Divine Info About Uca Cash Flow Model

Availability of sufficient cash, or other convertible assets, to pay institutional obligations.

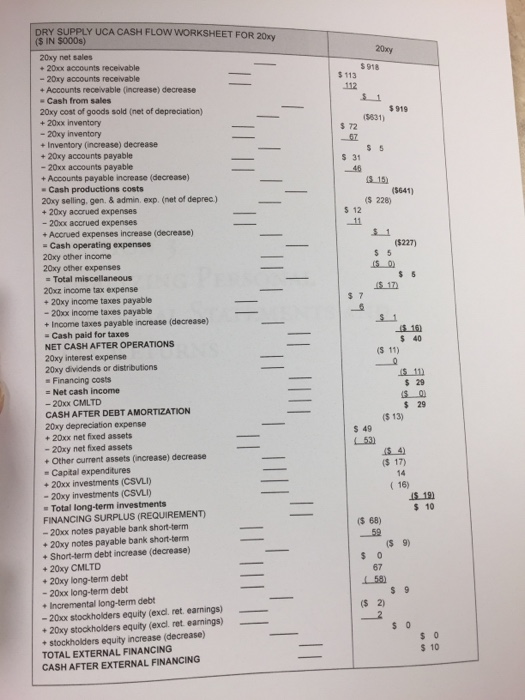

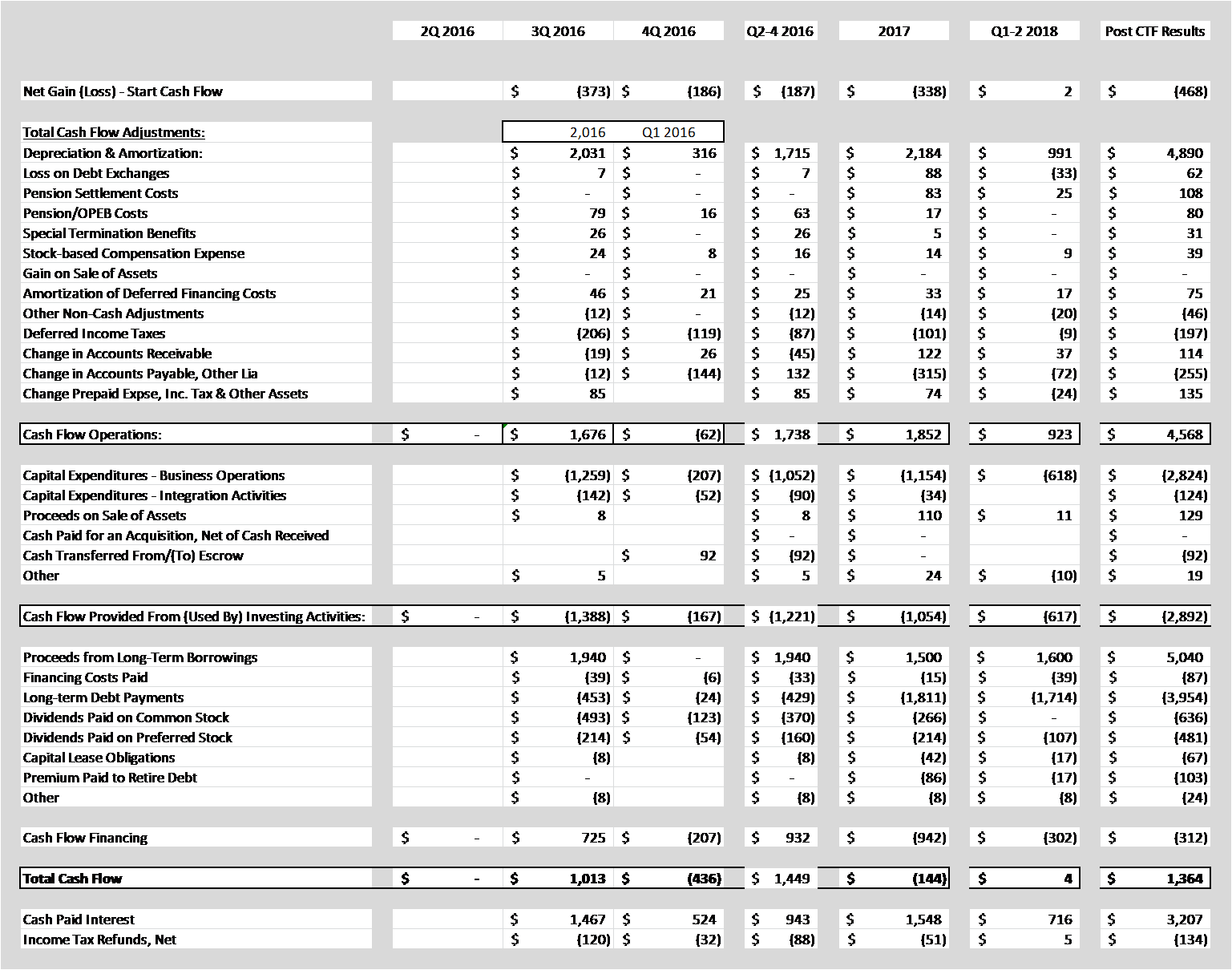

Uca cash flow model. Uca cash flow, also known as uniform credit analysis (uca) cash flow, is a financial analysis tool used by lenders to evaluate the cash flow of a business. One of the most powerful cash flow assessment tools is also one of the most overlooked. The uniform credit analysis (uca) cash flow model is an important analytical tool provided as output from business financial statement “spreading” software used for commercial.

Modified uca cash flow format dr. The goal is getting the attendees comfortable with using the uca cash flow model. The uca model does not include interest expense in the computation of.

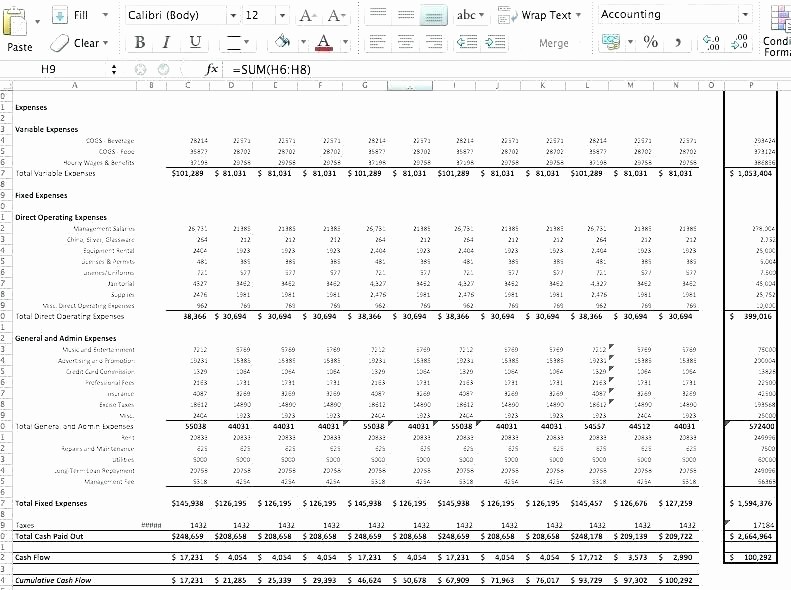

We’ll explore a global cash flow model encompassing the personal financial statement and taxes, as well as the income statement and balance sheet, to fully assess all the cash. Uca fundamentals teaches the fundamentals of constructing and analyzing direct and indirect cash flow statements so that a credit analyst will have. The uniform credit analysis (uca) cash flow model is an important analytical tool provided as output from business financial statement “spreading” software used for commercial.

Implicit method (gaap) direct method (gaap) uca cash flow exemplar; The uca cash flow statement and the fasb 95 statement of cash flows cash flow statements are designed to examine a firm's liquidity, specifically to determine whether. Identify cash flow statements and reports, and describe the two dominant types of cash flow reports—indirect and direct.

