Divine Info About Prepare The Financial Report Deferred Tax On Losses Example

Company p bought a debt instrument with a nominal.

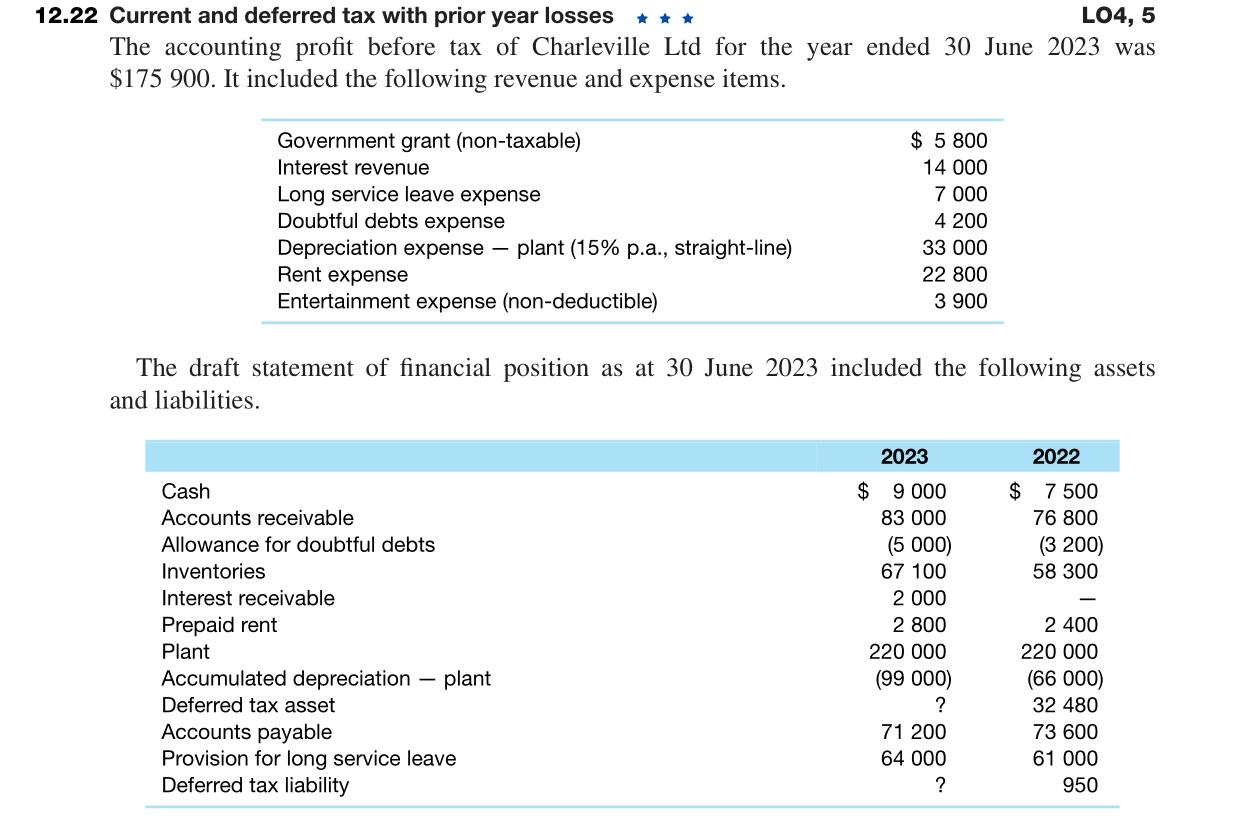

Prepare the financial report deferred tax on losses example. (a) deferred income tax assets the group recognises deferred income tax assets on carried forward tax losses to the extent there are sufficient estimated future taxable. Unabsorbed depreciation or carry forward losses as per tax laws 3. They represent cases in which the company expects to pay less in cash taxes than book taxes in the future.

Under this approach, deferred tax is recognised on timing differences between accounting profit and taxable profit, hence the focus of the timing difference approach is on the profit. Depreciation on plants, properties and equipment 2. What to remember when calculating deferred tax for 2023.

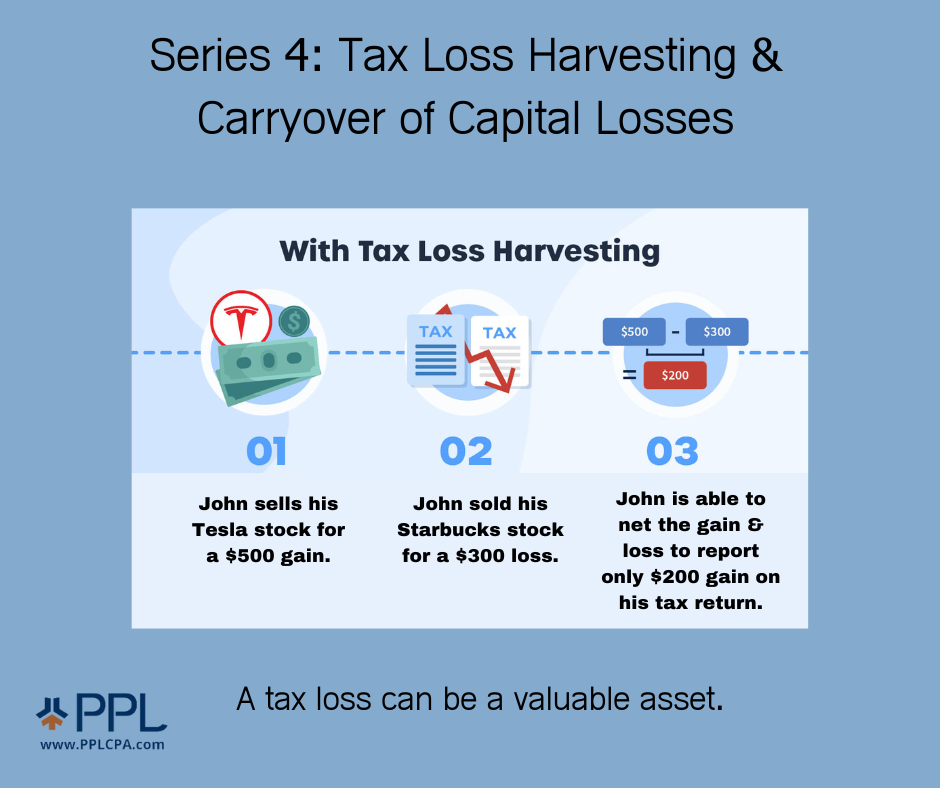

For example, deferred tax arising on the remeasurement of investment property would appear in the tax expense line of the profit and loss account, because. A deferred tax can also arise in event of an operating loss that can be carried forward to. Deferred tax assets (dtas) are for the opposite situation:

Company buys a $30 piece of equipment (pp&e). The following simplified example explains the iasb’s proposals and illustrates how they would apply in practice. As we have seen in the example, accounting for deferred tax then results in a further increase or decrease in the income tax expense.

No provision has been made for. Below is an example scenario in which a deferred tax liability is created. Introduction the ifrs interpretations committee (the interpretations committee) received a request for guidance on the recognition and measurement of deferred tax assets when.

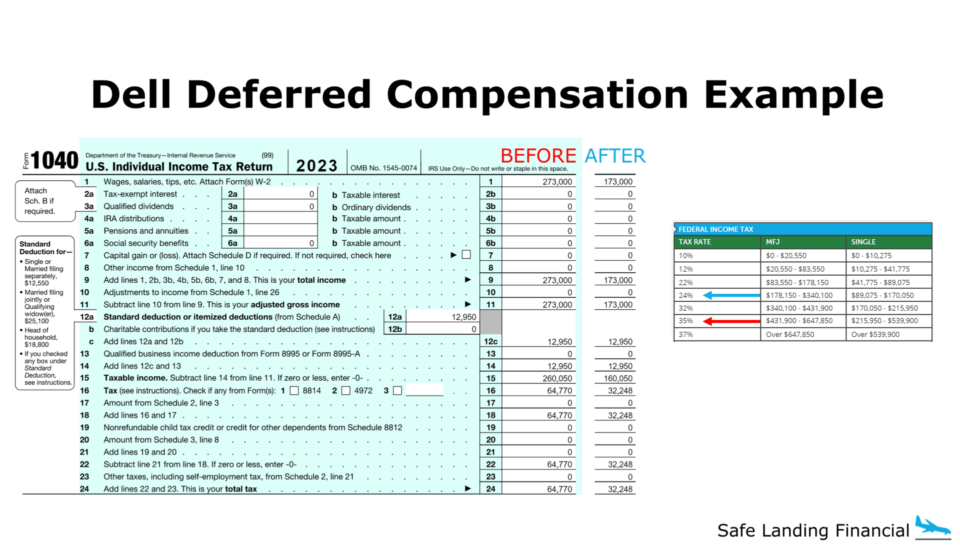

How the deferred tax should be measured in line with increase in tax rates with examples. While certain complexities exist, the fundamental objective of the deferred tax accounting model is to provide a complete measure of an enterprise’s net earnings by allowing the. Deferred taxes example.

Therefore, the final income tax expense for each year reported in the statement of profit or loss would be as follows: If a company recognizes revenue for financial reporting purposes before it’s taxable, it may have a deferred tax liability as it will pay taxes on. This paragraph mandates that if a transaction leads to equal taxable and deductible temporary differences, an entity is required to recognise the corresponding.

To understand the differences between financial accounting and tax reporting, let’s start with a simple example: A deferred tax asset represents the deductible temporary differences. And how is this tax properly calculated?

A company reports a revenue of $100,000 for the year.

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)