Exemplary Info About Dividends Paid Cash Flow From Financing Activities

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a.

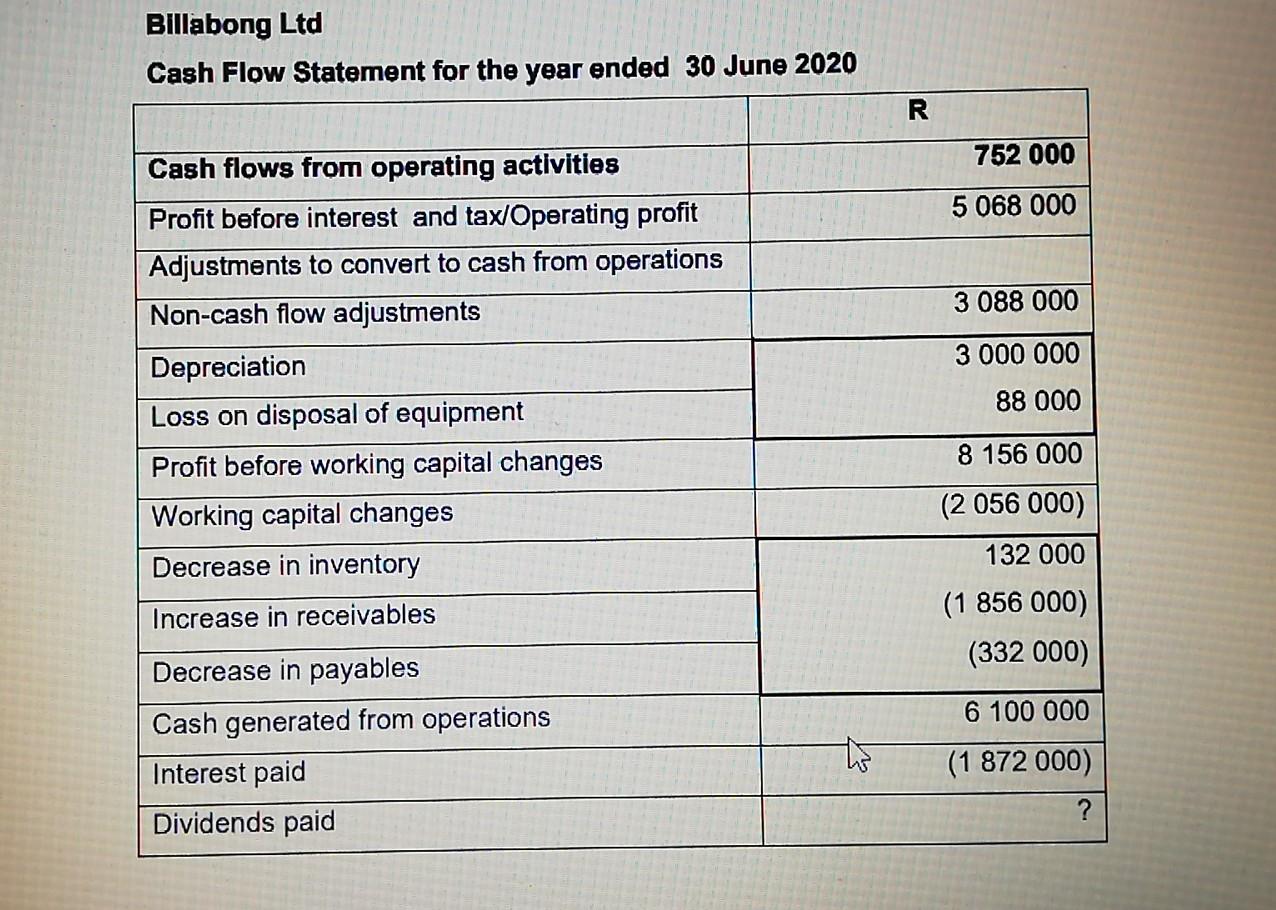

Dividends paid cash flow from financing activities. Finance document from university of south africa, 2 pages, summary group statement of cash flows for. Interest and dividends received and paid may be classified as operating, investing, or financing cash flows, provided that they are classified consistently from. Cash flow from financing activities definition.

