Awe-Inspiring Examples Of Info About Financial Reports For Small Business

Newly released federal trade commission data show that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached that benchmark.

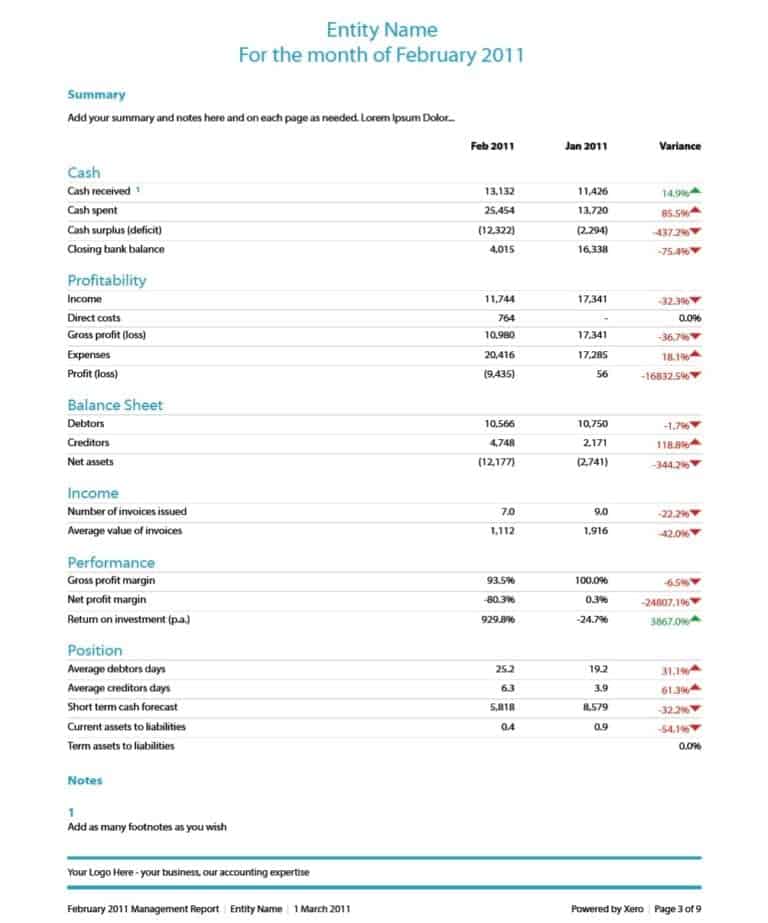

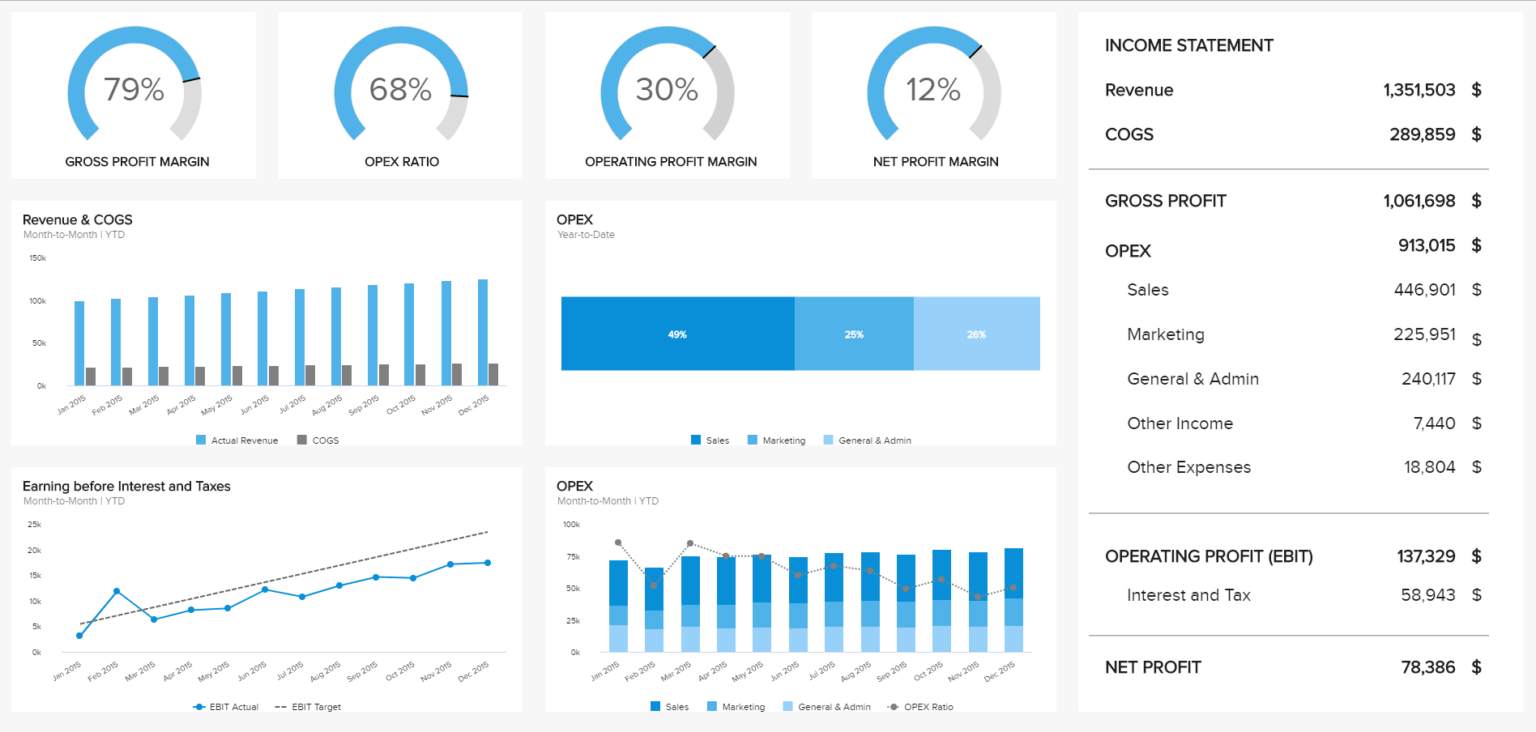

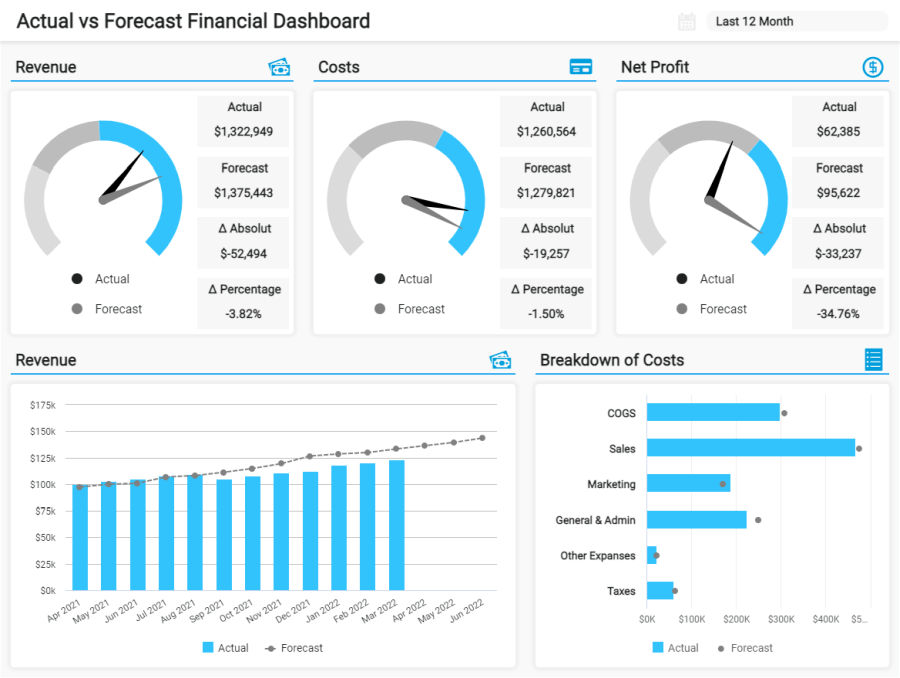

Financial reports for small business. With the help of interactive kpis, businesses can ensure steady growth and revenue while staying compliant with law and tax regulations. Then, enter your operating, payroll, and office expenses to determine your total expenses. An overwhelming 80% of those accessing credit expressed.

