Best Tips About Accounts Receivable Usually Appear In The Balance Sheet

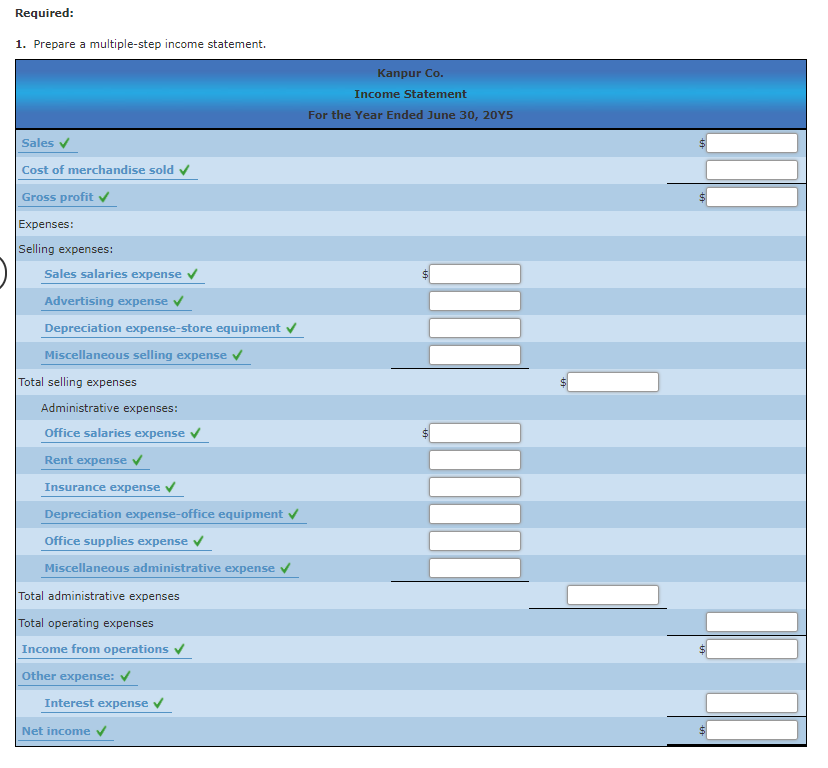

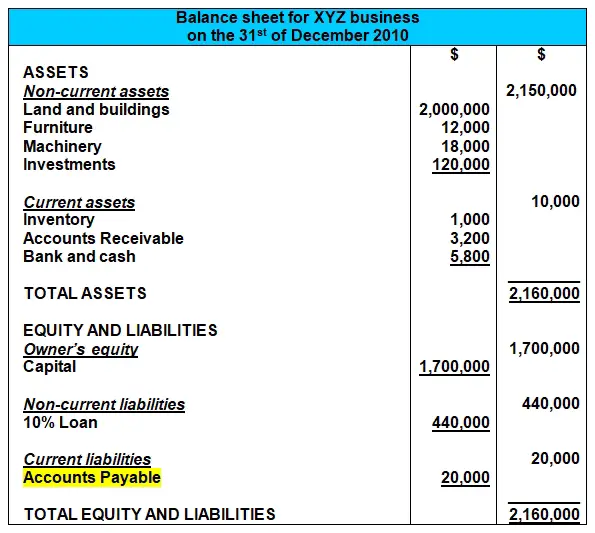

