Smart Info About Treatment Of Bad Debt Written Off In Cash Flow Statement

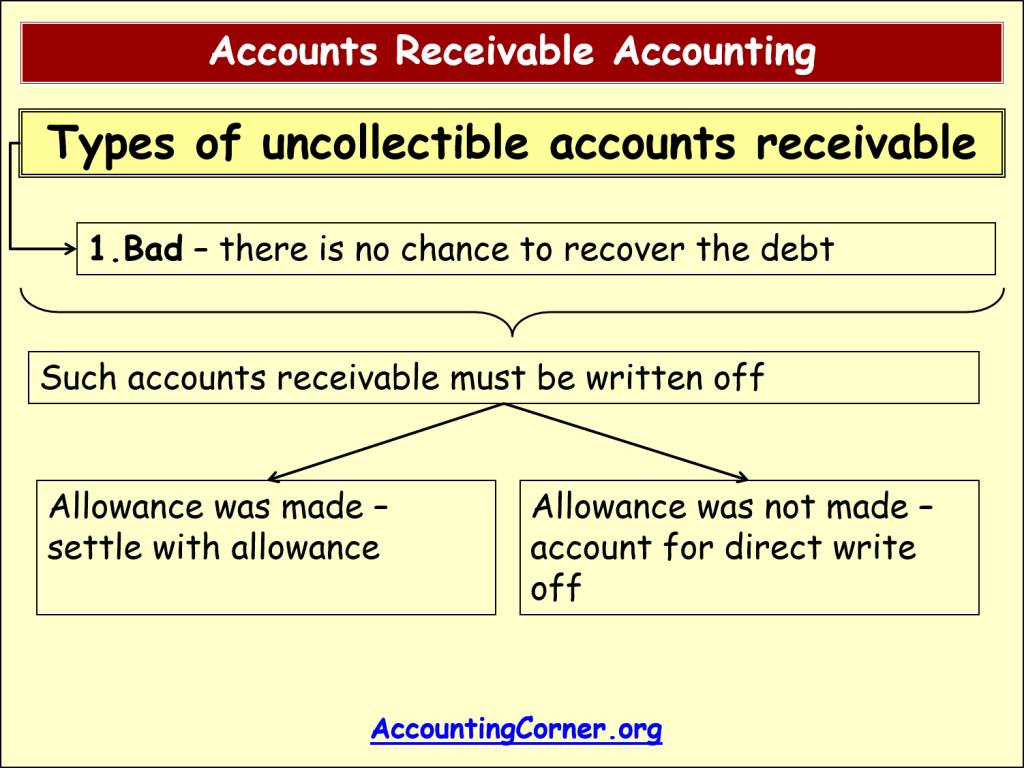

Debt that cannot be recovered or collected from a debtor is bad debt.