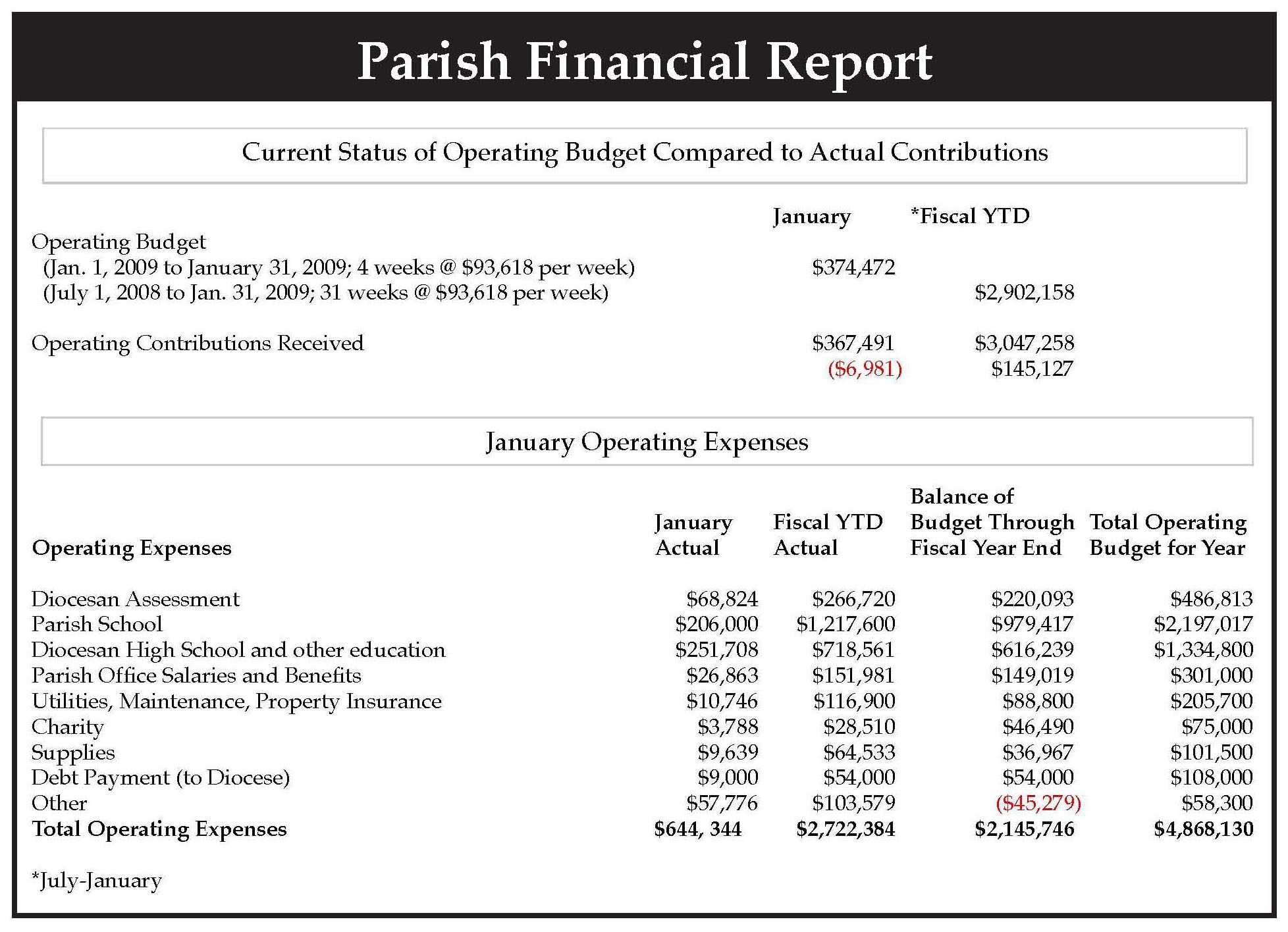

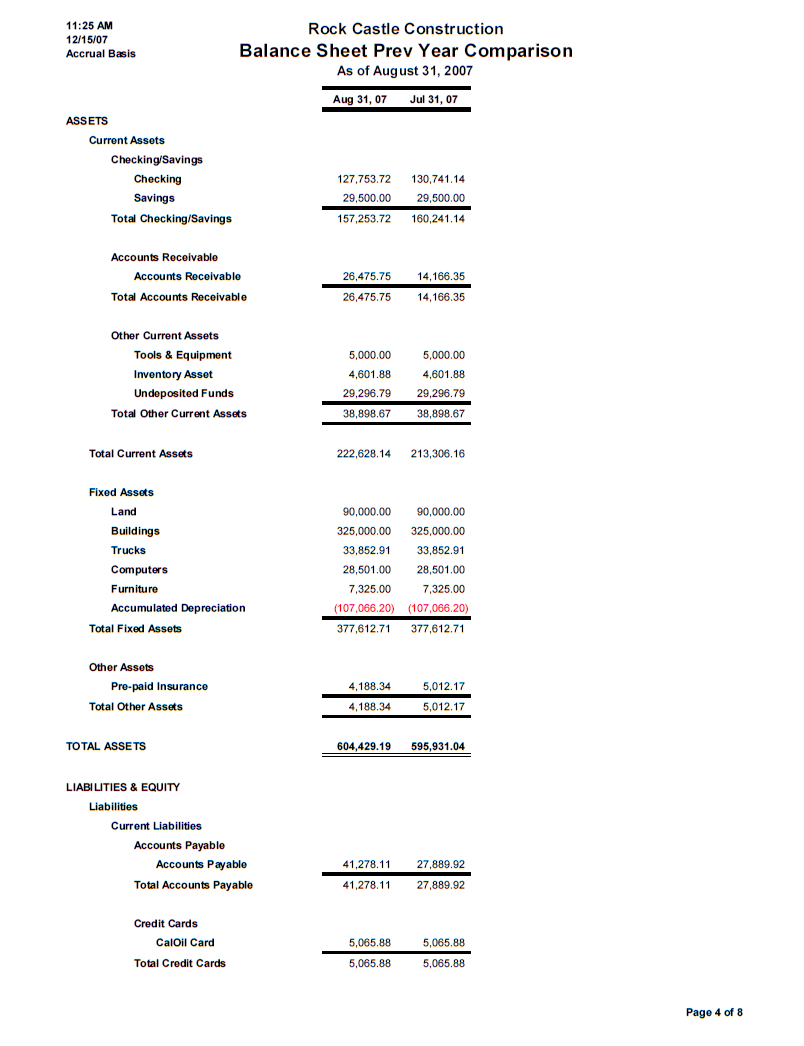

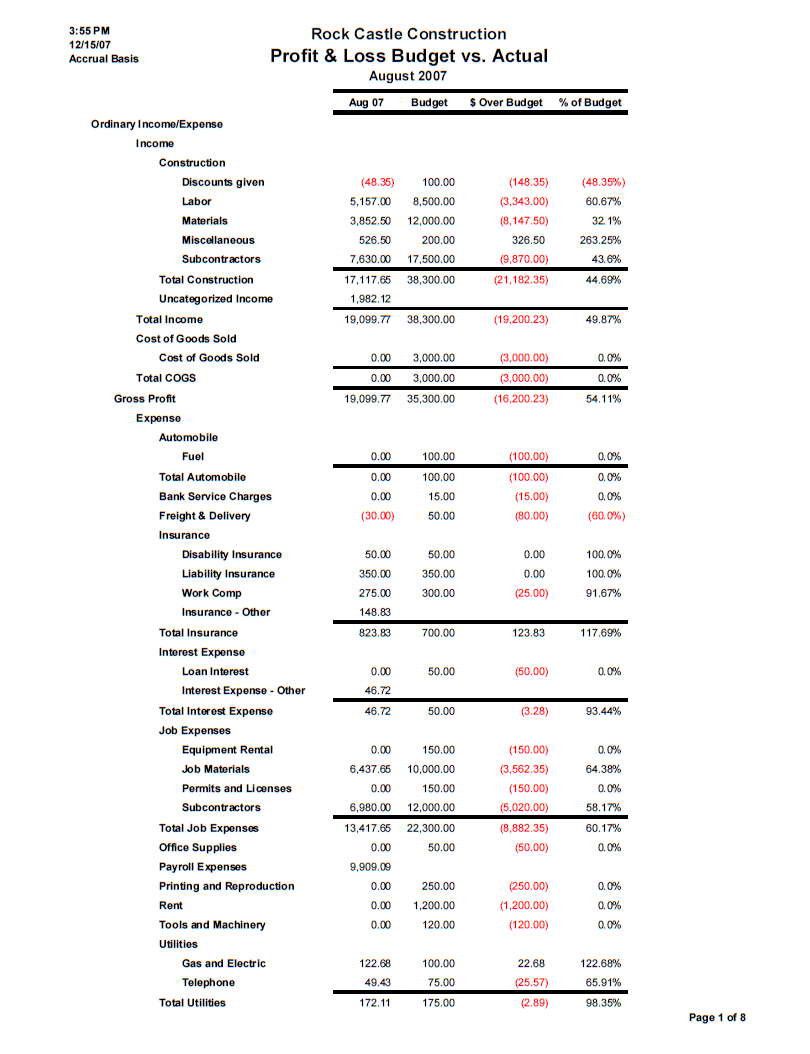

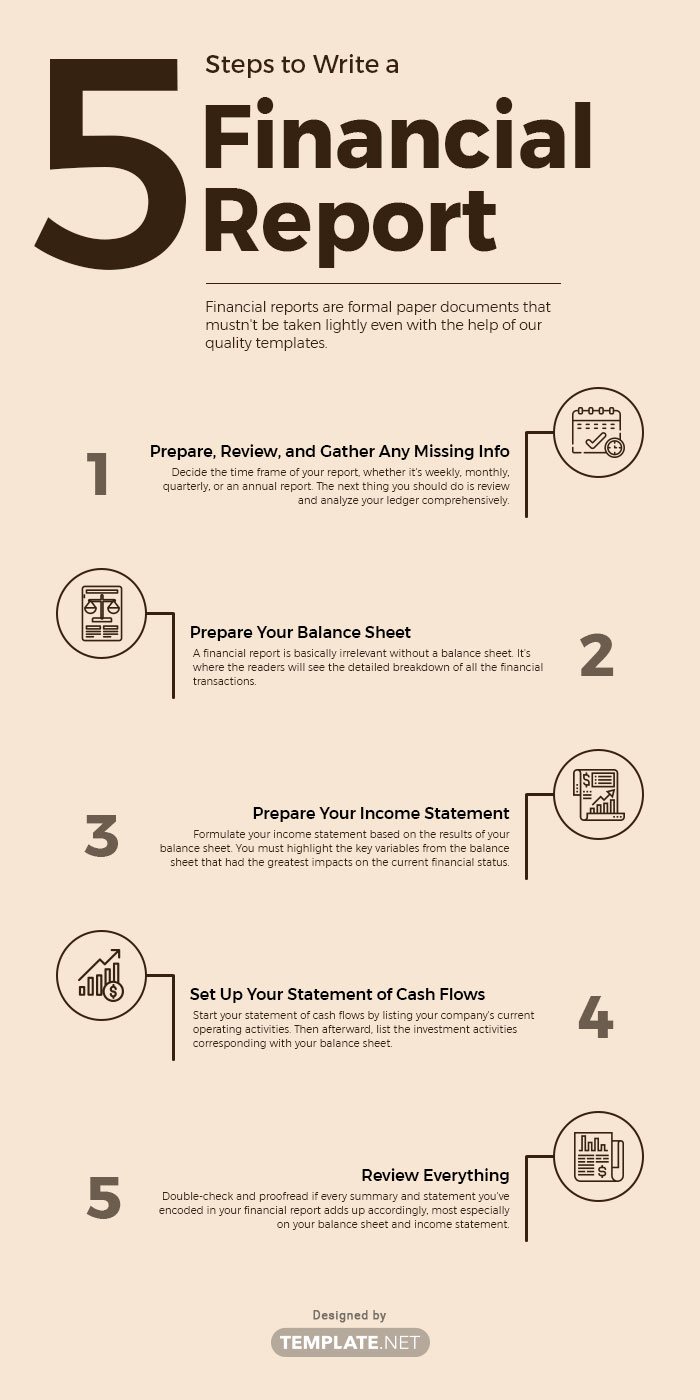

Use profit margin to make changes, so that you can maintain a higher level of profit as your. Canva modern cover annual report 9. The 3 most important monthly financial reports for small business owners looking to get a better understanding of their business are the balance sheet, income statement, and cash flow statement.

