Beautiful Info About Bank Balance In Trial

The ruling marks the end of a protracted and bitter civil lawsuit and represents a potentially devastating blow to the trump organization, which could damage his brand, bank balance and business.

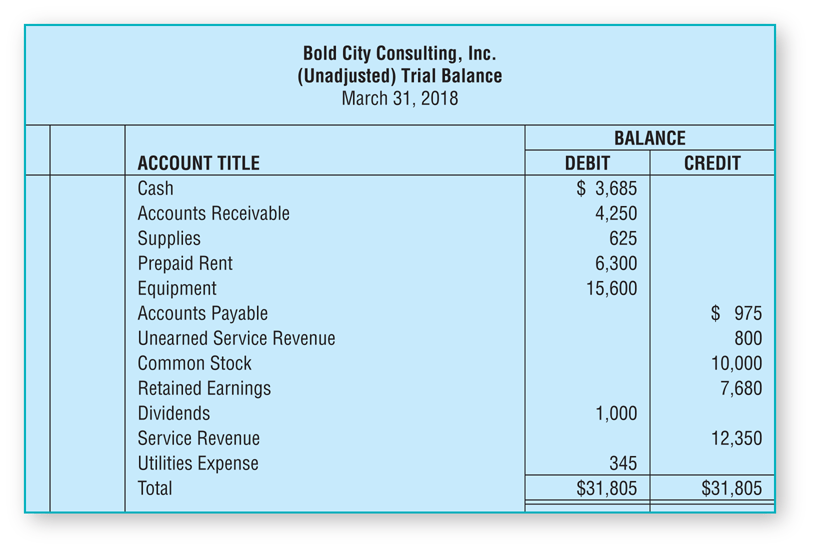

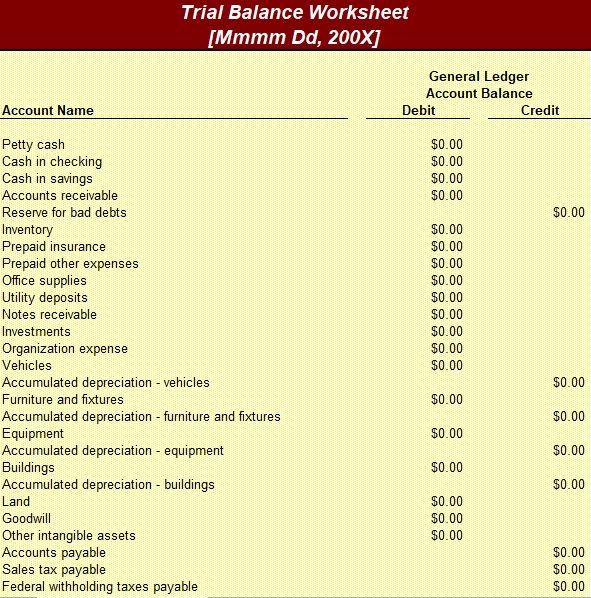

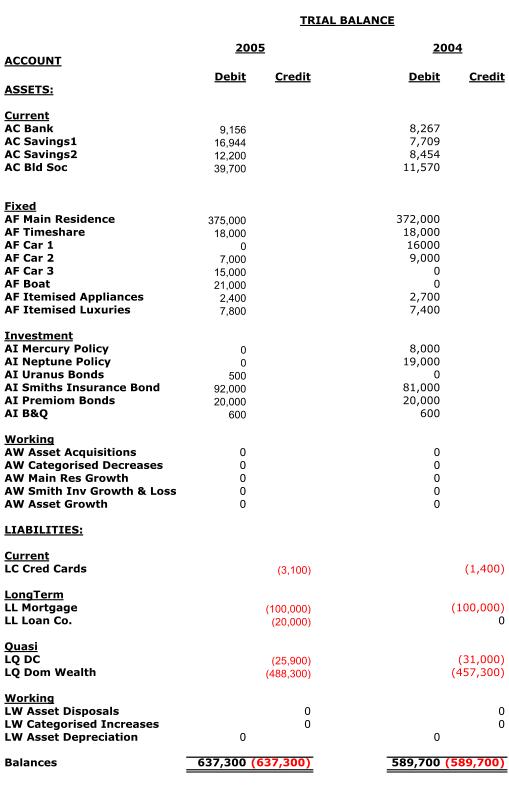

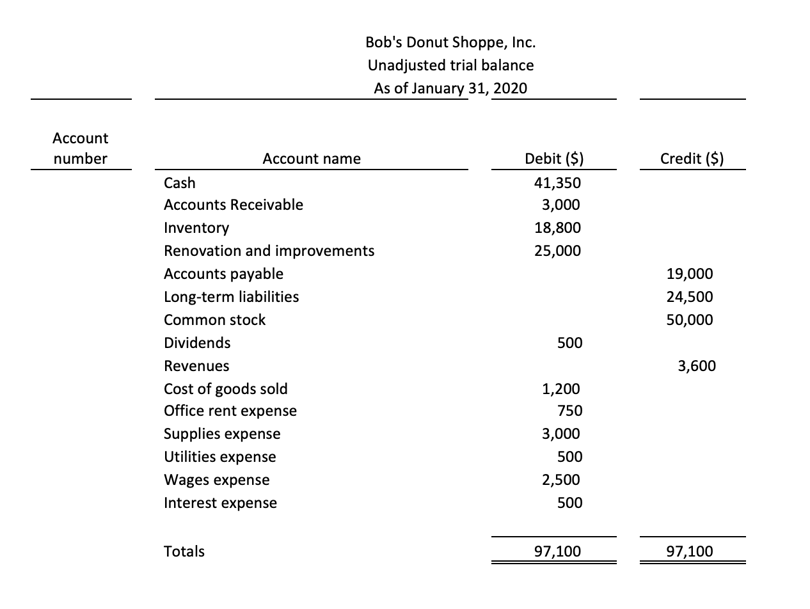

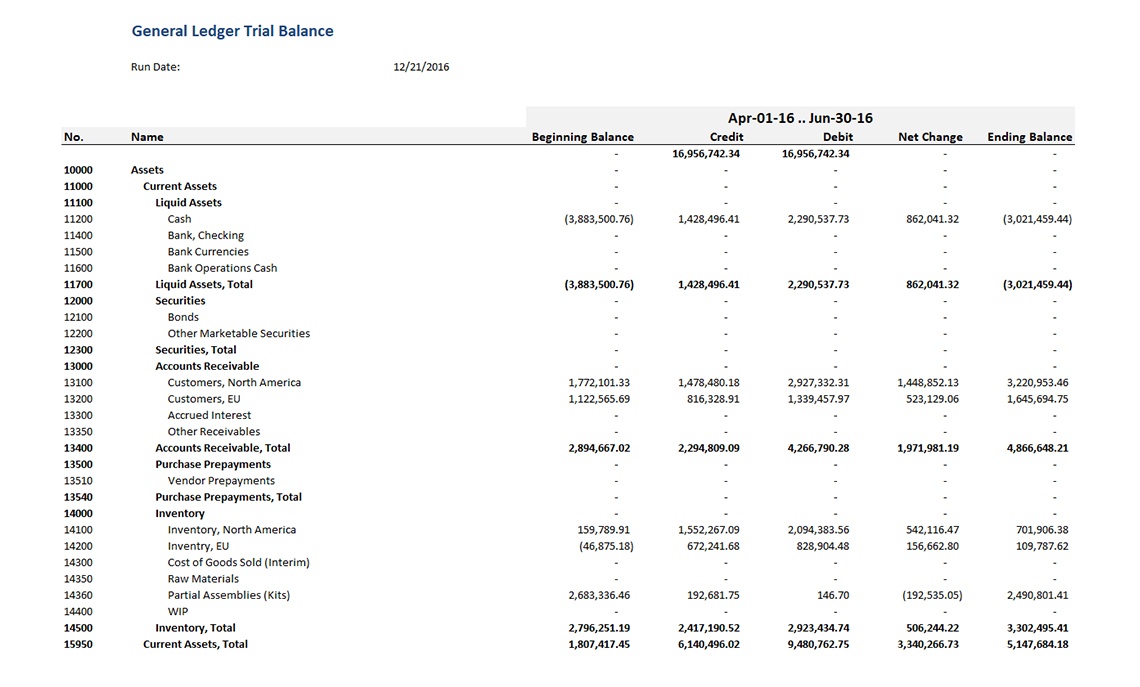

Bank balance in trial balance. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. What are the methods of preparing trial balance?

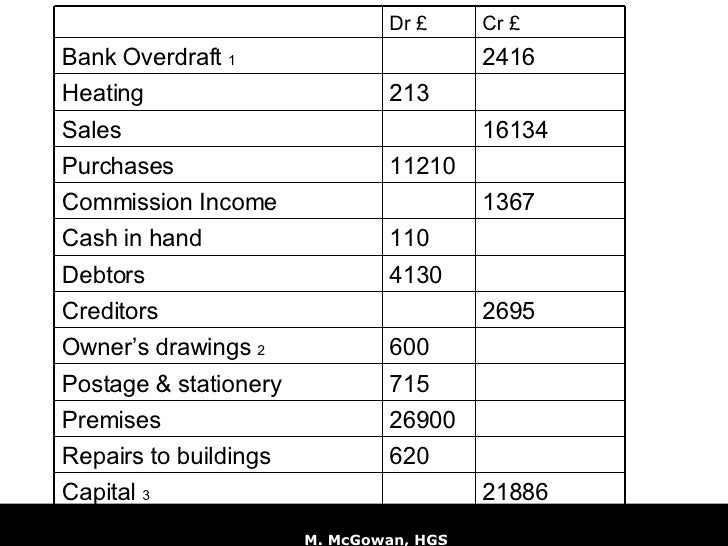

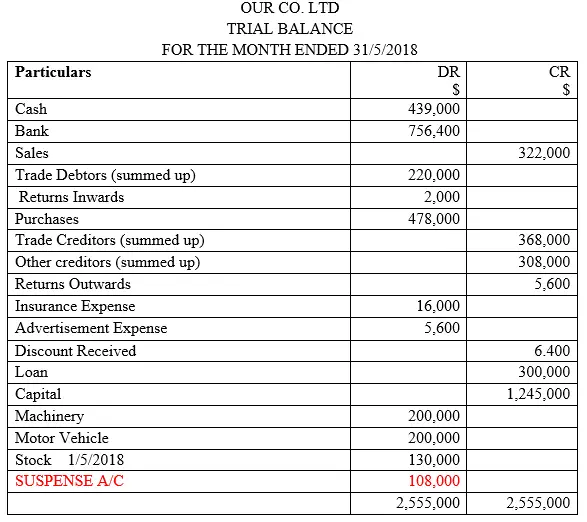

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. The total of debit balance in trial balance should match with a. In the trial balance it appears as a bank account entry but the amount is recorded on the credit side of the trial balance as shown below;

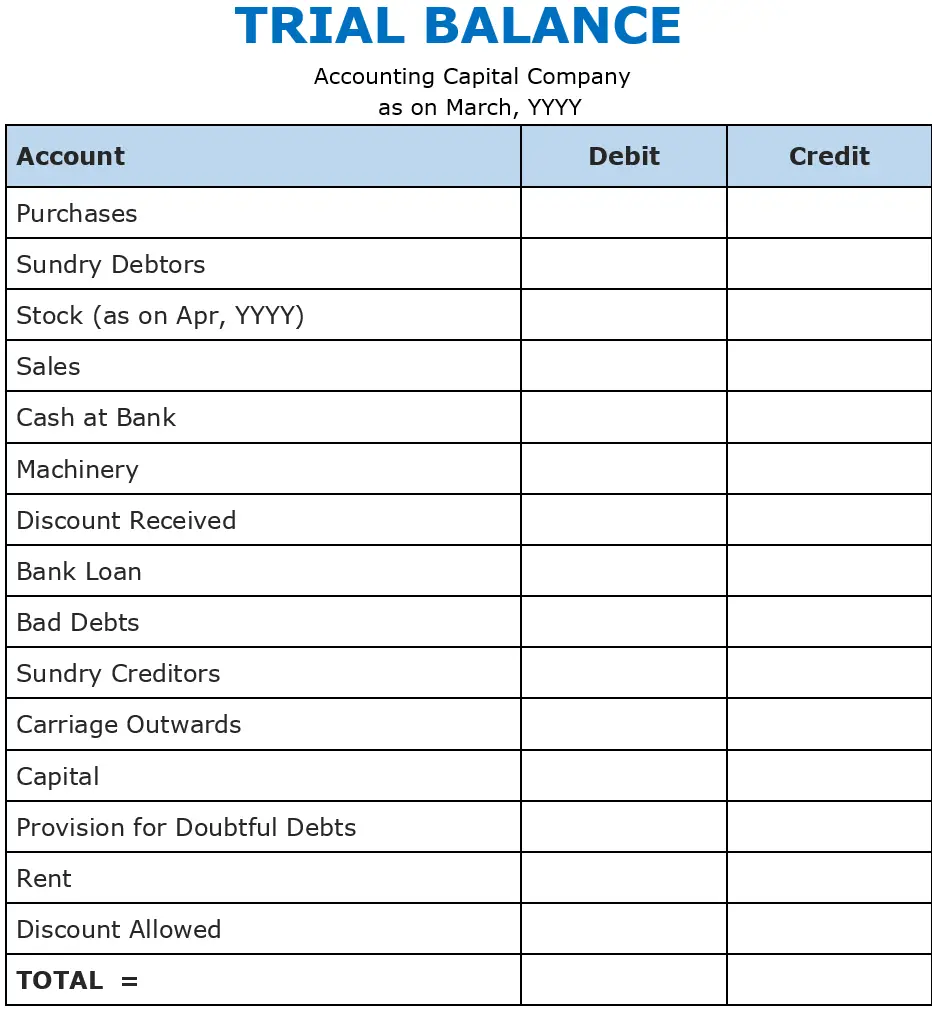

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. Balance brought down and balance carried down in trial balance. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown with the total of all.

Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal. The trial balance is the first step toward recording and interesting your financial results.

A company prepares a trial balance. The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600).

How do you prepare a trial balance? Trial balance example. It is a statement of debit and credit balances that are extracted on a specific date.

Trial balance is a statement summarizing the closing balance of all the ledger accounts, prepared with the view to verify the arithmetical accuracy of ledger posting. You will do the same process for all accounts. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available;

Bal b/d) and balance carried down (bal c. Ledger balances are segregated into debit balances and credit balances. The trial balance format is easy to read because of its clean layout.

This statement comprises two columns: The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements.

The tb does not form part of double entry. What will happen to my paytm payments bank account/wallet if there is a lien or freeze marked on the directions of law enforcement or. Zero) which will be carried forward on the ecb’s balance sheet to be offset against future profits.