Spectacular Tips About Loan In Cash Flow Statement

Although the presentation of operating cash flows differs between the two methods,.

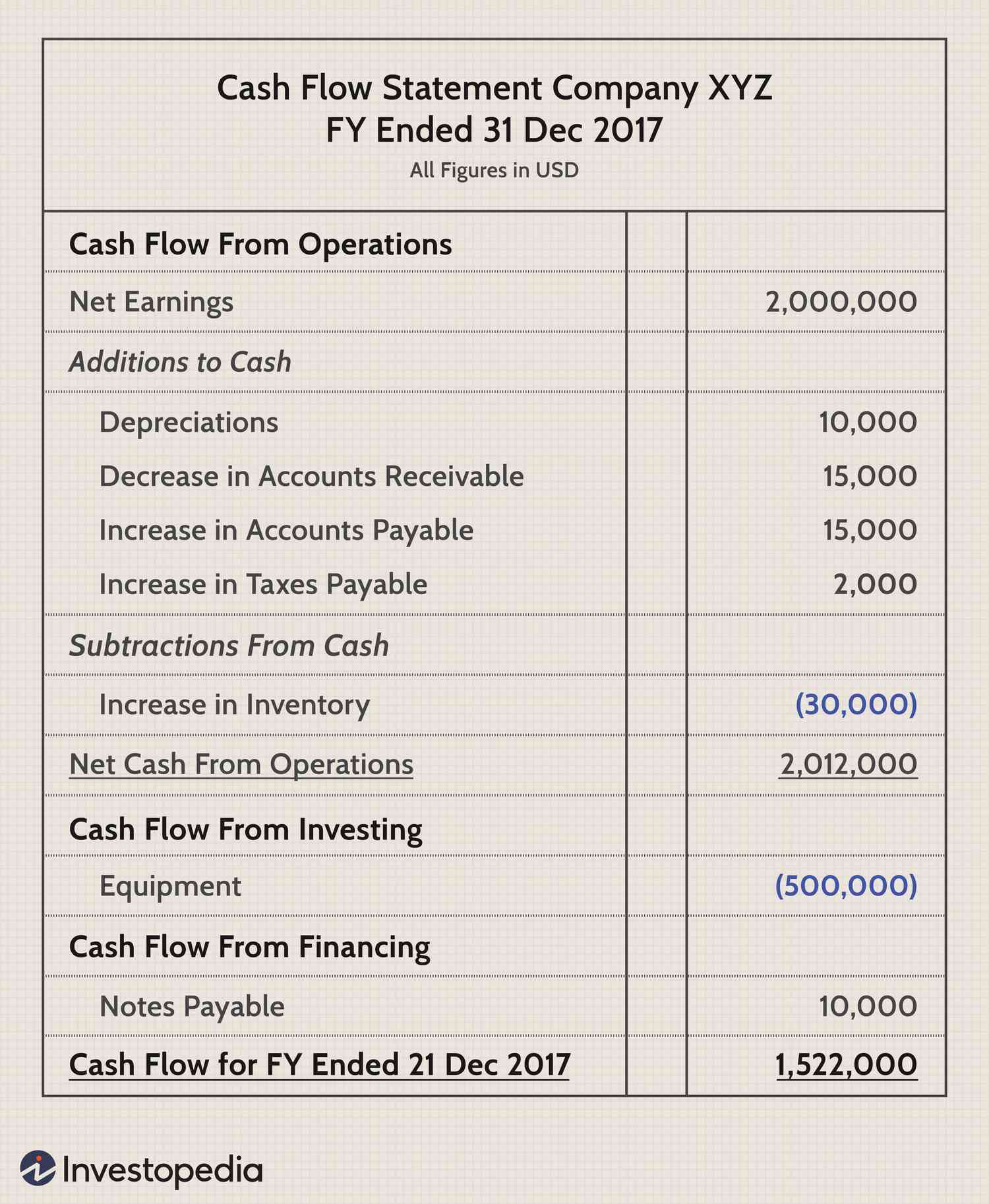

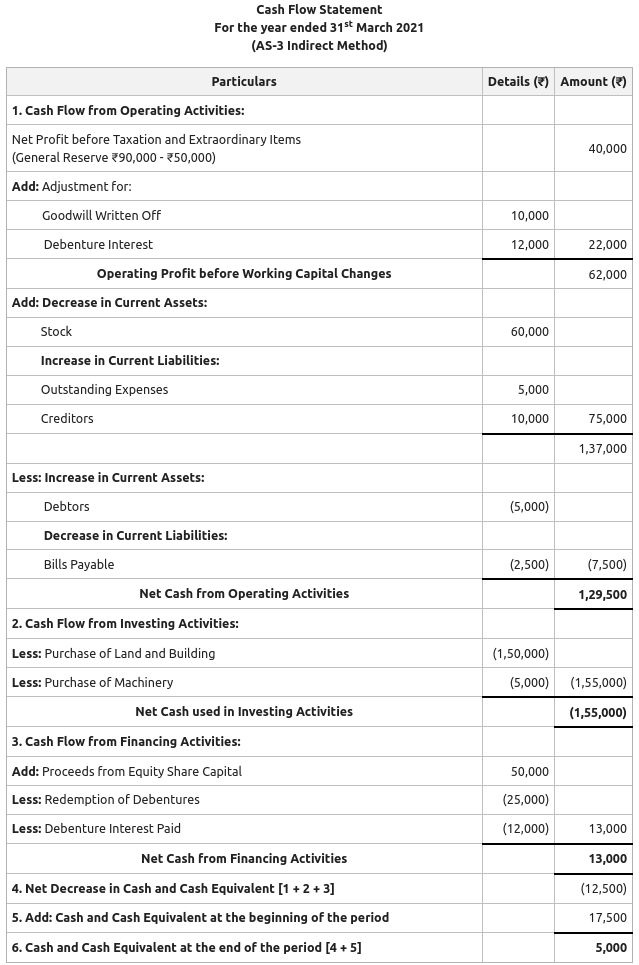

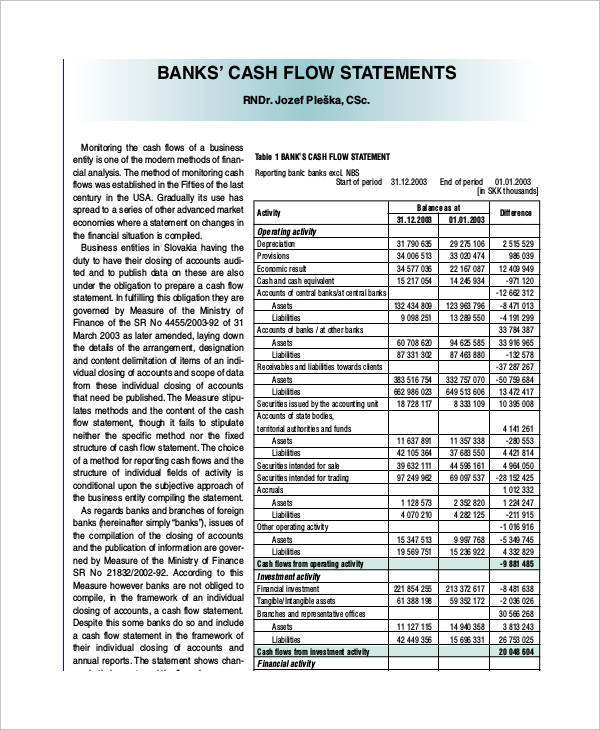

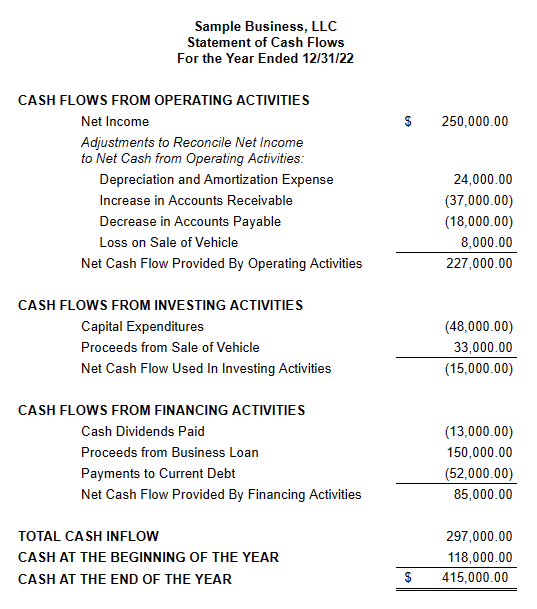

Loan in cash flow statement. Ceo statement “in 2023, we delivered another strong and resilient performance. Cash flow from investing activities is an item on the cash flow statement that reports the aggregate change in a company's cash position resulting from any gains (or losses) from investments in. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

A cash flow statement is a financial statement that presents total data. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The cash flow statement looks at the inflow and outflow of cash within a company.

Margin loan rates from 5.83% to 6.83%. If a company's business operations can generate positive cash flow, negative overall cash flow. Innovation rate increased to 20%;

Financing cash flows include cash flows associated with borrowing and repaying bank loans or bonds and issuing and buying back shares. Did you get it ⬇️樂 question: This value can be found on the income statement of the same accounting period.

Cash flow from financing activities is the net amount of funding a company generates in a given time period. This can include paying back a loan, obtaining a loan, issuing cash. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

Best for lower credit scores: Statement of cash flows: The 3 main types of cash flow cash flow from operations (cfo) cash flow from investing (cfi) cash flow from financing (cff) what about free cash flow?

Free cash flow eur 423 million; Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. Sap s/4hana cloud for finance.

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. Cash receipts from the repayment of advances and loans made to third parties furthermore, examples of cash inflow from investing activities are:

Cash sale of plant and machinery, land and building, furniture, goodwill etc cash sale of investments made in the shares and debentures of other companies Income statement and free cash flow. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

The cash flow statement is typically broken into three sections: Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Sap s/4hana cloud for finance.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)