Unique Tips About Tds 24q Means

The deductor can submit a request.

Tds 24q means. What is form 24q. Form 24q is utilized by the taxpayers for the declaration of the tds returns of the citizen. What is tds why is form 24q important?

You can easily file your tds returns through cleartax software i.e. The form would have the information on the salary and the tax deductions. In this article, we look at.

Form 24q is a quarterly statement of deduction of tax on salaries. Form 24q is a tds return/ statement containing details of tds deducted from the salary of employees by the employer. Tax deducted at source or tds refers to an advance tax which is deducted from the income or earnings of an individual or an organization before actually crediting.

In other words, form 24q is the quarterly statement of the payment made to the employee and the tds deducted from it by the deductor. When an employer pays a salary to an employee, the employer is required to deduct tds u/s 192. Details of salary paid to the employees and tds deducted on such payment is to be reported in 24q.

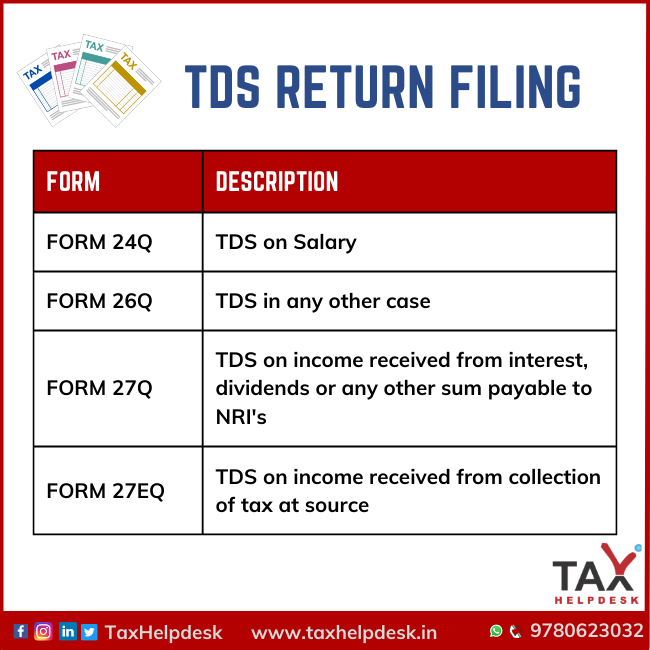

Requirements for filing form 24q form 24q consists of 2 annexures annexure i of. 24q is to be submitted on a quarterly basis. Form 24q is one type of tds return.

This form has to be filled up for declaration of a citizen's tds returns in detail. The employer has to file a salary tds return in form 24q, which. Annexure ii (salary details) are not.

The employer has to file salary tds return in form 24q. It contains details of tds deducted and. For the quarter ending 30th.

Form 24q is a statement for tds from salaries, which must be filled and submitted by the deductor on a quarterly basis. In this post, we take a close look at. Who is responsible for filing form 24q?

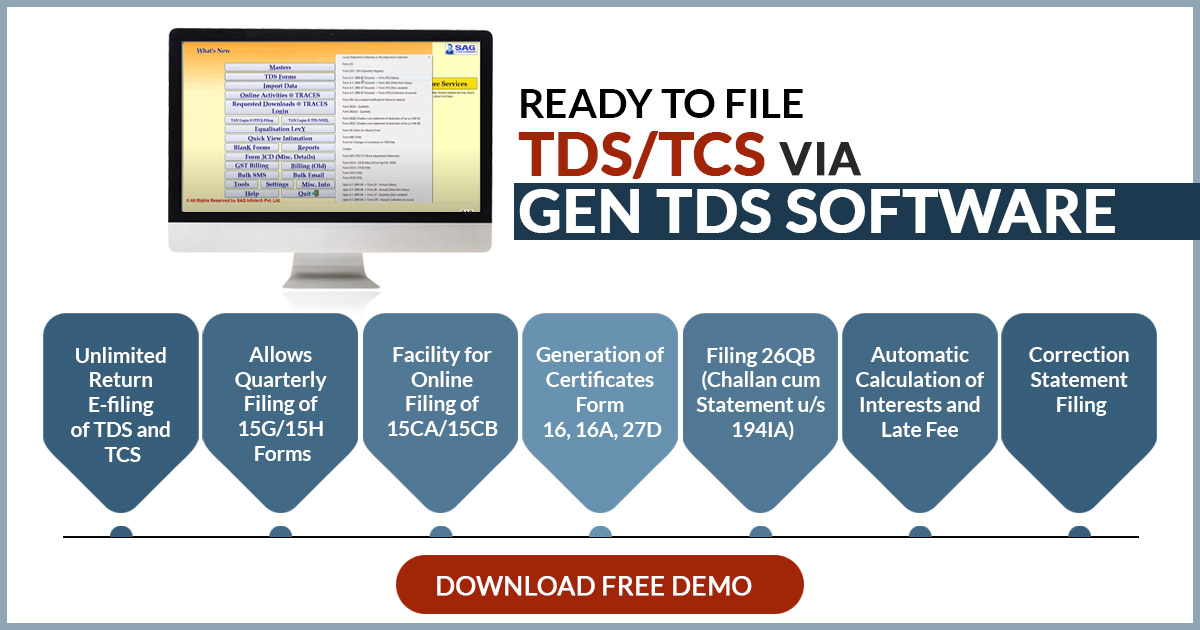

Form 24q is required to be submitted on. It has to be deducted by a person for certain payments made by them. It is used for preparing etds returns for the tds deducted on salary under section 192 of the income.

Tds is basically a part of income tax. Then select the tds_rpu.bat file. Form 24q is, in other words, the quarterly statement of the employee's paycheck and the tds withheld by the deductor.

![Form 24Q TDS on Salary Payment [Due Date, Format, & Penalty]](https://i1.wp.com/saral.pro/wp-content/uploads/2023/05/Form-24Q-–-TDS-on-Salary-Payment.png?resize=1024%2C583&ssl=1)