Stunning Tips About Financial Risk Ratios

There's an 85% chance the us economy will enter a recession in 2024, the economist david rosenberg says.

Financial risk ratios. Using financial ratios can also give you an idea of how much risk you might be taking on with a particular company, based on how well it manages its financial obligations. A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other. The working capital ratio is 2 ($8 million / $4 million).

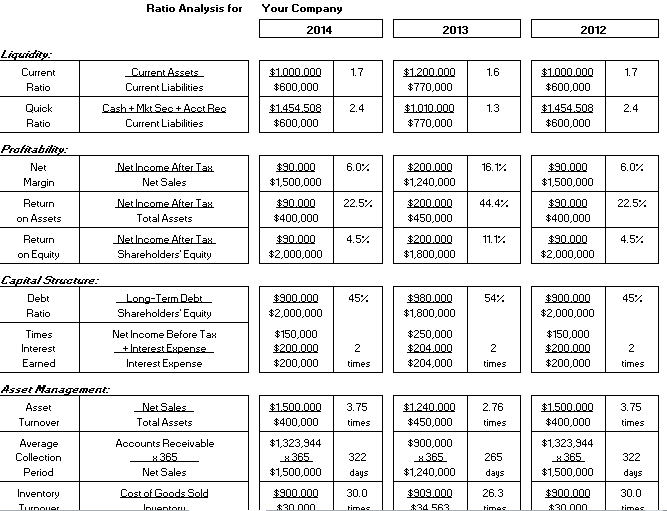

For instance, a tce/rwa ratio of 10 percent would have affected. To effectively measure business risk, it’s crucial to calculate some key financial ratios. Credit analysis is the process of evaluating the creditworthiness of a borrower using financial ratios and fundamental diligence (e.g.