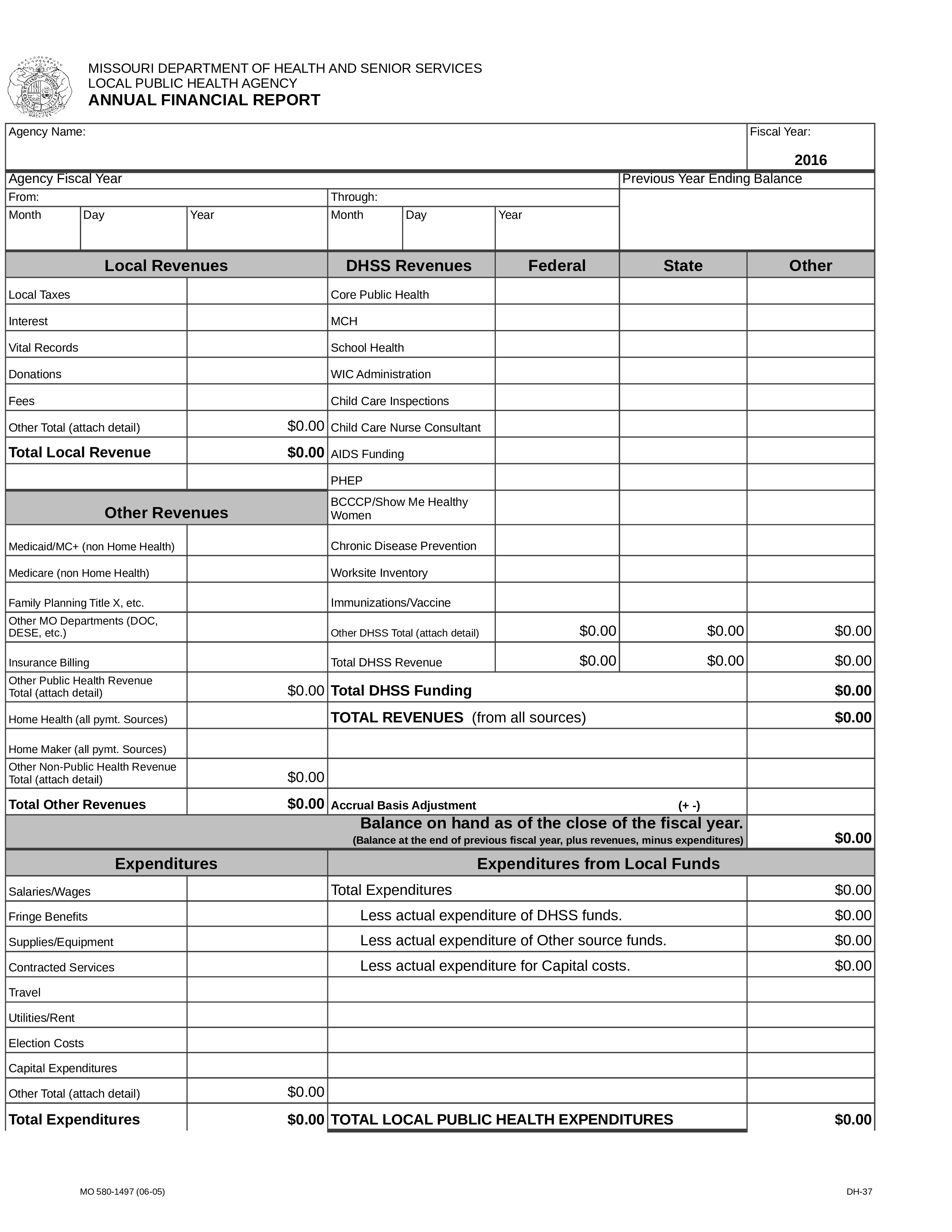

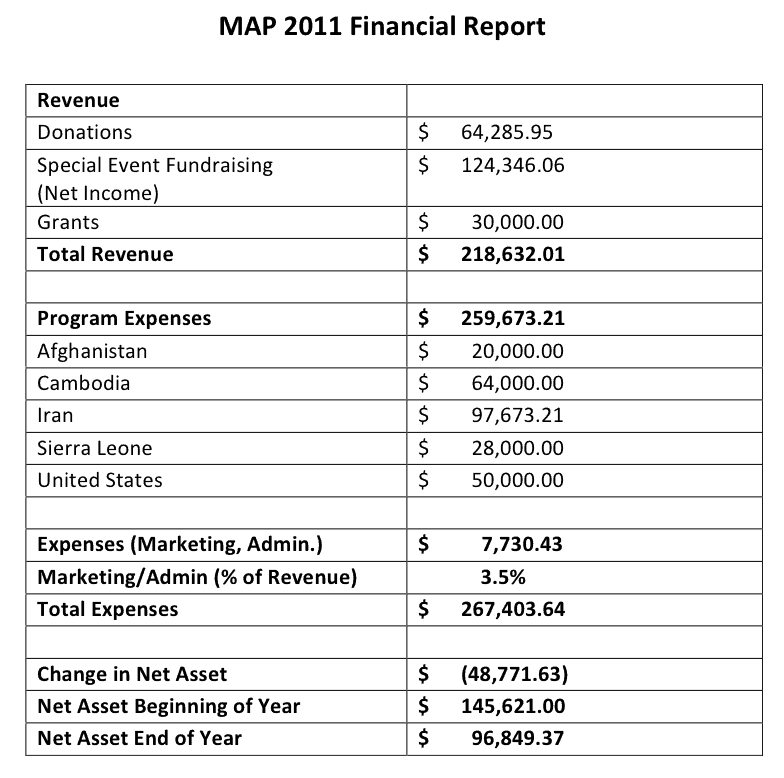

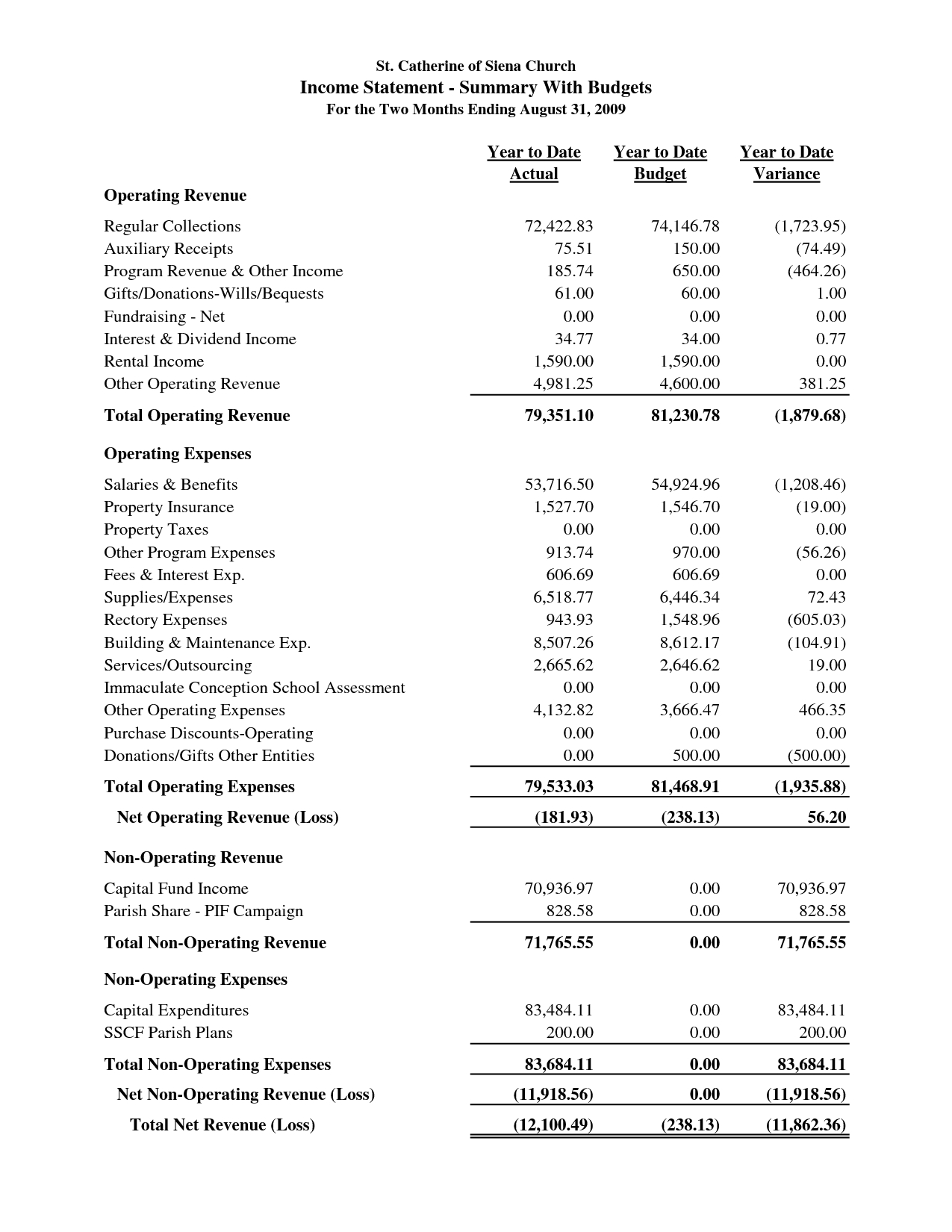

Annual report template by envato. The report is based on responses from nearly 500 small businesses with working capital loans and over 3 million small business applications for working capital financing during the past 18 months. Financial reports, such as income/profit and loss statements, balance sheets, cash flow statements, and accounts payable/receivable aging reports, are essential for small businesses to track and manage their financial health.

