Top Notch Tips About Loss On Balance Sheet

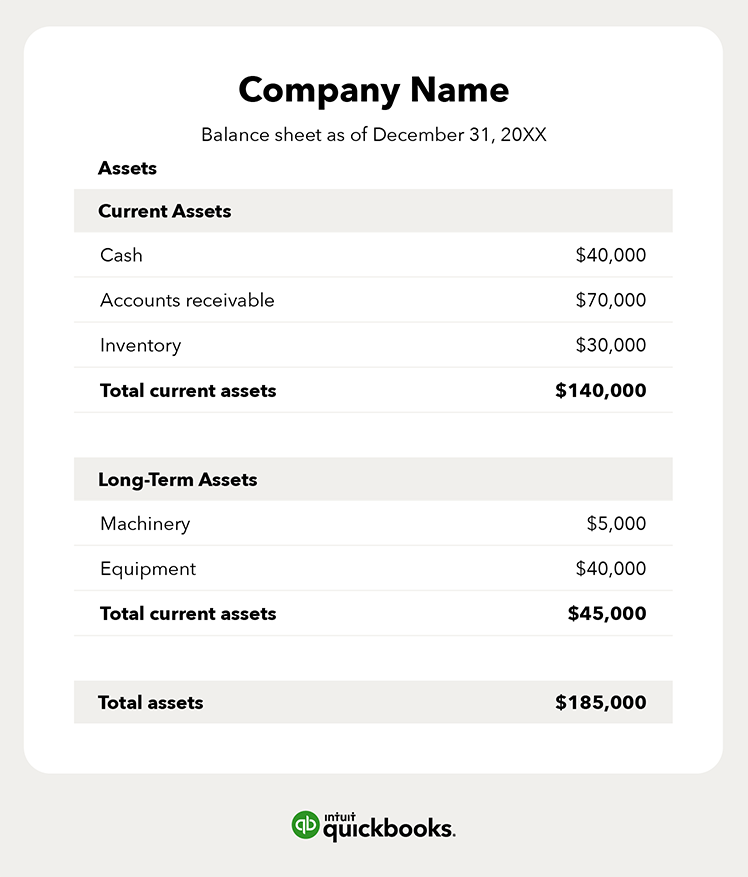

Assets = liabilities + owner’s equity.

Loss on balance sheet. This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which. In addition, the loss must be recorded. The balance sheet is one of the three core financial statements that are used to evaluate a business.

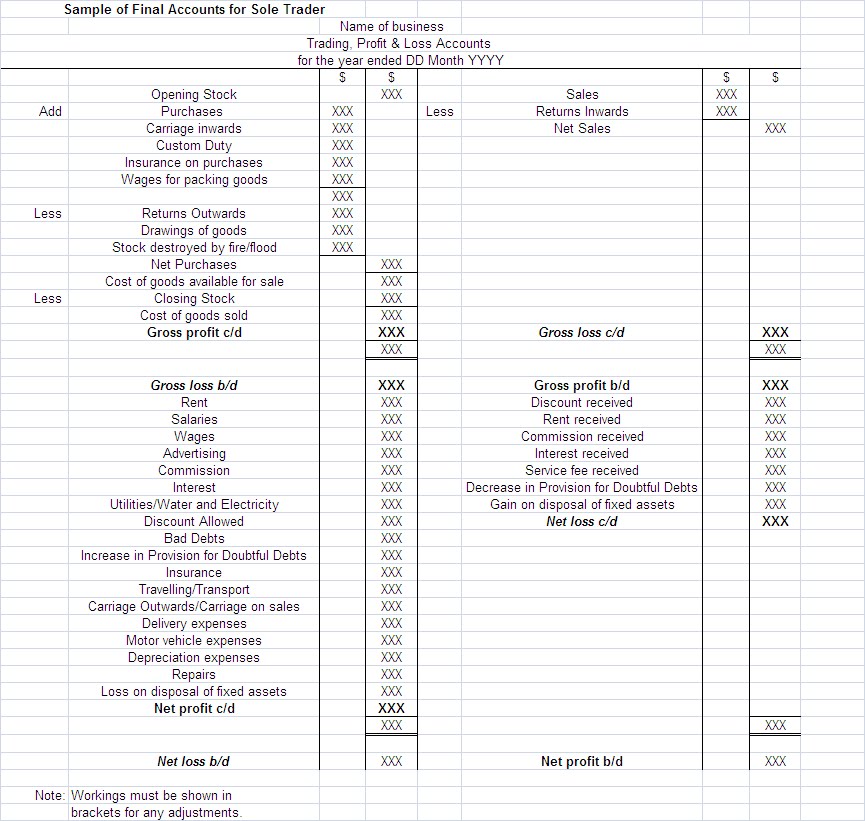

The income side it is said to have earned a net loss. It’s generally used alongside the other two types of financial statements: The expense side is greater than the credit side i.e.

It’s one of the three core financial statements. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. A p&l statement provides information about whether a company can generate.

Net loss is an accounting term, and it refers to a negative value for income. Policymakers said slower qt could ease shift to ample. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

Assets go on one side, liabilities plus equity go on the other. James leckie | last updated: To make my balance sheet powerhouses list, a company must:

Increasing your liabilities) or getting money from the owners (equity). Fed minutes suggest officials are seeking smallest balance sheet possible. The balance sheet shows a company’s.

Assets = liabilities + equity. Of these three statements, two are commonly confused: In other words, a company incurs a net loss when the expenses for a specific period are higher than the revenues for the same period.

Balance sheets are typically prepared and distributed monthly or quarterly depending on the. It can also be referred to as a statement of net worth or a statement of financial position. If truck is discarded at this point there is a $7,000 loss.

It provides a snapshot of a company's finances (what it owns and owes) as of the date of. Zero) which will be carried forward on the ecb’s balance sheet to be offset against future profits. The balance sheet is one of the three financial statements businesses use to measure their financial performance.

On the other hand, it had cash of us$25.0b and us. You pay for your company’s assets by either borrowing money (i.e. Net profit is transferred to the capital account and shown on the liability side of a balance sheet.