Who Else Wants Info About The Financial Statement That Reports Revenues And Expenses

The net income from the income statement will be used in the statement of equity.

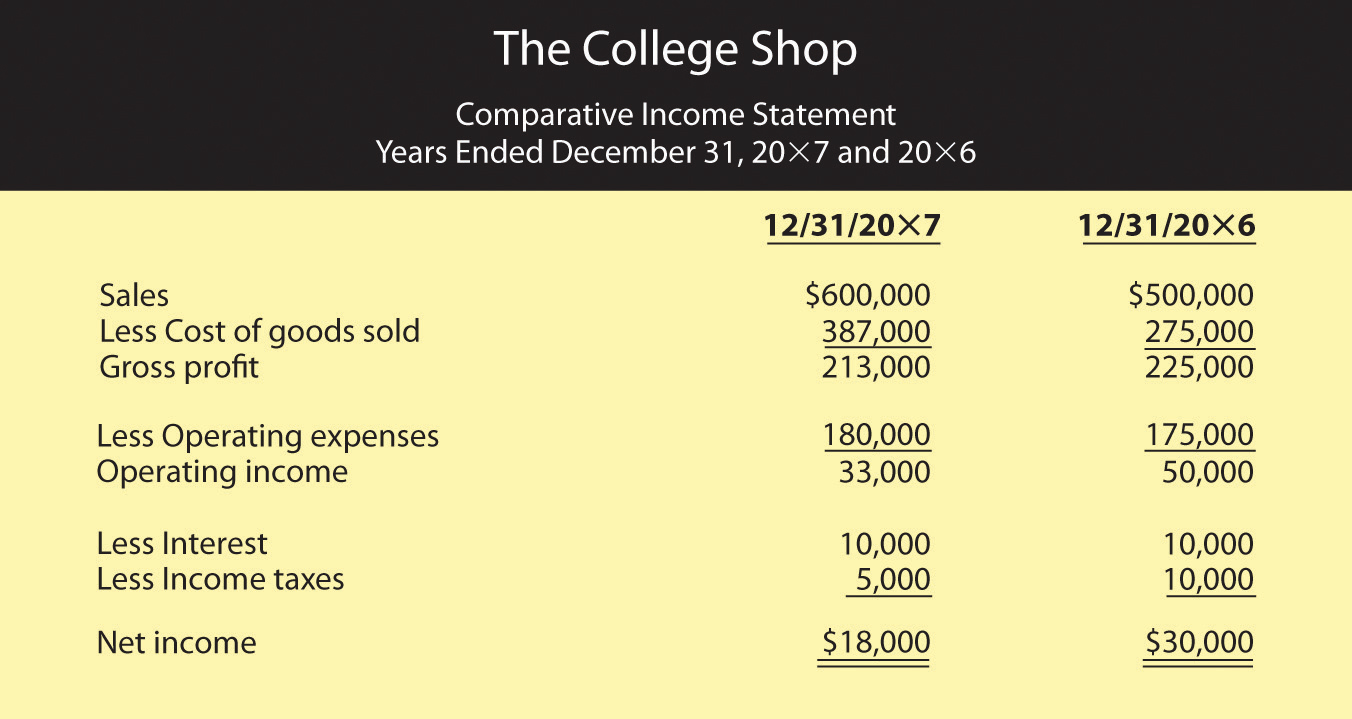

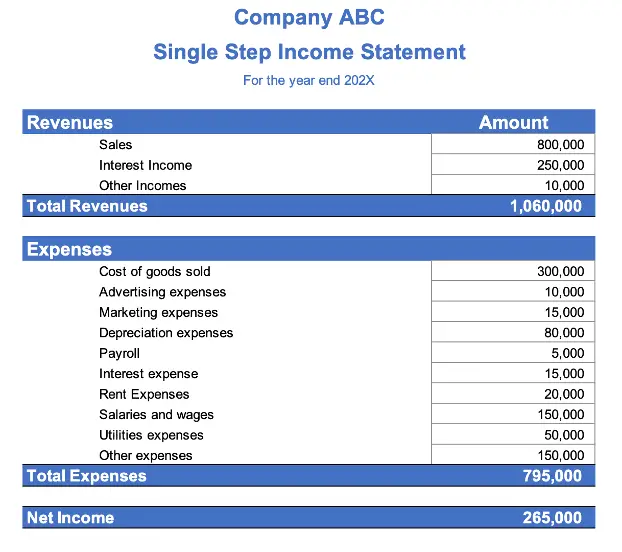

