Unique Info About View Form 26as Without Registration

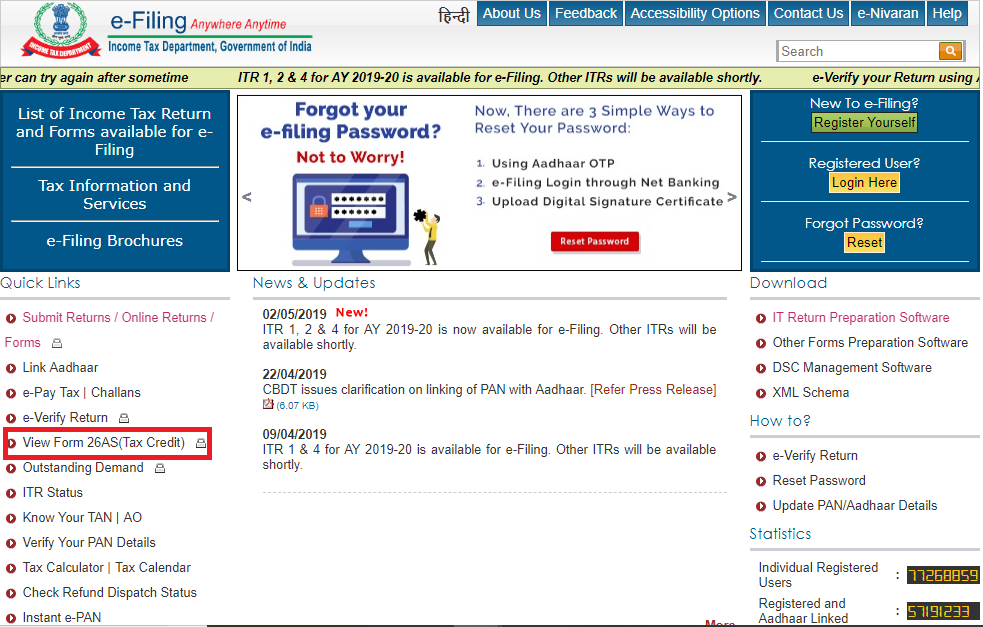

You can view tax credit statement (form 26as) without registering at nsdl through www.incometaxindiaefiling.gov.

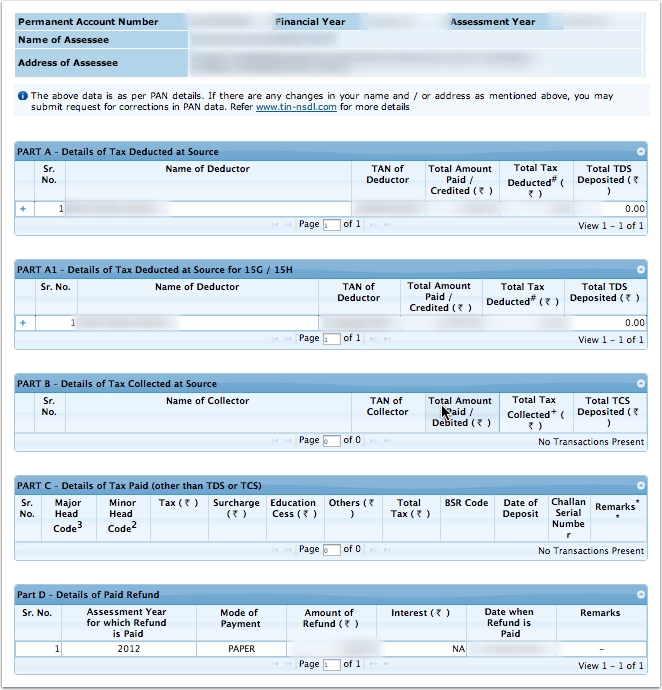

View form 26as without registration. Form 26as contains the following details: Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes. One can access form 26as from the income tax website by using their pan (permanent account number).

How to view form 26as? In.new facility added in “my account” for. You can download tds details in form 26as if you are registered on income tax website.

