Lessons I Learned From Tips About Balance Of Profit And Loss Account

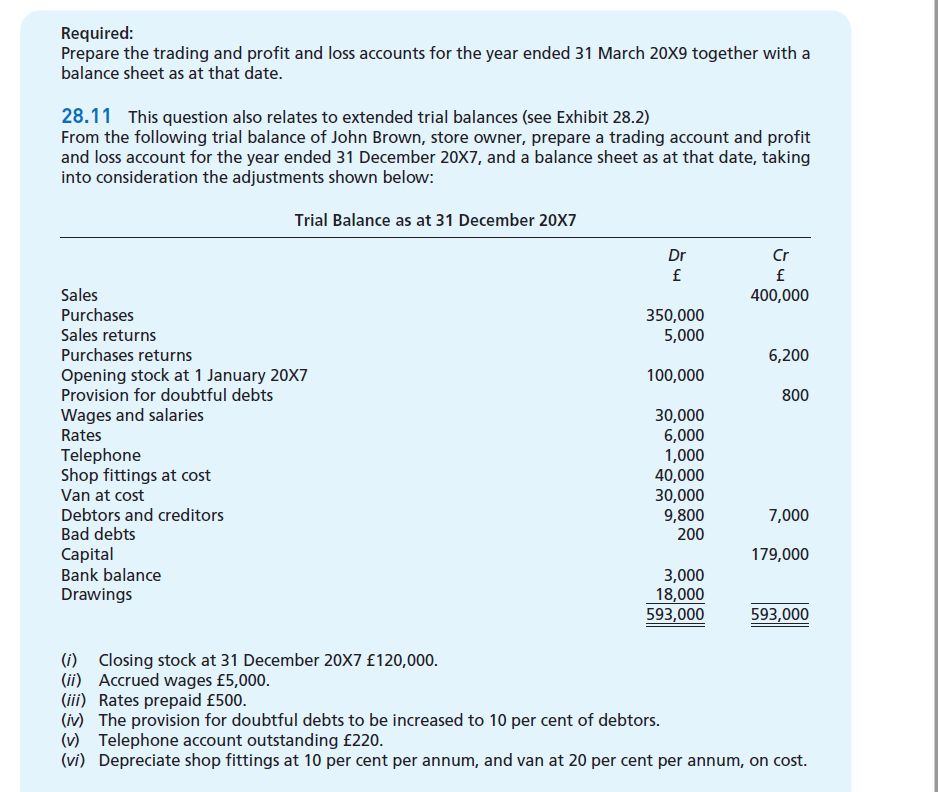

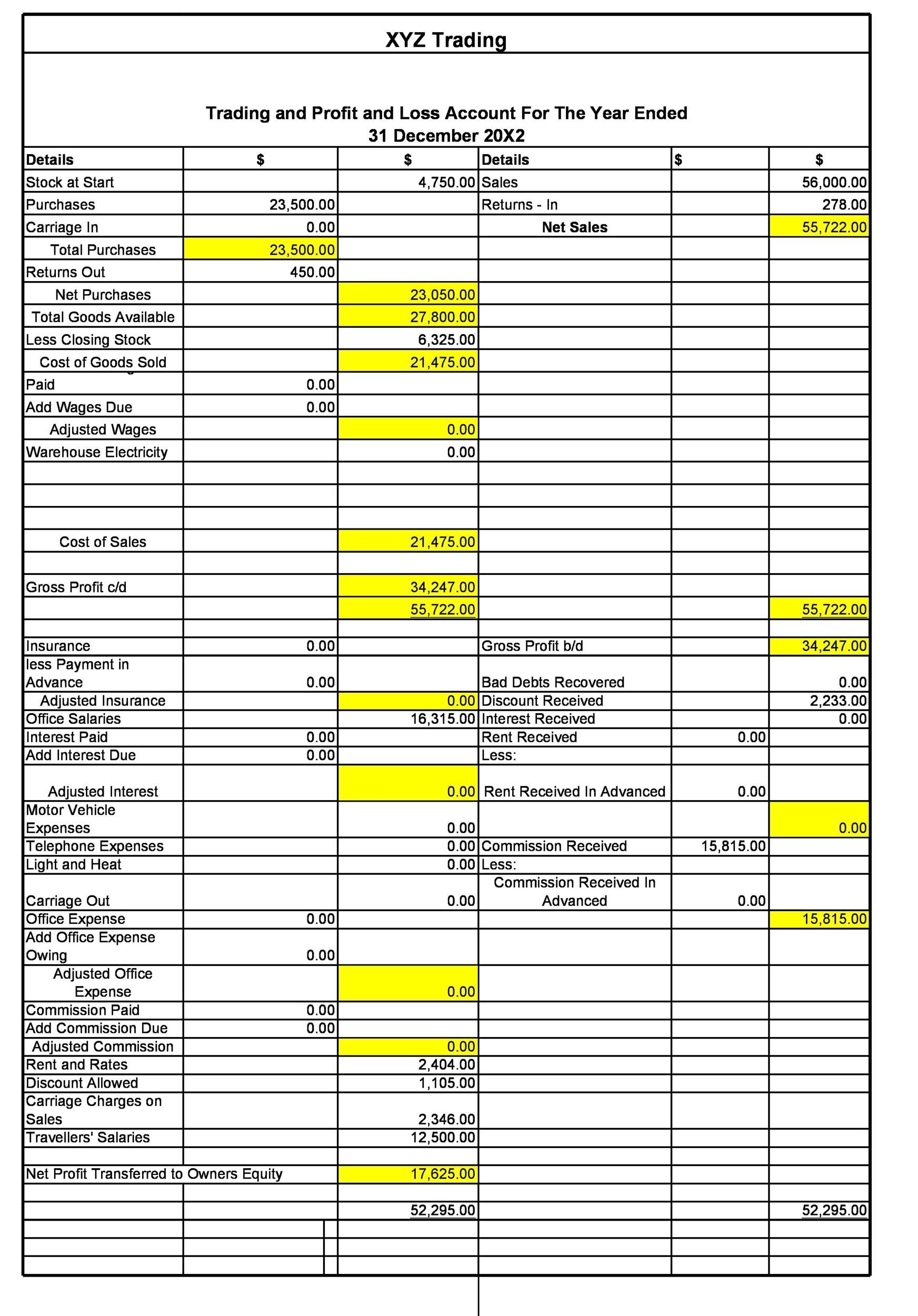

Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss.

Balance of profit and loss account. The formats of the annual balance sheet and the profit and loss account of the ecb are set out in annexes ii and iii of decision (eu) 2016/2247. The credit balance of a profit and loss account means “ net profit ” for the business, whereas a debit balance of a profit and loss account indicates a net loss. What is the profit and loss account?

What is profit and loss account? The account depicts the financial production of the. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly.

When to use a balance sheet and profit and loss statement main balance sheet and p&l statement differences the order in which they are prepared the. Balance sheet | tabulation what are profit and loss (p&l)? A profit and loss account (p&l) reports the true financial position of the business, i.e.