Enter the number of customers and the average sale per customer to determine your total monthly sales. Use this monthly small business income statement template to track and manage your small business finances. However, many new business owners feel overwhelmed by the breadth of financial reporting available to them.

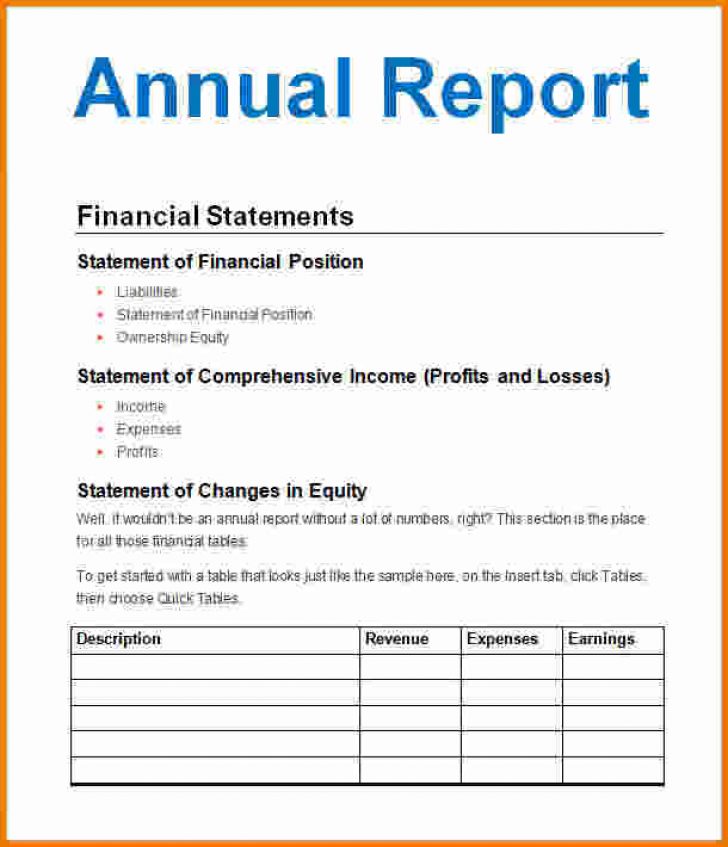

Financial statements provide a formal record of an organization’s financial activity, its current financial status and an idea of how well it may (or, may not) perform in the future. This marks a 14% increase over reported losses in 2022. Financial statements can help to show business activity and financial performance.