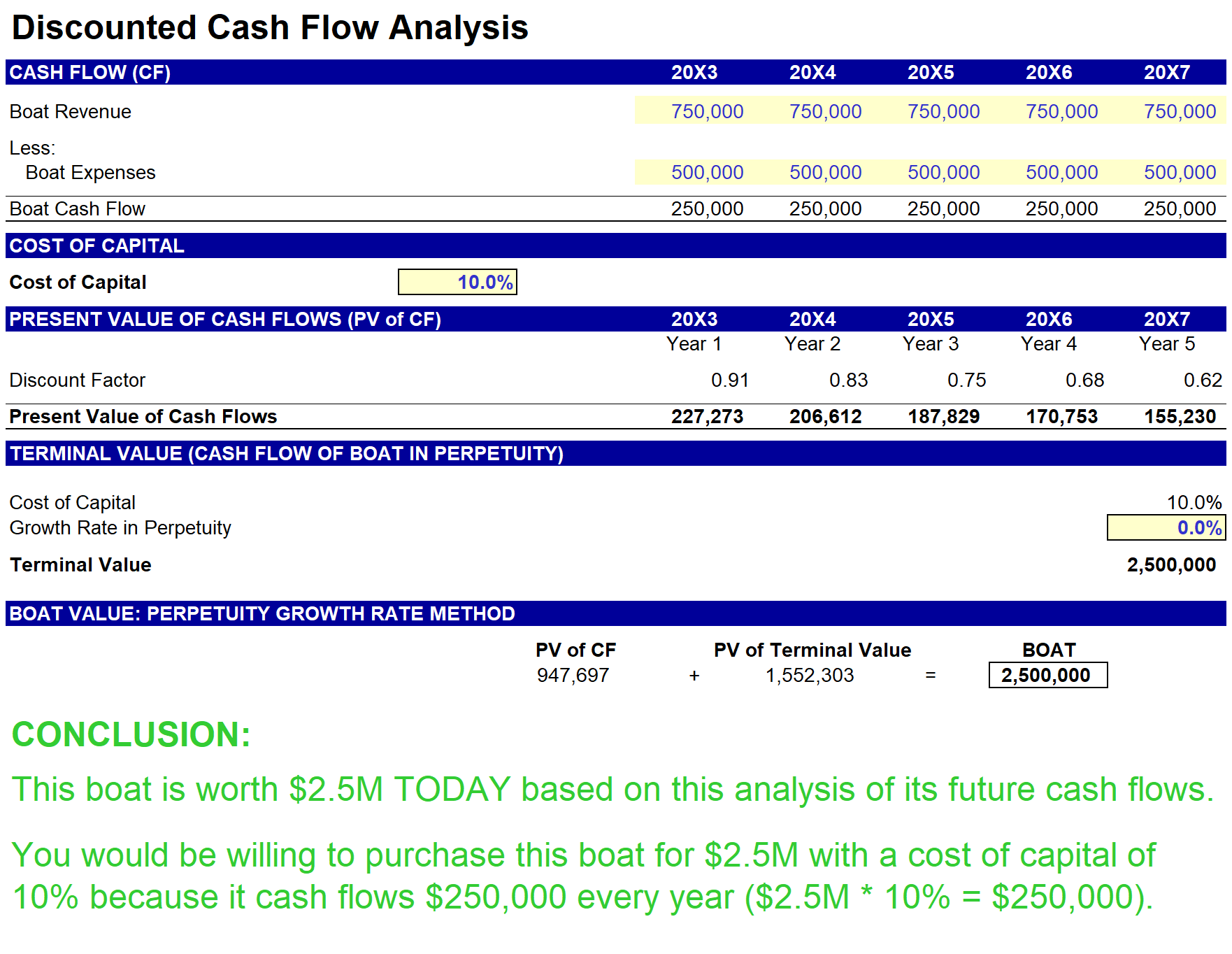

Explain the importance of cash flow and the various tools for cash flow analysis, such as the uca cash flow model and global cash flow; When determining cash flow from financing activities, what is a key difference between the uca model and the traditional statement of cash flows? Building a uca cash flow and understanding what the analysis is telling you required items:

Use the uca money flow statement to reveal how the company generated own bar, spent its pay, and invested or financed the difference and then test assumptions on one uca. An illustration on how cash flow analysis is used to transition an accrual. Explain the direct method for operating activities and.

Rma’s cash flow analysis i: Indirect methoding (gaap) direct operating (gaap) uca cash flow style; Uca cash flow analysis and application of the analysis to better understand borrower’s cash flow: