Cool Info About Preparing A Post Closing Trial Balance

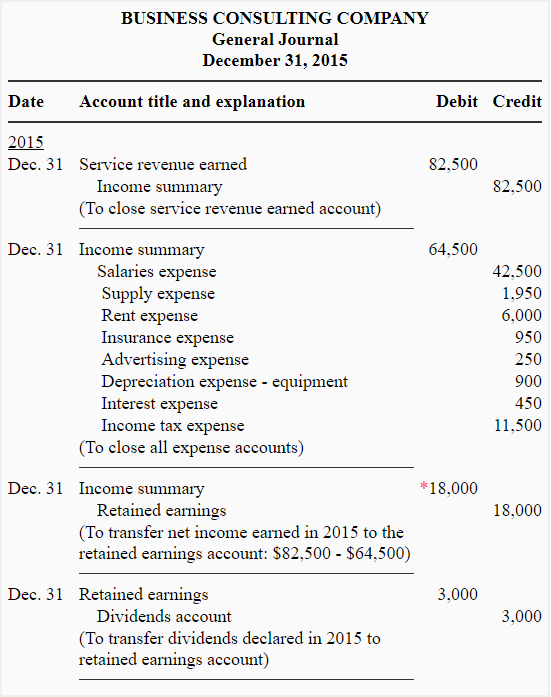

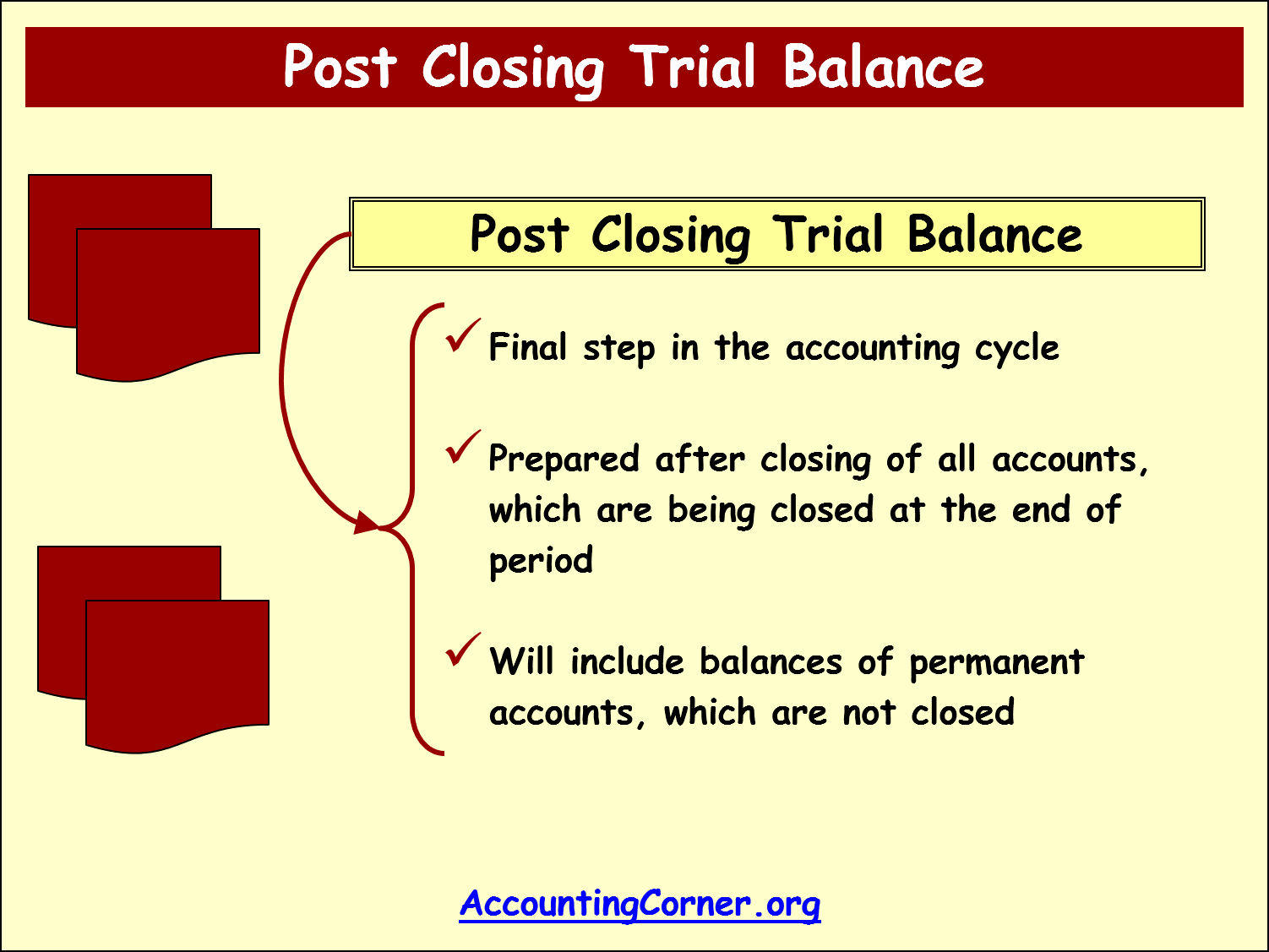

Closing, or clearing the balances, means returning the account to a zero balance.