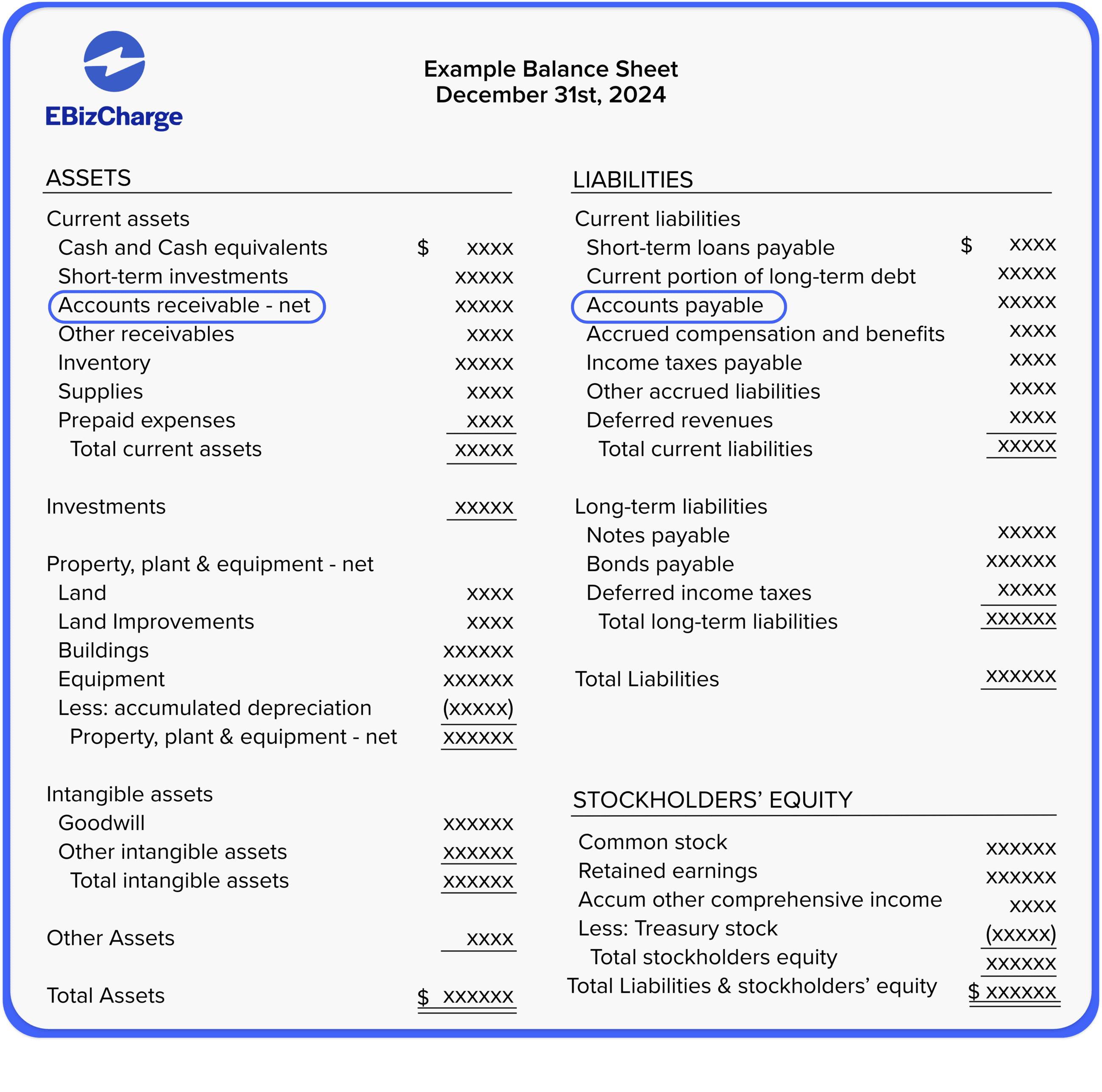

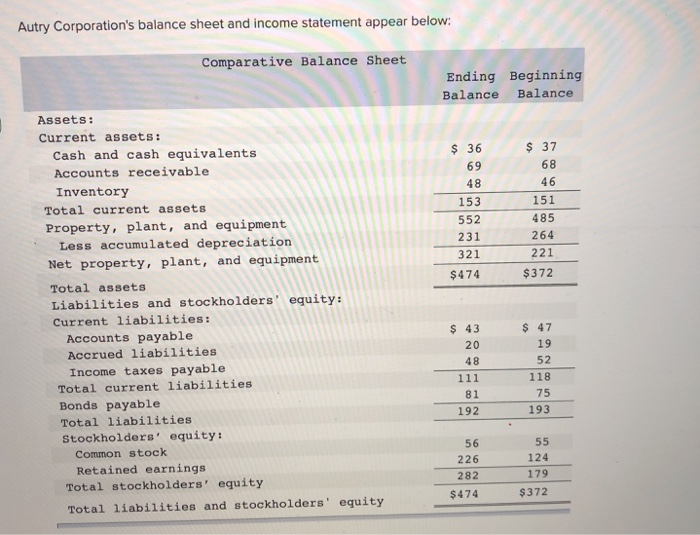

Balance sheets are typically organized according to the following formula:

