Top Notch Info About Does A Trial Balance Have To

As of december 31, 202x.

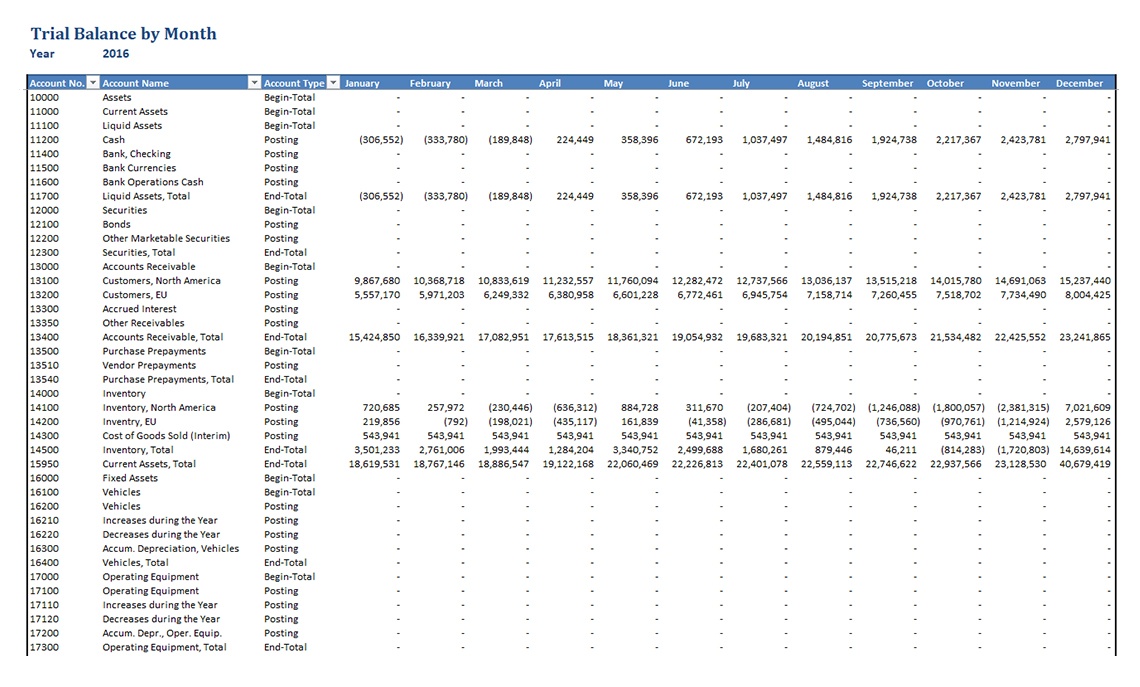

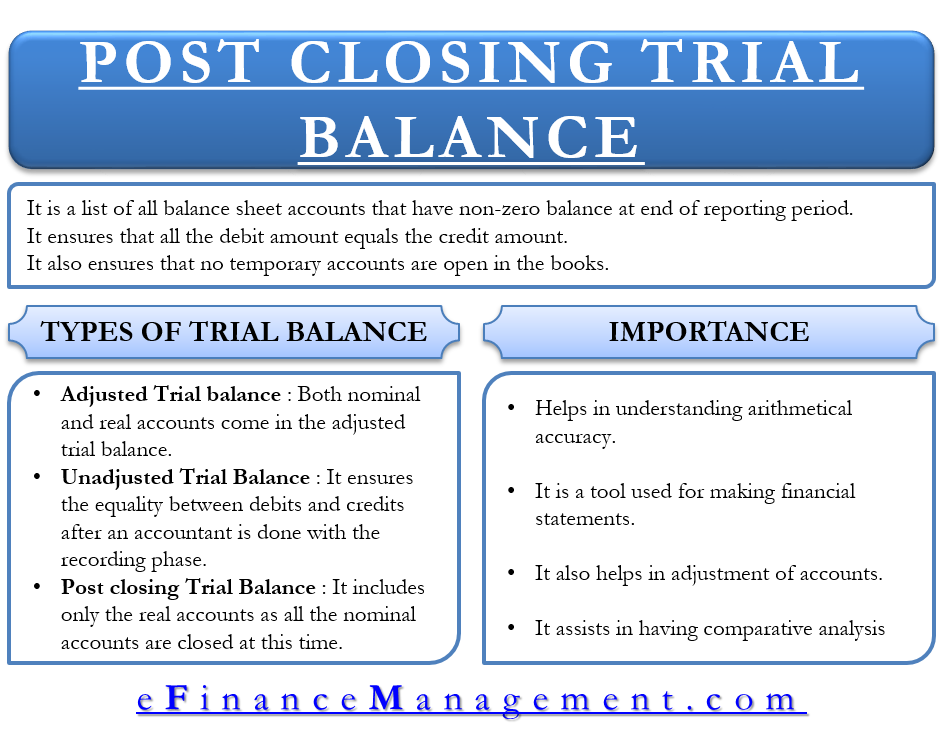

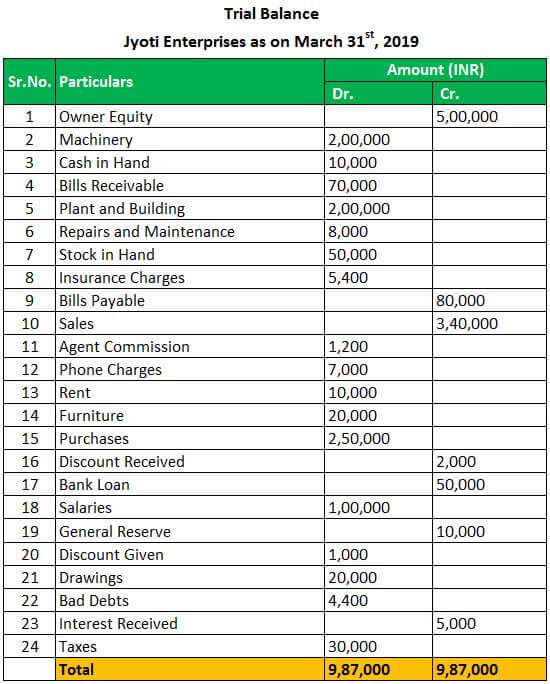

Does a trial balance have to balance. Does a business have to use a trial balance? Creating a trial balance is the first step in closing the books at the end of an accounting period. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

It can also be used to keep track of a business’s financial position since the balances of all the different accounts is recorded in one place. Judge arthur f. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Hopefully, this will give you some help when it comes to studying trial balances. The following are the steps to take when preparing a trial balance for your business: During the accounting close process, check that the trial balance line items are included in the general ledger.

All the ledger accounts (from your chart of accounts) are listed on the left side of the report. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. No, a business doesn’t need to use a trial balance, but it should.

A trial balance typically includes five elements: For example, accounts payable should have a credit balance, and accounts receivable should have a debit balance. However, this does not mean that there.

This is something that needs to be done once a year. Chad daybell’s attorney files a motion to delay trial based on new evidence. The trial balance is a useful tool that helps accountants check their work.

A balance sheet is created to show the right picture of financial affairs to the stakeholders. Engoron attends the trump organization civil fraud trial in new york in november 2023. No, a business doesn’t need to use a trial balance, but it should.

Trial balances are most commonly prepared at the end of an accounting period. The ruling marks the end of a protracted and bitter civil lawsuit and represents a potentially devastating blow to the trump organization, which could damage his brand, bank balance and business. Defining the term your trial balance is comprised of the results of stocktaking.

That means the amount i was supposed to get as per the contract would have gone up. The total of both should be equal. A trial balance is created to ensure the accuracy of financial affairs.

Start 14 days free trial. Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their balances, where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. However, it’s still helpful to scan the trial balance for any obvious bookkeeping errors that may appear as odd account balances.