Sensational Tips About Cost Of Investment In Balance Sheet

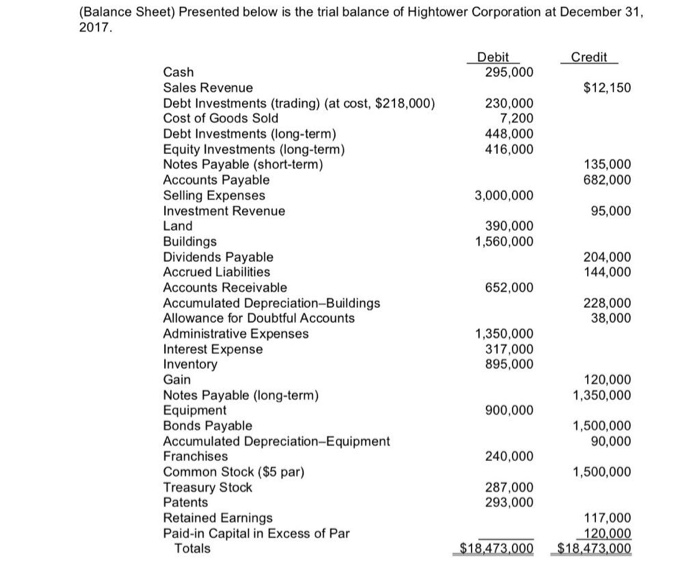

Under the cost method, the investment stays on the balance sheet at its original cost.

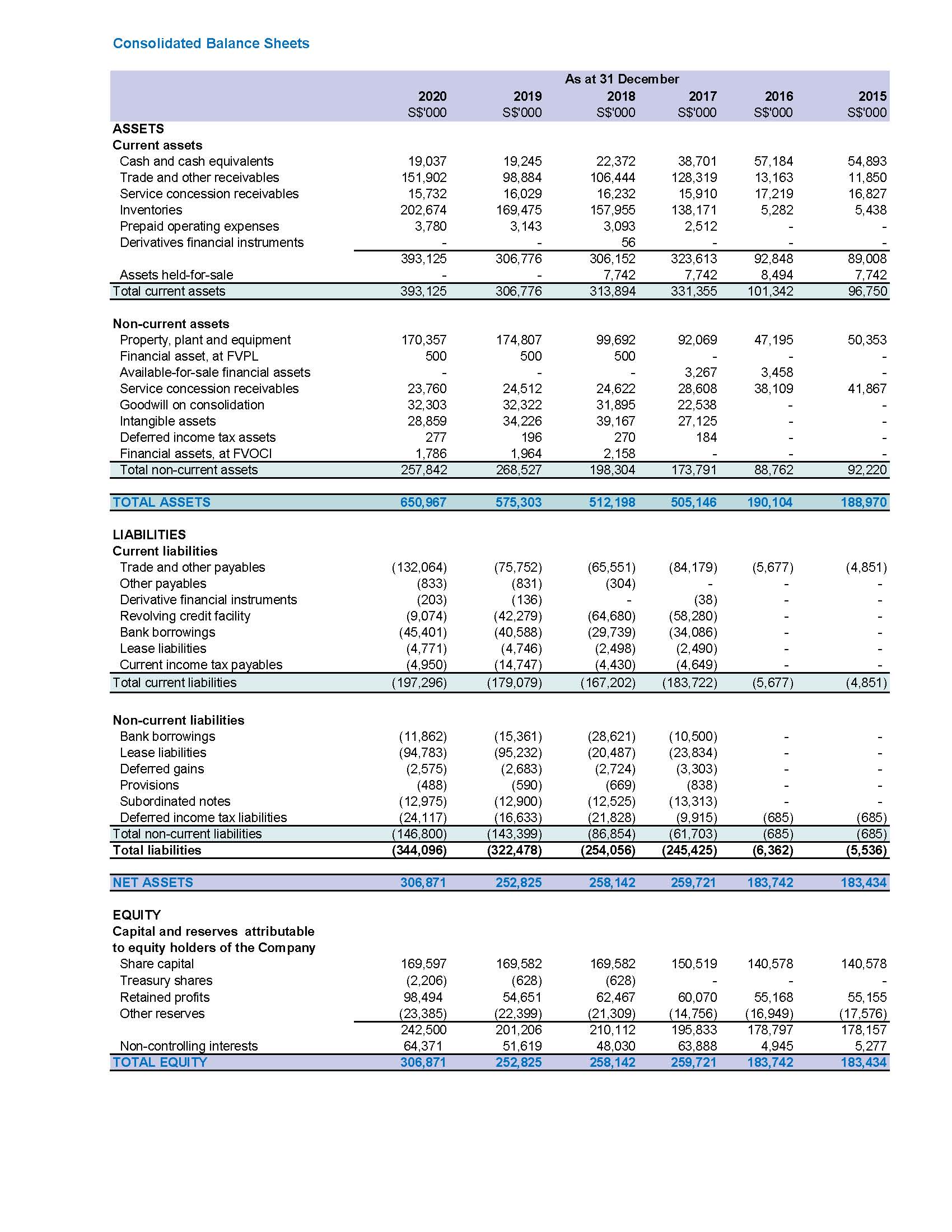

Cost of investment in balance sheet. By analyzing the balance sheet, investors, creditors, and other. In addition to the equity and debt transactions, first quantum also announced a $500m. We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said.

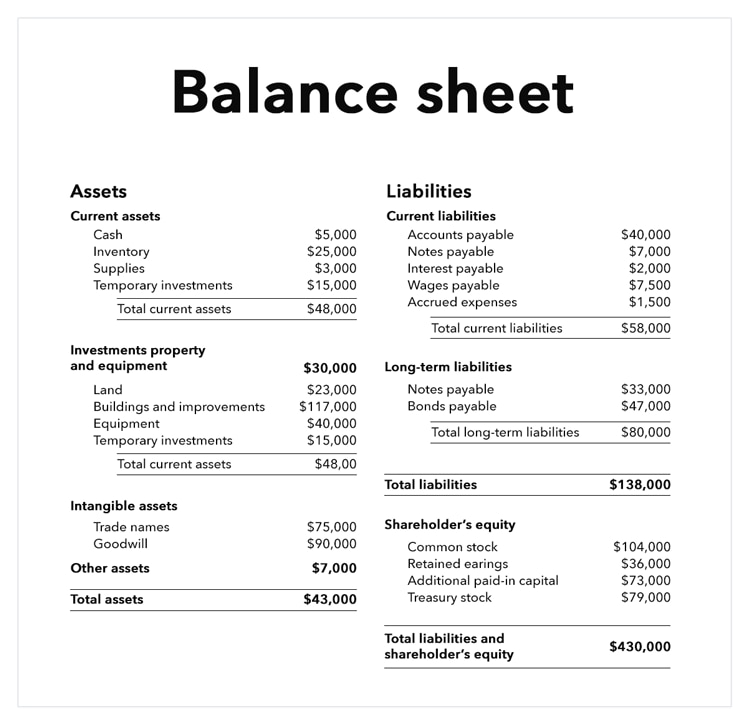

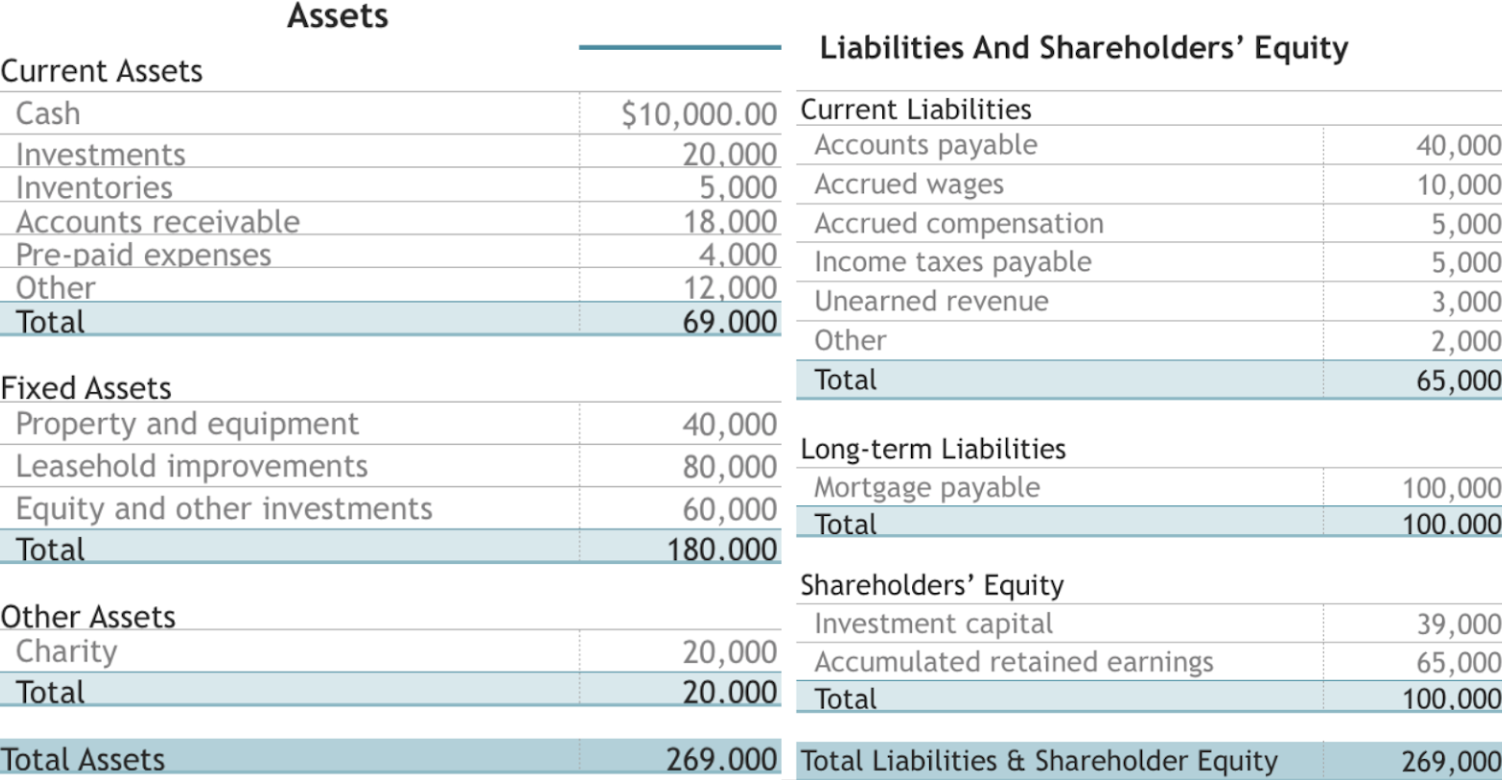

The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a. This will then appear as an. Investment is a crucial item in the balance sheet of the business.

What are the 3 components of the balance sheet? Under these circumstances, the cost method mandates that the investor account for the investment. This method is used when the investor exerts little or no influence over the investment that it owns, which is typically represented as owning less than 20% of the company.