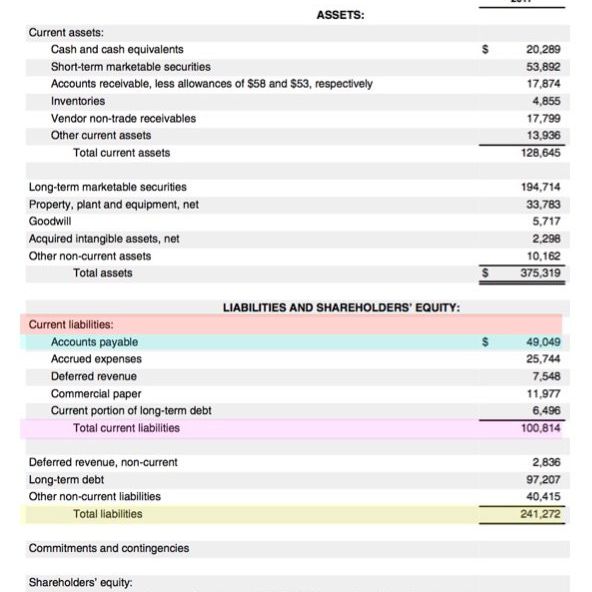

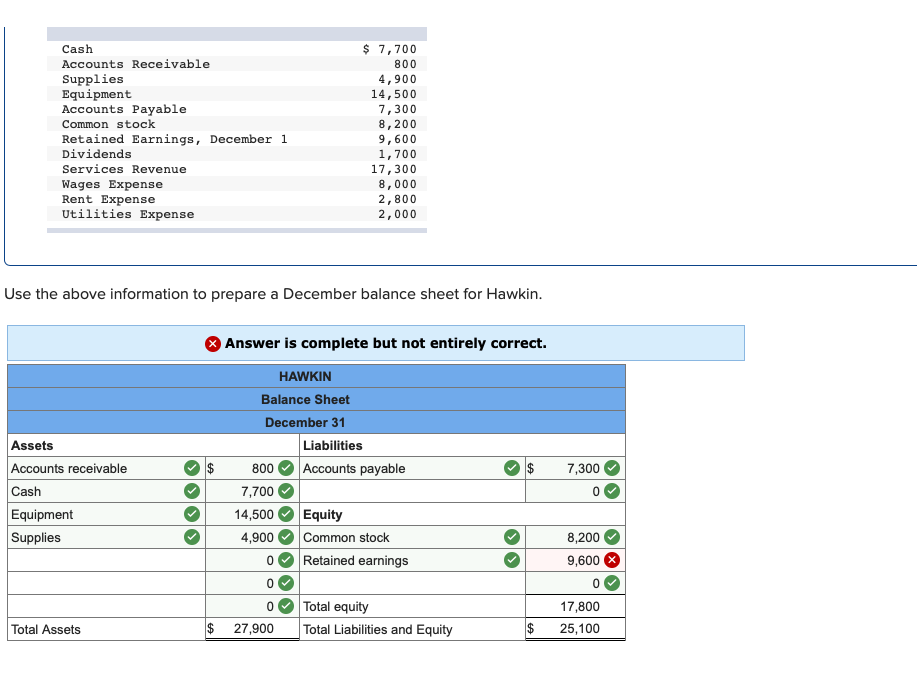

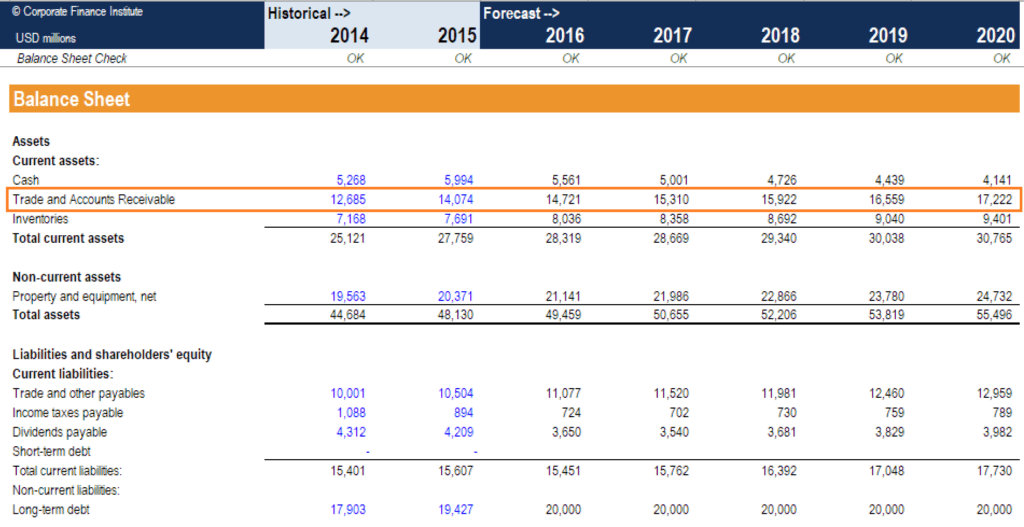

Accounts receivable usually appear in the balance sheet. As such, it is an asset, since it is convertible to cash on a future date. The balance sheet is one of the three core financial. What accounts appear on the balance sheet?

If accounts receivable is the money a company is owed, then accounts. Accounts receivable appears as a current asset on the balance sheet. Jan 2nd, 2022 | 4 min read contents [ show] accounts receivables refer to the amounts a company would receive from customers who have bought goods and.

Accounts receivable (ar) represents money for goods and services a company has delivered but not yet received payment for. Several key accounts appear on the balance sheet, each providing valuable insights into a company's. The best way to understand accounts receivable is to view a transaction and how it ends up on the balance sheet.

March 2023 bulletin published on 25 april 2023, we have reduced our estimate of borrowing for the 12 months to march 2023. Assets = liabilities + owners’ equity the formula can also be rearranged like so:. Walmart agrees to buy 50,000 units that people can only buy at walmart.