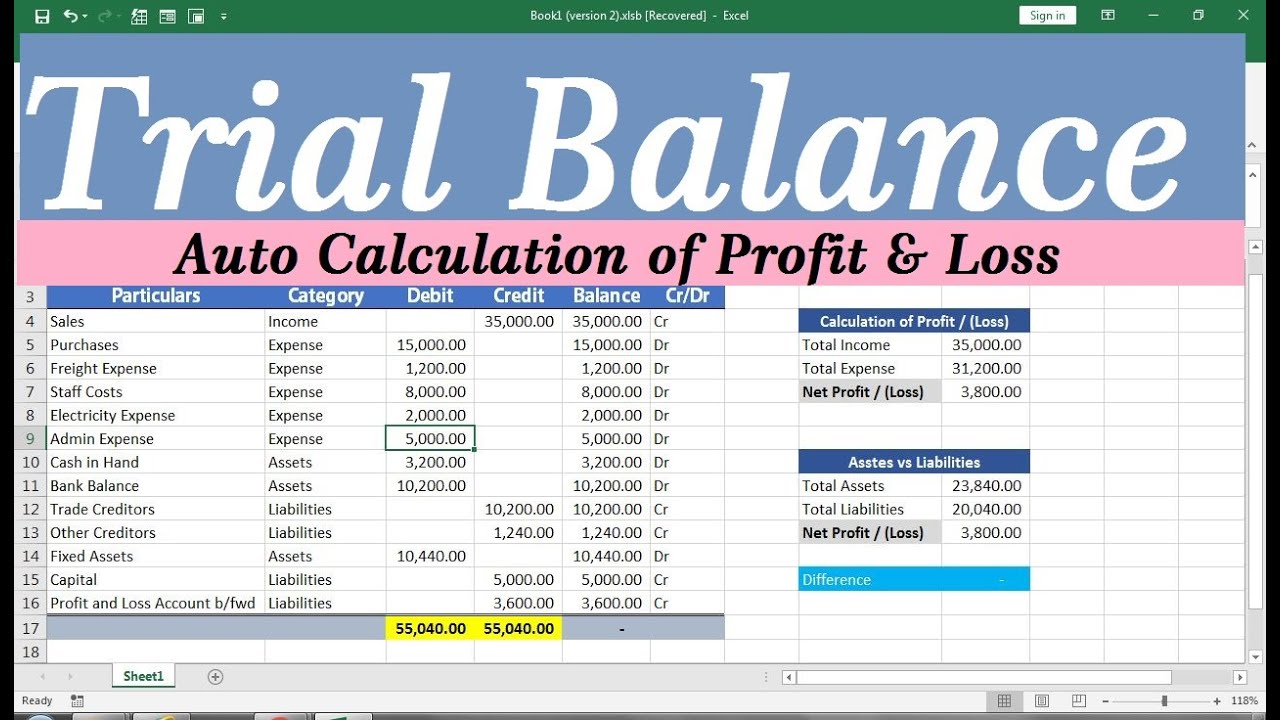

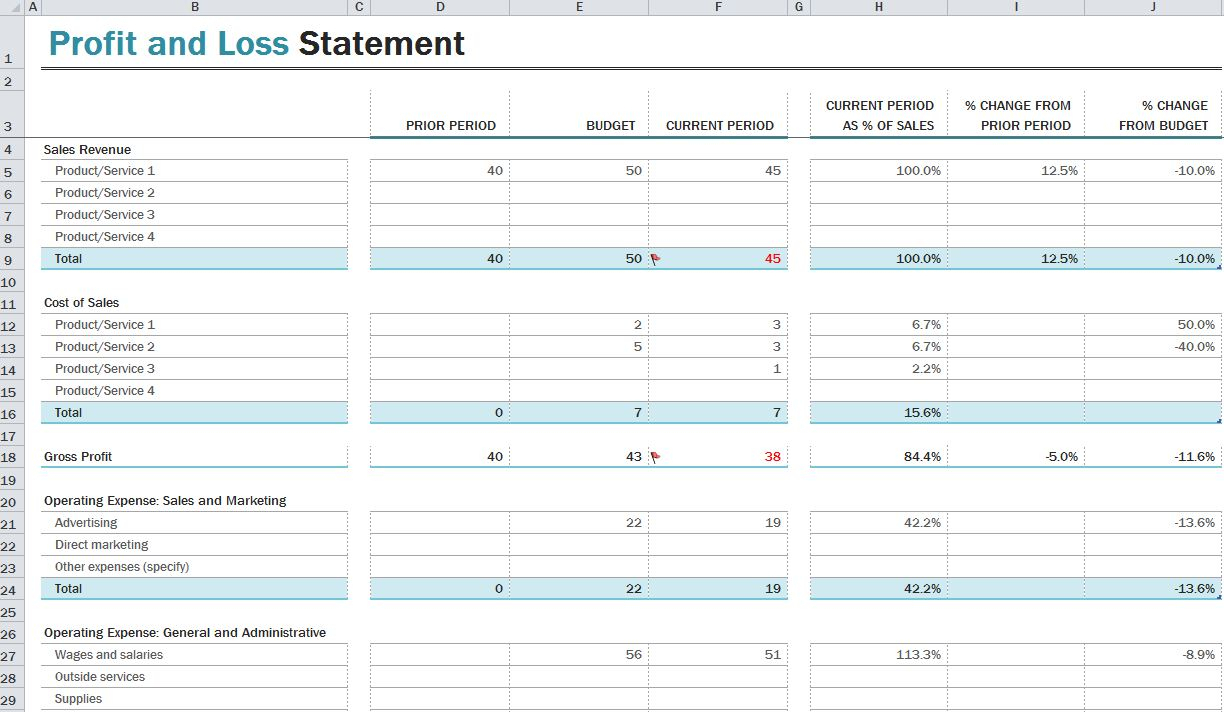

Income statement difference between p&l and balance sheet | tabulation trial balance vs. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss account is prepared to determine the net income(performance result) of an enterprise for the year/period.

In the world of accounting, profit and loss accounts have a debit balance when the debit side (expenses & losses) exceeds the credit side (incomes and gains). The profit and loss account is one of the three core financial statements. 7.1 the profit and loss account the profit and.

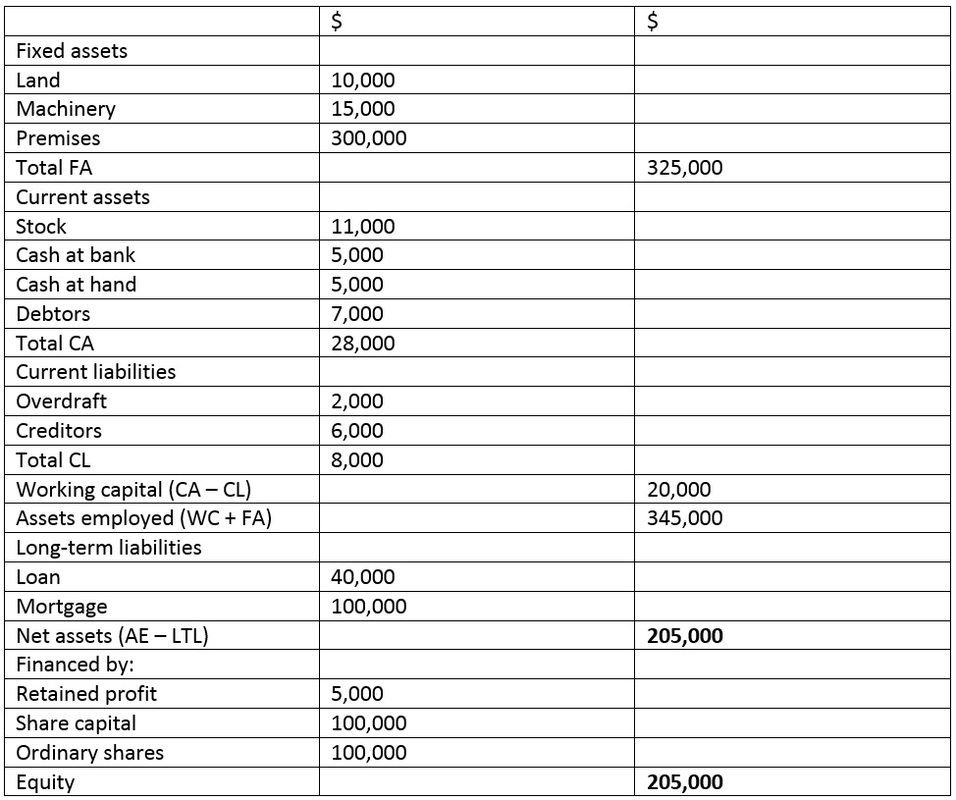

This is the most significant information to be reported for decision making. A balance sheet is a declaration that details a company's assets, liabilities, and equity as of a certain time. Every company prepares a profit and loss account statement at the end of the year generally, to get the visibility.

Net income or net profit is calculated by charging all operating expenses and by considering other incomes earned. Balance sheet is prepared to provide the financial position of the company at a specific time span. A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given period of time.

It is generated on a given date to. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement,. Whether you are making a profit or loss over a period of time.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. It’s generally used alongside the two other types of. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements.

P&l a/c which also called a statement of revenue and expenses or an income statement. A balance sheet is a statement that discloses the financial position of its assets,. Profit and loss accounts, balance sheets two of the most important financial statements for a business are the profit and loss account, and the balance sheet.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)