Can’t-Miss Takeaways Of Tips About Income Statement Balance Sheet And Cash Flow

Most analysts start their financial statement analysis with the income statement.

Income statement balance sheet and cash flow. View tevogen bio's (nasdaq:tvgn) latest financials, balance sheet, income statement, cash flow statement, and 10k report at marketbeat. (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. This question hasn't been solved yet!

Lenders may want to evaluate both along with the cash flow statement you create from them as part of their funding decision. Table of contents what are financial statements? Understanding your financial statements is one of the keys to business success and yet most small business owners don't.

Net income & retained earnings. These statements are a crucial part of any annual report of a company. View flame acquisition's (nyse:soc) latest financials, balance sheet, income statement, cash flow statement, and 10k report at marketbeat.

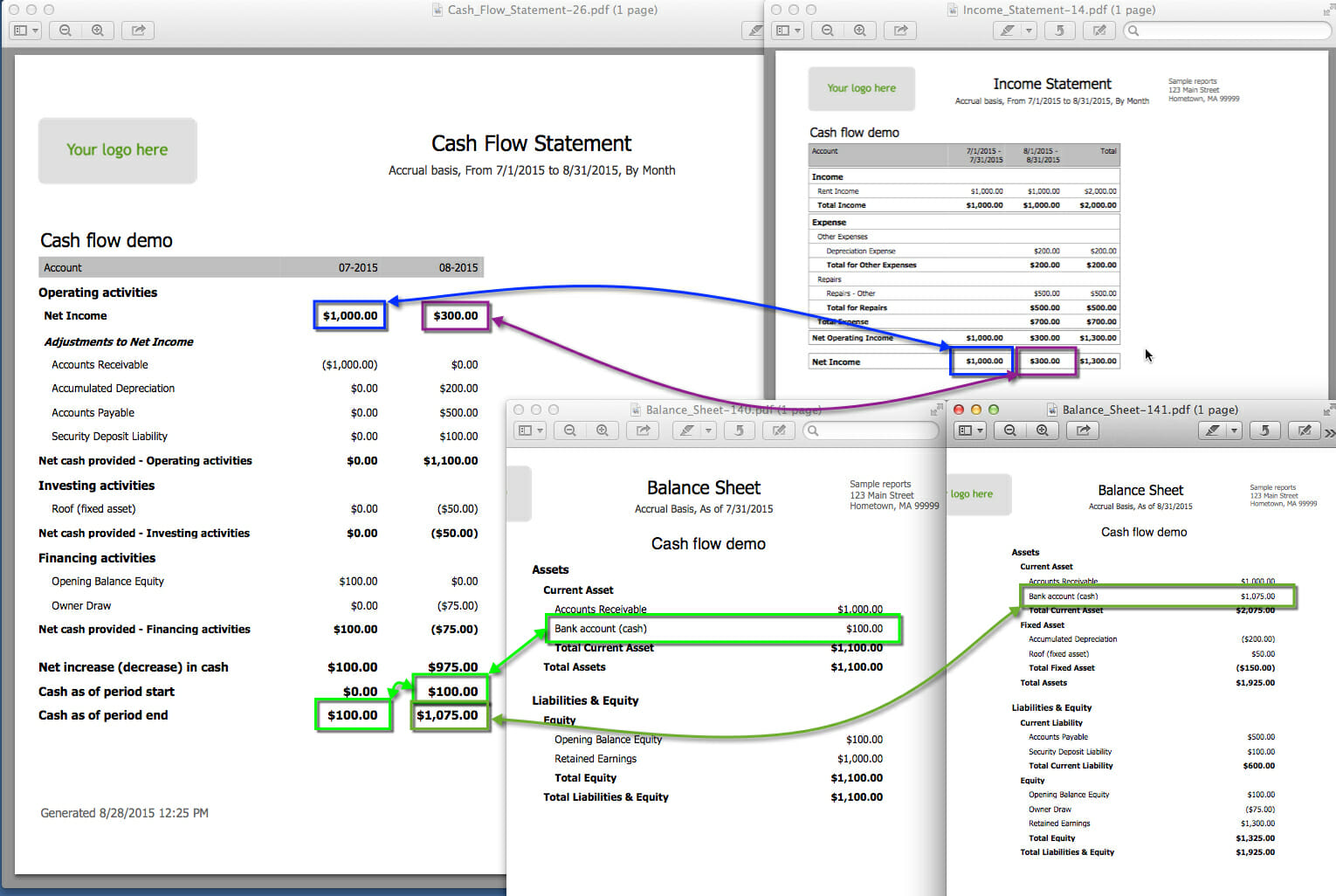

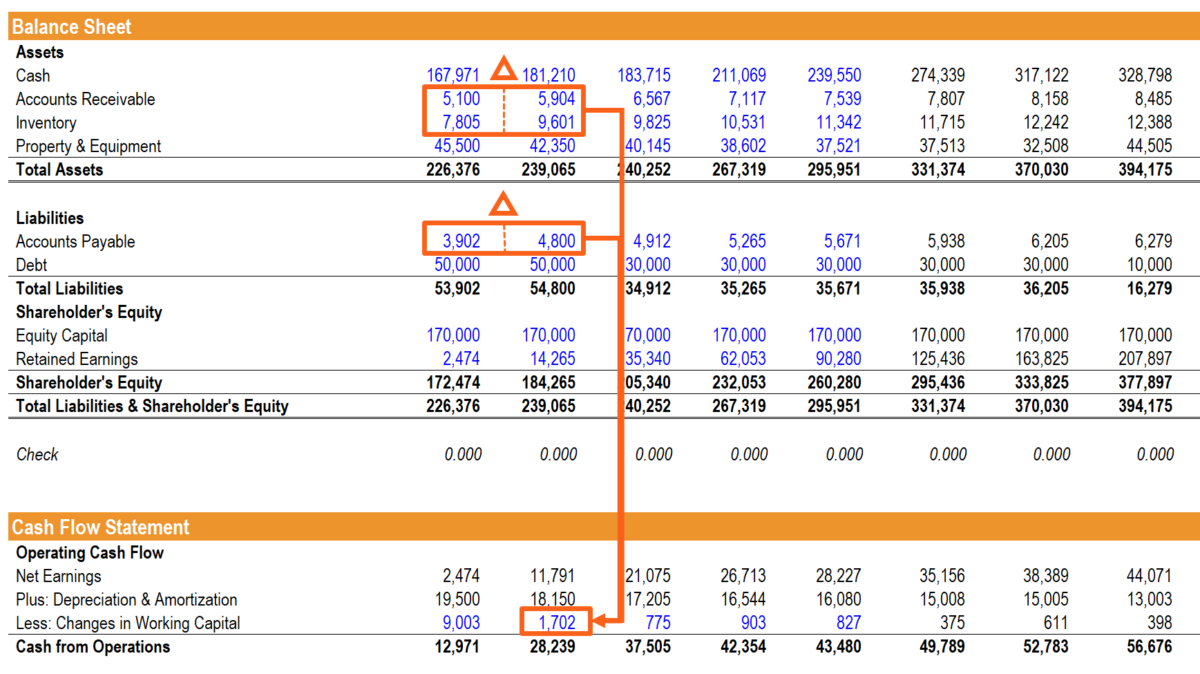

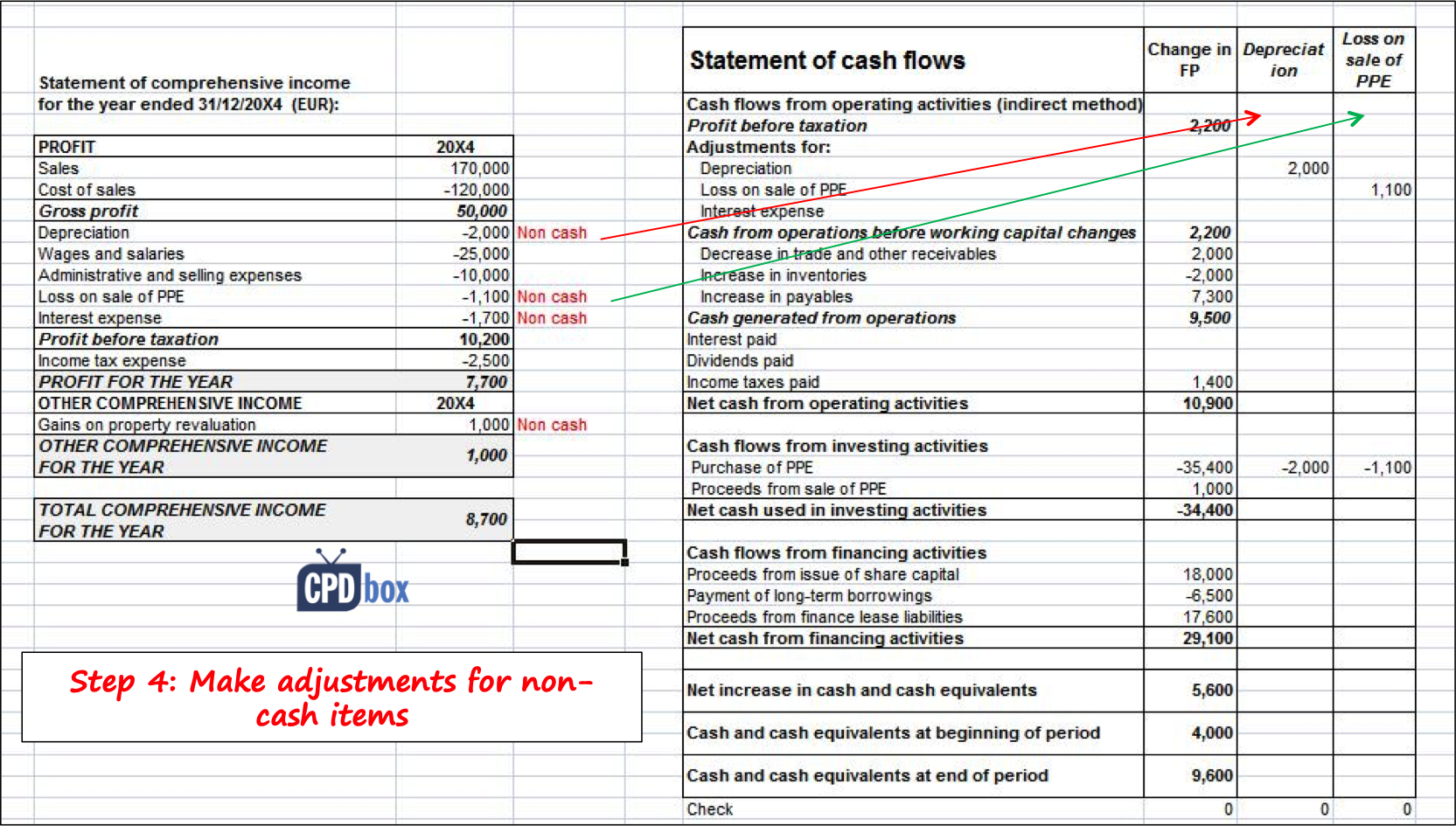

Net income from the bottom of the income statement links to the balance sheet and cash flow statement. Income statement (is), balance sheet (bs), statement of stockholders' equity (se), or statement of cash flows (scf). Now we can see the full flow of information from the income statement to the statement of retained earnings (figure 5.10) and finally to the balance sheet.clear lake’s net income flows from the income statement into retained earnings, which is reflected on the statement of retained earnings.

How to read business reports. The three financial statements are: How to create a cash flow statement.

Need balance sheet, income statement and cash flow utilizing these numbers. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: 2.3 prepare an income statement,.

The balance sheet shows what a business has and owes at any moment. Balance sheet, income statement, and cash flow statement. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

By looking at all three documents, you can analyze the company’s performance from different angles. The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts. The value of these documents lies in the story they tell when reviewed together.

The cash flow statement shows the actual cash going in and out of the business. Not what you’re looking for? Export data to excel for your own analysis.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Export data to excel for your own analysis. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial.