Ideal Info About Cash Flow Statement Income

Income statement and free cash flow.

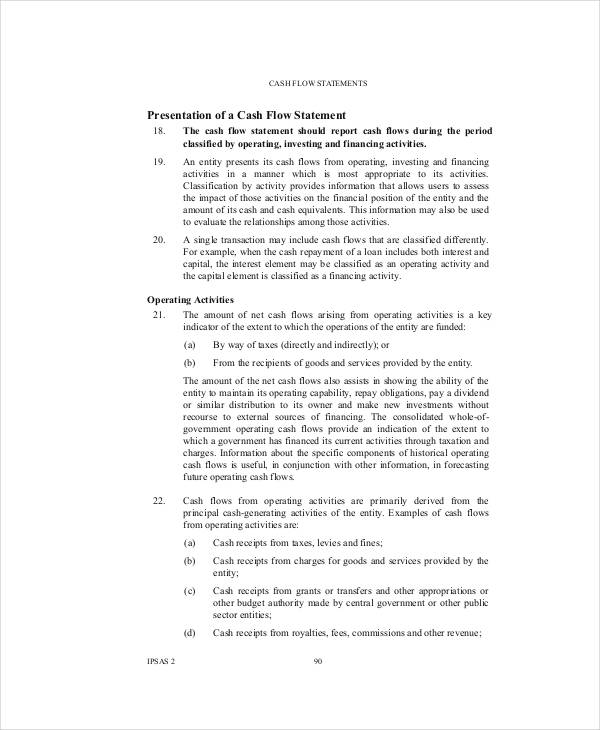

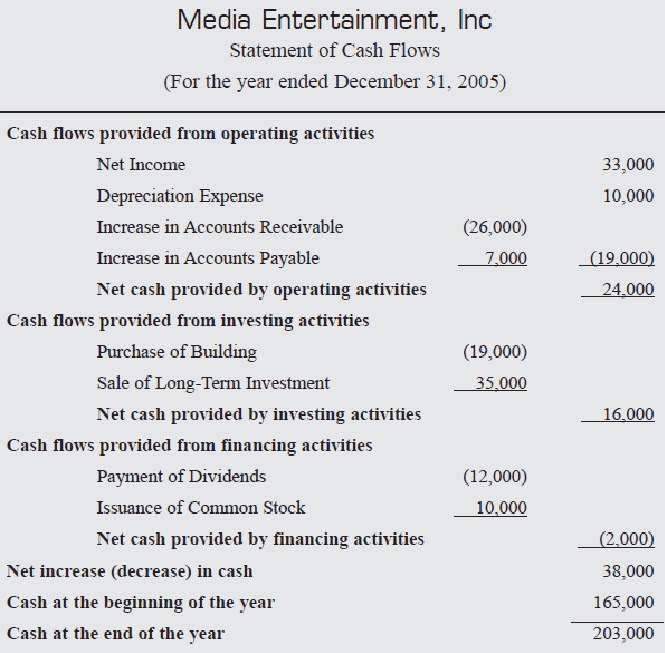

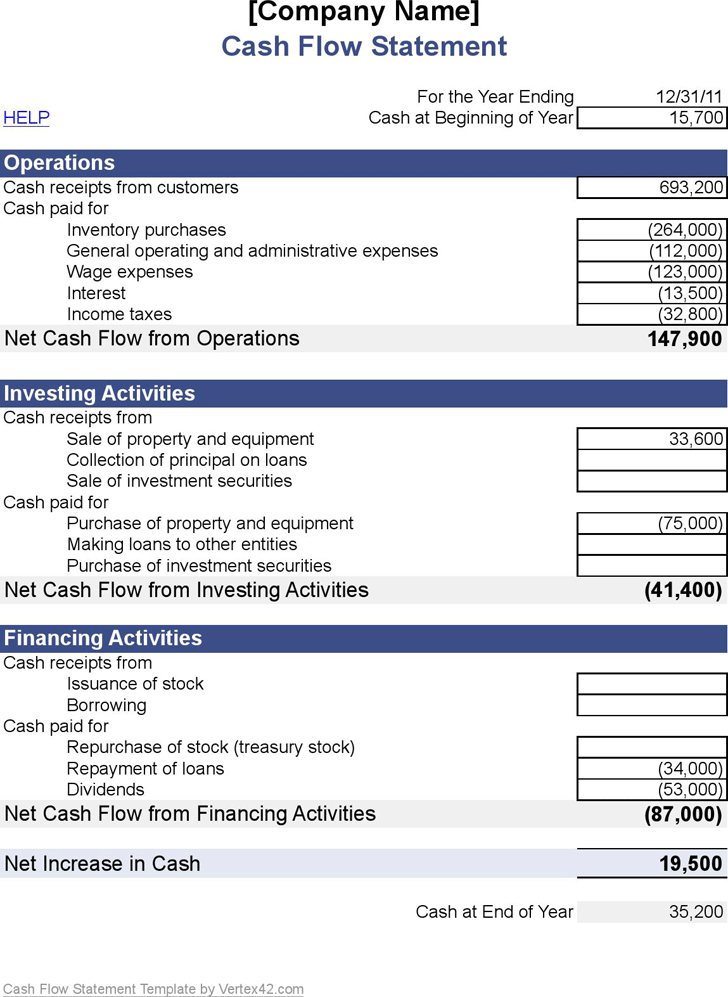

Cash flow statement income statement. If we talk about income statement indicates the amount of revenue and expenses during the financial year. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

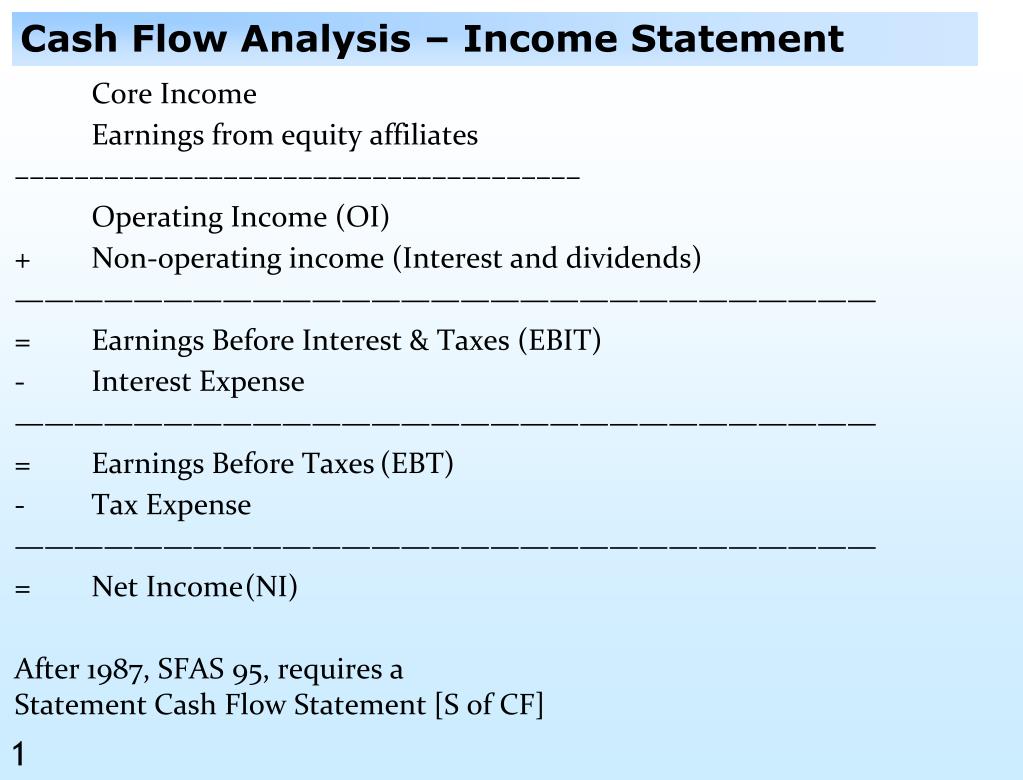