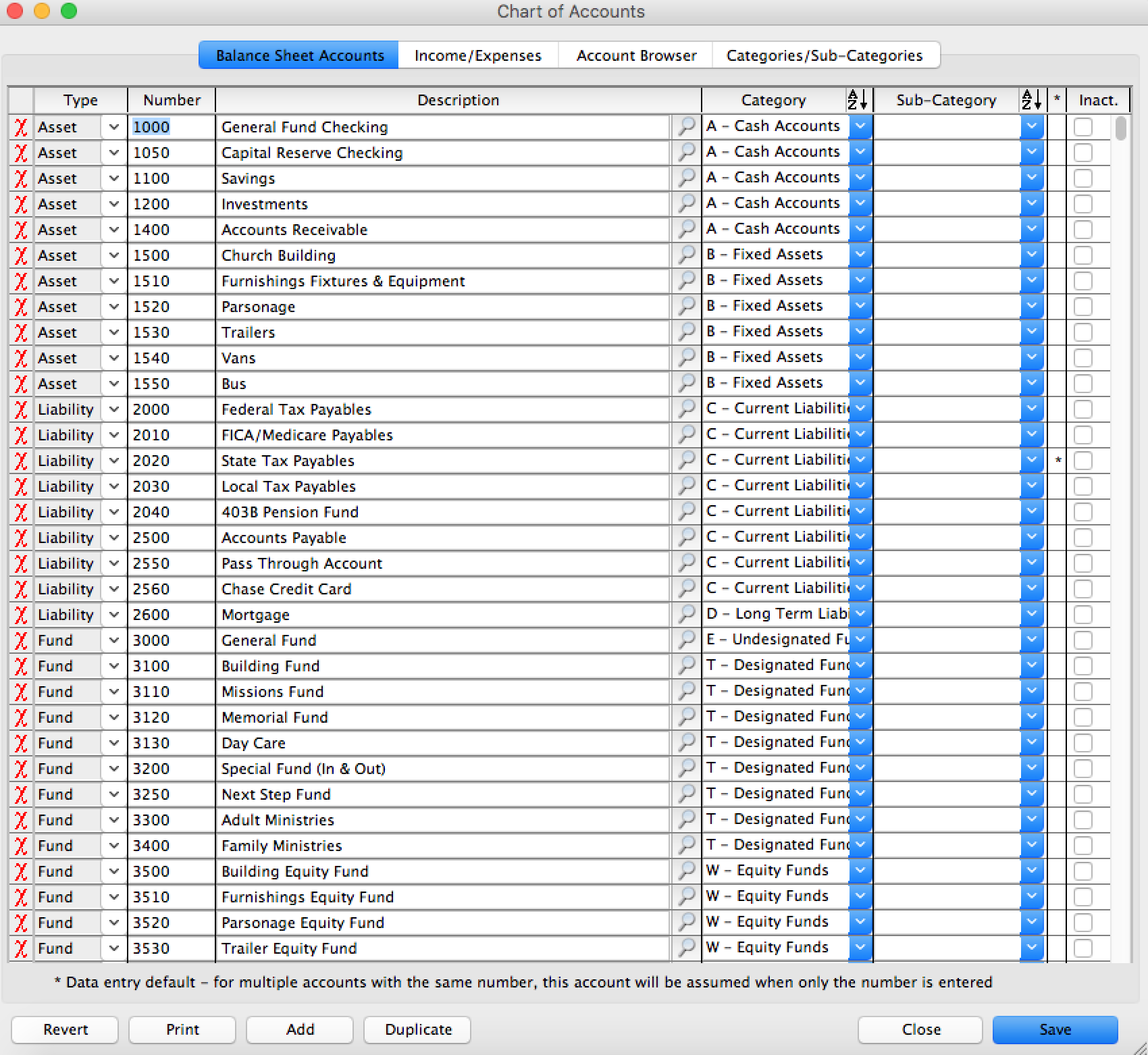

When you list the sum of your company’s accounts receivable on the assets side of your balance sheet, you add to the dollar value of the entries in that column. A second account, used for branch operations, is. Credit is usually granted in order to gain sales or to respond to the granting of credit by competitors.

One account balance is segregated solely for a november 15, 2018 payment into a bond sinking fund. June 10, 2022 calculating accounts receivable on the balance sheet is not a formula, rather it is the sum of all unpaid credit invoices that have been issued to customers. On a company's balance sheet, the accounts receivable line represents money the company is owed by its customers for goods or services rendered.

If you sell a good or product and invoice the customer, you’ll have accounts receivable. Accounts receivable is the next best. The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

Since our public sector finances, uk: Accounts receivable and accounts payable are the opposite of one another. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Accounts receivable is the amount owed to a seller by a customer. As current assets, immediately after cash. Accounts receivable is located in the asset section of the balance sheet usually right underneath cash or bank accounts.

Imagine that walmart, the buyer, wants to order a new boxed set of books from the publisher, which is the seller. As current assets, combined with cash and cash equivalents.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)