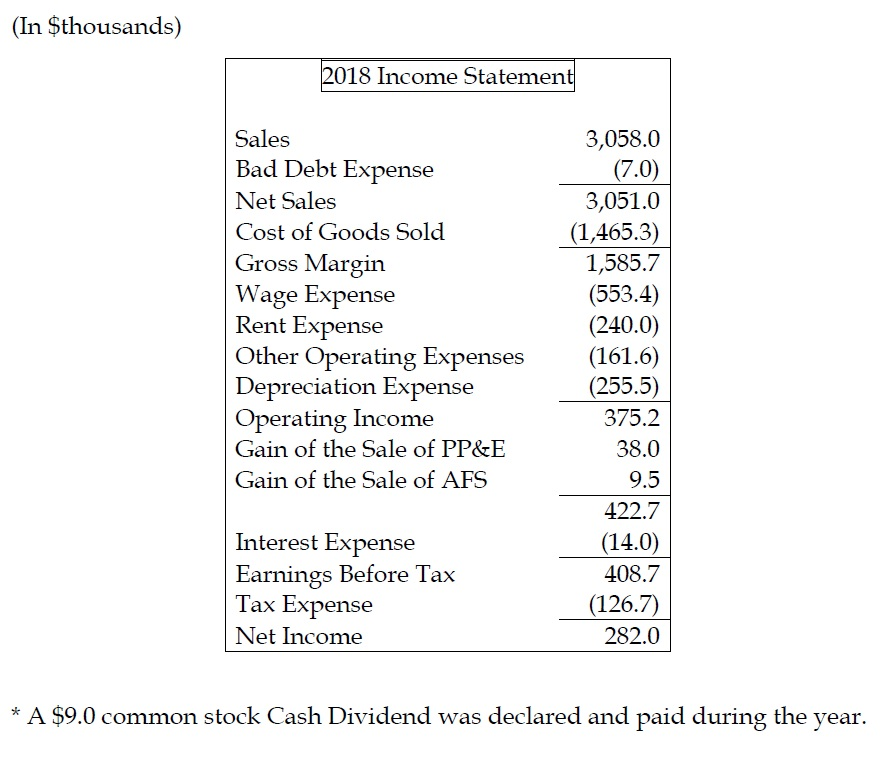

Treatment of bad debt written off in cash flow statement. ( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000. However, bad debts and/or changes in the allowance for doubtful accounts are an example of accounts receivable reducing in a. The treatment of the bad debts provision in the reconciliation of net income and cash flows from operations under the indirect method is particularly troublesome.

Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as. Direct impact of bad debt under operating activities on the cash flow statement, the first line is net income,. The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense account.

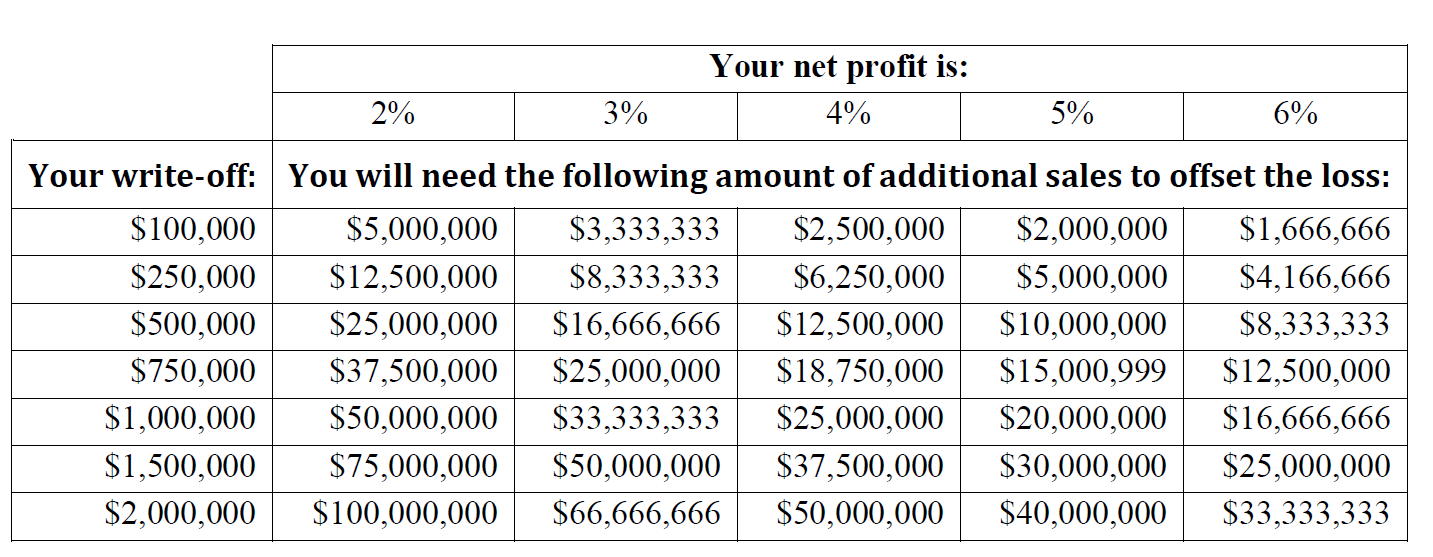

Such an estimate is called a bad debt allowance, a bad debt reserve,. The bad debt provision isn't an issue with the direct method. While a bad debt minimizes the cash that could flow to the business, there are very few ways that anything classified as a bad debt could influence the cash flow statement.

The problem i have is, if we incorporate bad and doubtful debts into the receivables balance, then compare receivables with the prior year, we will be misled into. Under the provision or allowance method of accounting, businesses. First, the entry to write off the debt as shown in section 2 must be reversed as follows:

Bad debt recovery refers to a payment received for a debt that had previously been written off and considered. Because, you know, cash is king. Hi katrien, that's kind of a trick question.

Depreciation, amortization, impairment losses, bad debts written off, etc). Treatment of bad debts written off in cash flow statement? The first approach tends to delay recognition of the bad debt expense.

And this, in turn, is subtracted from the balance sheet current assets category accounts. Elimination of non cash expenses (e.g. Removal of expenses to be classified.

To record bad debts in the account books, firms must initially estimate their potential losses. This will reduce the receivables. A bad debt can be written off using either the direct write off method or the provision method.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)