What’s the difference between a cash flow statement and an income statement? Many key fundamental ratios use information from the income statement. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via.

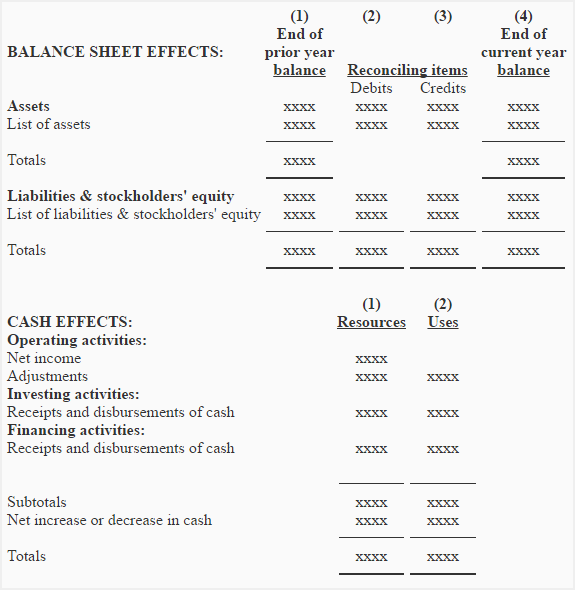

The income statement shows a company or individual’s money. A cash flow statement sets out a business's cash flows from its operating activities, its financing activities, and its investment activities. Calculate the cash flows from investing activities

