Divine Tips About Total Expenses Income Statement

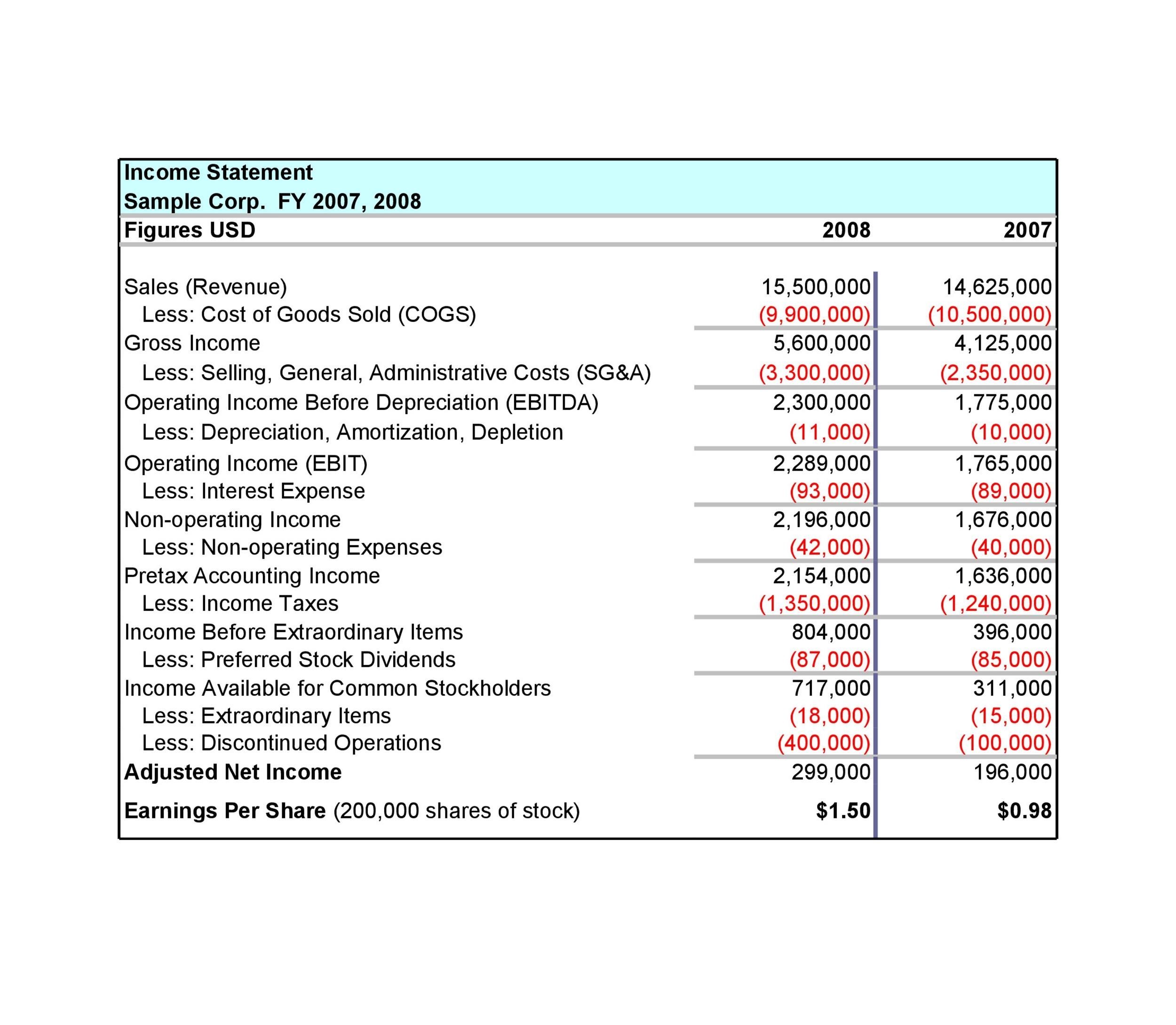

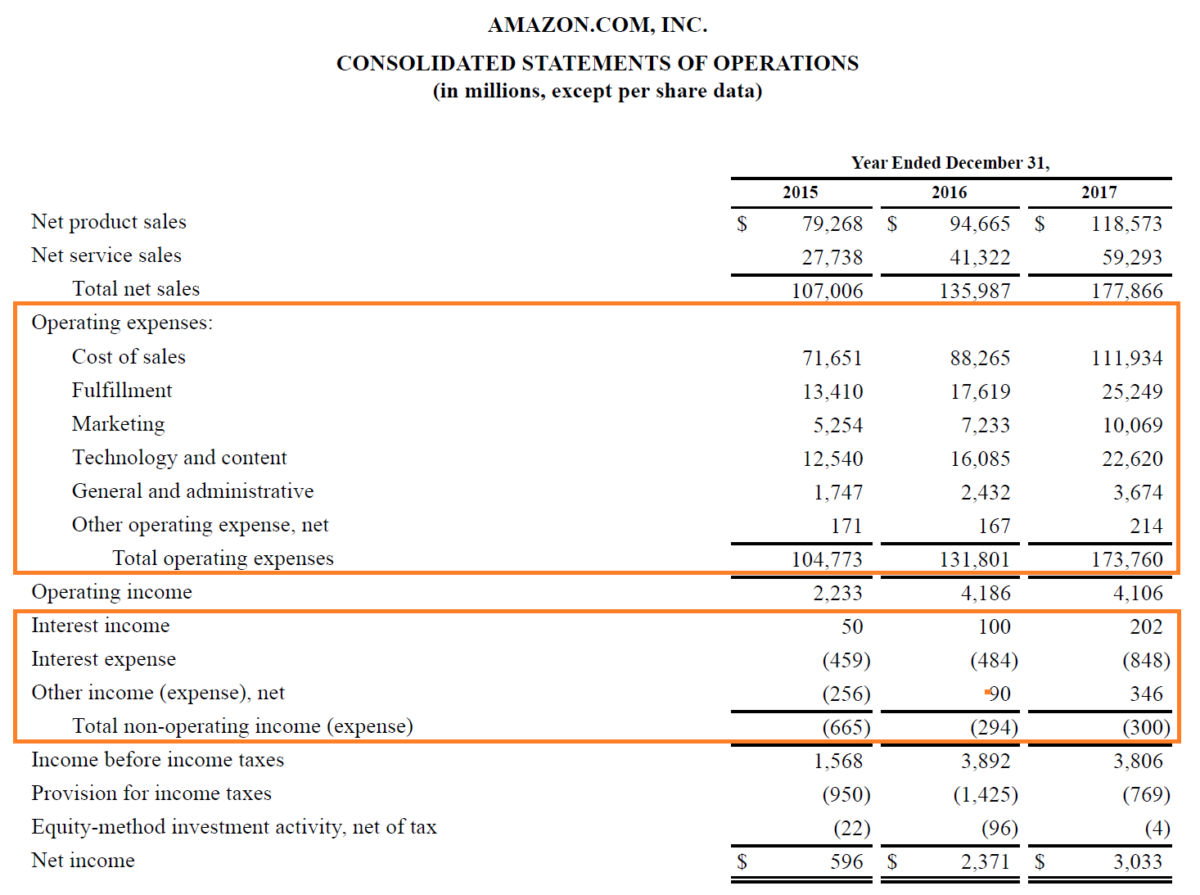

It is the top line of the income statement as compared with the bottom line, which is net income or net profit.

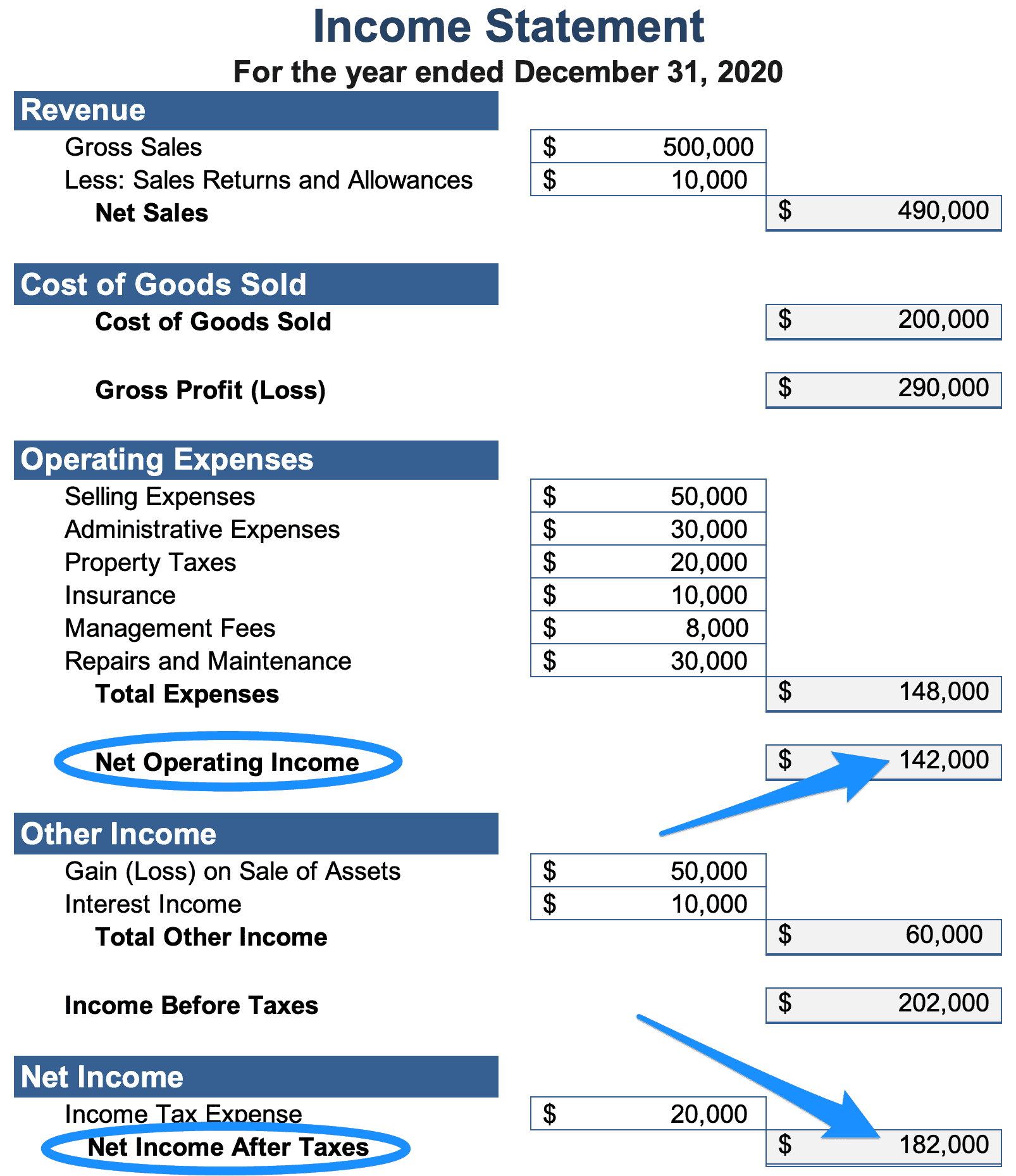

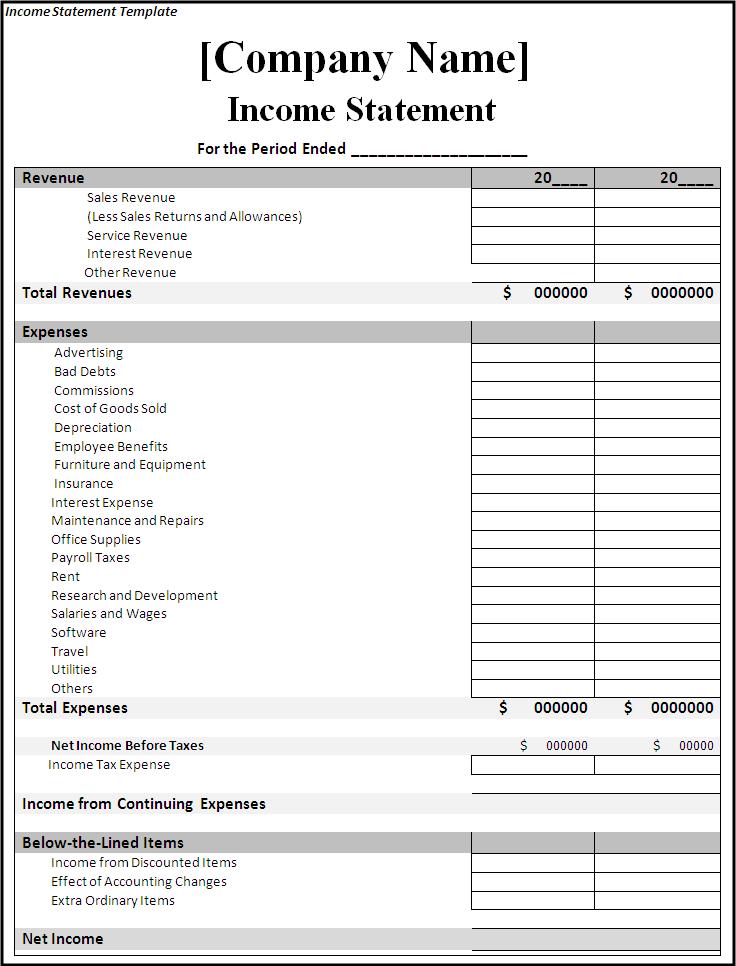

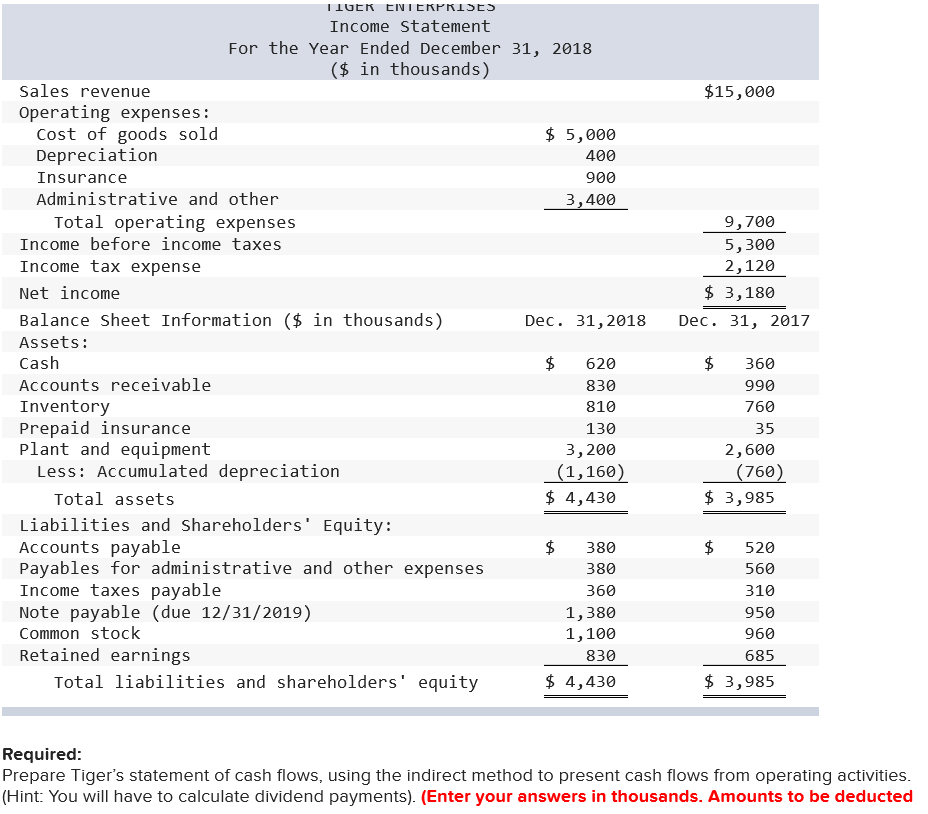

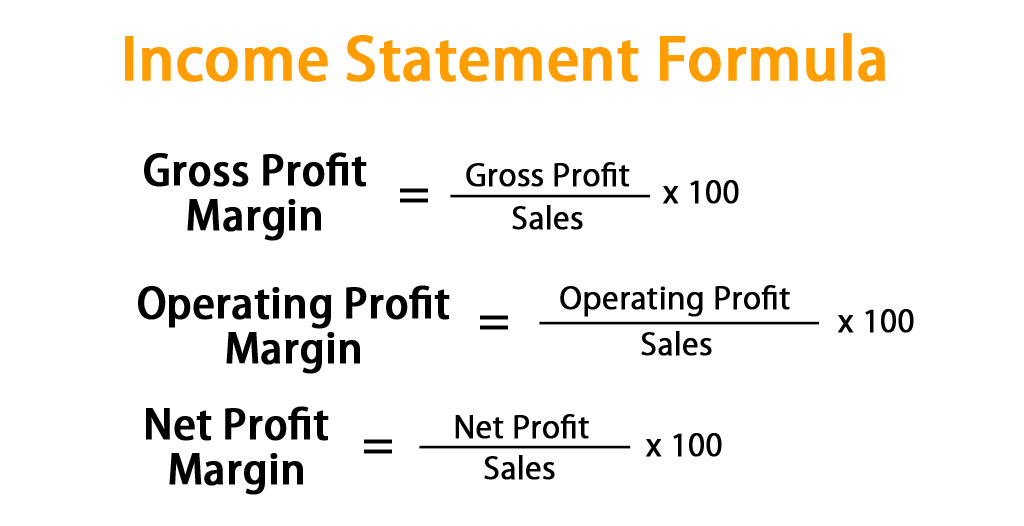

Total expenses income statement. Gross income represents the total income from all sources, including returns, discounts, and allowances, before deducting any expenses or taxes. The income statement primarily focuses on a company's revenues and expenses during a particular period. This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues.

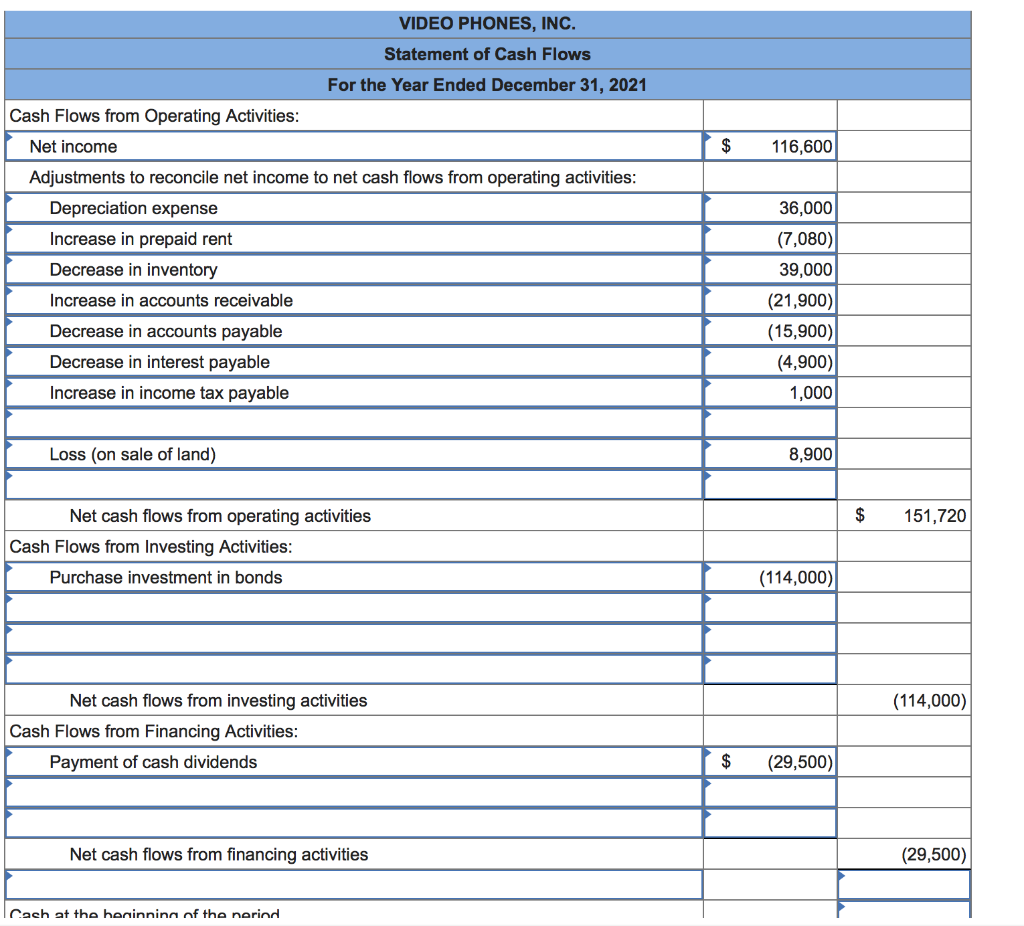

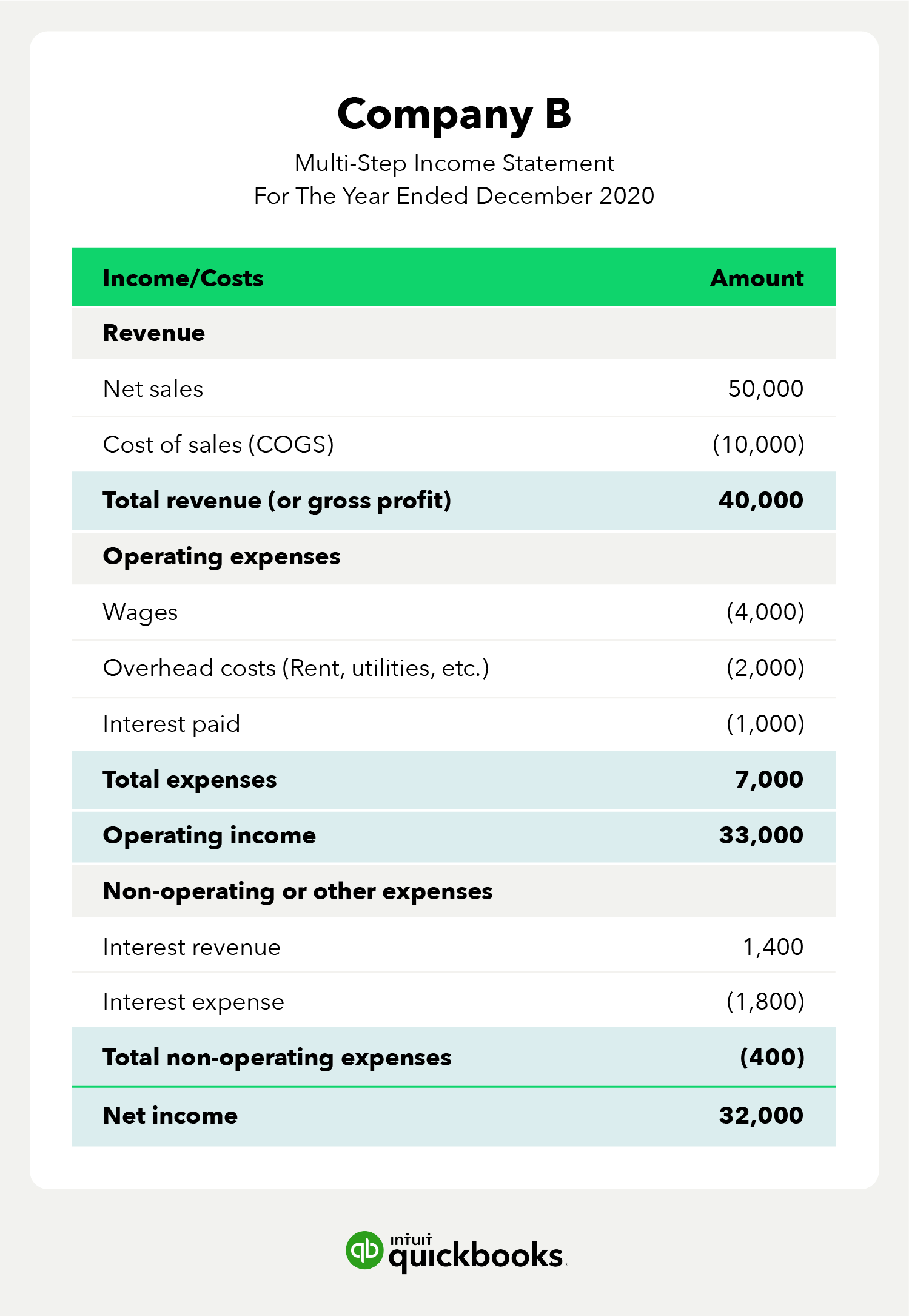

It adds up your total revenue then subtracts your total expenses to get your net income. The formula above is helpful for reverse engineering a company's total expenses. How much money a business took in during a reporting period expenses:

The income statement calculator streamlines this calculation by allowing users to input the values for revenue, cogs, operating expenses, other income, and other expenses, and then automatically calculates the net income. How much money a business spent during a reporting period costs of goods sold (cogs): The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss.

An income statement reports a business’s revenues, expenses, and overall profit or loss for a specific time period. Sales start at the top, expenses and other costs are subtracted as you go down the column and the bottom line tells you how much money your practice earned or lost at the end of the reporting period. An income statement typically includes the following information:

The income statement can also help you make decisions about your spending and overall management of business operations. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. For printing plus, the following is its january 2019 income statement.

Net income can be positive or negative. The income statement serves as a tool to understand the profitability of your business. When preparing an income statement, revenues will always come before expenses in the presentation.

Deduct the operational expenses from your. How to create a formula for income or expenses in excel First, we need a formula to calculate total expenses if we know total revenues and net income.

Revenue is the total amount of money an entity earns from a variety of sources. The income statement is an essential part of the financial statements that an. This is the value of all the expenses incurred by the company during the specified accounting period.

The layout of an income statement is simple to follow. Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement.

Formula and what it tells you Sales on credit) or cash. Remember that an income statement records the total activity of the business’ operations throughout a certain period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)