Smart Tips About Accrued Salaries Balance Sheet Schedule 3 Of Companies Act 2013 Format

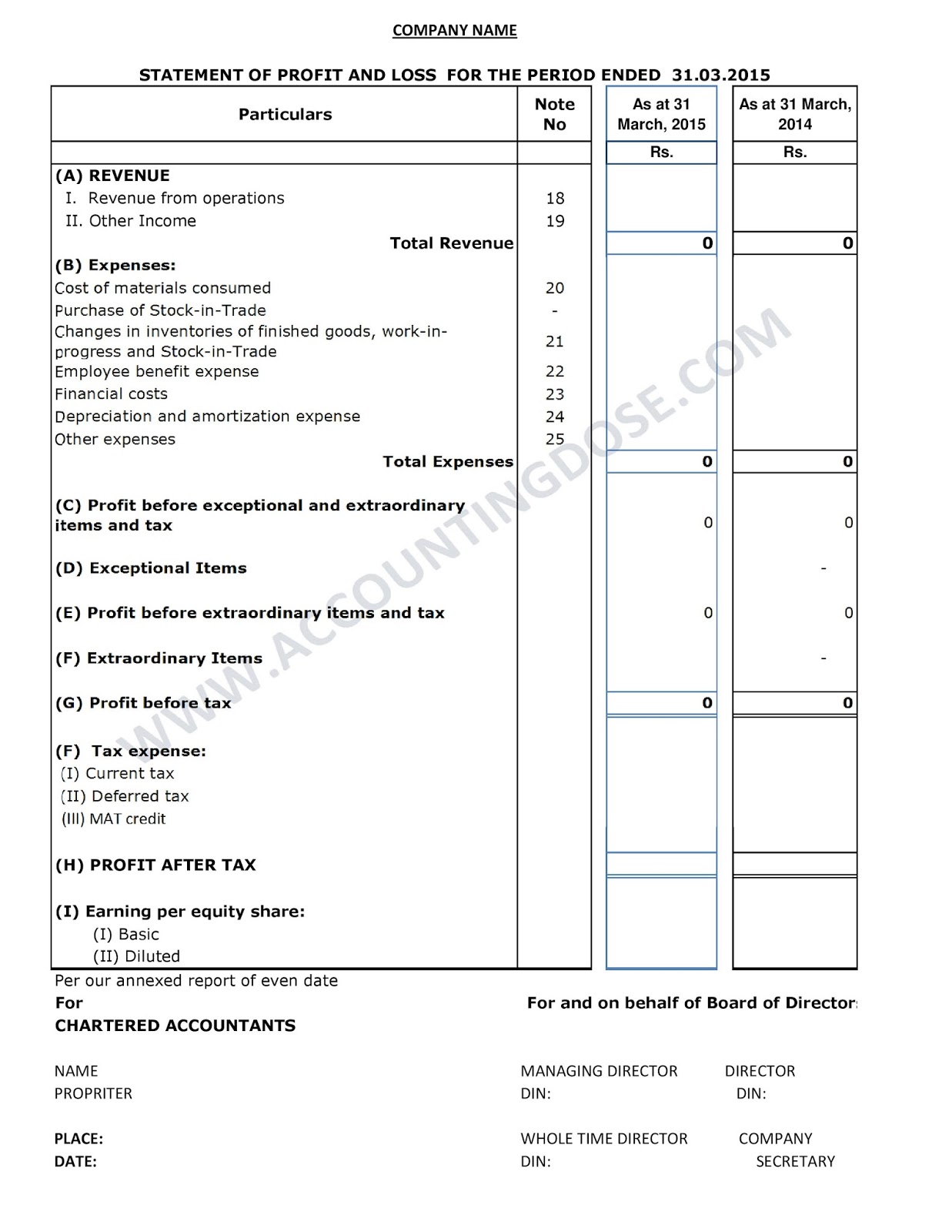

The guidance note provides guidance on each of the item of the balance sheet, statement.

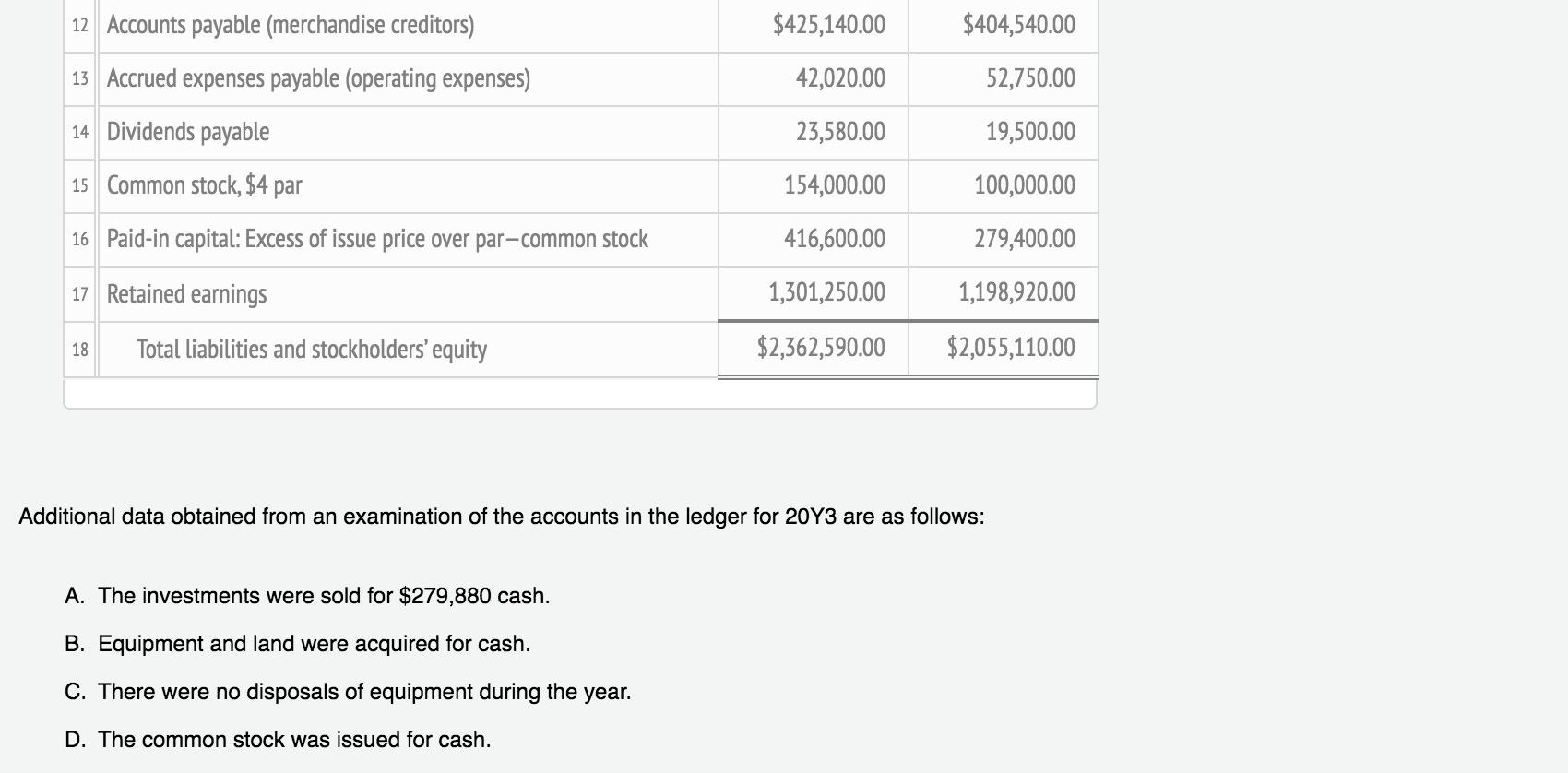

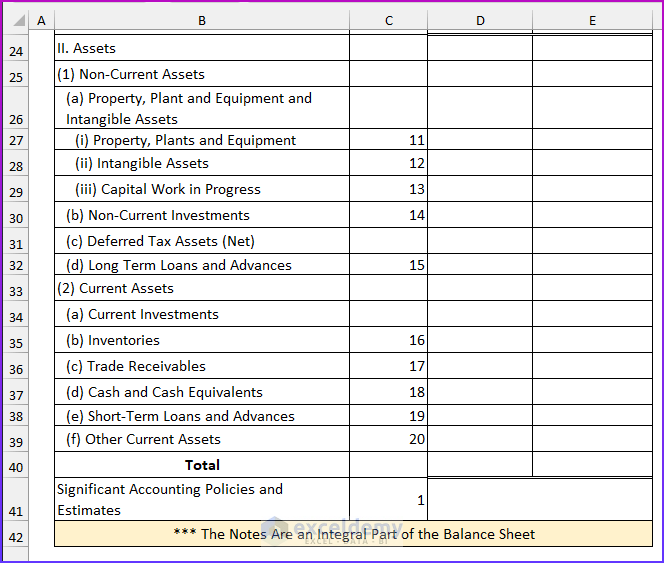

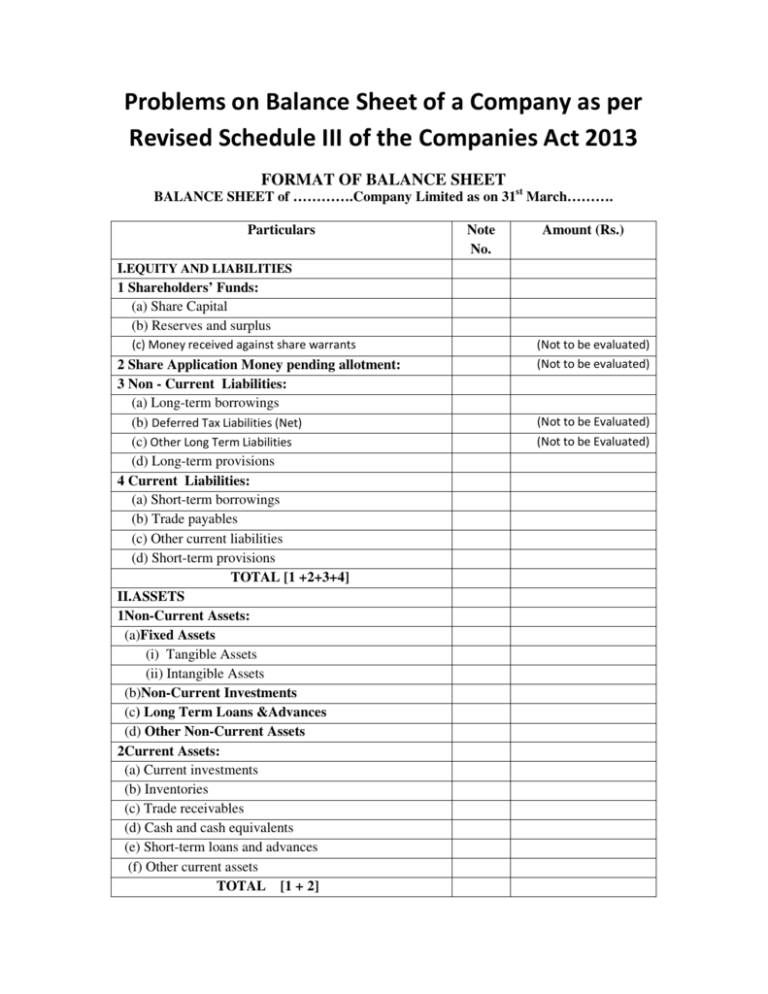

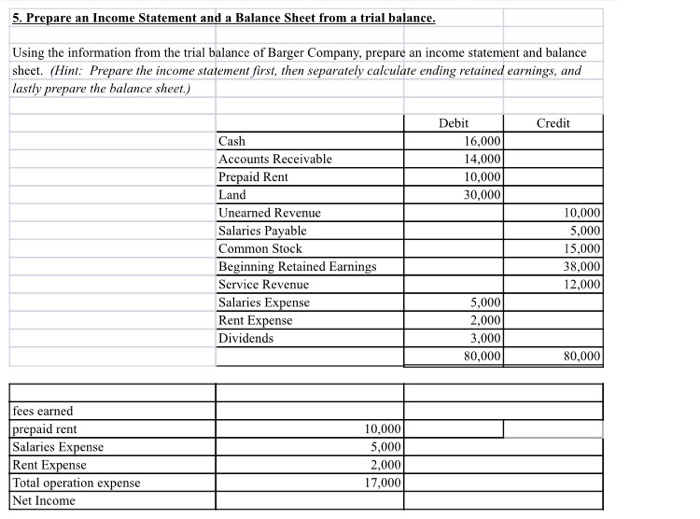

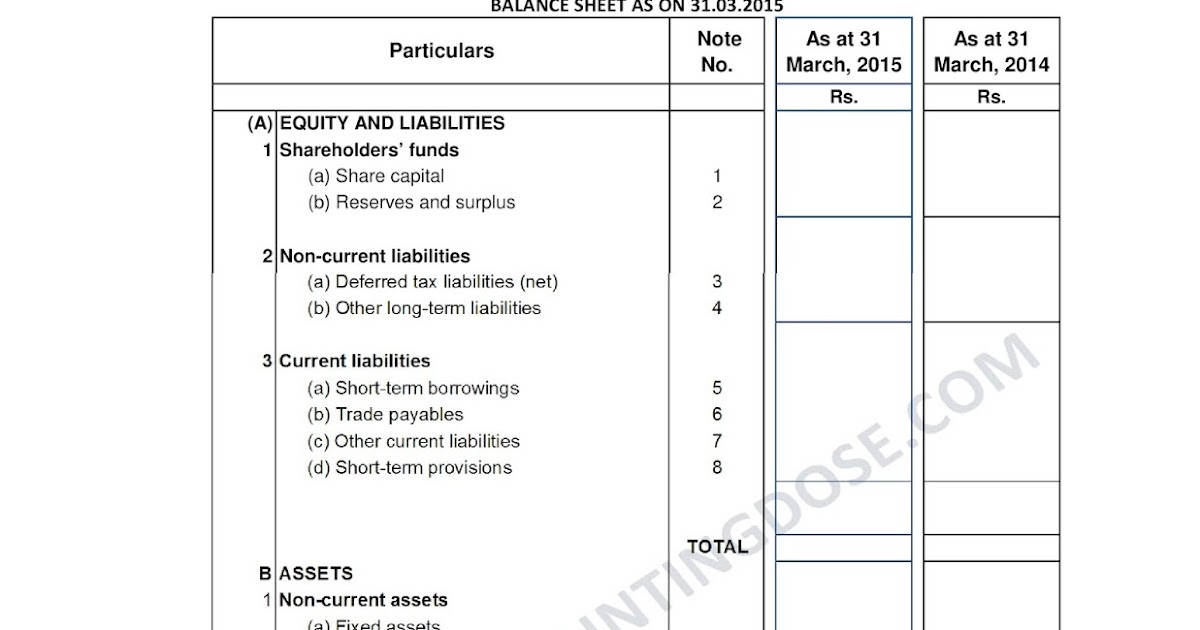

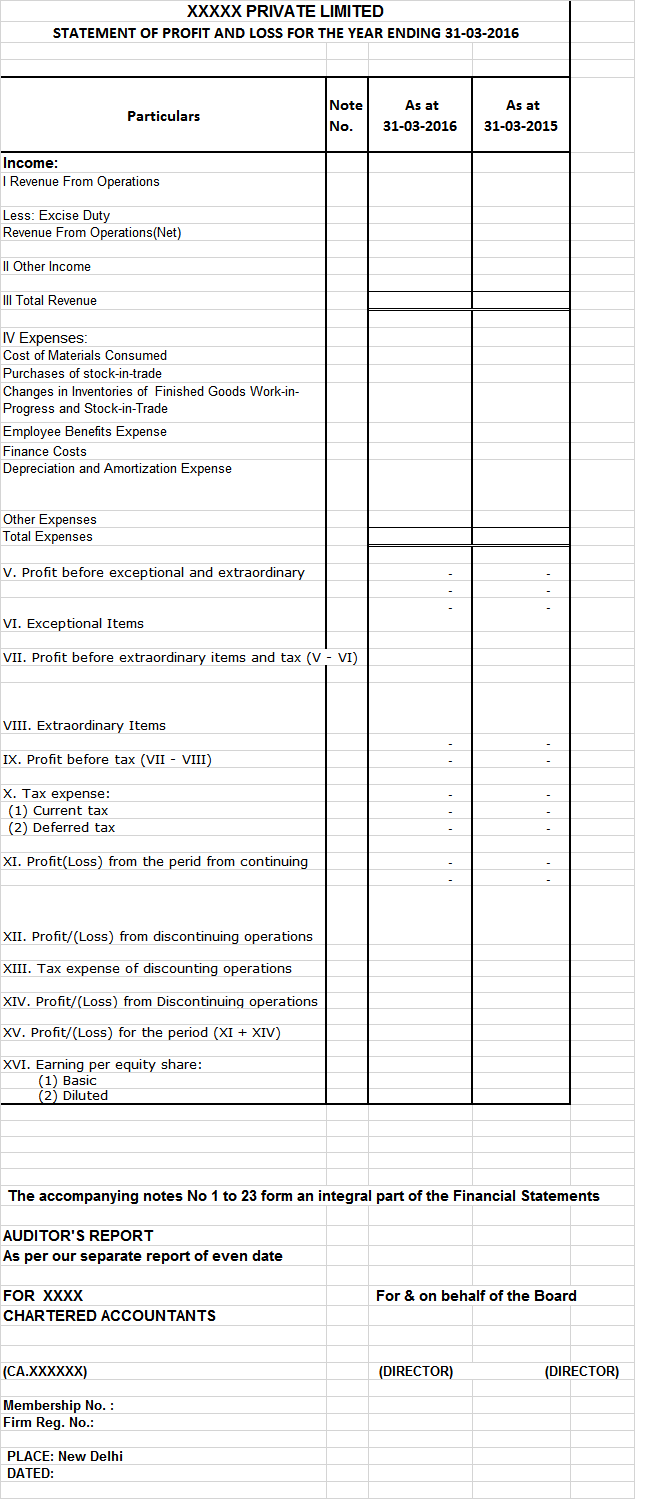

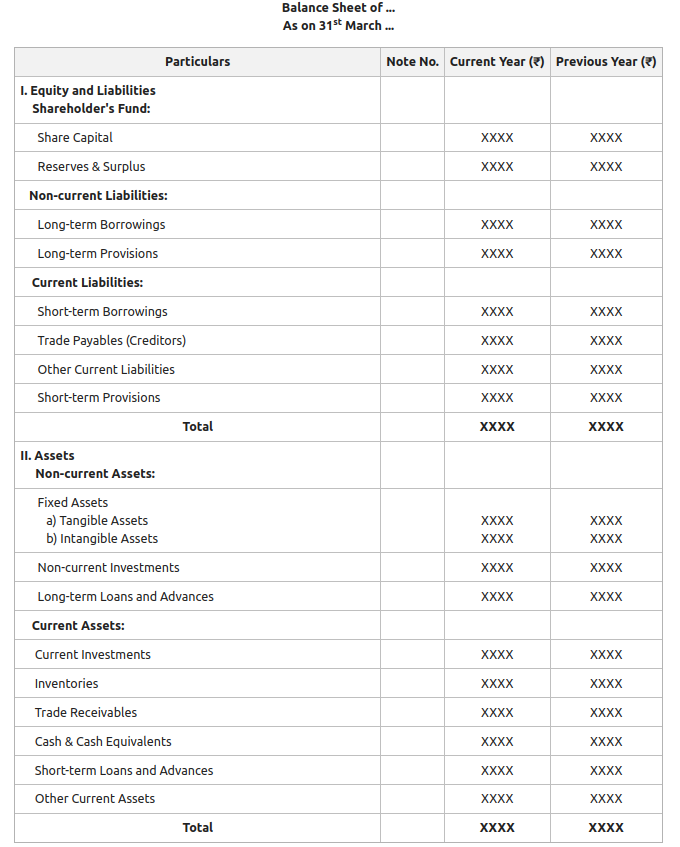

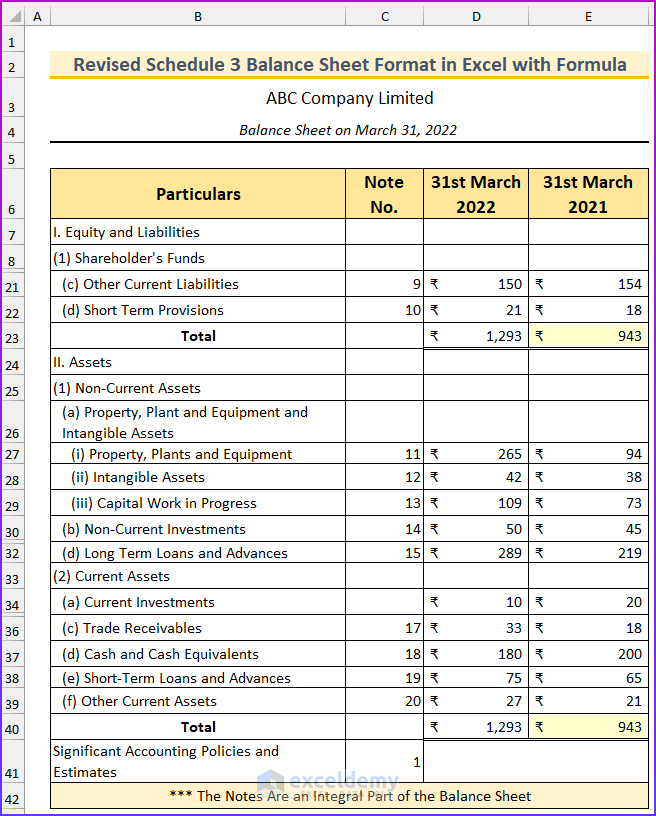

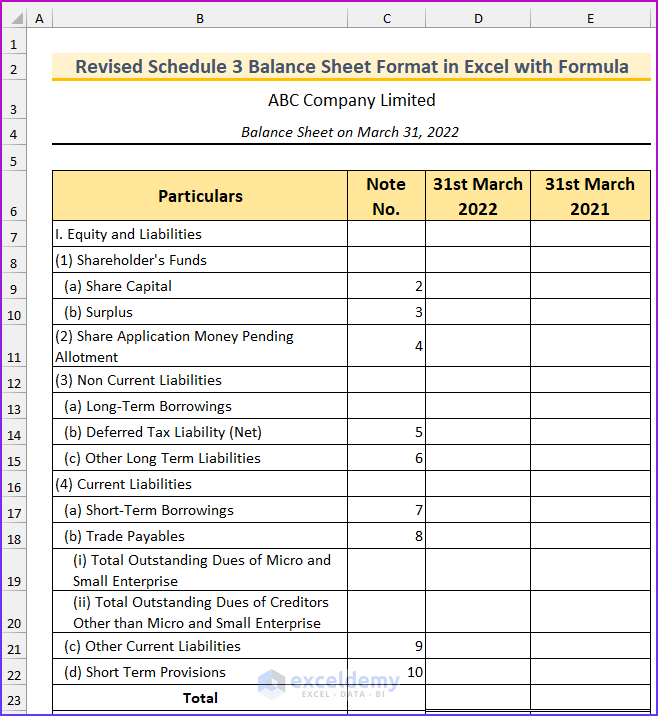

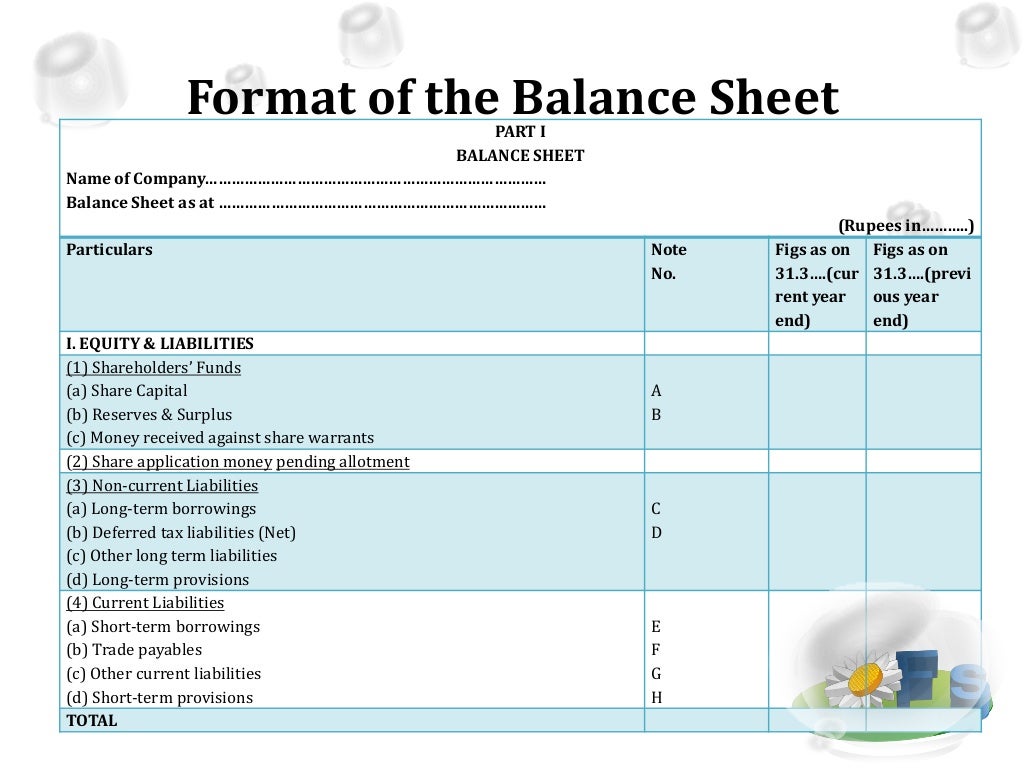