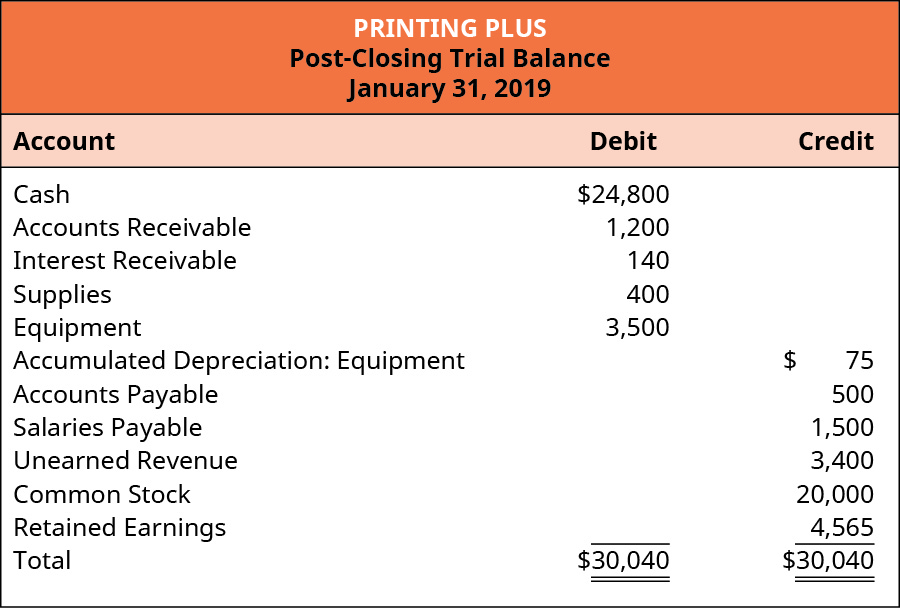

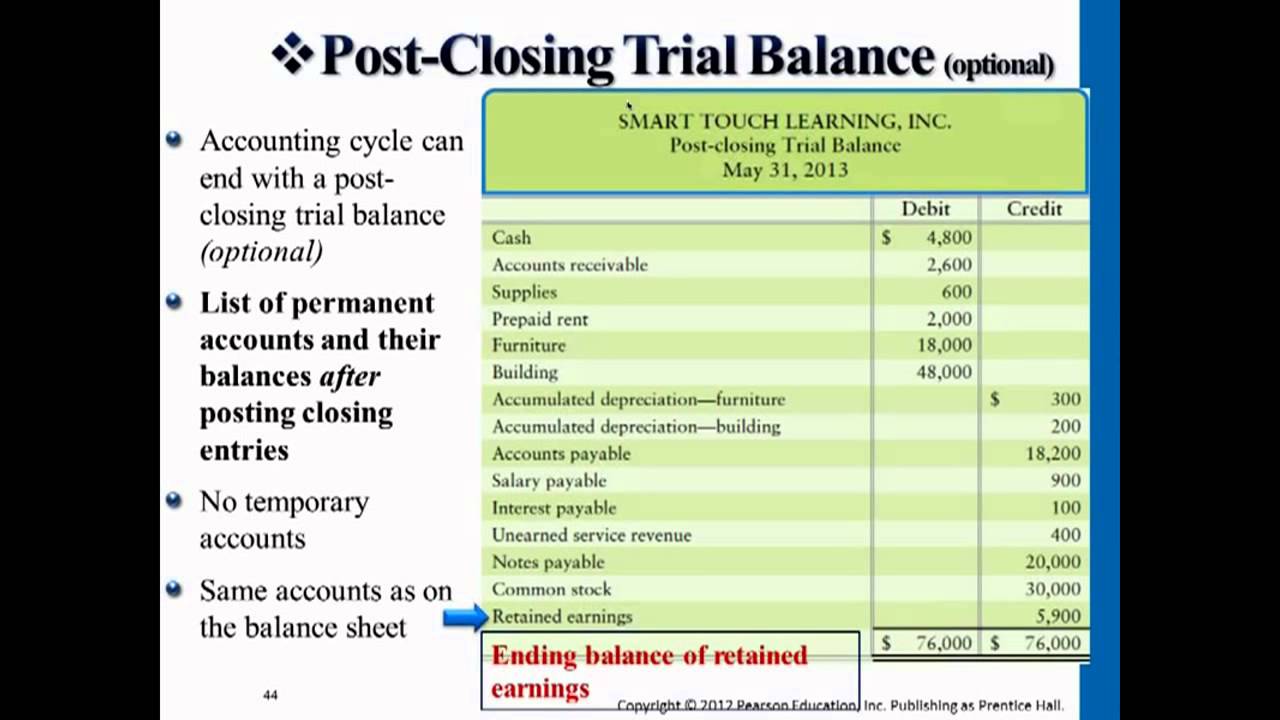

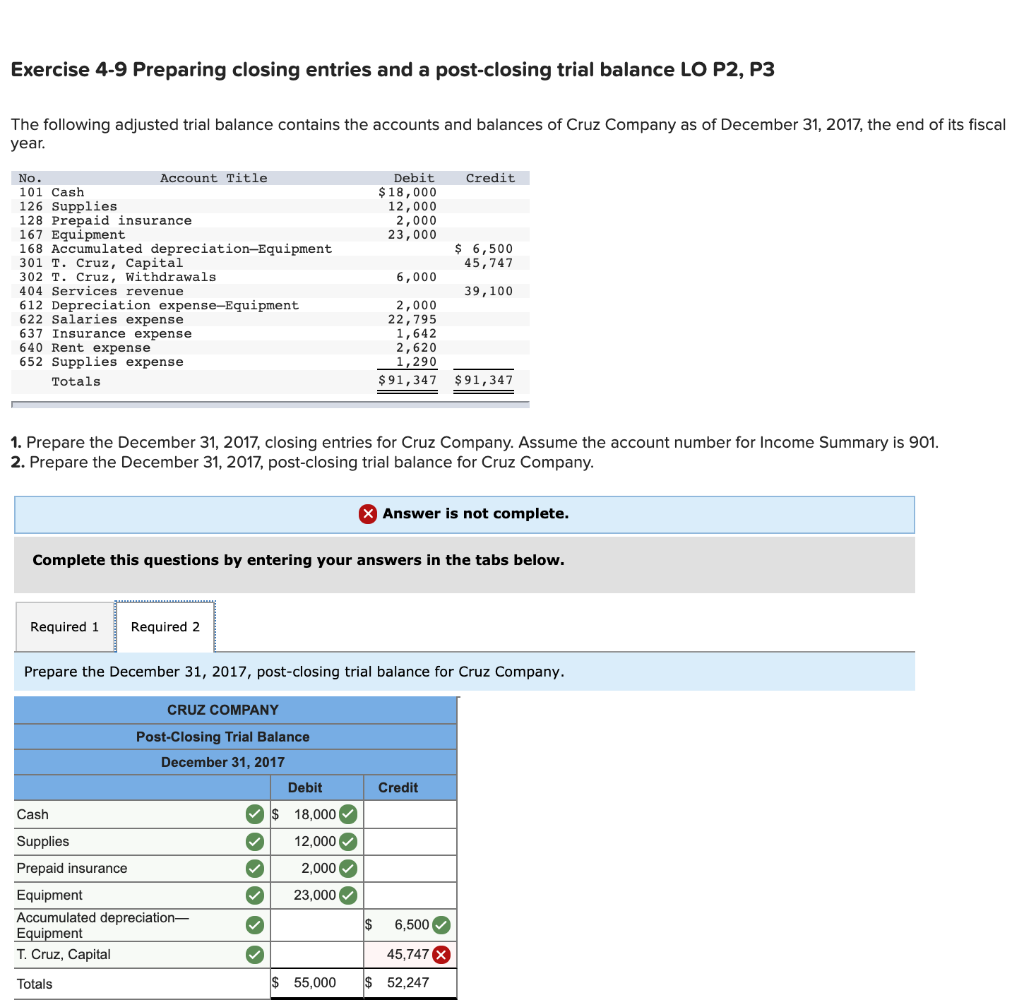

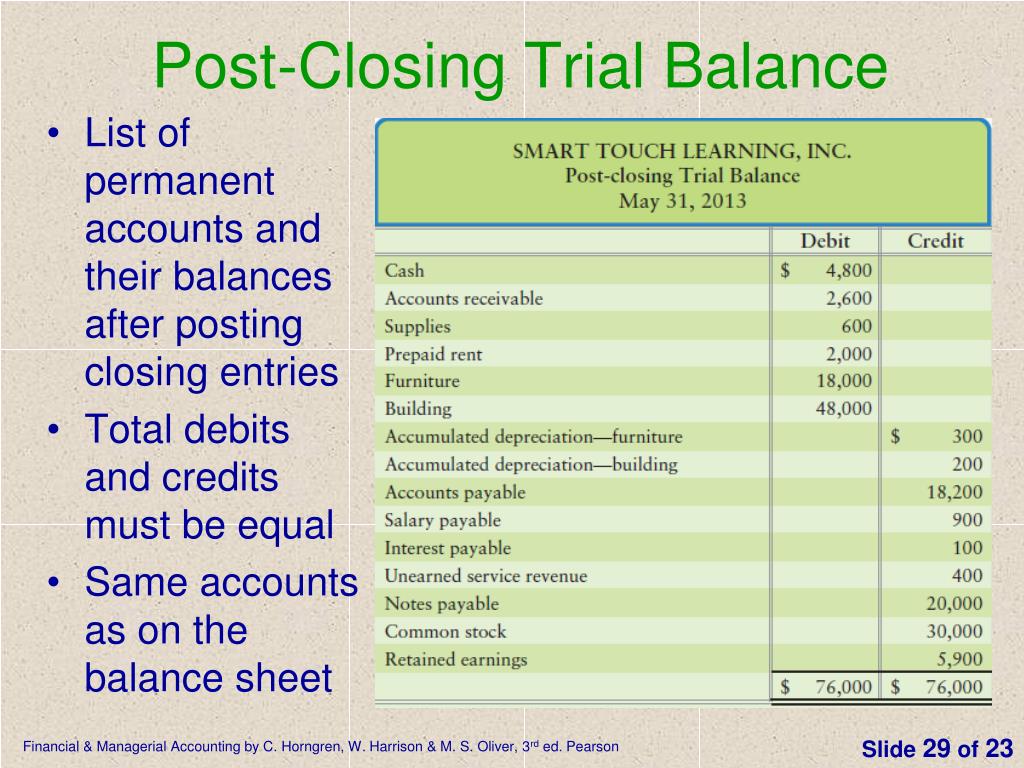

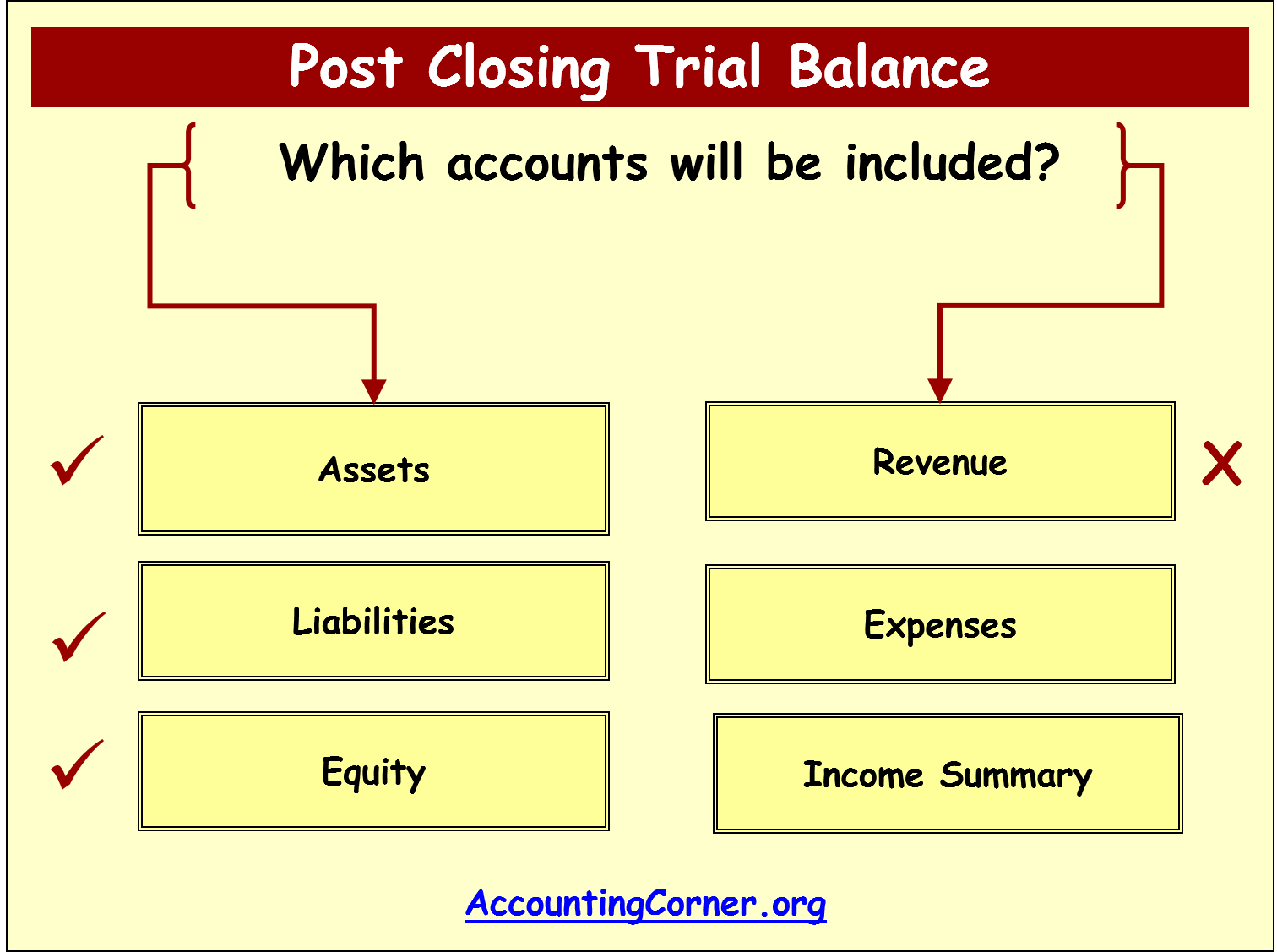

