Lessons I Learned From Tips About Cash Inflow From Investing Activities

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Learn how to calculate it.

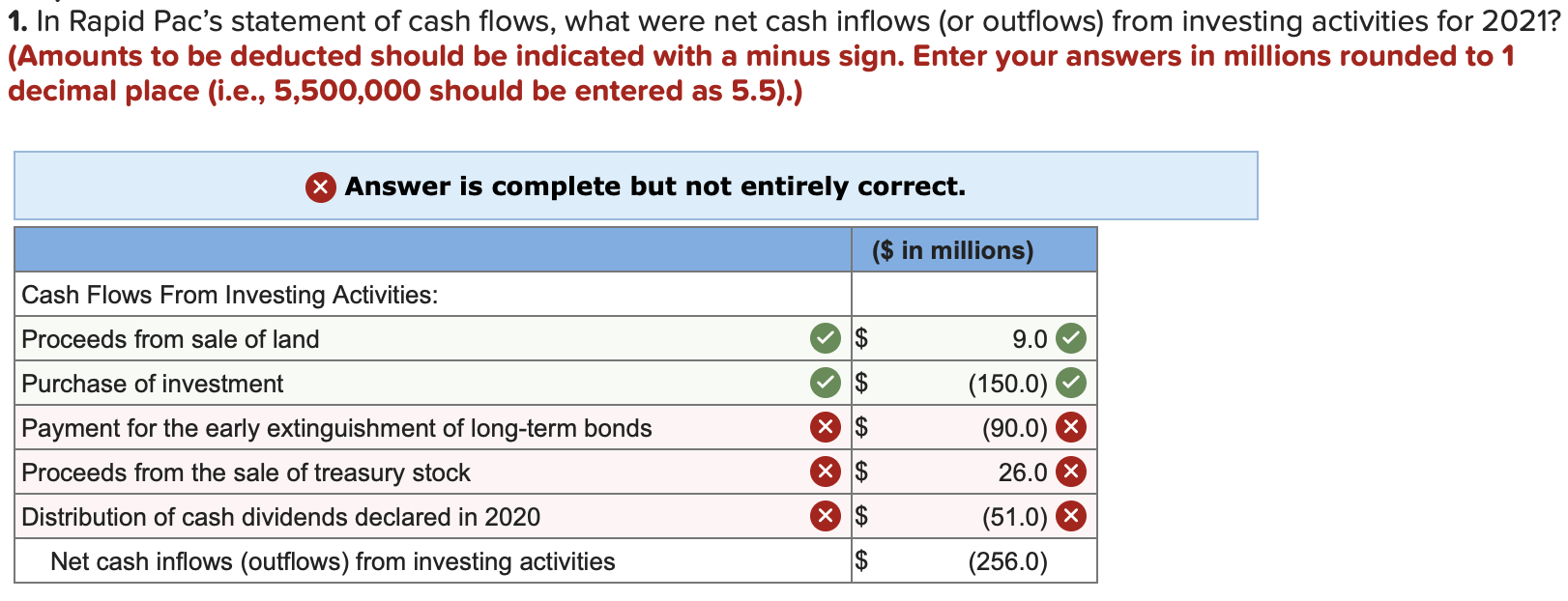

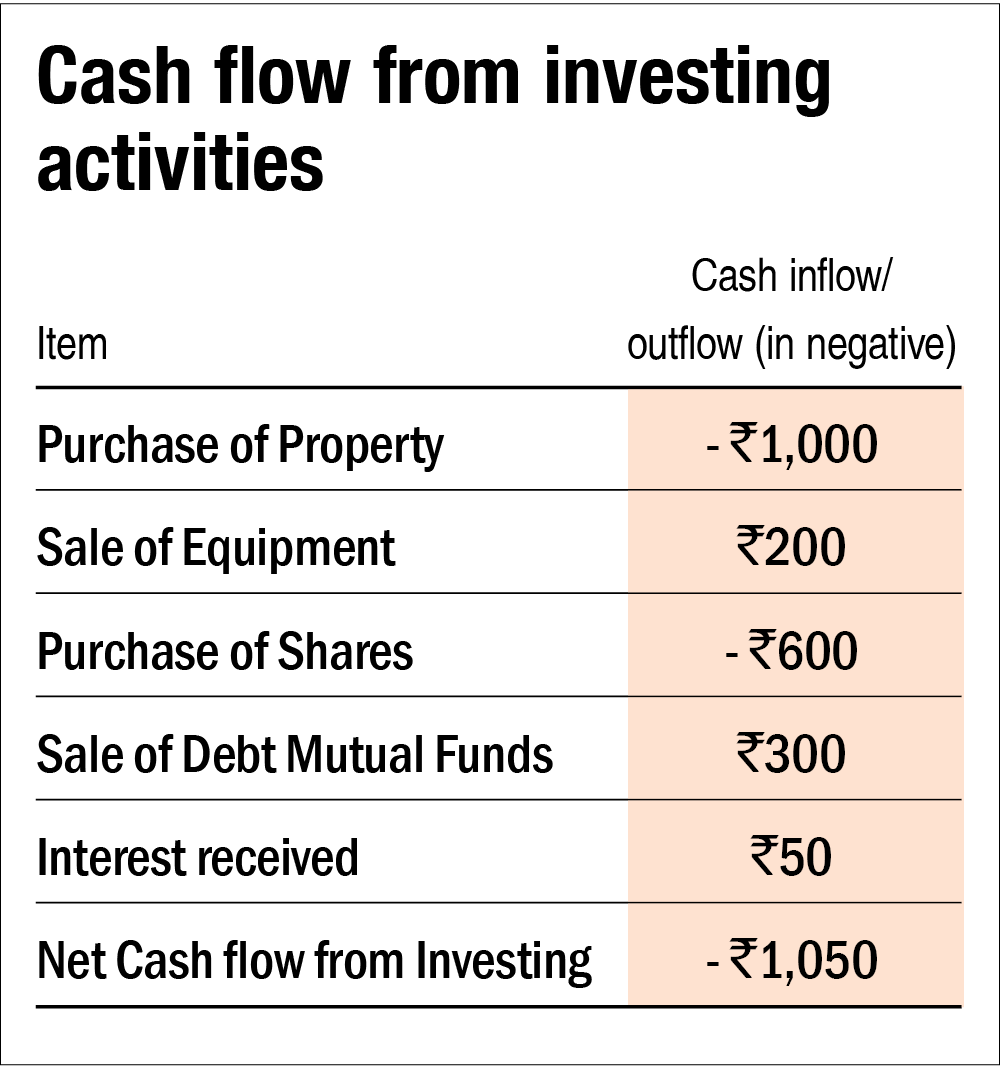

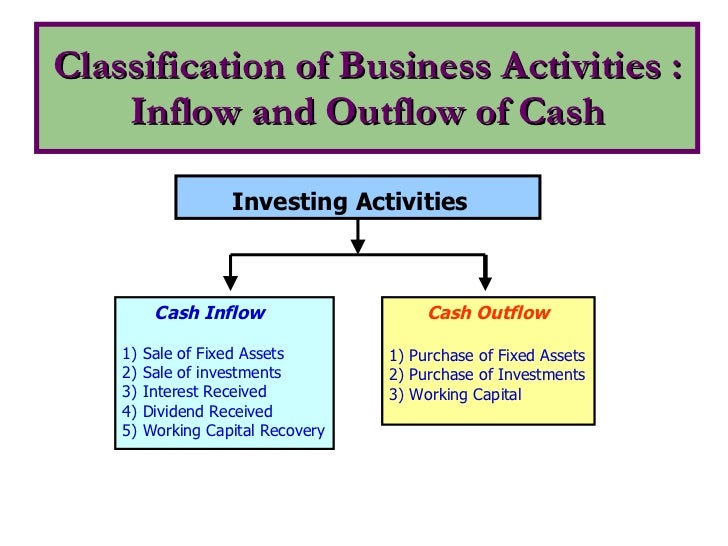

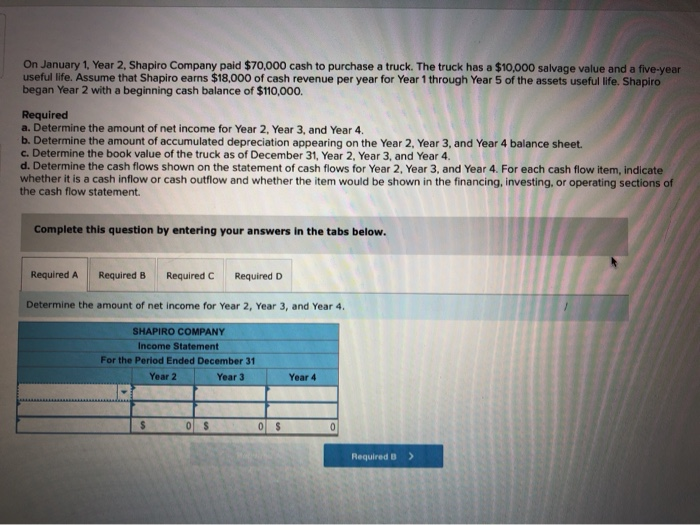

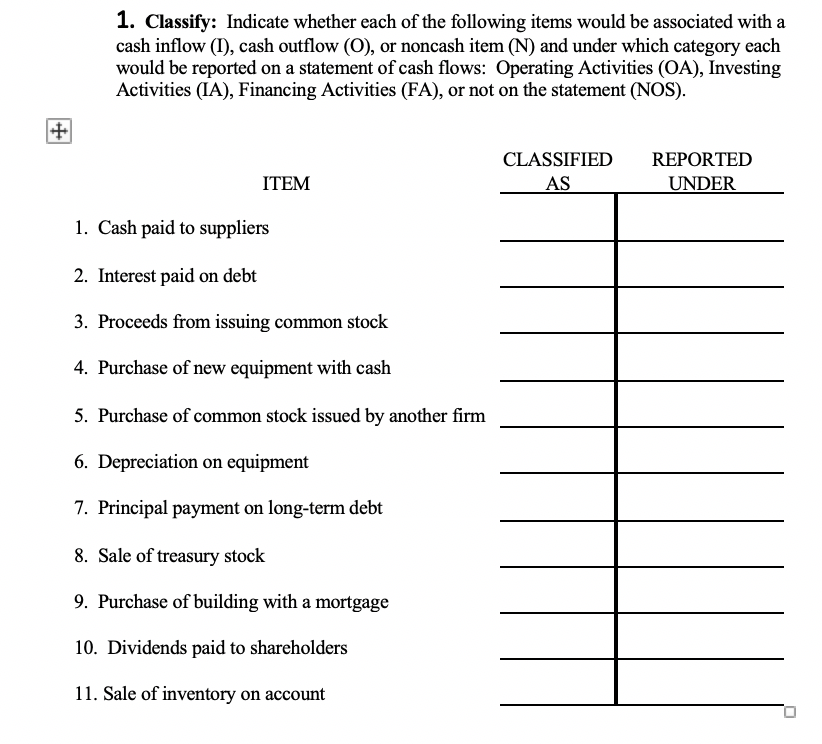

Cash inflow from investing activities. Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued. Cash flow from investing activities is one of three primary categories in the cash flow statement. The cash flow statement reports the amount of cash and cash.

Cash flow from investing activities refers to the cash inflow and outflow from investing and purchasing assets like property, plant, and equipment (pp&e) and from sale proceeds of assets or disposal of shares or redemption of investments like a collection from loans advanced or debt issued. The formula for calculating the cash from investing section is as follows. Cfi tracks the cash inflow and outflow from your investing activities.

Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Cash flow from investing activities is part of your company cash flow statement and is used to display investing activities and their impact on cash flow. Cash flow from investing activities (cfi) is one of the three sections presented on your company’s cash flow statement, alongside cash flow from operations and cash flow from financing activities.

Cash flow from investing activities typically refers to the cash generated in a company by making or selling investments and/or earning from investments.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)