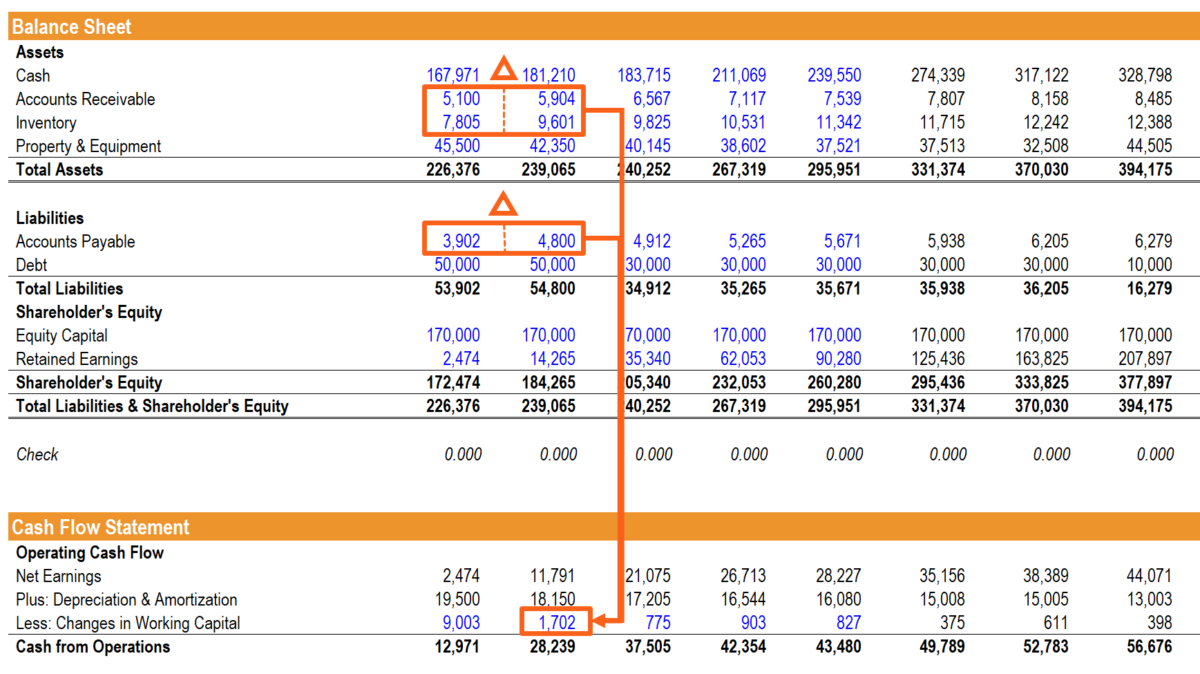

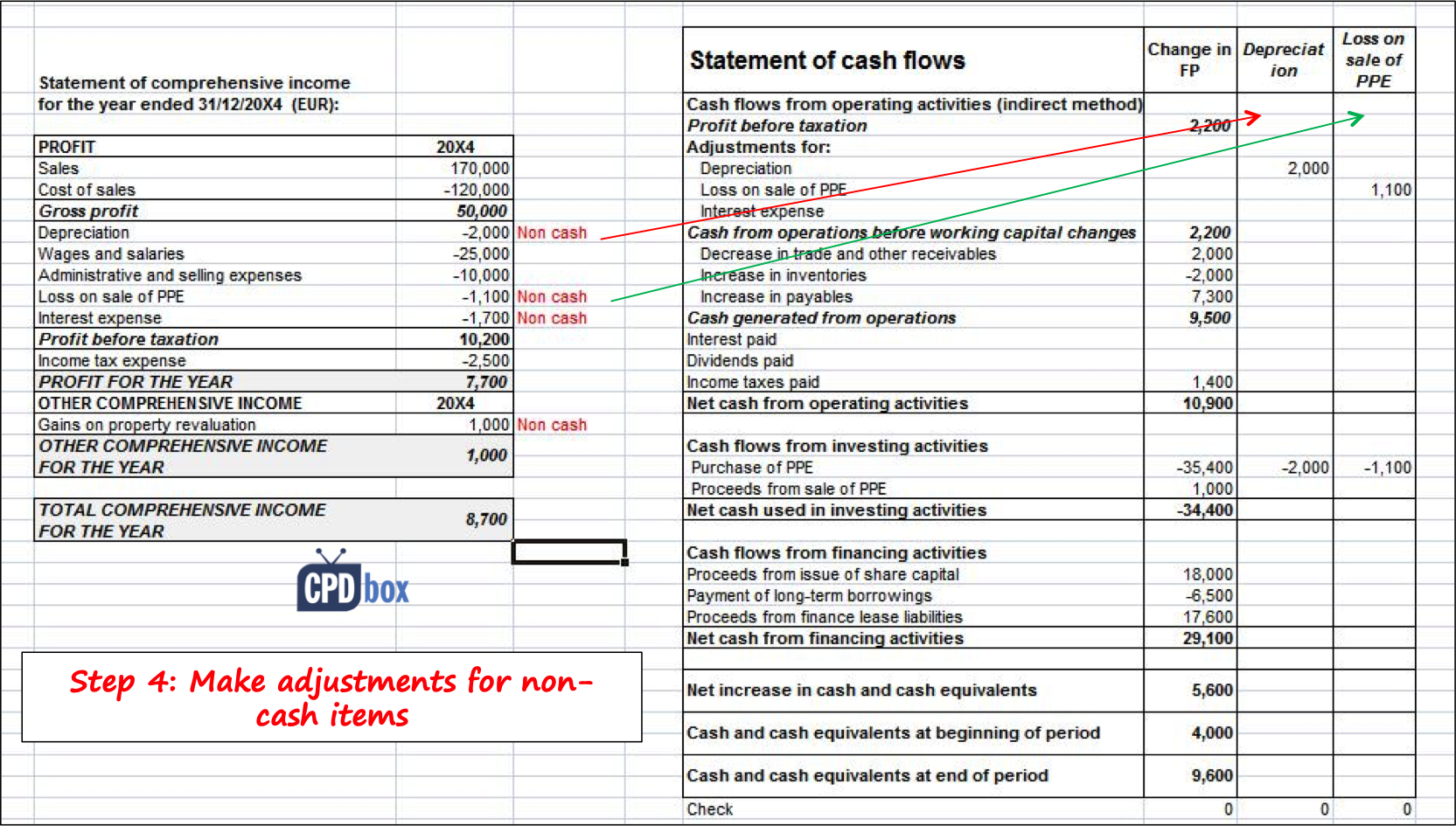

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Make adjustments for movement in working capital step 6:

Do dividends go on the balance sheet? Difference between cash flow and income statement This section of your cash flow statement only shows cash transactions.

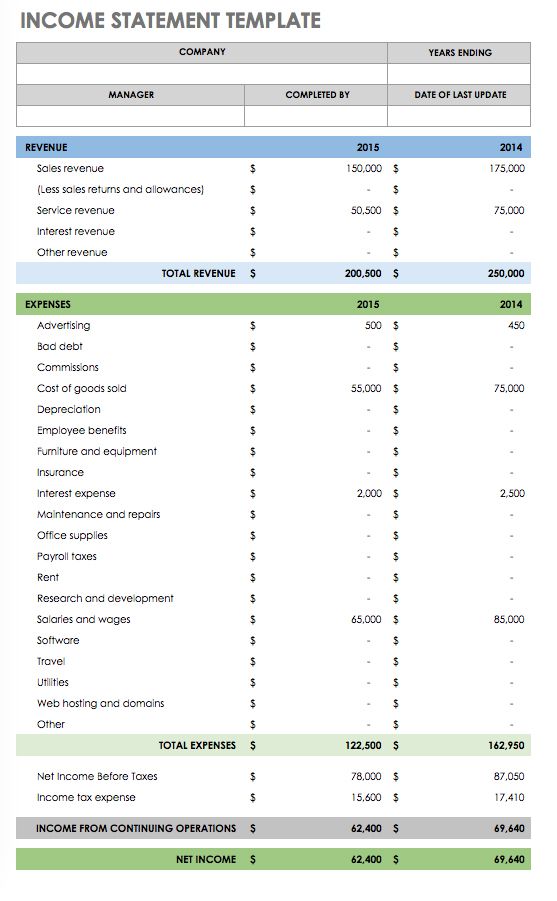

An income statement compares revenue to expenses to determine profit or loss. The income statement includes items like gross profit, net profit, taxes paid, revenue, costs, selling and administrative expenses, etc. A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period.

Find the net profit from the income statement step 2: The time interval (period of time) covered in the scf is shown in its heading. What is a cash flow statement?

The cash flow statement just proves that everything balances out. A cash flow statement is generally divided into three main parts: These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. Operating activities analyze a company’s cash flow from net income or losses by reconciling the net income to the actual. An understanding of the linkages among the cash flow statement, income statement, and balance sheet is useful for understanding a company’s financial health.

Record adjusted ebitda margin fourth. You can learn about the health of a business—up and down, and across time—by looking at its income statement. The income statement measures a company's financial performance, such as revenues, expenses, profits, or losses over a specific time period.