Unique Info About Ledger And Trial Balance Format Of A Sheet In Accounting

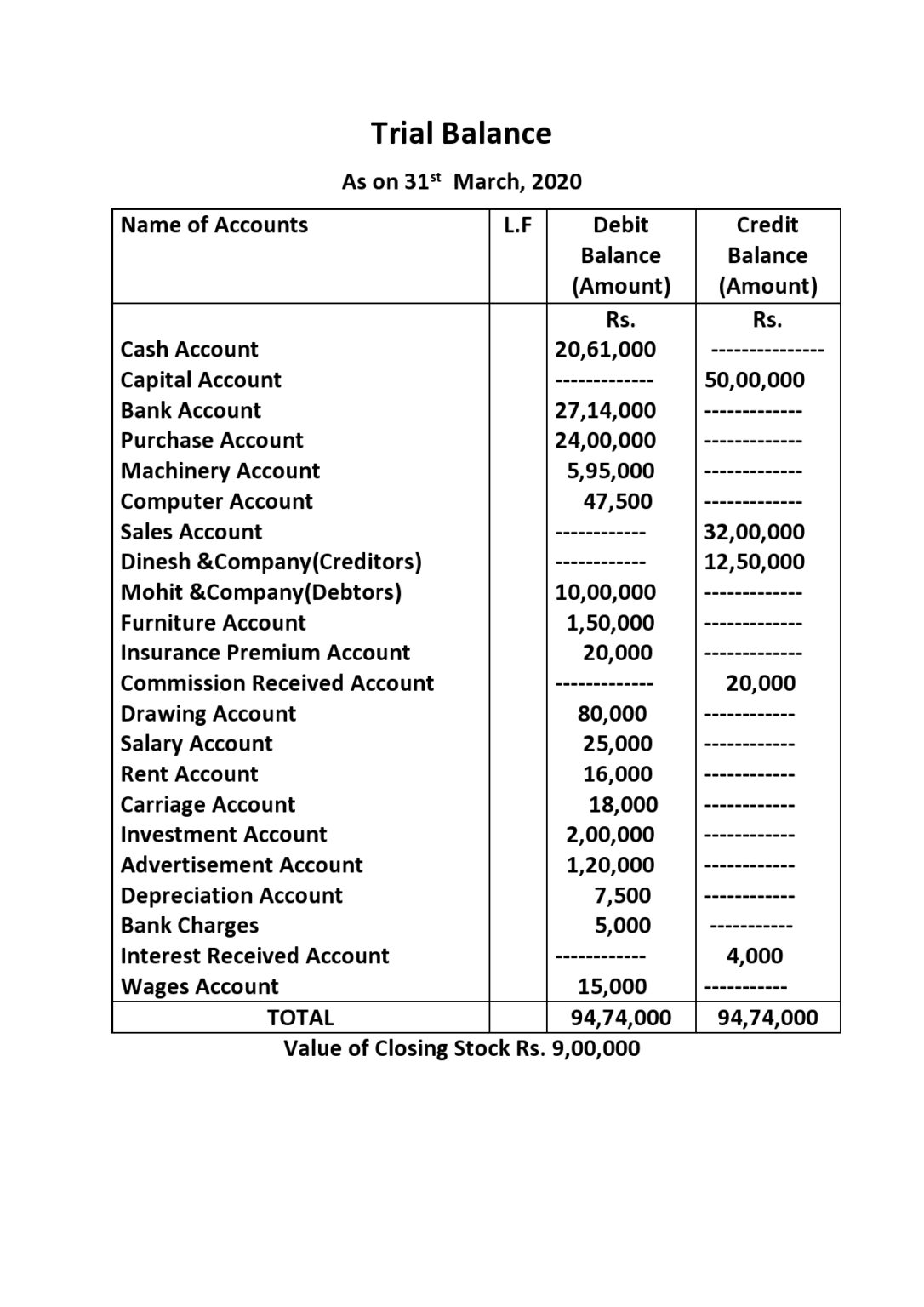

A trial balance is a listing of all accounts and their balances at a specific point in time.

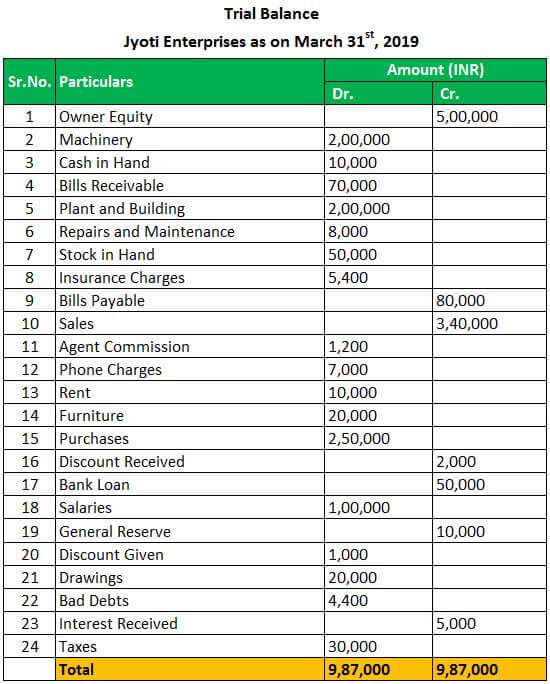

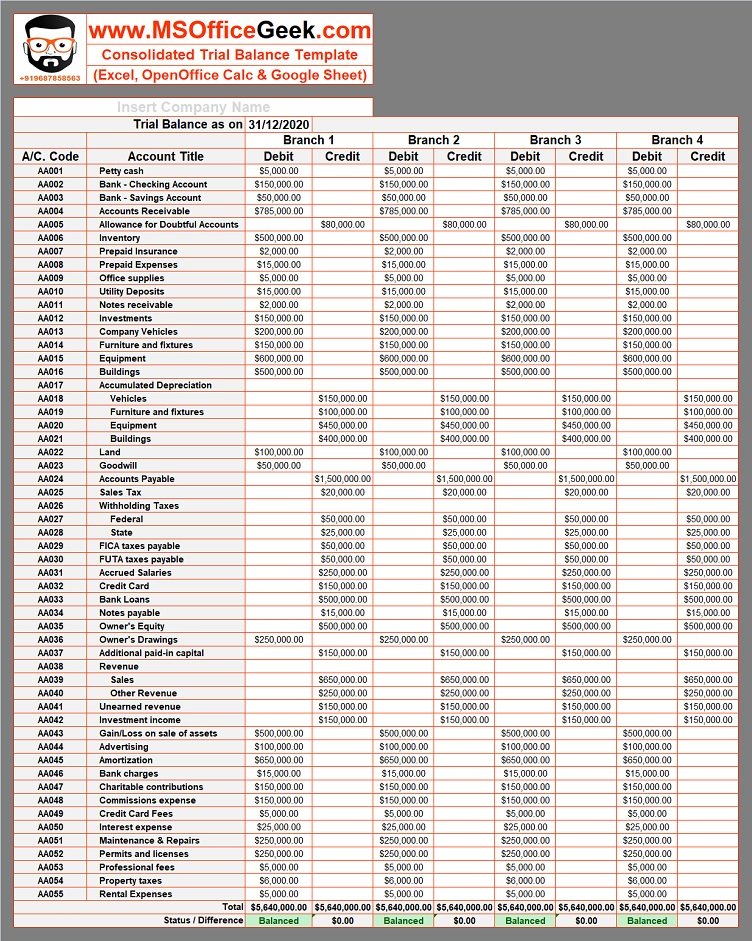

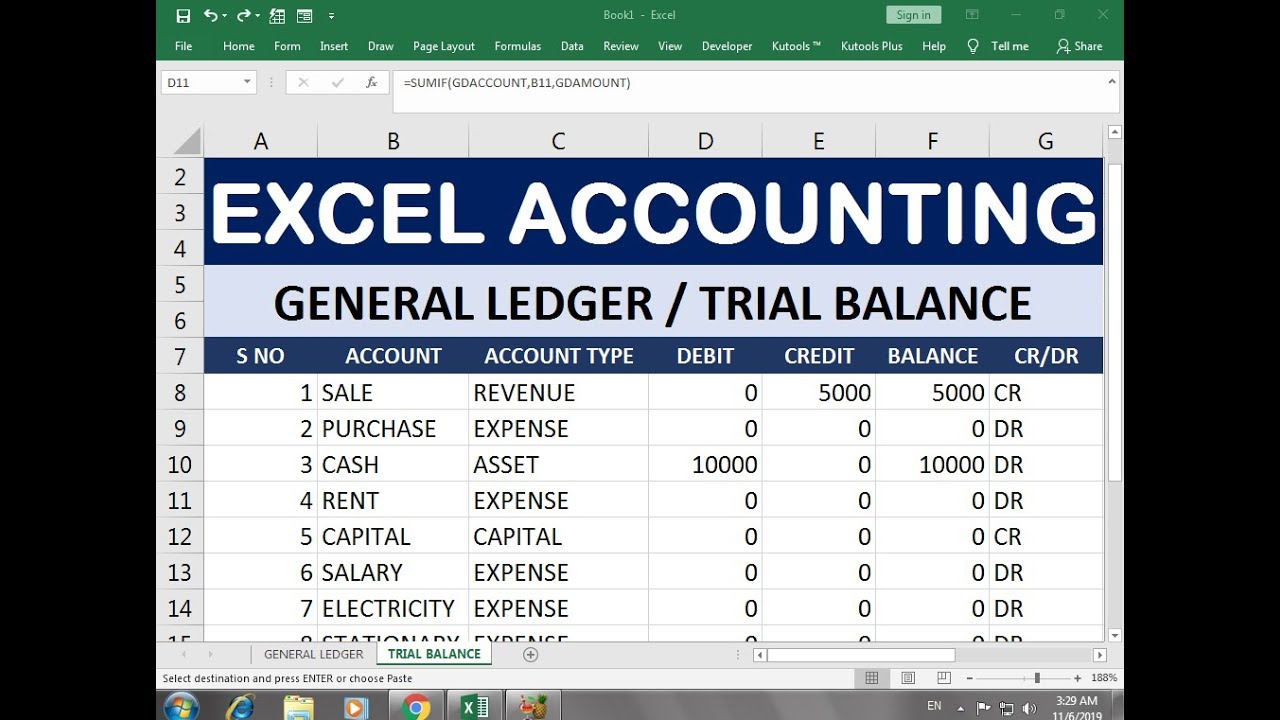

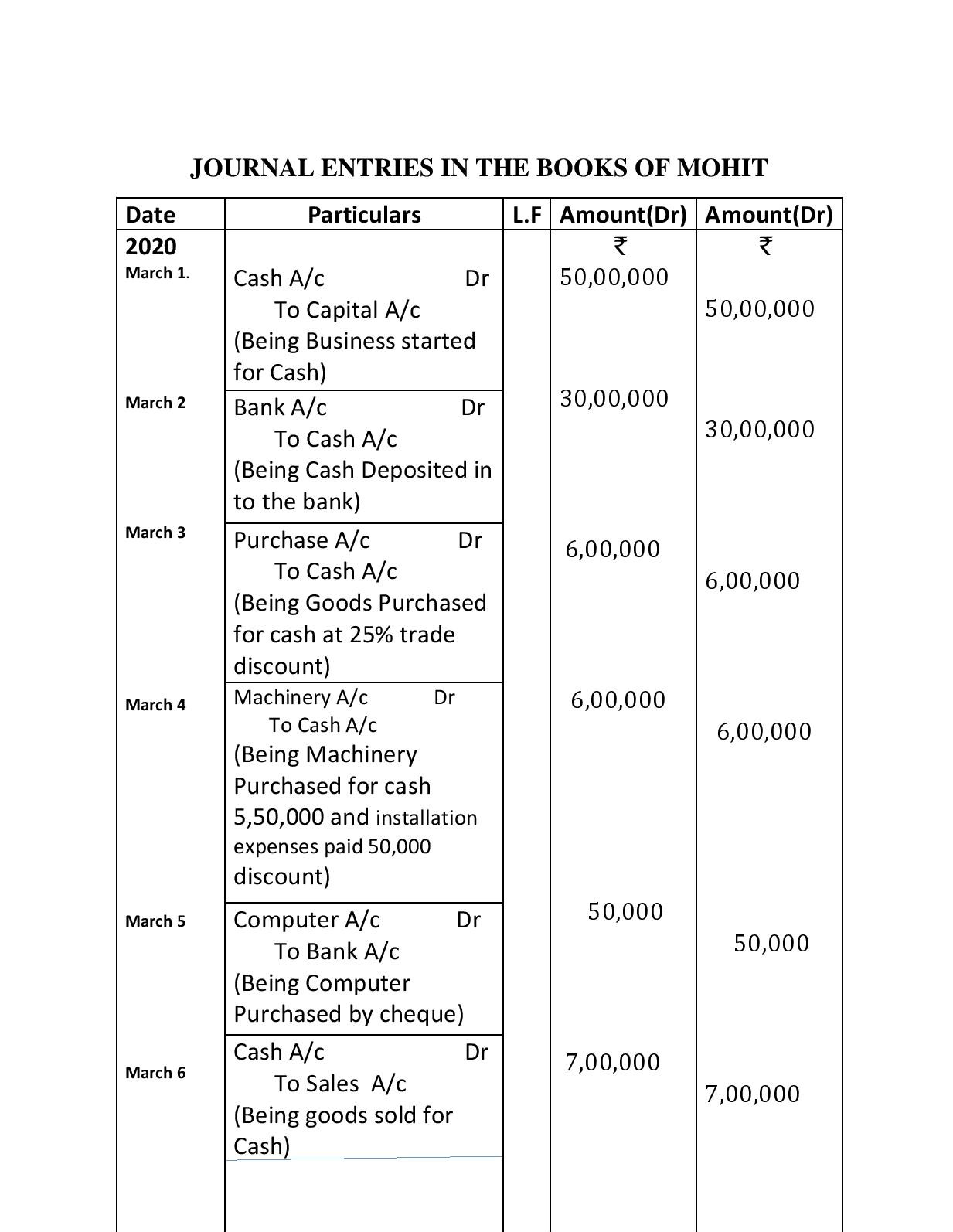

Ledger and trial balance format of a balance sheet in accounting. It lists the titles of all the accounts in a business’ general ledger in a column on the left, followed by the debit or credit balance of each account. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Ledger 6.1 points to be noted in the ledger 6.2 distinction between journal and ledger 6.3 ledger posting 6.4 balancing.

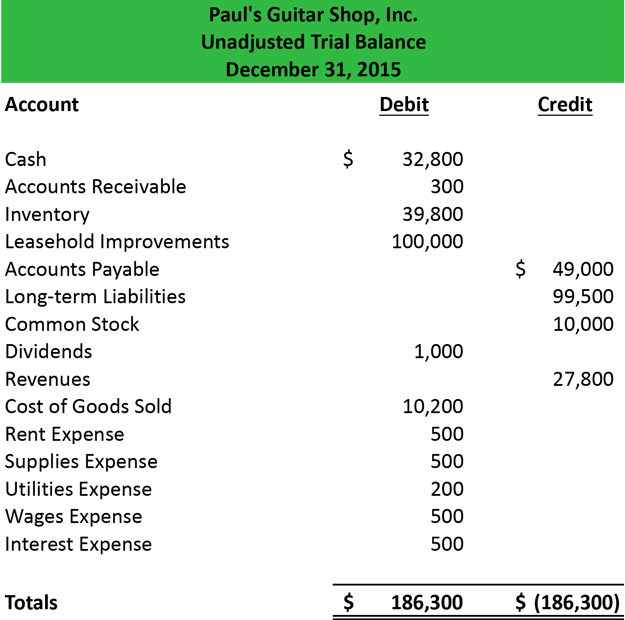

The trial balance is divided between debit and credit. A balance sheet is divided into assets, liabilities, and shareholders’ equity. At the end of a particular accounting period, a trial balance is prepared in a separate sheet of prescribed form recording debit ledger balance, in the debit column and credit ledger balances in the credit money column.

The chart of accounts is a listing of the titles and numbers of all the accounts in the ledger. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts. A company prepares their trial balance at the end of the financial year.

Journal 4.1 recording in journal 4.2 types of accounts 4.3 nominal account v. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. The trial balance is an accounting report or worksheet, mostly for internal use, listing each of the accounts from the general ledger together with their closing balances (debit or credit).

A trial balance is a statement that gives a report of the final debit or credit balances of all ledger accounts in an organisation. A balanced trial balance ascertains the arithmetical accuracy of financial records. This trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first five steps in the cycle.

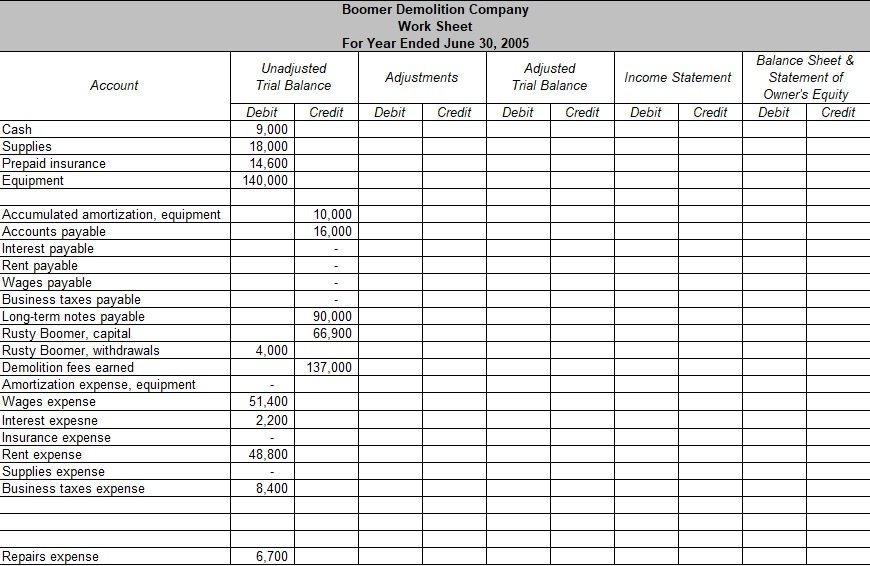

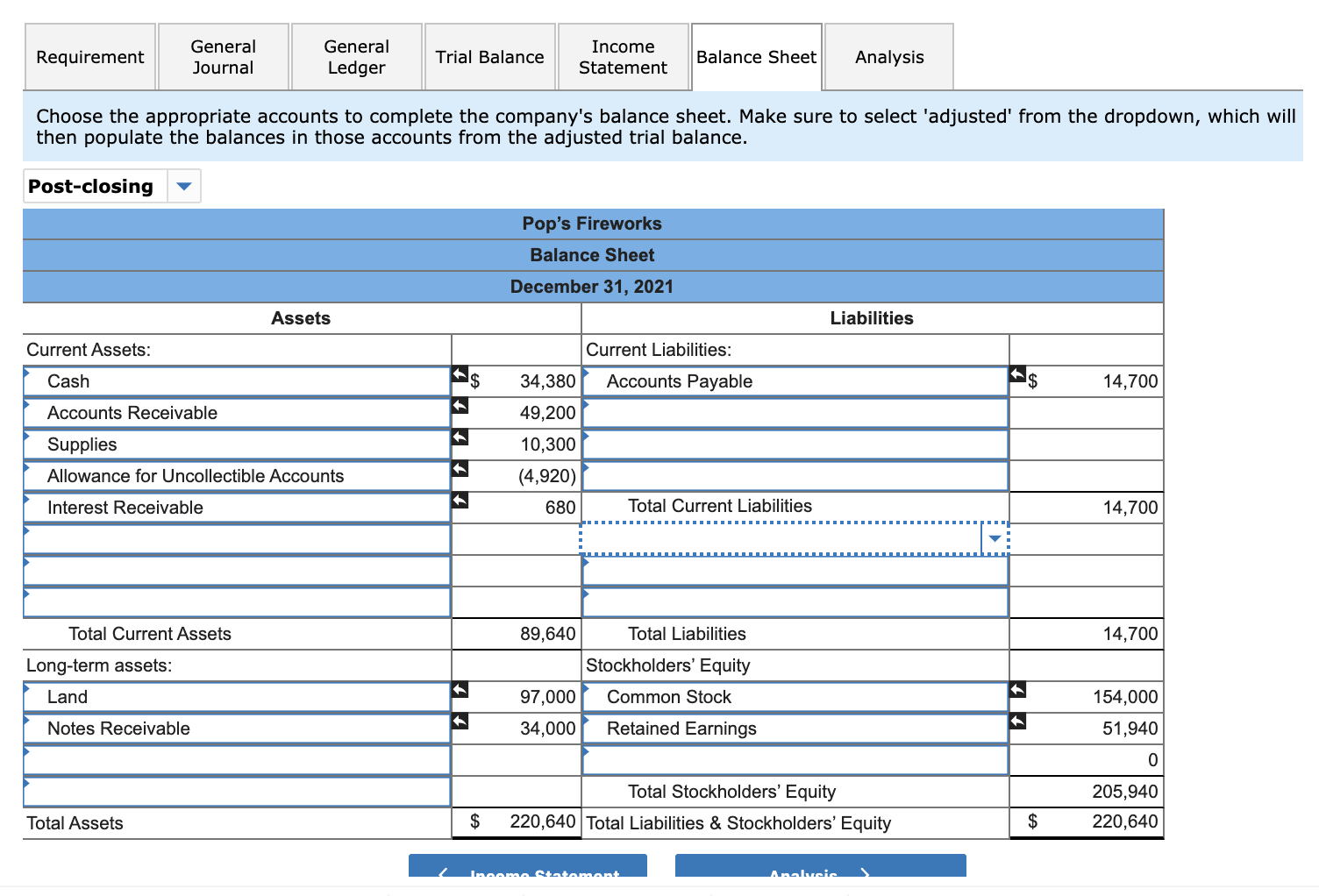

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Trial balance and balance sheet. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and. The chart of accounts can be compared to a table of contents. As we know, the trial balance is the report of accounting in which ending balances of a different general ledger are presented into the debit/credit column as per their balances where debit amounts are listed on the debit column, and.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The trial balance is an internal statement for use within the company. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet.

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. A company prepares a trial balance. A trial balance is a worksheet that lists all general ledger ending account balances into two columns either a debit or a credit.

Steps in accounting process 3. Assets = liabilities + shareholders’. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.