Unique Tips About Opening Balances From Trial Balance

Description opening balances represent the financial position of your business on the day you start using sage 50 accounts.

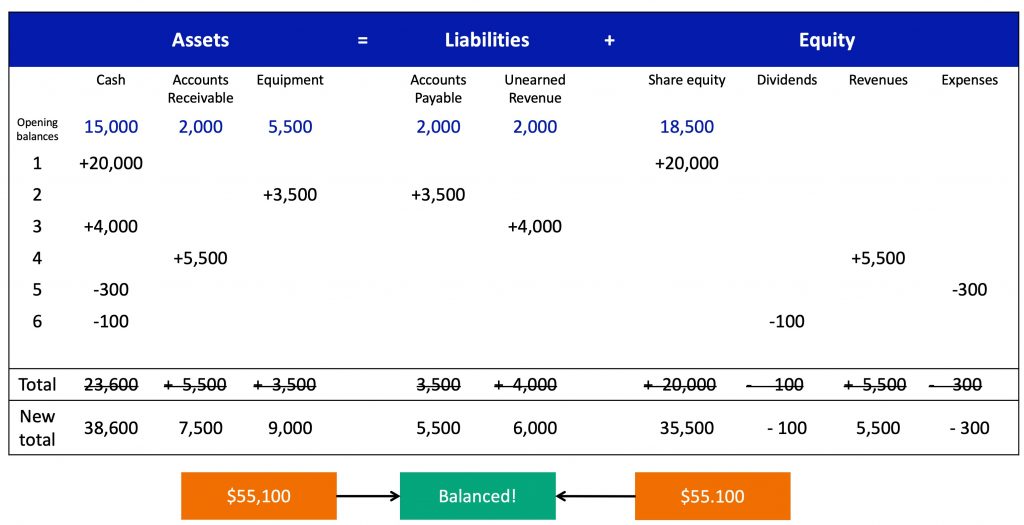

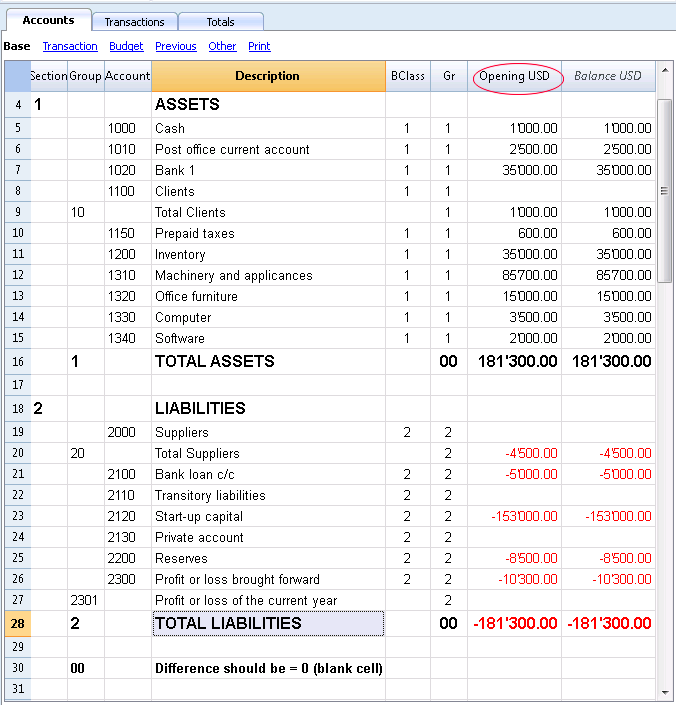

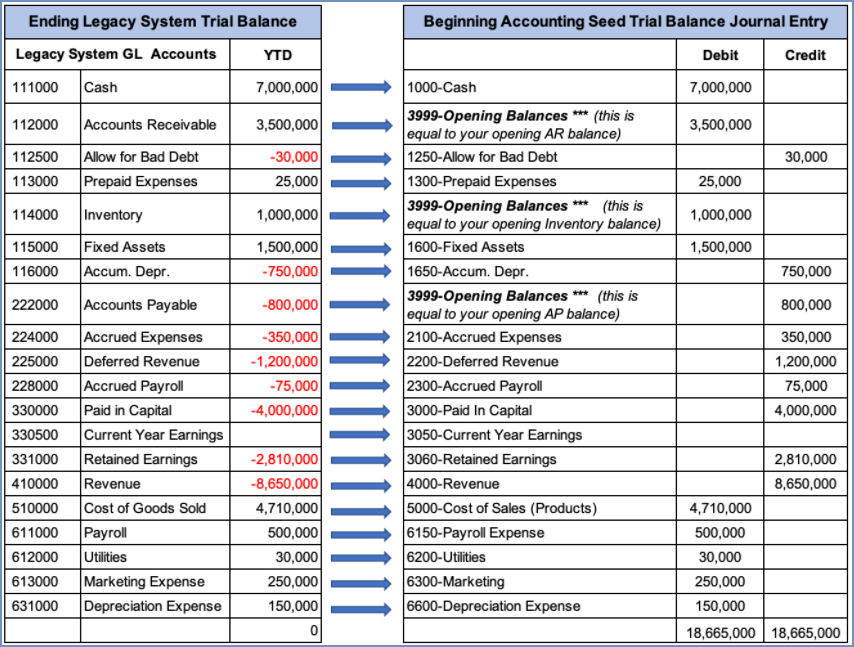

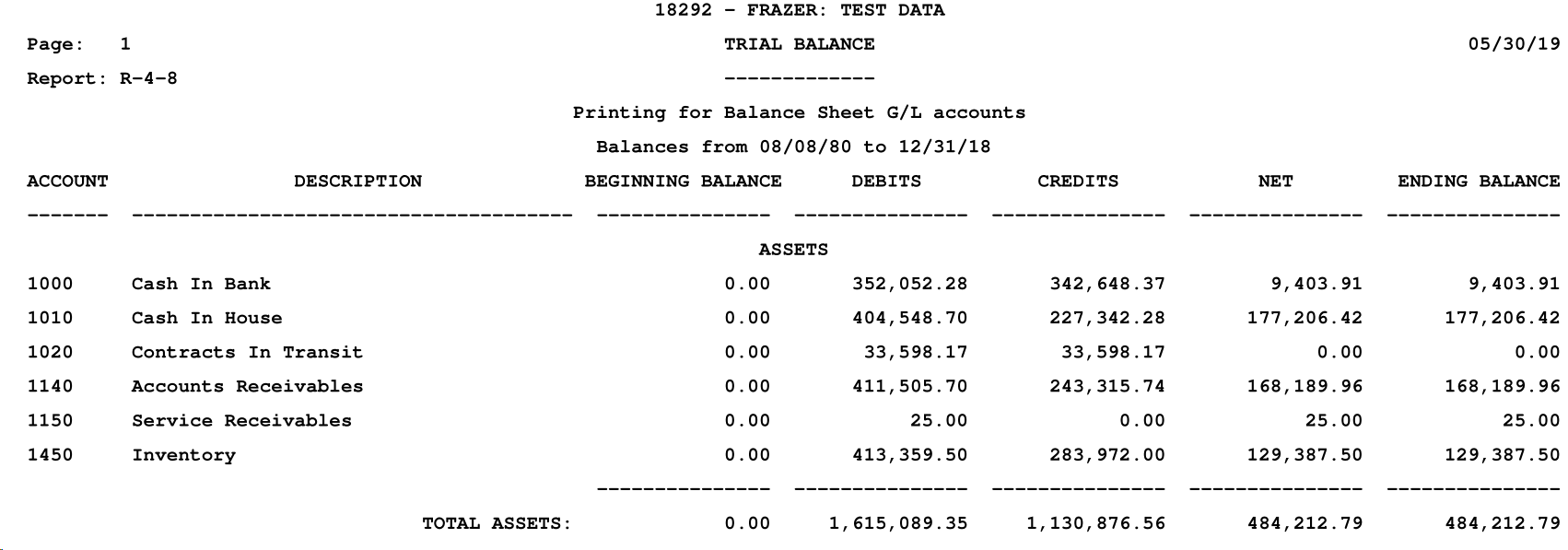

Opening balances from trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. The opening balances will be listed all together on your trial balance. Opening balance(debit/credit), movements(debit/credit), and closing balance(debit/credit).

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. (or) enter opening balances of customers/vendors individually.

All your customers/vendors along with their outstanding opening balances will be imported to zoho books. Follow the process below to prepare a balance sheet from the trial balance: It reflects the cumulative financial position from.

The trial balance in quickbooks online (qbo)will show you the closing balance of each account in a given period. Magnificent adjusted trial balance go over the adjusted trial balance for magnificent landscaping service. You can find a list of your opening balances on your trial balance, which is a list of balances in all of your accounts at a given point in time.

If you are looking at a trial balance on the first day of a new accounting year,. Typically opening balances consist of information. We're unable to add the opening balances.

The trial balance is a summary of all the ledger balances. Identify which financial statement each account will go on:. After posting the journal entry(s) the accountant should print a trial balance from sap and use it to compare balances from the trial balance produced from the legacy system.

Example of opening balances : This is done to determine that debits equal. Prepare and adjust the balances in the trial balance.

The opening balance marks the starting point for a business’s financial records at the commencement of an accounting period. Ledger accounts from a trial balance; Eliminate any expense or revenue.

The main thing to focus on is that the total balance of the credit and debit sides of the trial balance would always match if all the postings were made correctly. It helps in checking whether the transactions are correct and balanced. How opening balances are recorded.