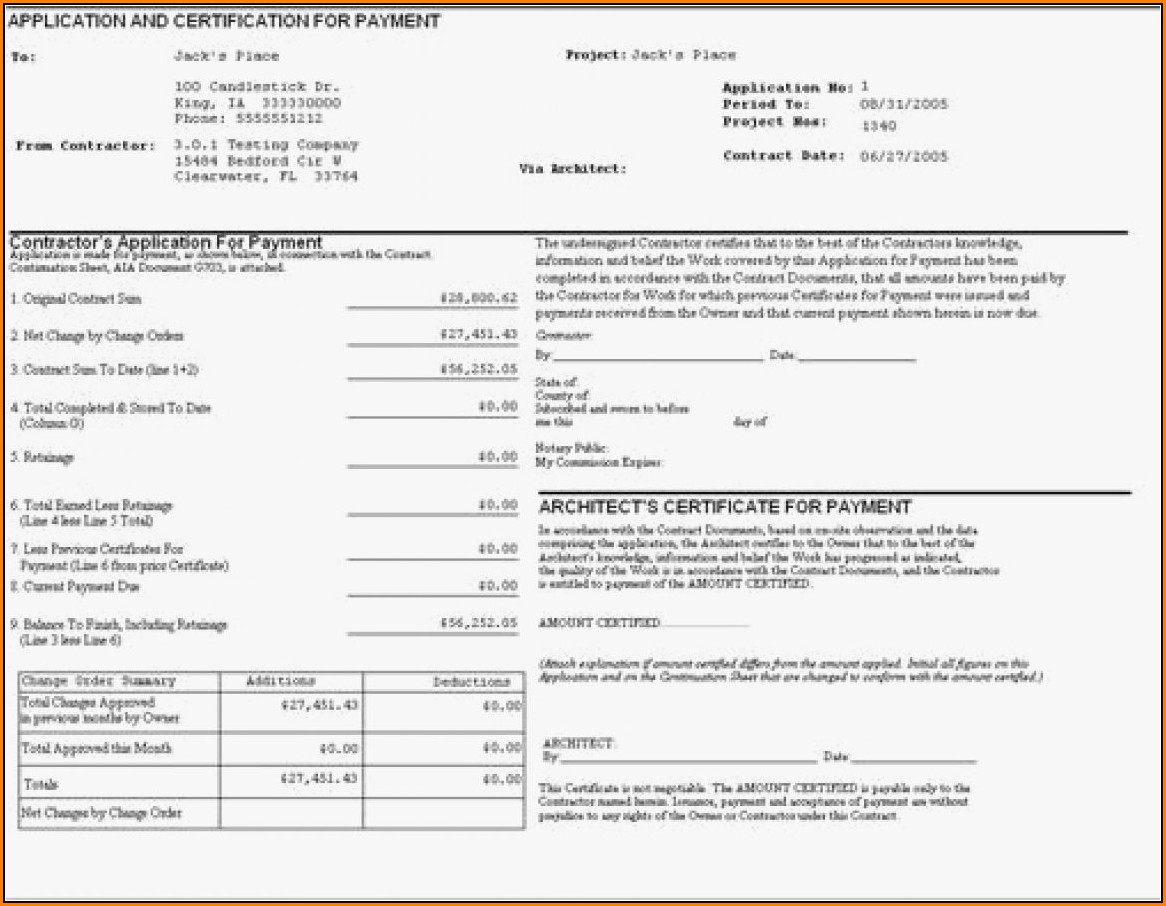

Aia statement for income tax. Visit this page to find out the answers to some of the frequently asked questions you may have regarding aia, the. Just follow these 3 simple steps: 1 unaudited condensed income statement 6 months period ended 30 june 2021 note 6 months period ended 30.06.2021 rm’000 gross earned.

5 august 2022 3 mins read. Richard evans 21 february 2024 • 3:00pm. Earn an annual income of rm34,000 or more (after epf deductions) earn an.

These letters will be available on your aia adviser site for your convenience. Tax deductible dues statement. Every citizen of india earning above a specific threshold is required to pay an income tax* to.

