Divine Info About Cash Flow Statement Increase In Inventory

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

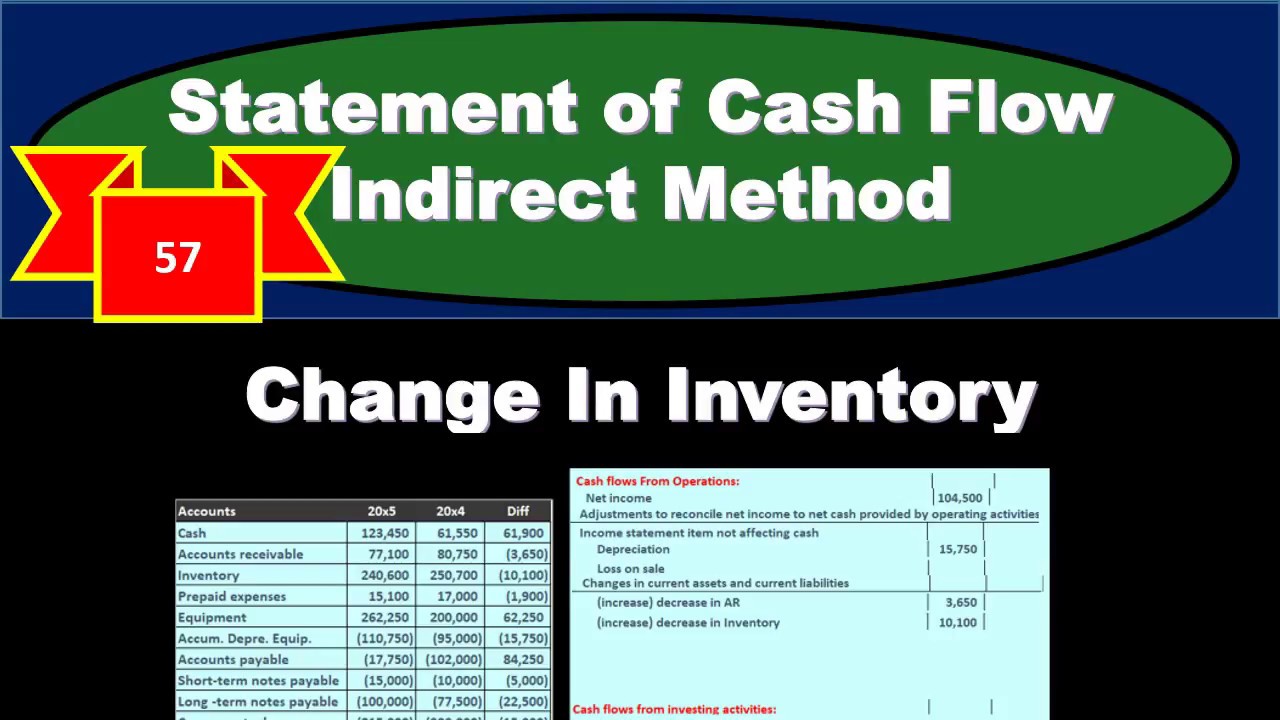

Partial statement of cash flow.

Cash flow statement increase in inventory. Combining the amounts in operating, investing, and financing activities, the cash flow statement reports an increase in cash of $2,100. A items are top 20% by value. That also depends on your industry.

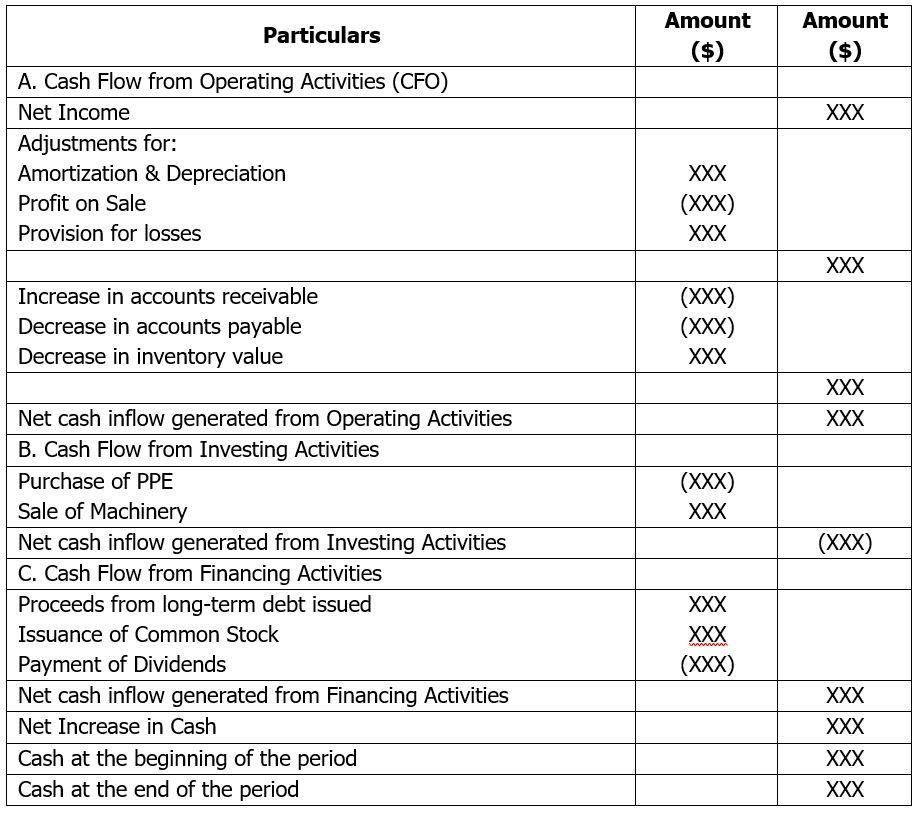

The inventory balance decrease when items are sold, and the company recognizes the sale and costs of good sold. Cash from operating activities, cash from investing activities and cash from financing activities. Cash flow 2021:

An outflow of cash has a negative or unfavorable effect on the company's cash balance. The cash flow statement is required for a complete set of financial statements. A cash flow statement consists of three sections:

Cash flow from operations was $11.6 billion for the full year, up 5%; Cash flow is the money that flows in and out of your business, reflected on your cash flow statement. Whether it’s a rapidly growing startup or a mature and profitable company.

Example of a cash flow statement red dollar amounts decrease cash. Begin with net income from the income statement. The cash flow statement is annually prepared and is audited along with the income statement and.

In this article, we are going to talk about how changes in inventory affect the statement of cash flow. Written by jeff schmidt what is the statement of cash flows? The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Add back noncash expenses, such as depreciation, amortization, and depletion.

Previous question next question back to. When the company purchases inventory related items, that increases the inventory balance and represents a cash outflow. For example, when we see $20,000 next to “depreciation,” that $20,000 is an expense.

These 4 quick wins can boost your customer count and revenue dynamic management of cash flow and credit card debt. Similarly, increasing the amount of supplies on hand was not good for cash and it is reported as a negative $150. The increase in inventory was not good for cash, as shown by the negative adjustment of $200.

A decrease in the inventory balance represents a cash inflow. The balancing figure is the cash spent to buy new ppe. Good cash flow means you can pay your bills and keep investing in growth.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)