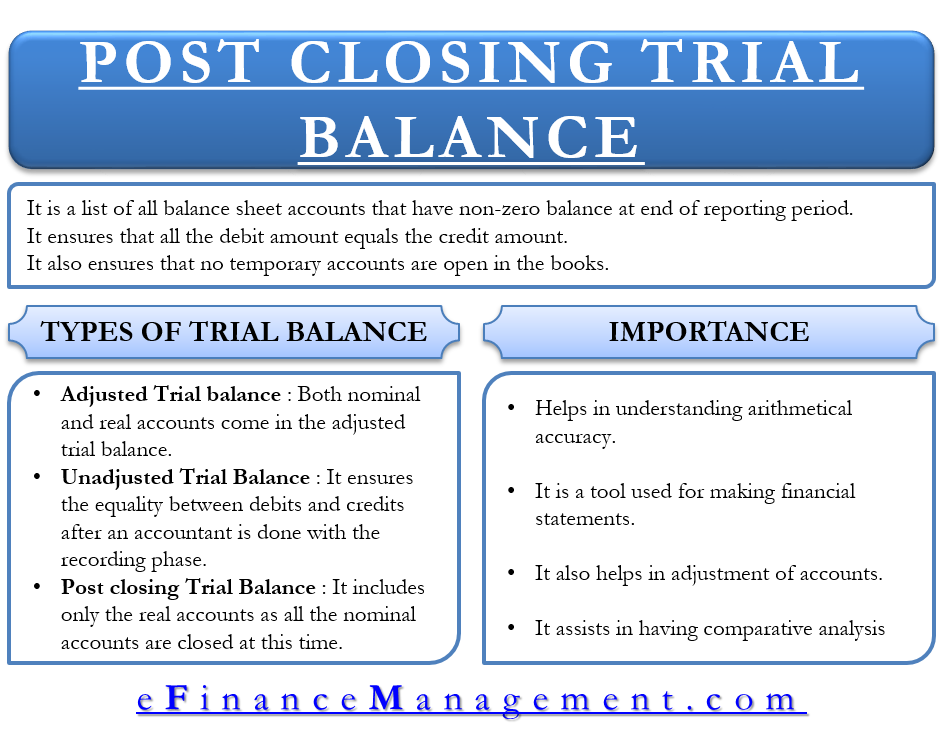

Preparing a post closing trial balance. You are preparing a trial balance after the closing entries are complete. It provides the openings balances for the ledger accounts of the new accounting period. These temporary accounts have already been closed and their balances moved into the retained earnings account as part of the closing process.

A post closing trial balance is comprised of permanent accounts and is produced after adjusting entries are posted, and the adjusted trial balance is prepared. Step 4, preparing an unadjusted trial balance; You are preparing a trial balance after the closing entries are complete.

Three types of trial balance 1. You are preparing a trial balance after the closing entries are complete. An post closing trial balance is formatted the same as the other trial balances in the accounting cycle.

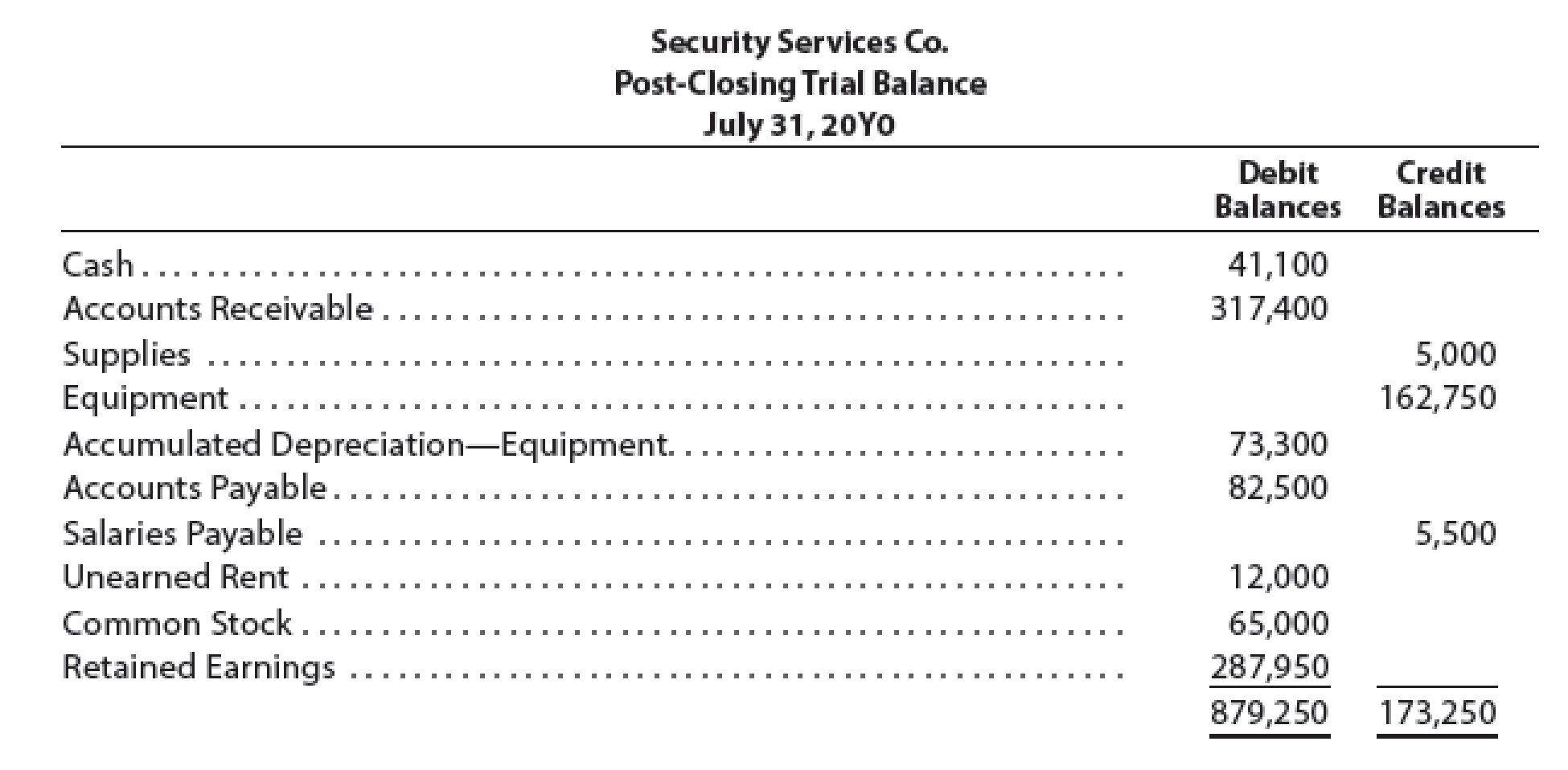

Post closing trial balance format. To unlock this lesson you must be a. It is a list of all the balance sheet accounts that do not have a zero balance.

It ensures that the sum of all debit and credit balances equals zero. There are several steps in the accounting cycle that require the preparation of a trial balance: Step 6, preparing an adjusted trial balance;

A trial balance is a list of all accounts in the general ledger that have nonzero balances. You are preparing a trial balance after the closing entries are complete. Posting accounts to the post closing trial balance follows the exact same procedures as preparing the other.

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. Both represent the summaries of ledger accounts of a business. The trial balance should have a net.

Note that for this step, we are considering our trial balance to be unadjusted, which means it includes accounts before they have been adjusted. Underneath, you'll include columns for account title, debit totals and credit amounts with a total of the debit and credit columns at the bottom.