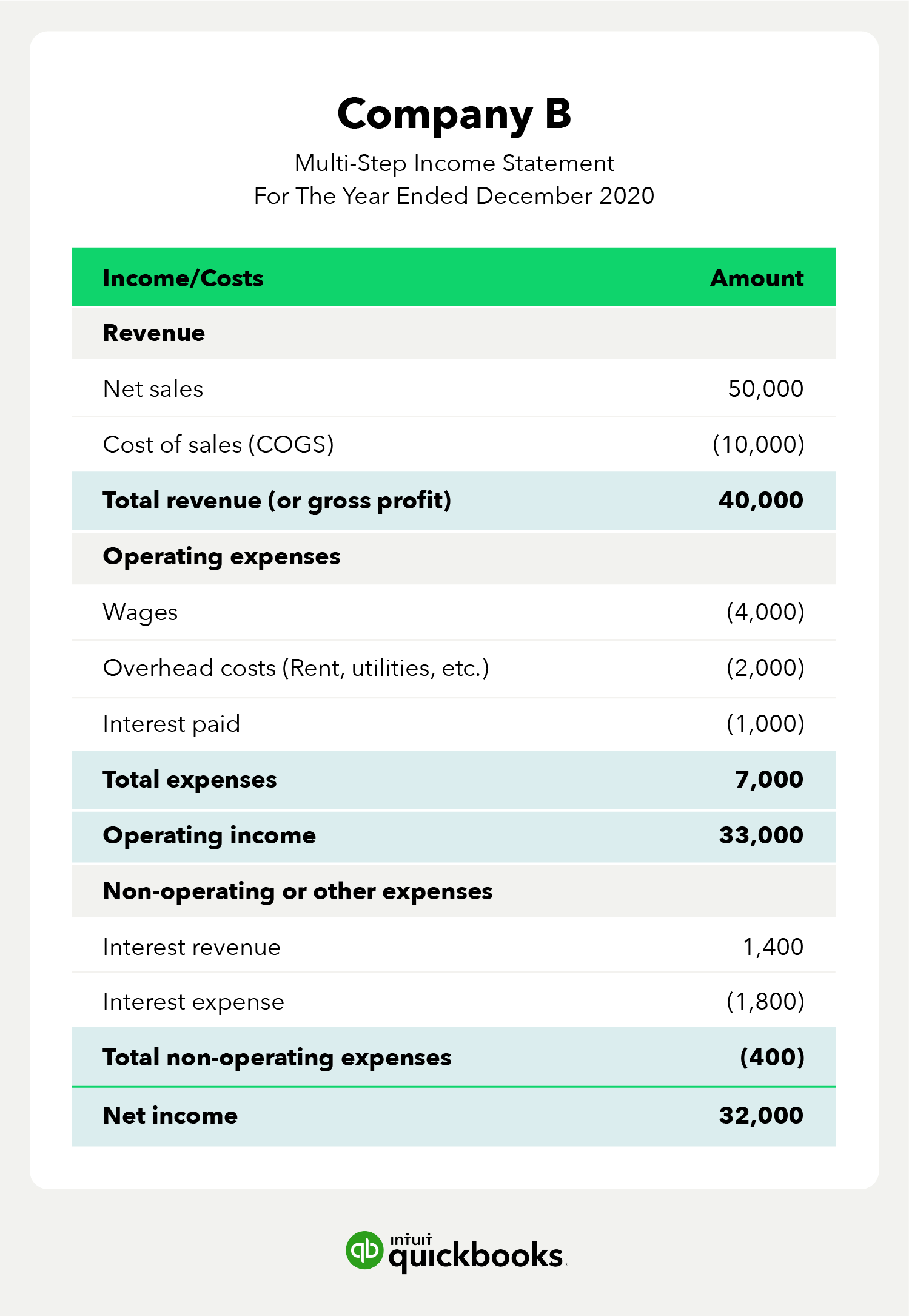

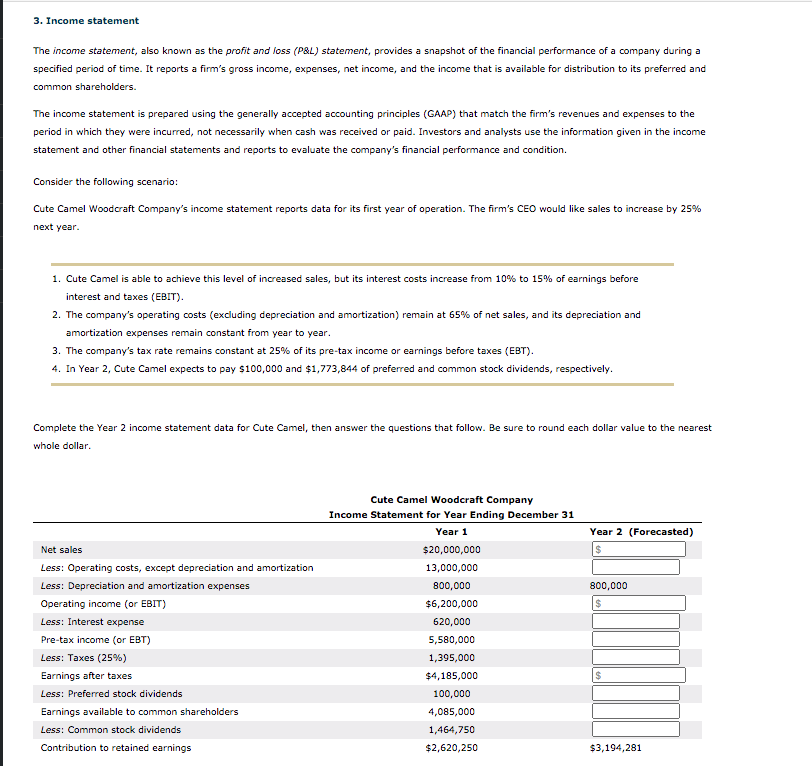

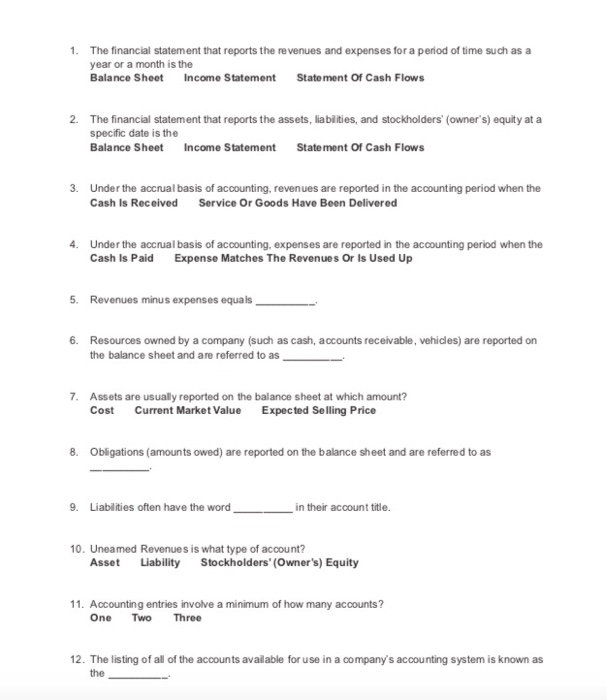

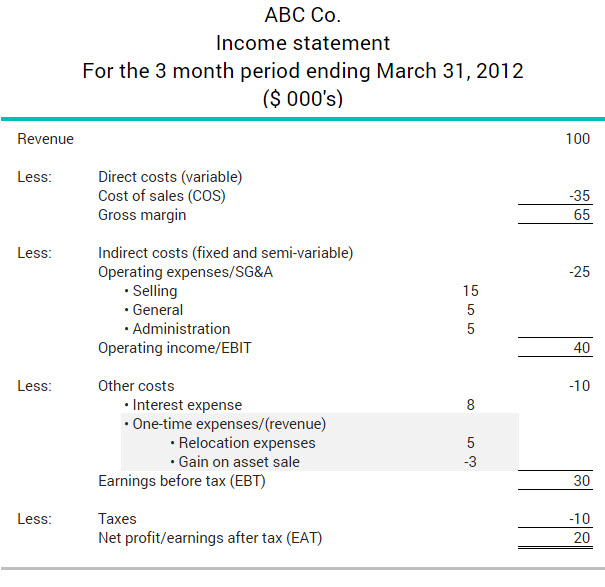

The financial statement that reports the revenues and expenses. This information included revenues, expenses, and profit or loss for the period. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The income statement the income statement the income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements.