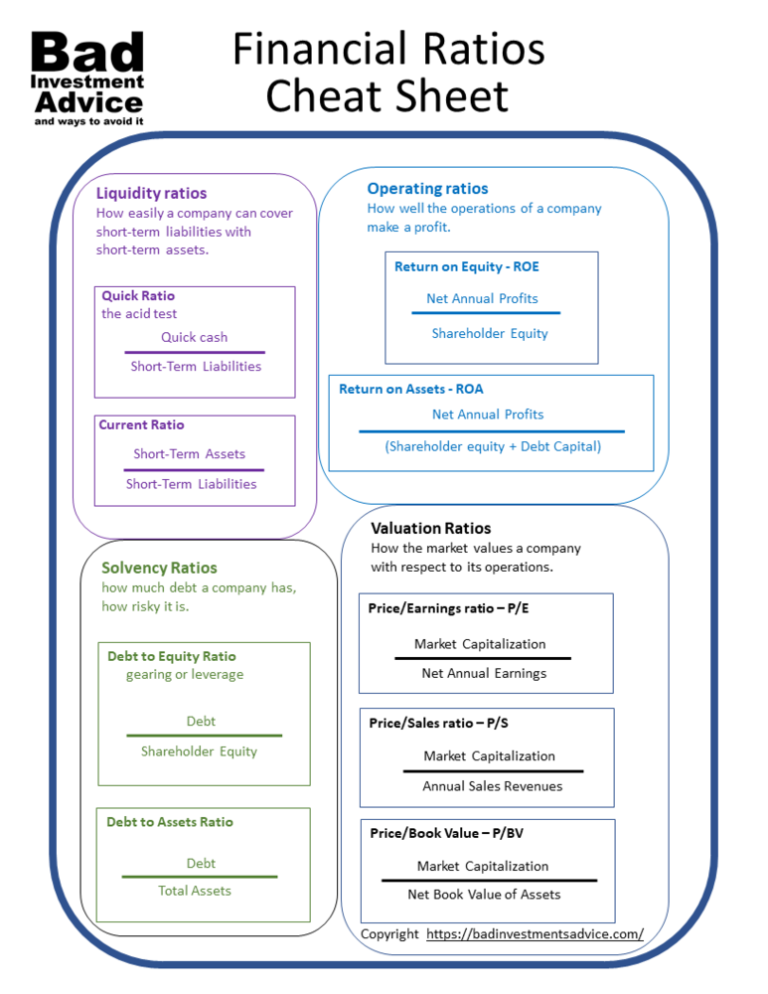

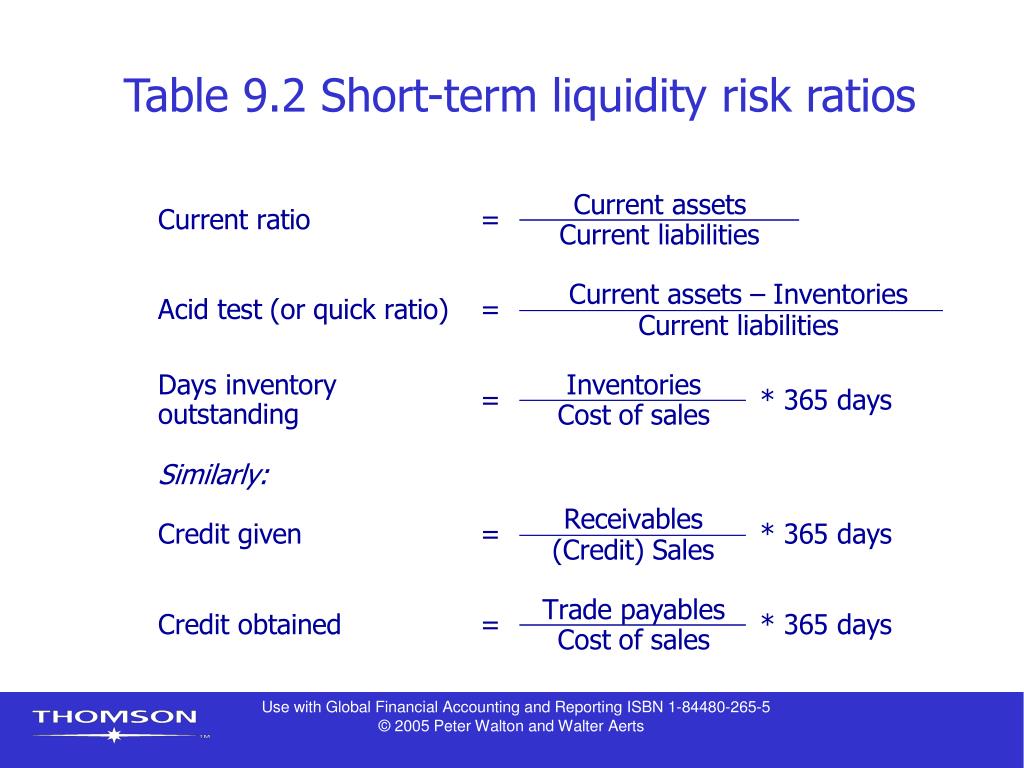

Which financial ratios are used to measure risk? Financial ratios are the indicators of the financial performance of companies. Solvency ratios measure financial risk.

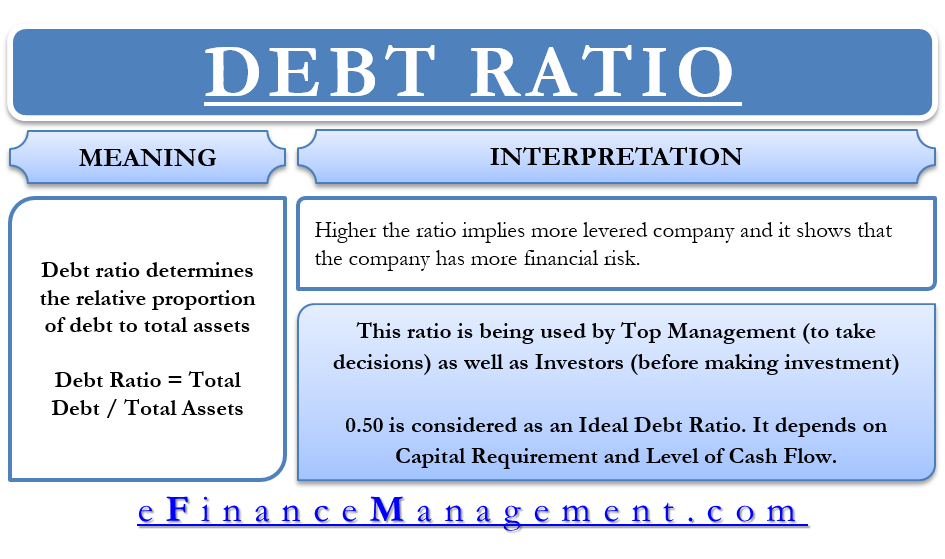

Understanding financial risks for businesses financial markets face financial risk due to various. These two factors are combined into an “anchor” score that can be notched up or down by a set of modifier factors, including liquidity, financial policy, diversification, comparable rating analysis and quality of management. This ratio shows that most of the assets are financed by debt when the ratio is greater than 1.0.

These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. Analysis of financial ratios serves two. The contribution margin is calculated as sales minus variable costs.