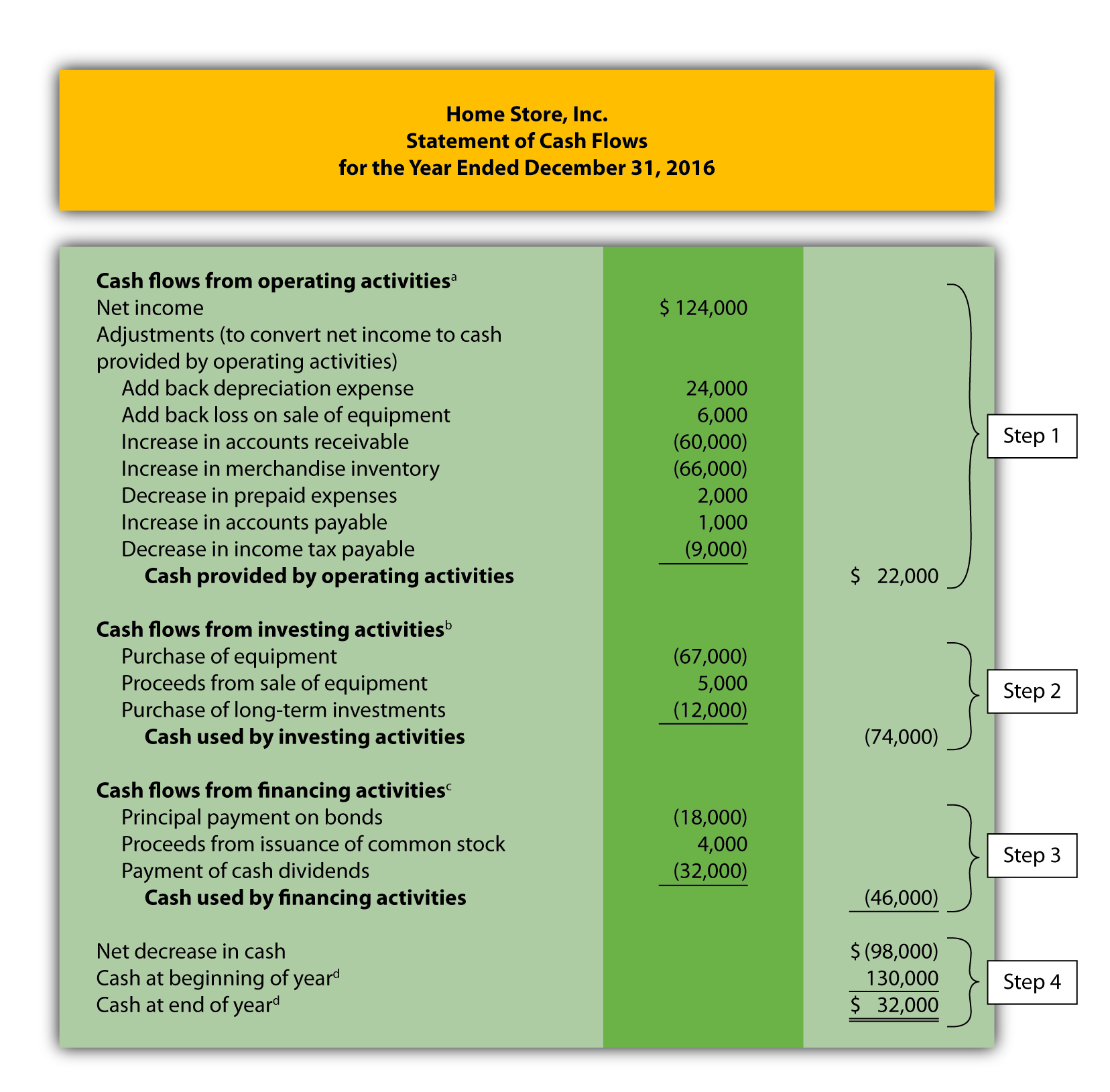

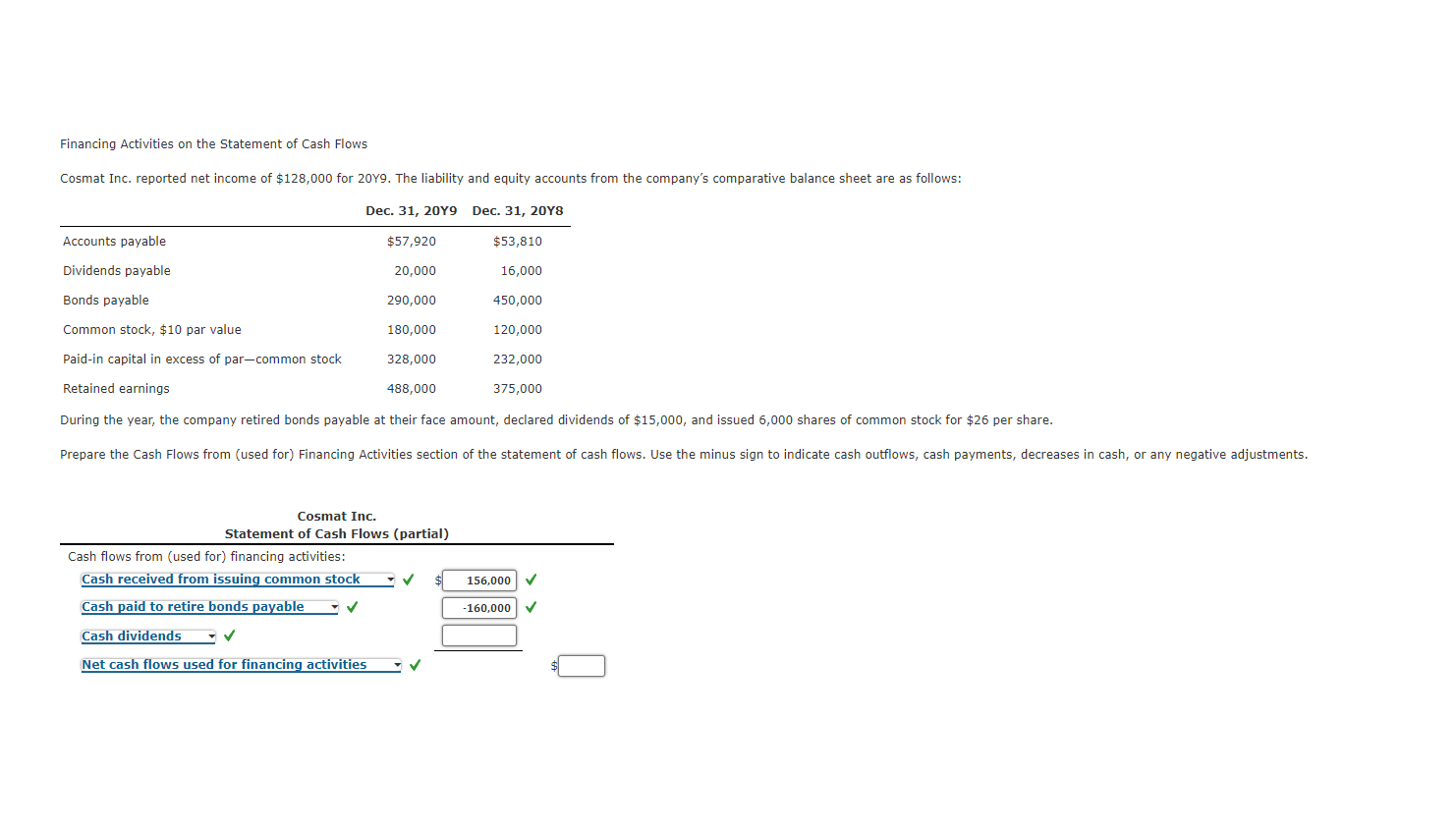

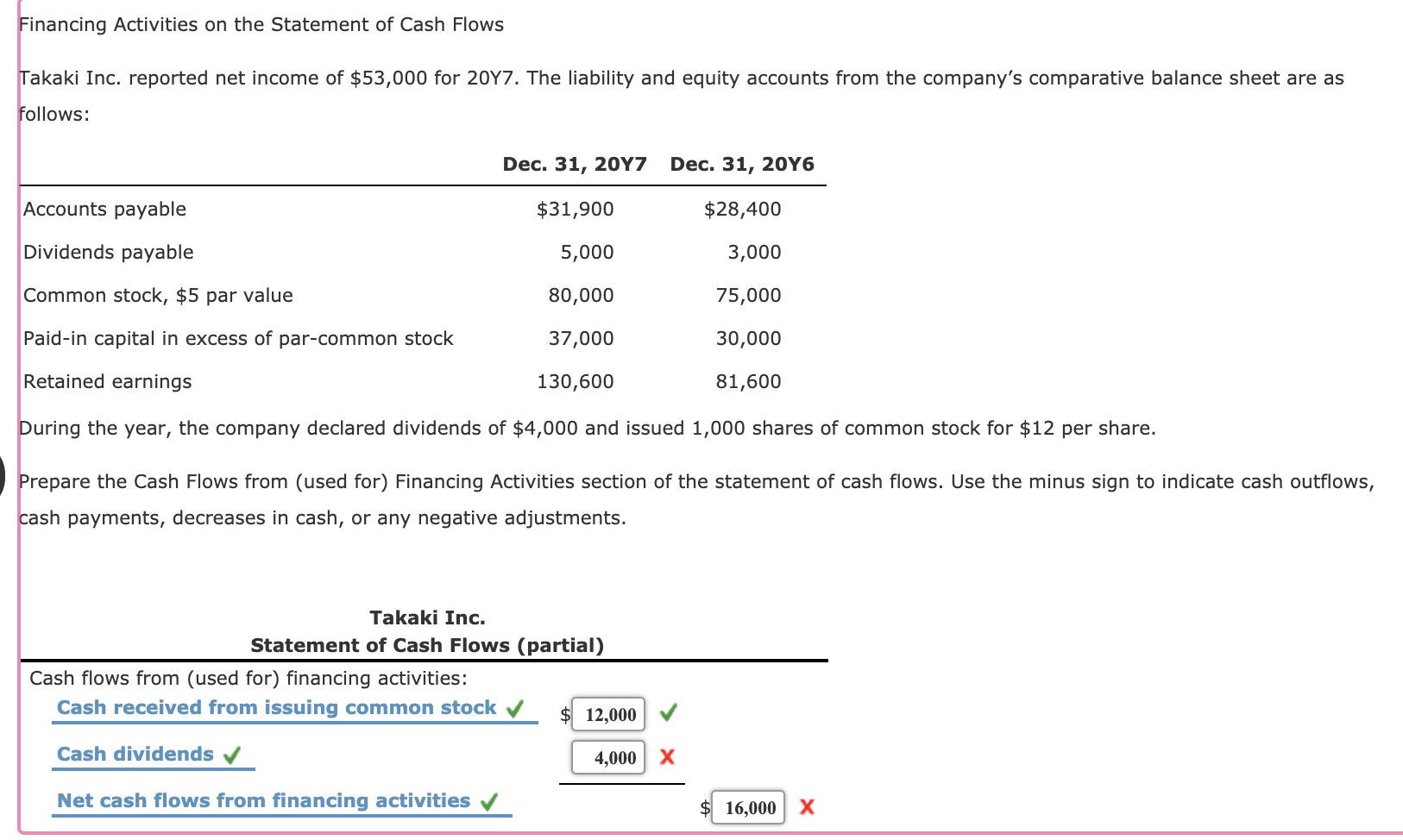

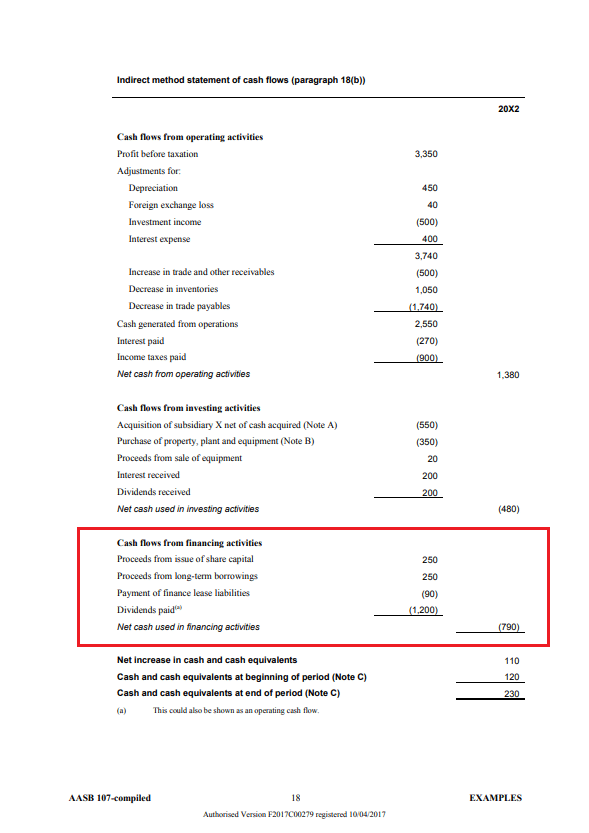

Dividends paid to shareholders may be classed as financing activities (as shown in the illustrative cash flow statement above) because they are a cost of. Cash flow from financing activities tracks the net change in cash related to raising capital (e.g. Cash flow from financing activities.

Uploaded by ministermoonfly30 on coursehero.com. Dividends paid may be classified as a financing cash flow because they are a cost of obtaining financial resources. Finance activities include the issuance and repayment of equity,.

Cash flows from financing activities: (b) cash flows arising from interest paid that is capitalised as part of the cost of an asset should be classified as financing cash flows;. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

Cash flow from financing activities provides investors with insight into. Equity, debt), share repurchases, dividends, and repayment of. Dividends paid are required to be classified in the financing section of the cash flow statement and interest paid (and expensed), interest received, and dividends received.

Cash flow from financing activities is a subsection of a company’s cash flow statement that illustrates the amount. Financing activities include transactions involving debt, equity, and dividends. Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows.

As stated above, cash flow from financing activities describes the money your business generates from financing. Cash flow from financing activities is the net amount of funding a company generates in a given time period. The cash flow from the financing activities section shows cash flows from issuing and paying off outside financing, such as stock and debt, and from paying.

Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital. As retained earnings are linked to the net income from the income statement.

It is not a part of financing activities. Classified as financing cash flows; Cash flow that arises from financing activities is known to.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)