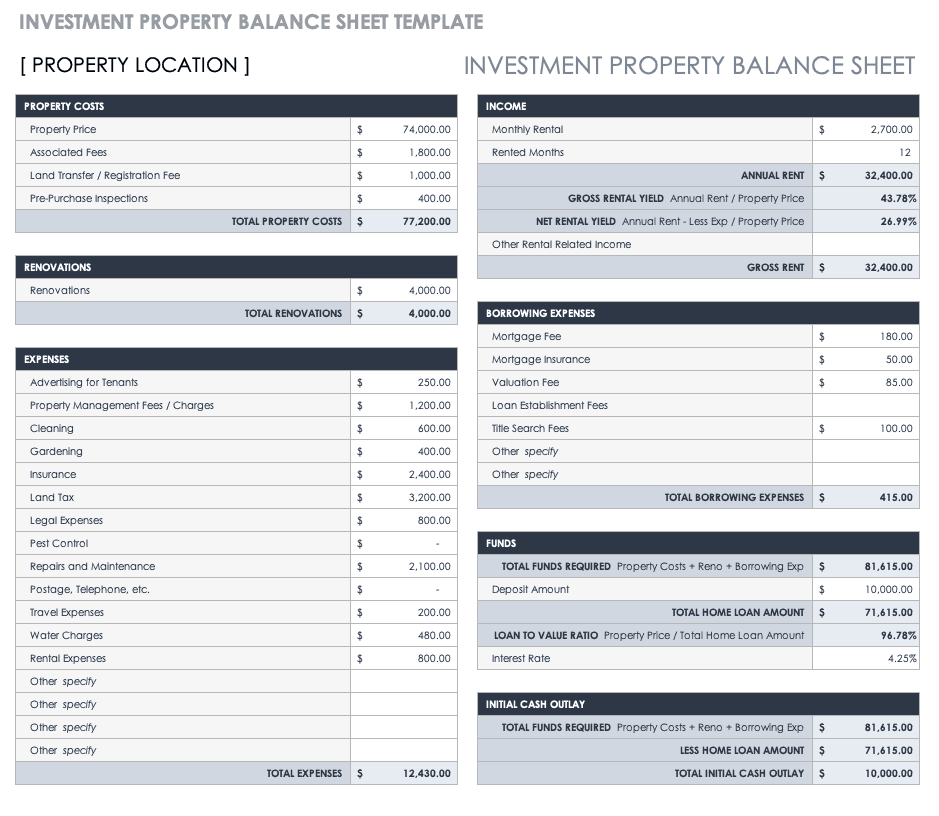

After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value. In alignment with its strategic plan, the company expanded its product offerings and enhanced its presence in promising markets. · have a market value of $5 billion or more.

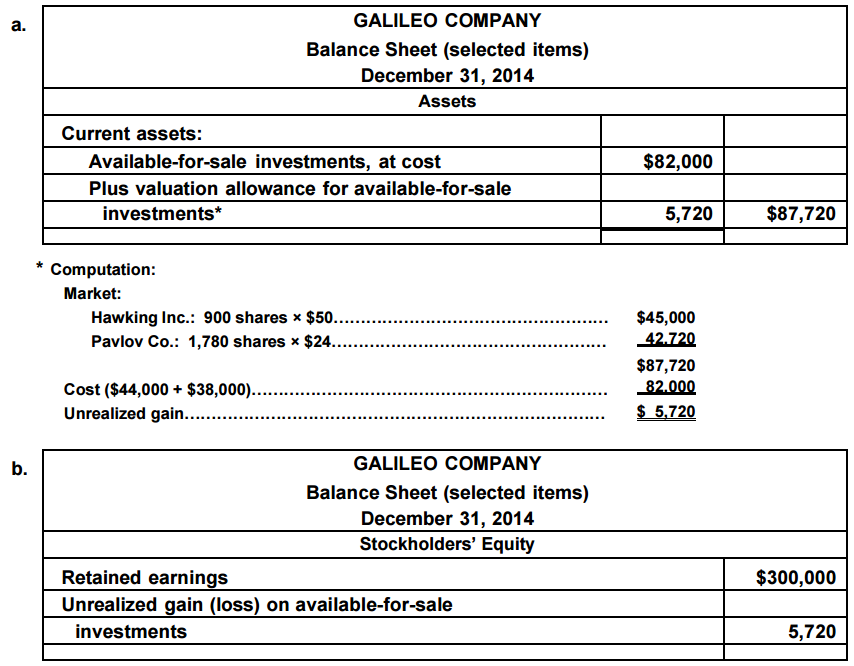

What is the equity method? The equity method is an accounting technique used by a company to record the profits earned through its investment in another. However, the amount is subsequently adjusted to account for your.

The carrying amount of an equity method investment reflects the accumulated cost of the investment and includes items such as transaction costs (see em 3.2.1), and. · have debt no more than 10% of the company’s net. Under the equity method, the investment is initially recorded in the same way as the cost method.

About valuing stocks the more your assets outweigh your liabilities, the larger your investors' equity. The business can decide to invest in a range of financial assets, including equity securities, debt securities, or. If you receive any dividends from the investment, those dividends get.

A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. This part of the balance sheet typically houses the assets. The ratios that you can figure out.

The cost method of accounting is used for recording certain investments in a company’s financial statements. However, with the sharp increase in free cash flow generation, cash & equivalents on the balance sheet have jumped considerably. It's easy to inflate the value of assets by overestimating the.

Budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled. The investment is kept on the balance sheet at its initial acquisition cost rather than its fair market value, making it one of the more conservative techniques for. The unamortized balance of loan origination fees, commitment fees or other fees or costs, and purchase premiums and discounts that are being recognized as a yield adjustment,.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)