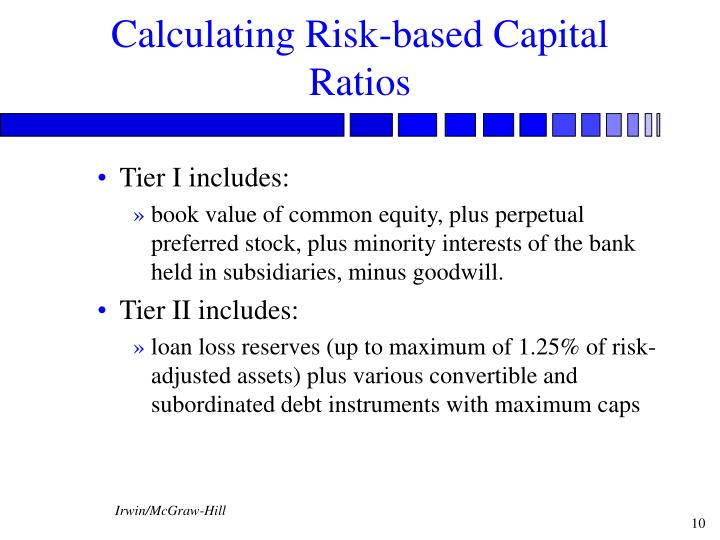

Uses and users of financial ratio analysis. Here is a list of some commonly used ratios that can help you measure your business and financial risk to better manage the health of your organization. Discover’s tier i risk based capital (13.2%) and leverage ratio (11.2%) are.

The final group of ratios are designed to help you measure the degree of financial risk that your business faces. But what if two similar companies each had ratios of 2? Financial ratios serve various purposes, including assessing a company's financial stability, profitability, efficiency, and market valuation.

You can use these ratios to select companies that align with your risk tolerance and desired return profile. Reducing the number of banks at risk through a higher capital base decreases the returns on equity (roe) for the industry (exhibit 2). What financial ratio measures risk?

Capital one is a level iii bank, which means that it is subject to annual supervisory capital stress tests. Last updated december 28, 2023 learn online now credit risk knowledge panel what is credit analysis? Financial ratios are instrumental in evaluating a company’s performance over time.

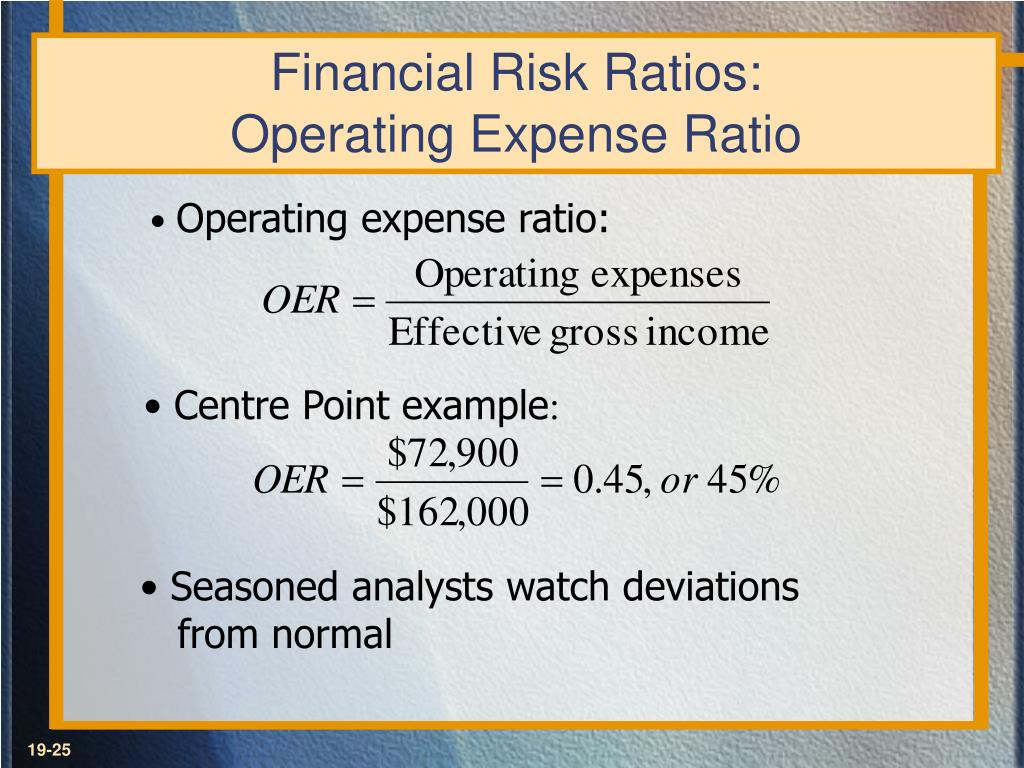

Types of ratio analysis the various kinds of financial ratios. The financial risk profile assessment is based on financial ratios covering cash flow/leverage analysis. There are four financial ratios that a business owner or financial manager can use to calculate the business risk facing a firm.

:max_bytes(150000):strip_icc()/TermDefinitions_FinancialRisk_4-3-8717bb0b3ebb43539b3a900b7eb74ca0.jpg)