Awesome Info About Free Cash Flow For Firm

With this fcff calculator, you can easily calculate the free cash flow to firm (fcff) which will help you to value a company.

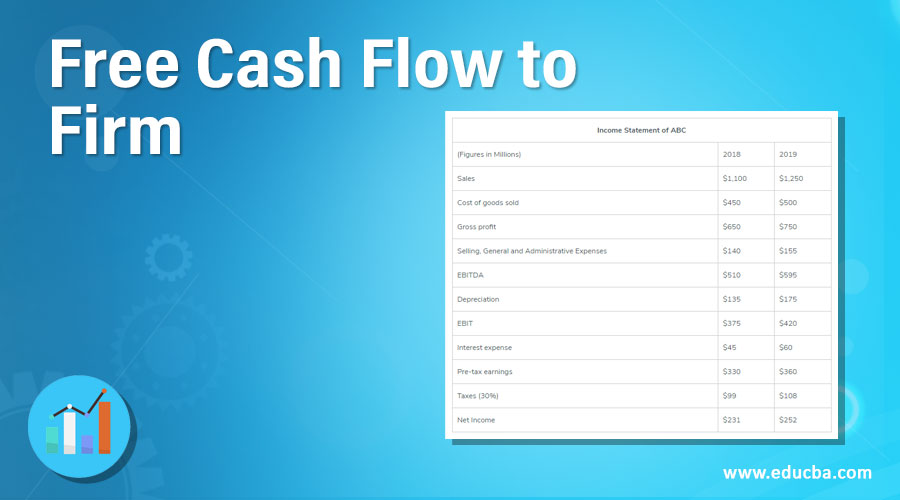

Free cash flow for firm. Free cash flows refer to the cash a company generates after cash outflows. For fy2023, it reported its free cash flow as $748.7 million, down from $1.34 billion in 2022. Another formula to calculate fcff is as follows:

When valuing individual equities, 92.8% of analysts use market multiples and 78.8% use a discounted cash flow approach. Key takeaways free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. In that regard, fcff is the cash flow available for the business to use after all its operating and capital expenses have been covered.

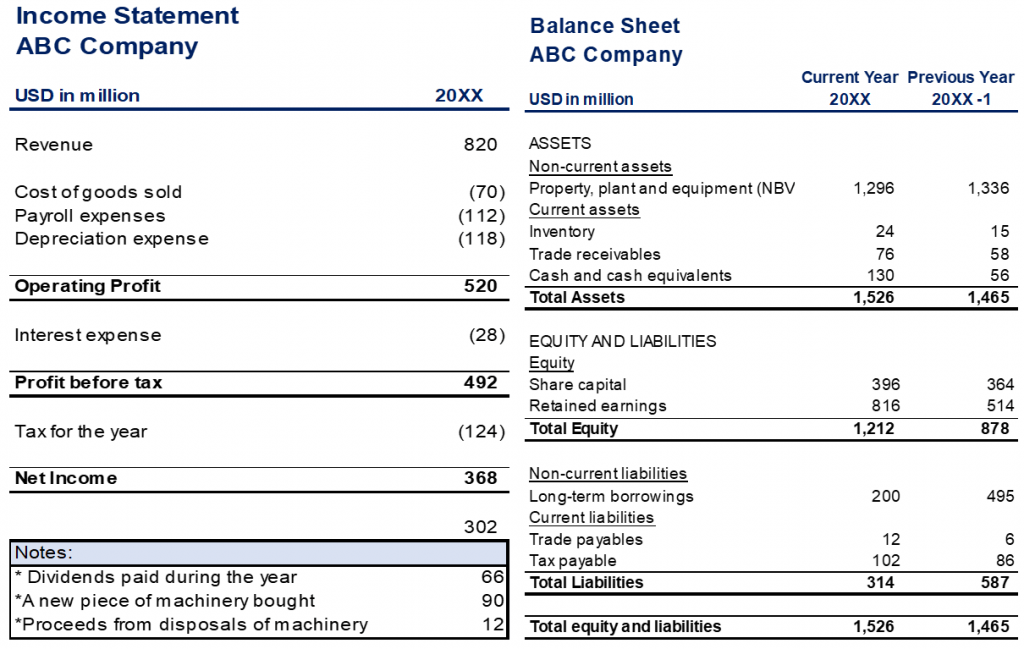

It is equal to a company’s cash flow from operations (cfo) minus any capital expenditures (capex). A positive fcff value indicates that the firm has cash remaining after. Docs free cash flow data by ycharts;

In financial accounting, free cash flow ( fcf) or free cash flow to firm ( fcff) is the amount by which a business's operating cash flow exceeds its working capital needs and expenditures on fixed assets (known as capital expenditures ). Free cash flow to firm (fcff) (also referred to as unlevered free cash flow) and free cash flow to equity (fcfe), commonly referred to as levered free cash flow. Whether the company could face legal liability is unclear, experts.