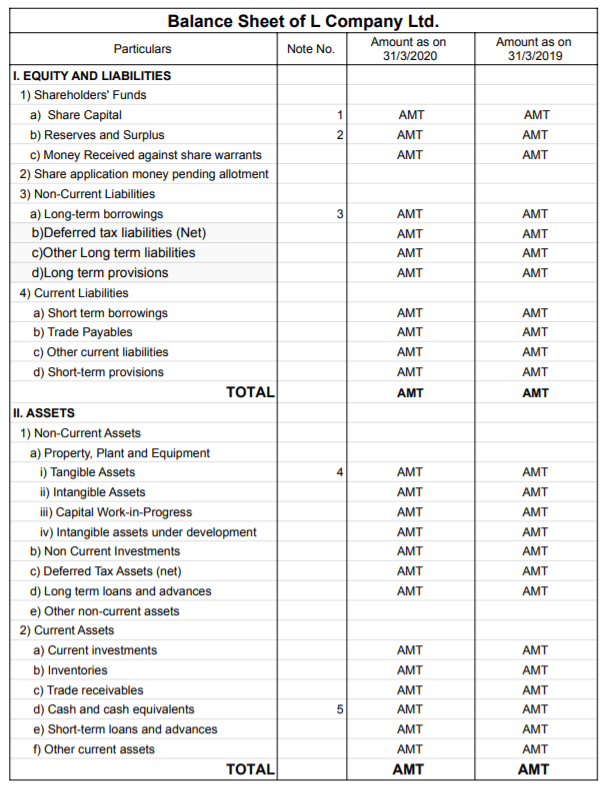

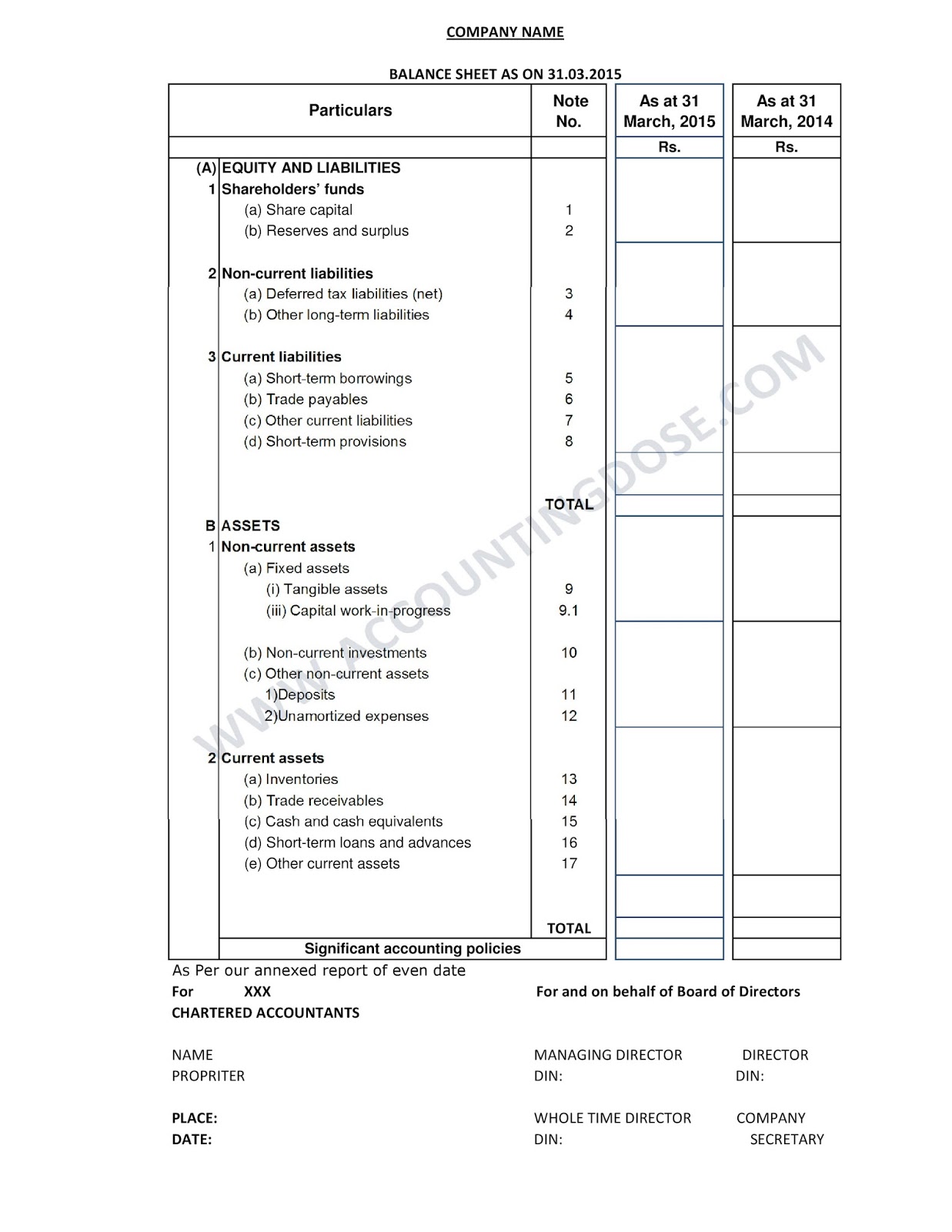

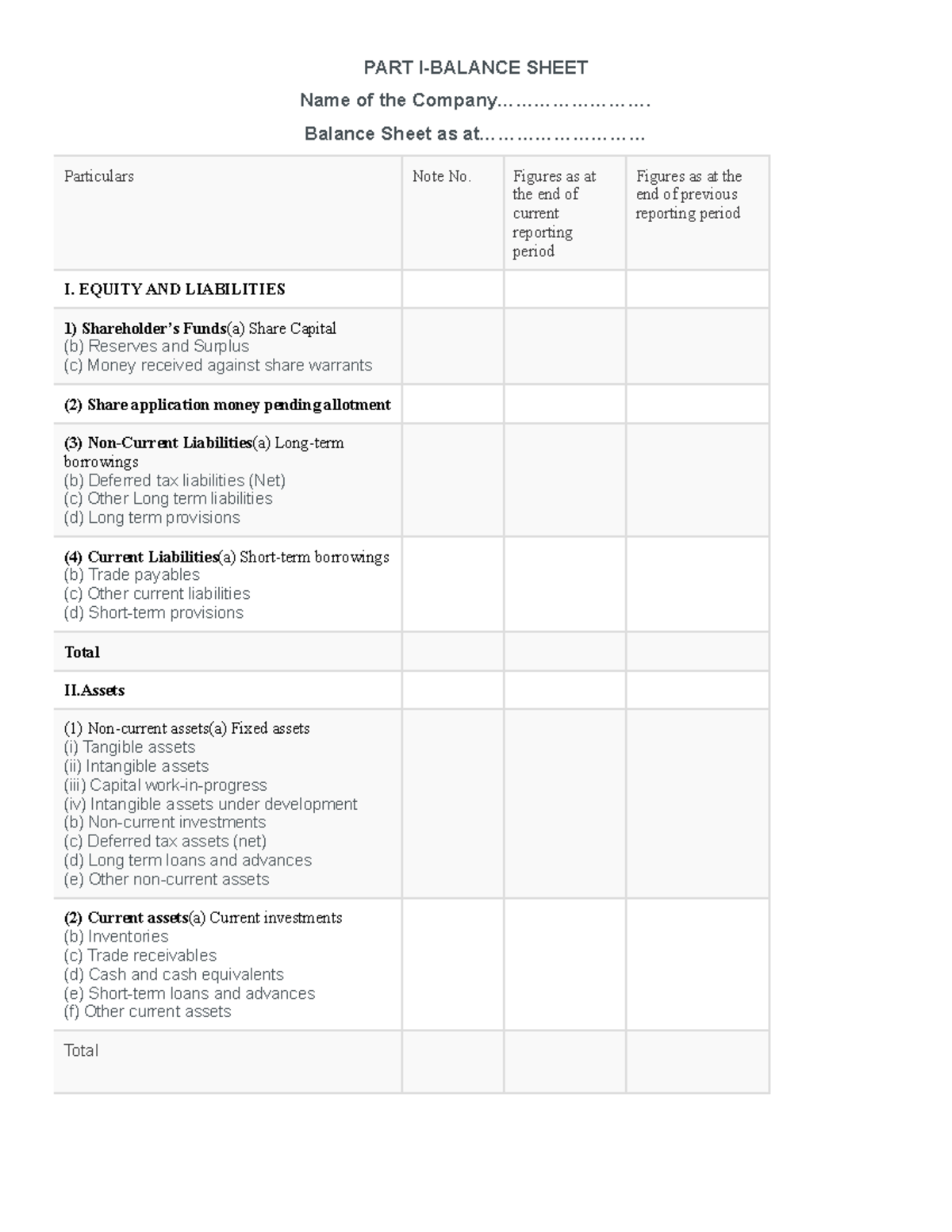

Accrued salaries balance sheet schedule 3 of companies act 2013 balance sheet format. The formats of the balance sheet and statement of profit and loss prescribed under the sebi (issue of capital & disclosure requirements) regulations 2009 (‘icdr. Schedule iii of the companies act 2013, provides the format of