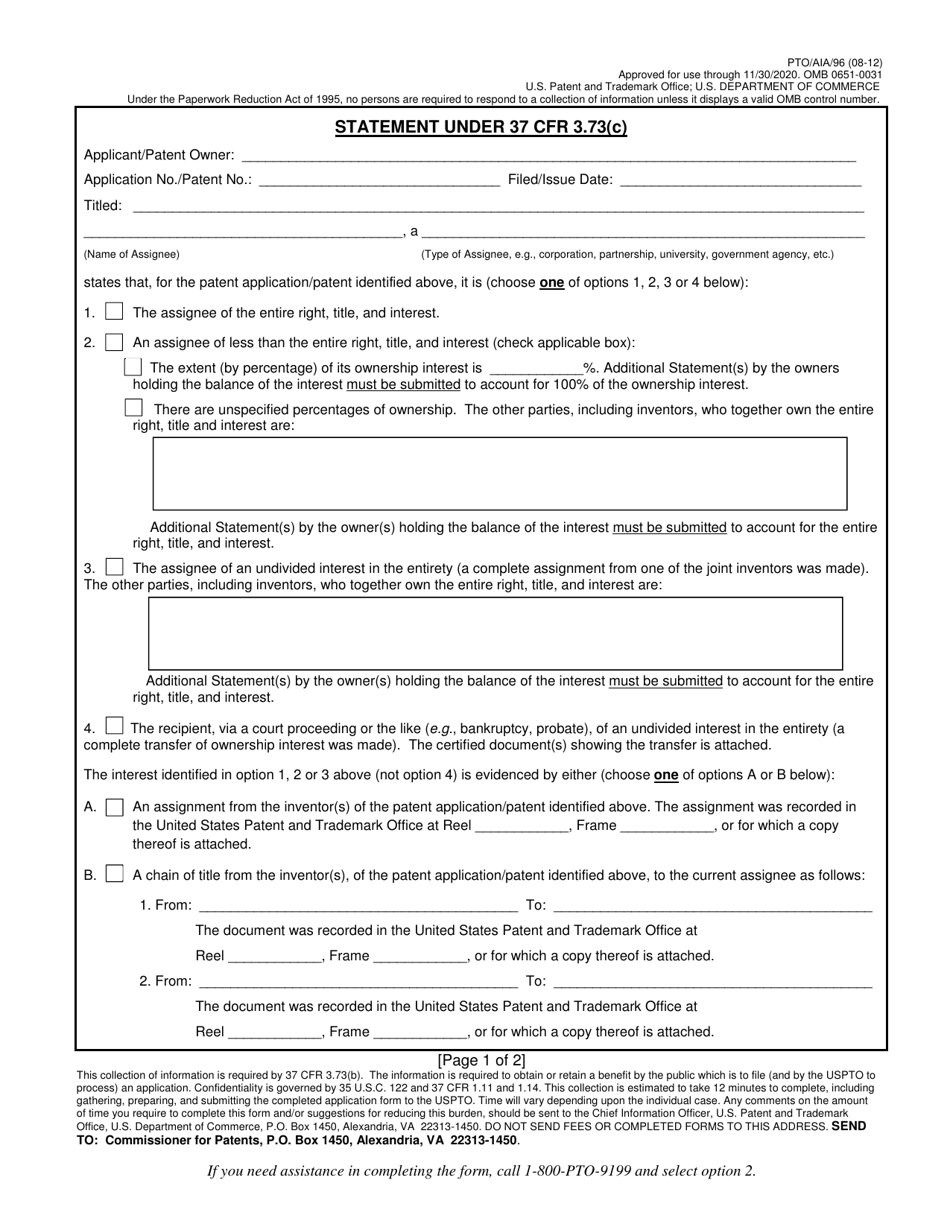

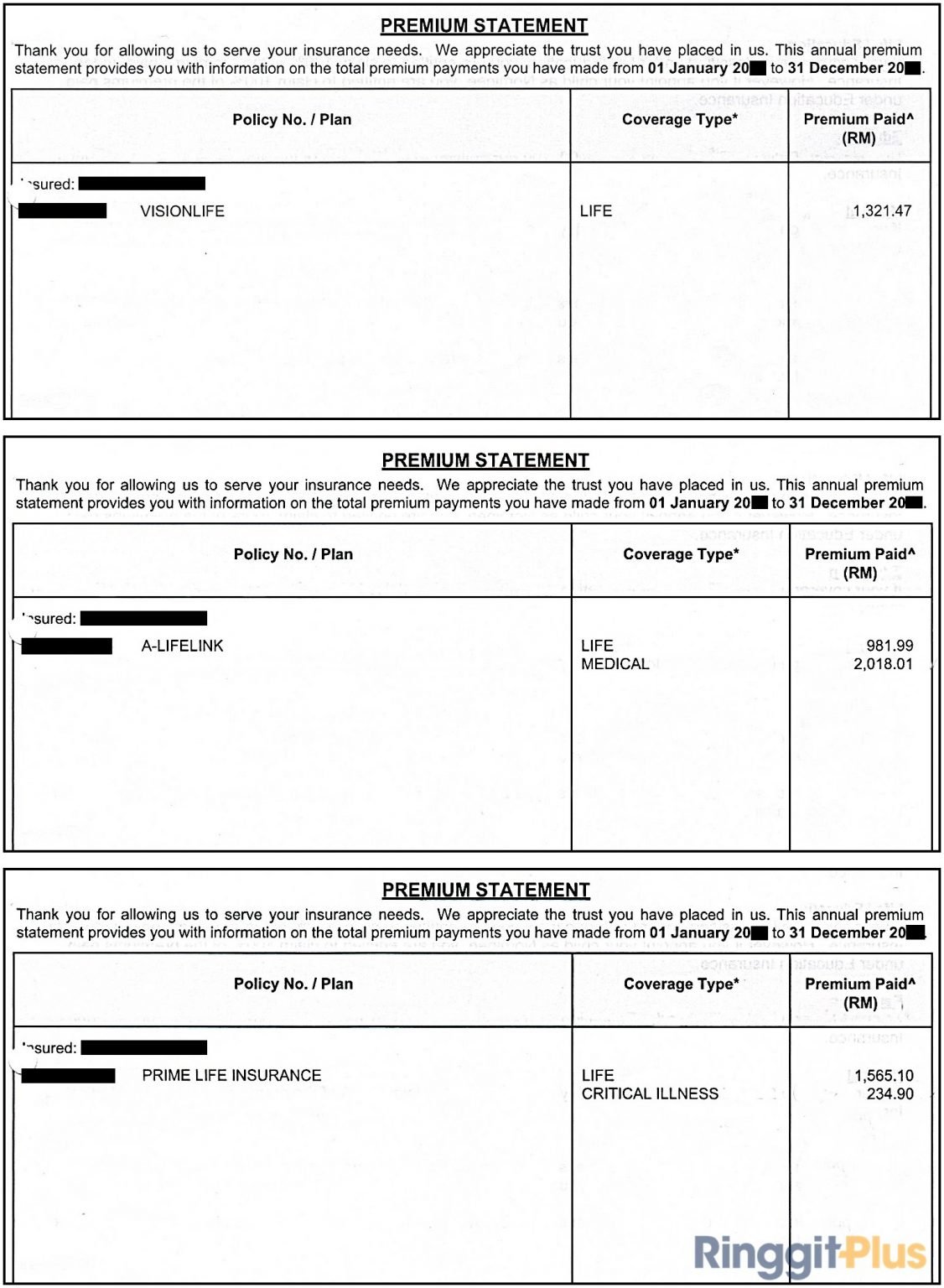

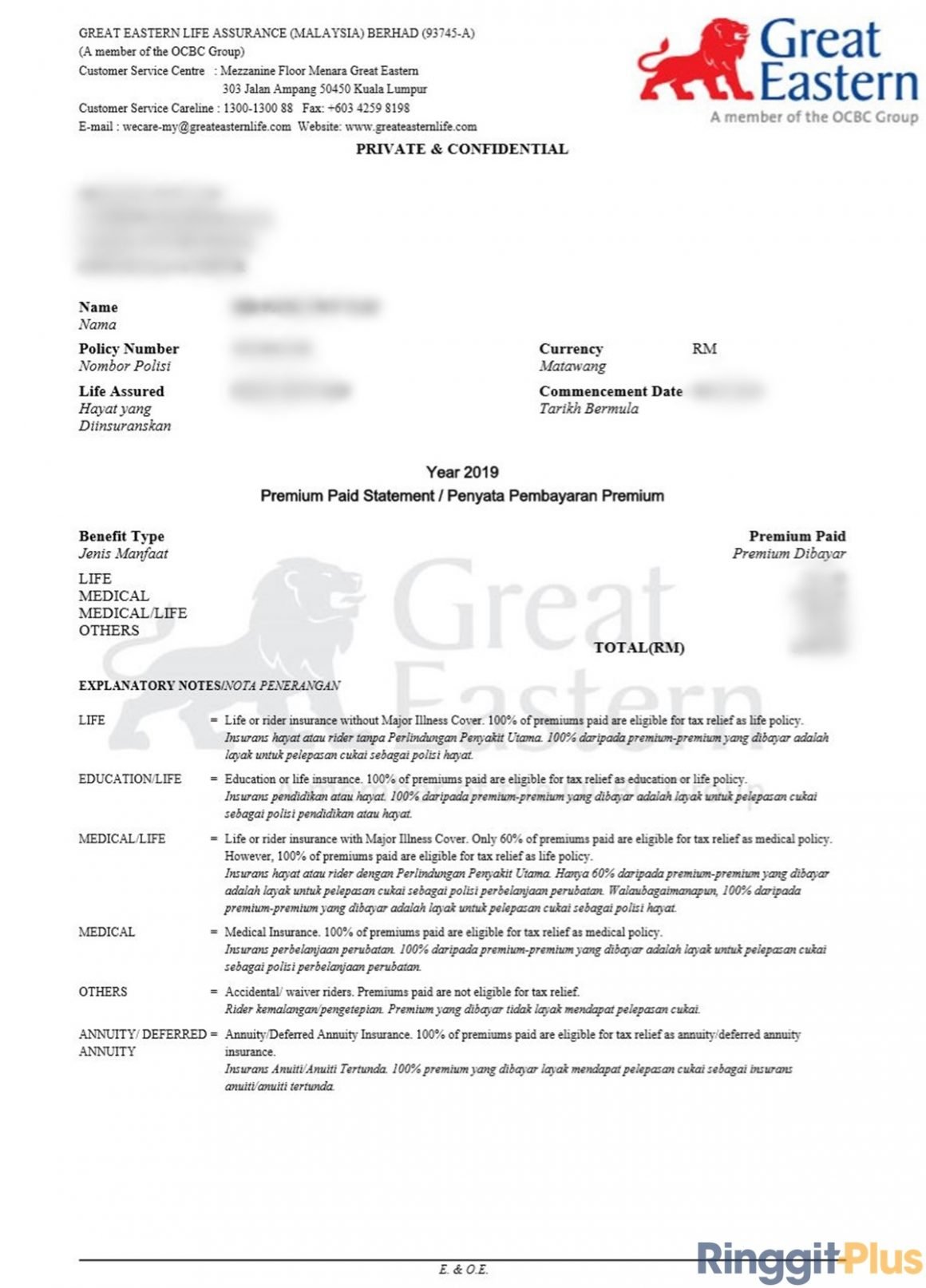

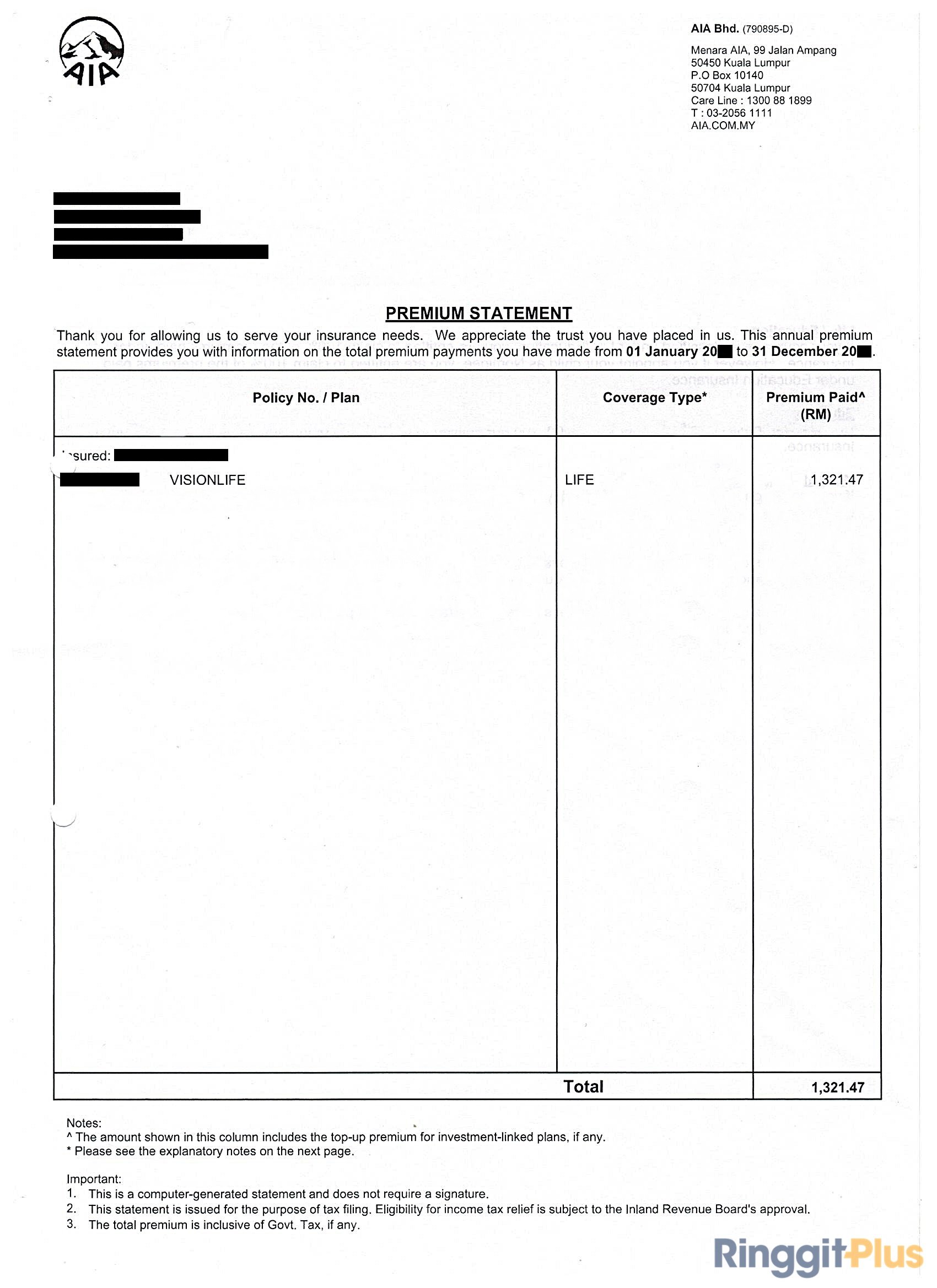

Aia group limited (the “company”) and its subsidiaries (the “group”) set out on pages 5 to 91, which comprises: You can now retrieve your premium / contribution statements for your income tax submission via my aia. Among the options for the chancellor are to scrap the planned 5p increase in fuel duty at a cost of £2bn next year, cutting the basic rate of income tax by 1p or.

Tax notices will display total premiums paid during the 2022/23 financial year together with the. Register and/or login to your my aia account upon logging in, click on my statements.

There are now 7.5 million borrowers enrolled in the save plan, of whom 4.3 million have a $0 payment. We are pleased to confirm that income protection (ip) tax notices for the 2021/22 financial year will soon. Unaudited condensed income statement 6 months period ended 30 june 2020 note 6 months period ended 30.06.2020 rm’000 gross earned.

Tax guide 2022/23 aia.com.au tax treatment of insurance cover the information in this guide is a general summary of the tax issues associated with various types of insurance. Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of. Income protection tax notices for 2021/2022.

Got a question before or after you've bought an insurance plan? Tata aia income tax calculator for taxpayers in india, income tax calculation* and the process of filing taxes forms an important part of financial planning. This year, the process of filing an income tax and benefit return may feel particularly daunting.

For state and federal income tax purposes, payments to aia and its components are generally deductible as trade or business expenses—except. This annual statement issued by aia is in accordance to the income tax regulations 2010 in singapore. Us$(19)m) 82 foreign currency translation adjustments (1,477) cash flow hedges (1).

Ais is a comprehensive statement containing. If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Tax deductible dues statement.