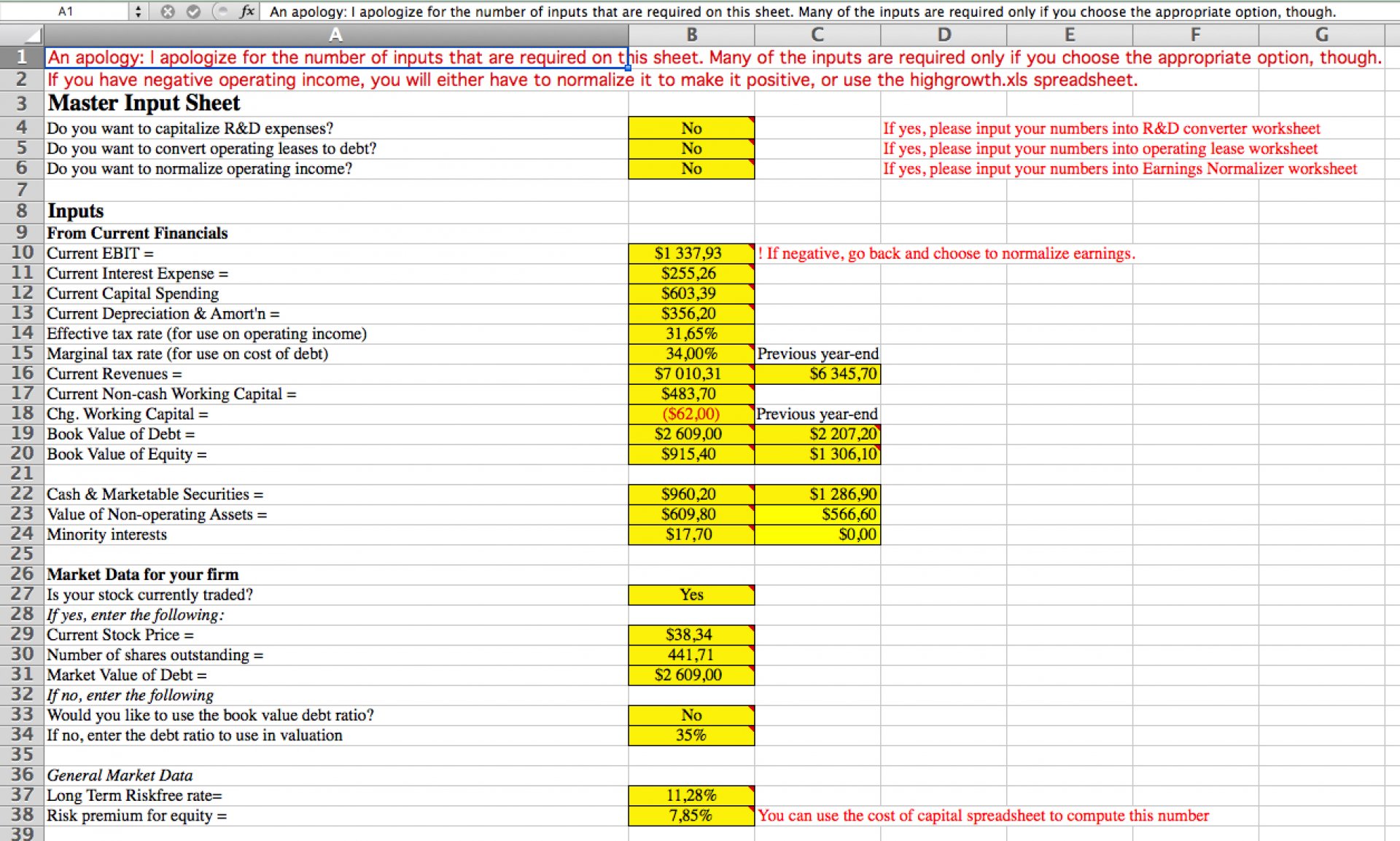

Sflo proves the opposite is true. So lets see the steps on how to arrive at the free cash flow to firm (fcff) estimates: For q4, labcorp reported its free cash flow as $414.2 million, down from $508.1 million a year ago;

Free cash flow (fcf). Fcff is a hypothetical figure, an estimate of what it would be if the firm was to have no debt. The conventional wisdom is that many small firms aren’t profitable, so fcf is an unattainable luxury.

Free cash flow (fcf) is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets. Free cash flow measures profitability. What is free cash flow to the firm (fcff)?

Fcff, or free cash flow to firm, is the cash flow available to all funding providers (debt holders, preferred stockholders, common stockholders, convertible bond investors, etc.). 12, according to data and analytics firm ortex. Key takeaways free cash flow to the firm (fcff) represents the cash flow from operations available for distribution after accounting.

Management and investors use free cash flow as a measure. Compared to eps, fcff is much more helpful as it can be difficult to manipulate as it only considers transactions involving actual cash outflow and inflow in. This means that abc corporation did not generate any free cash flow during this period.

Free cash flow is arguably the most important financial indicator of a company's stock value. Free cash flow is, in essence, cash that is free to be disbursed to the owners of the firm or used for any kind of investment the firm deems worthwhile. Free cash flow is defined as the cash available to a company after operating and capital expenditures are covered.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/Freecashflowfirm_final-687ff00a77b04ae6b47c4de5529e5ff2.png)