There are more specific reports looking at itemised areas of the business such as sales or inventory, but we’ll focus on the big three. Cash flow is the heartbeat of your business. Small businesses may also put out an annual report that includes financial statements and more detailed information about their year, including key business goals and achievements.

Financial reporting is the formal recording of the financial activities of your business into accounting reports. With all your financial information in one place, you can immediately access your financial data whenever you or your accountant needs it. It’s a time to review performance, assess financial.

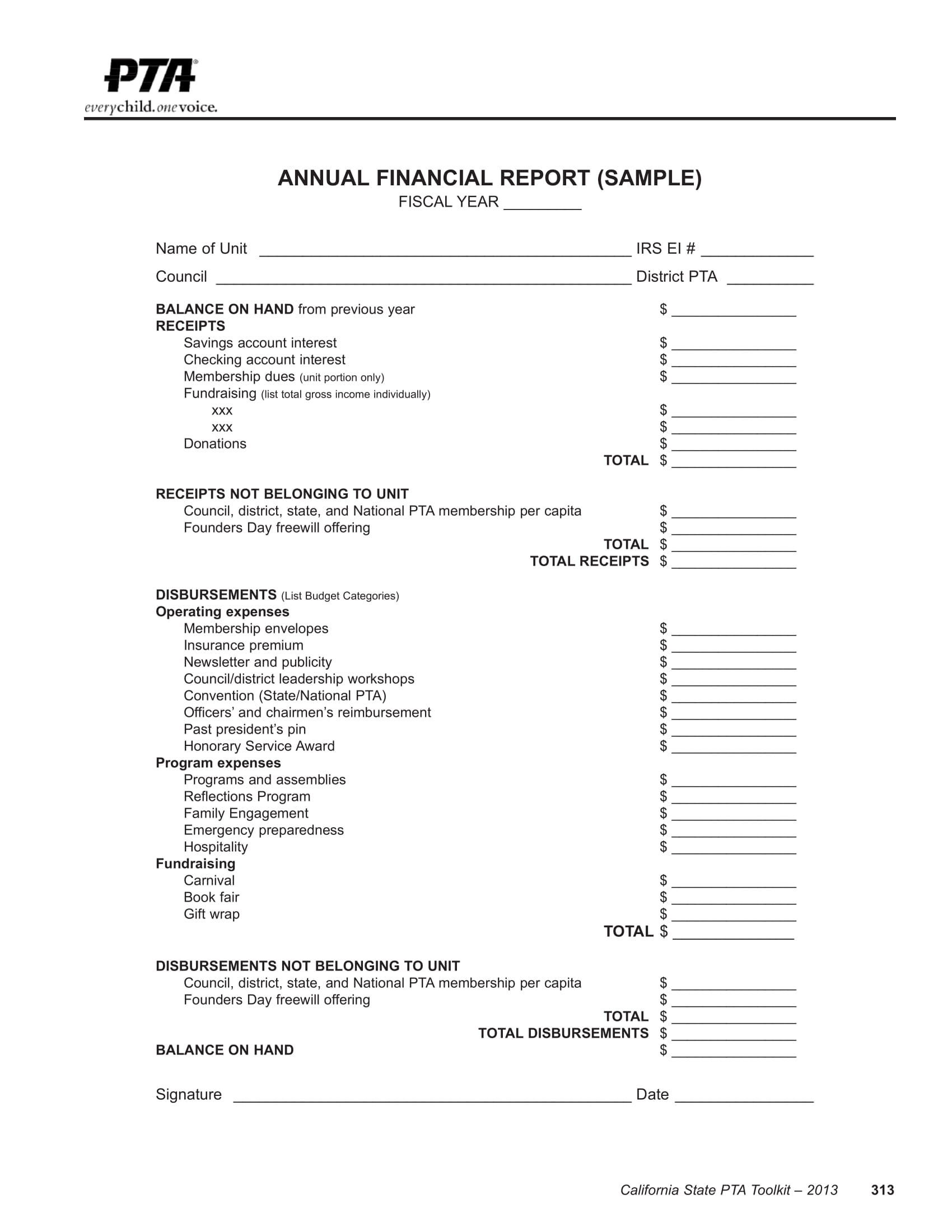

The next year, you post a $51,200 profit on $640,000 in sales. For small businesses, financial reporting always includes the balance sheet, income statement (also called the profit and loss statement) and the cash flow statement. How to create and compile an annual report for your small business.

The 7 most important financial reports for small businesses. Remember, adaptability is a must in budget management, as business conditions are rarely static. We are committed to sharing unbiased reviews.

Out of the reports we asked them to vote on, cash flow statements, balance sheets, and income statements received the most support. A guide to the top three financial reports for small businesses | entrepreneur leadership thought leaders a guide to the top three financial reports for small businesses. Correct records form the backbone of trustworthy financial statements.