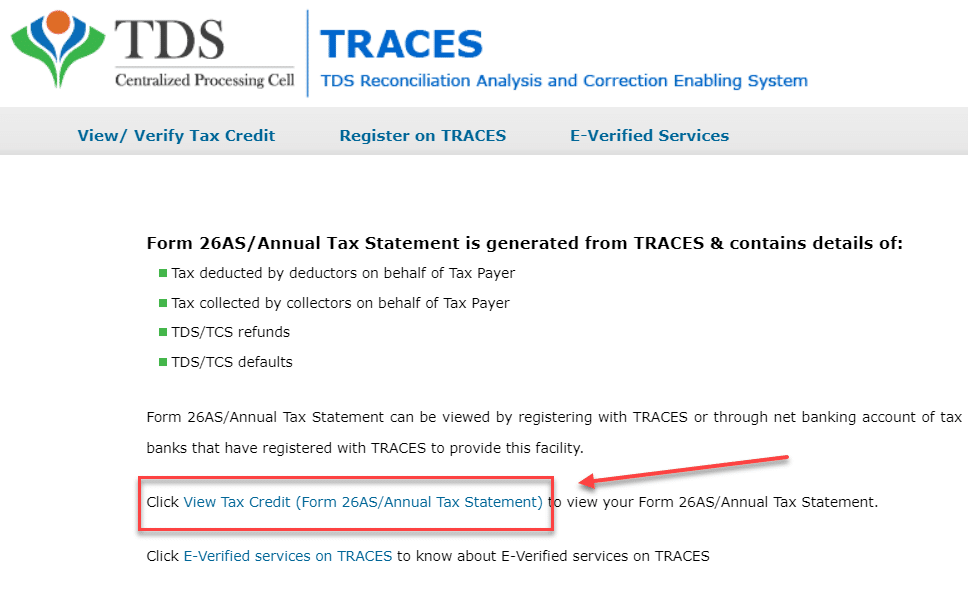

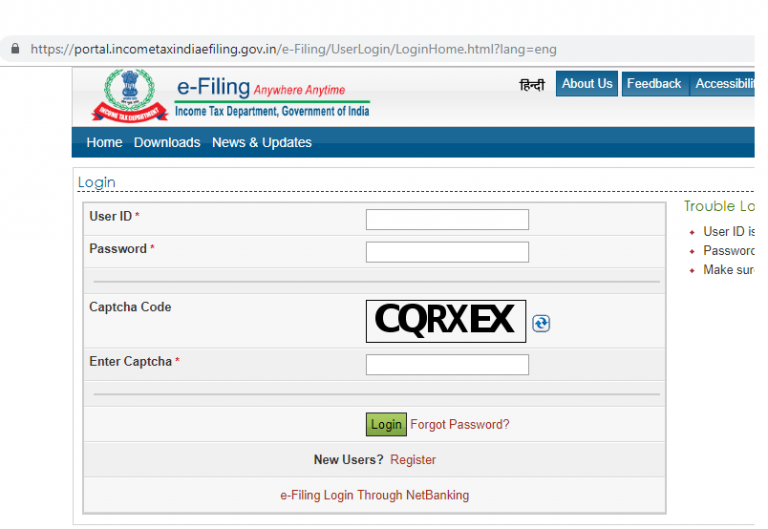

There are three ways to view and download form 26as. Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as. If you don’t have an account, you’ll need to register first (see the button on top of login).

Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit. Individuals have the option to view form 26as from the traces portal and can also download it as shown in the previous section. Form 26as can be downloaded:

How to view and download form 26as? The website provides access to the pan holders to view the details of tax credits in form 26as. How to download form 26as?

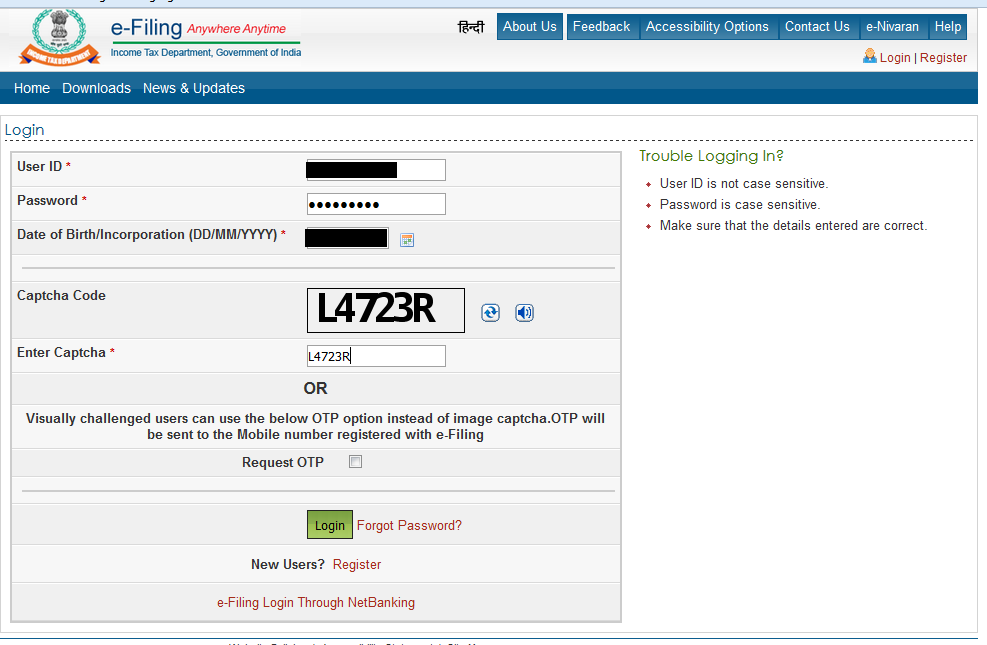

You will need to register yourself, to view or download the form 26as from the income tax efiling portal. The first is to view it on the traces website. Form 26as can be viewed through:

Choose the assessment year and the. Sometime you need form 26as but you don't have login id and password so on this video we talk about how to view or download form 26as without login user id and password or. View and download form 26as online the tax credit statement, also known as form 26as, is crucial documentation for file taxes.

If you are registered on income tax website then your can see. On the traces website or via net banking facility of authorized banks step 1: The requirement to manually file it returns.