financial statements of companies complying with accounting standards (as) and ind as under. Contents [ hide] 1 schedule iii 2 (see section 129) 3 general instructions.

(i) under the heading “a. Balance sheet, p&l a/c, notes to accounts, etc.) by the. General instructions for preparation of balance sheet 1.

Section a general rules 2. (1) subject to the provisions of this schedule— (a) every balance sheet of a company shall show the items listed in either of the balance sheet. 2 (40) to include balance sheet, profit and loss account/income and.

List of schedules under companies act 2013. Schedule iii of companies act, 2013. An asset shall be classified as current when it satisfies any of the following criteria:— (a) it is expected to be realised in, or is intended for sale or consumption in, the company’s.

You need to enable javascript to run this app. You need to enable javascript to run this app. These amendments indicates the revised instructions for preparation of financial statements (i.e.

The revised schedule 3 of the companies act 2013 specifies compliance with accounting standards and the requirement of disclosures. An asset shall be classified as current when it satisfies any of the following criteria:— (a) it is expected. Note:—this part of schedule sets out the minimum requirements.

Excel format of balance sheet as per amended schedule iii. Section 129 of companies act 2013, provides for preparation of financial statements. General instructions for preparation of.

Schedule iii of the companies act, 2013 provides guidelines and instructions for the preparation of financial statements, which include the balance. Schedule iii to the companies act, 2013 deals with the form of balance sheet and profit and loss account and classified disclosure to be made therein and it applies to all the. Articles discuss on balance sheet schedule iii companies act 2013.

The companies in india requires to prepare their financial statements in form of schedule iii to the companies act, 2013. The revised schedule 6 of the. Trade receivables”, for item (i), the following shall be substituted, namely:— “(i) trade.