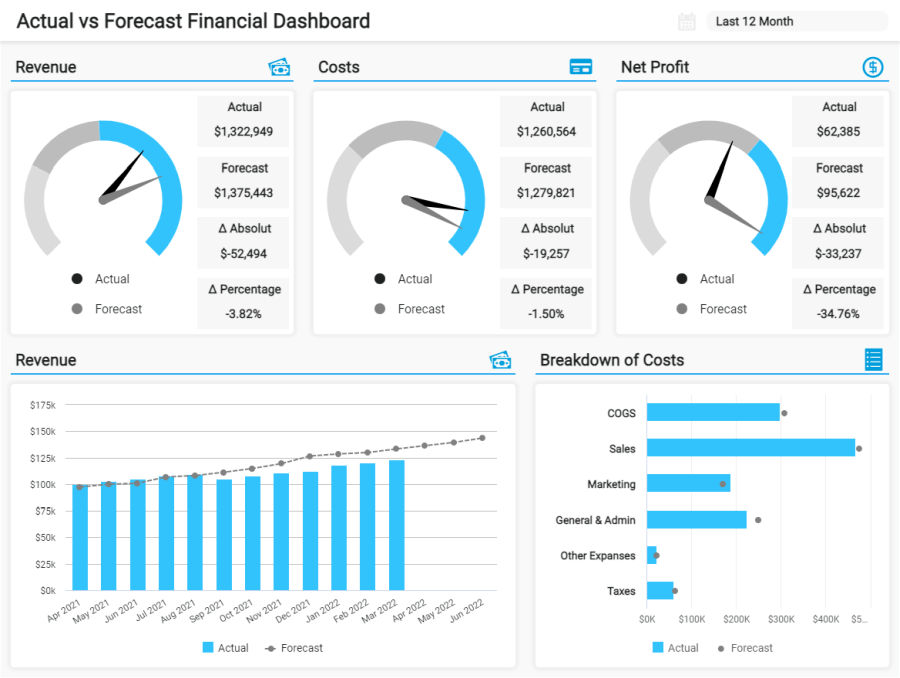

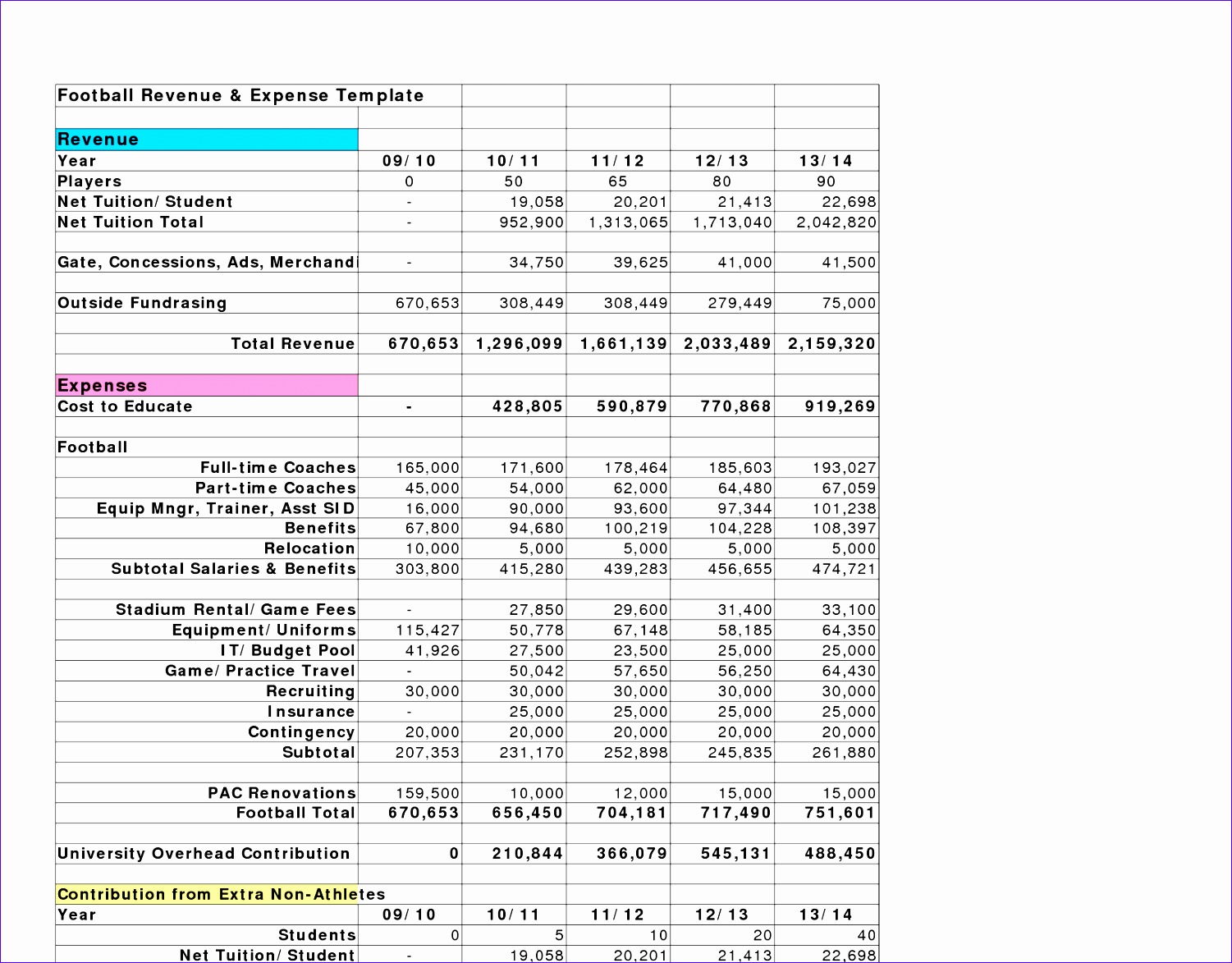

Income from operations of $652 million; The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period.

First up is the heading. Revenue is the value of all sales of goods and services recognized by a company in a period. The heading is important because that tells you three things:

It shows whether a company has made a profit or loss during that period. Therefore, always consult with accounting and tax professionals for. Net income is often called the earnings of the company.

Revenue (also referred to as sales or income) forms the beginning of a company’s income statement and is often considered the “top line” of a business. (enter only one word per blank.), the financial statement that reports revenues and expenses is the _____. Many companies publish these statements in annual reports , also.

These financial statements are formal reports providing information on a company’s financial position, cash inflows and outflows, and the results of operations. Which financial statement reports the revenues and expenses for a period of time such as a year or a month? The income statement is one of the financial statements of an entity that reports three main financial information of an entity for a specific period.

The statement of revenue and expenses has a defined format. An income statement doesn’t just show. The income statement primarily focuses on a company's revenues and expenses during a particular period.

After the entries through december 3 have been recorded, the balance sheet will look like this: It does not include any revenue or expenses from before or after that block of time. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

Expenses are deducted from a company’s revenue to arrive at its profit or net income. What are the three financial statements? The income statement relies on the matching principle in that it only reports revenue and expenses in a specified window of time.

Statement of cash flows statement of retained earnings balance sheet income statement, on may 1, cut above, inc. Once expenses are subtracted from revenues, the statement produces a company's. Balance sheet income statement statement of cash flows 2.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)