Divine Tips About Examples Of Extraordinary Items In Cash Flow Statement

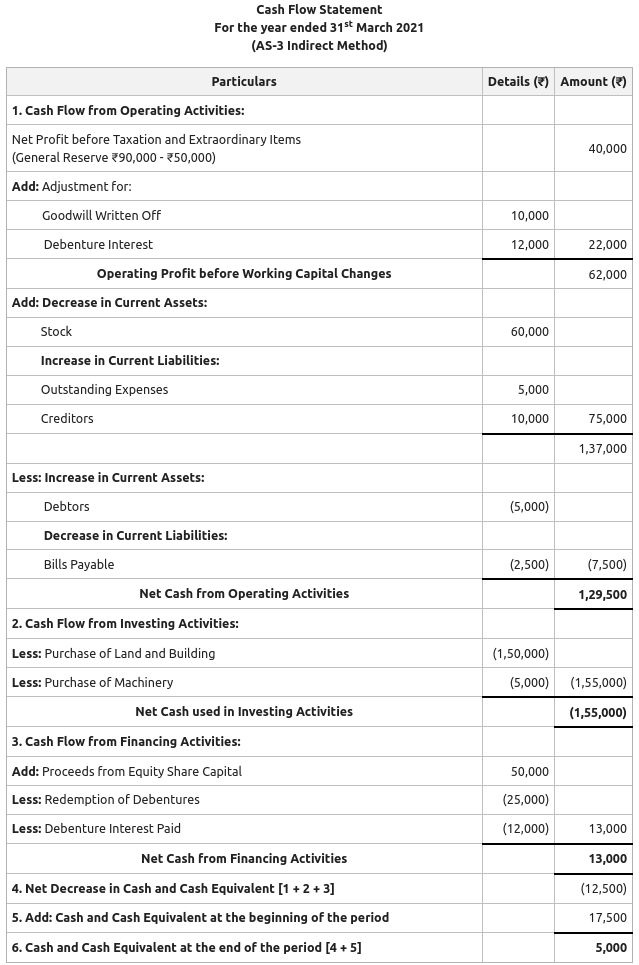

Cash flow from operating activities:

Examples of extraordinary items in cash flow statement. Losses experienced by the business organization due to natural hazards or natural calamities like earthquakes or floods etc. Examples of extraordinary items are losses from various catastrophic events, such as earthquakes, tsunamis, and wildfires. Extraordinary items are events and transactions that are distinguished by their unusual nature and by the infrequency of their occurrence.

Cash flows from dividends and interest received and paid must be separately disclosed. For example, a royalty of $10,000 earned by a street vendor for selling his recipe to a restaurant chain will be classified as an extraordinary gain as it is a substantial amount relative to his/her annual profit. Extraordinary items in accounting are income statement events that are both unusual and infrequent.

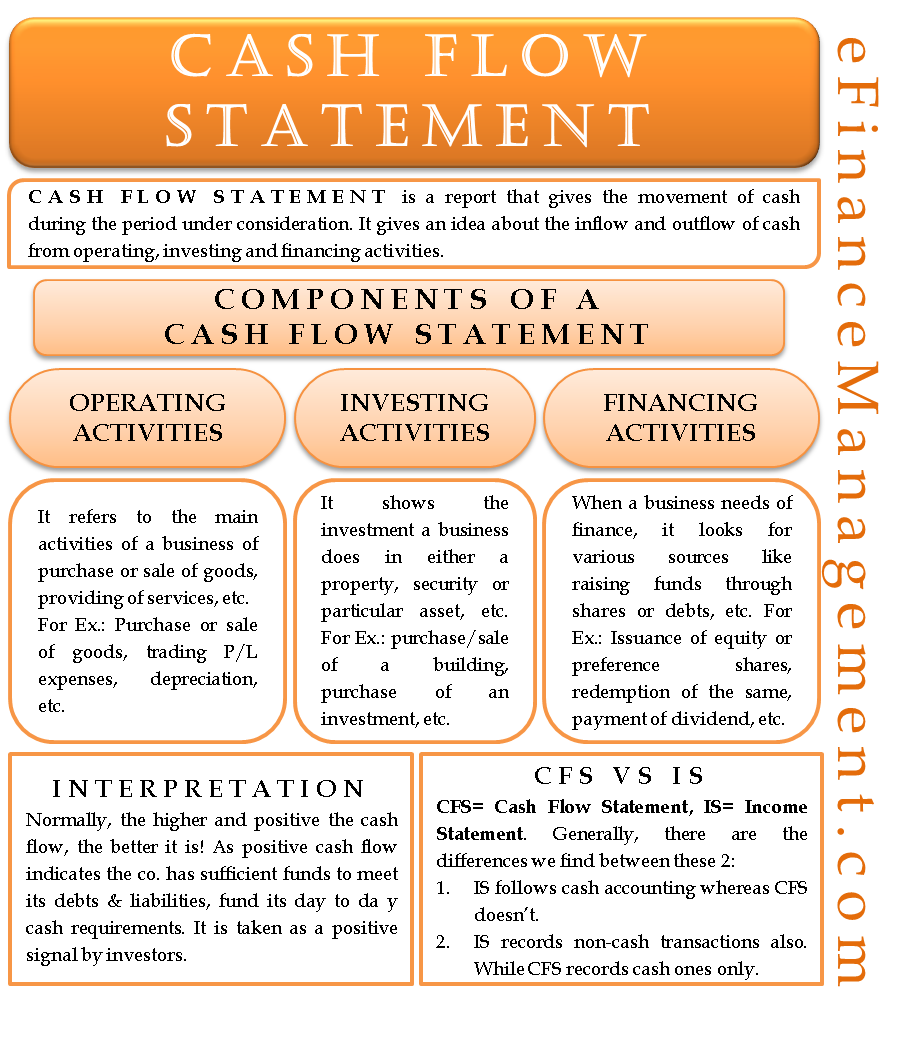

The income statement extraordinary items refer to gains and losses from specific business transactions, which are unusual and rare from the normal course of business. Operating activities are the operations of a company directly associated with furnishing its commodities and services to the marketplace. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

In the cash flow statement, the proposed dividend of the previous year is added back to determine net profit tax and extraordinary items. What is the statement of cash flows? It is important to mention here that a transaction may include cash flows

Two examples include year ended december 31, 2022 and three months ended september 30, 2022. Extraordinary items in accounting are referred to as any kind of abnormal loss or gain that is not generated from the regular business operations. While designating and estimating the effect from certain.

(ias 1.87) the amount of each of these gains or losses, net of the income. The cash flows related to the extraordinary items must be categorized as arising from operating, financing or investing activities as apt and disclosed distinctly. Company accounts and analysis of financial statements cash outflows from financing activities l cash repayments of amounts borrowed.

If information of unpaid dividend (dividend payable) is given. Gaap guidebook the income statement examples of extraordinary items examples of items that could be classified as extraordinary were the destruction of facilities by an earthquake or the destruction of a vineyard by a hailstorm in a region where hailstorm damage was rare. Extraordinary cash flow means the cash receipts of the company from a major capital event as reduced by (a) the costs and expenses incurred by the company in connection with such major capital event, including title, survey, appraisal, recording, escrow, transfer tax and similar costs, brokerage expense and attorneys, and.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Extraordinary items, dividends & interests. The accounting for extraordinary items are done separately in the financial statements of the business entity.

Although the presentation of operating cash flows differs between the two methods,. The same amount is deducted as an outflow in financial activity. They also are not predictable or occur on regular basis.

The cfs highlights a company's cash management, including how well it generates cash. Examples of extraordinary items. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)